KangeStudio/iStock via Getty Images

I had previously recommended Suburban Propane Partners L.P. (NYSE:SPH) as a place to ride out market volatility. Despite a headline earnings miss in its latest Q4/2022 earnings report, my thesis remains unchanged.

The Q4 earnings miss was mostly due to unrealized losses from derivatives used to hedge commodity prices. Adjusted EBITDA, which excludes the MTM changes in derivatives, increased 5.5% in fiscal 2022. Looking forward, I continue to view SPH as a relatively safe place to park capital, especially as economic storm clouds gather.

Q4 Headline Earnings Miss; What Happened?

Recently, Suburban Propane reported its fiscal fourth quarter results that was a big headline miss compared to estimates. SPH reported revenues of $238 million (+14.1% YoY), and GAAP EPS of -$0.86, a $0.41 miss to consensus estimates. What happened and should investors be concerned?

Poor Q4 Mostly From Unrealized Hedging Losses

Before investors panic, they need to understand that Q4/2022 results included a $26.5 million unrealized loss from mark-to-market (“MTM”) changes in derivative instruments used for hedging purposes while Q4/2021’s results included a $25.5 million unrealized gain.

The derivative instruments are meant to reduce the reduce the effect of commodity price volatility, and can swing between gains or losses from quarter to quarter depending on commodity price movements. The key is to track the unrealized MTM gains and losses over time and make sure they even out.

Volumes Soft With Lower Gross Margins

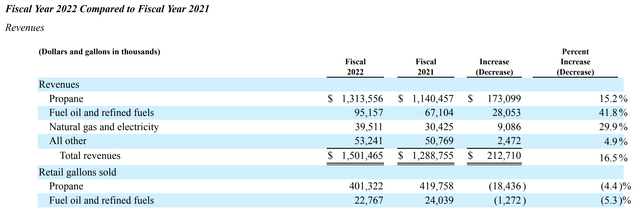

In terms of the operating business, volume trends continued to be soft, with retail gallons of propane sold falling 1.5% YoY for Q4/2022 to 61.4 million gallons. For the full year, retail propane volumes sold fell 4.4% to 401.3 million gallons (Figure 1). Volumes were negatively impacted in 2022 by unseasonably warm temperatures during the heating season and high commodity prices. However, higher commodity prices meant that full year revenues actually increased 16.5% to $1.5 billion despite lower volumes sold.

Figure 1 – SPH 2022 revenues and volumes (SPH 2022 10-K Report)

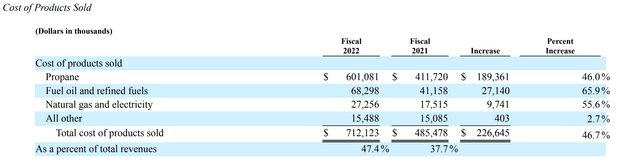

Gross margin was 52.6% for 2022, a decline from 62.3% in 2021 (Figure 2). Note, the MTM derivative gains and losses were included in COGS and 2021 results saw a $43.1 million benefit while 2022 results saw a $27.9 million loss. Excluding the MTM derivatives impact, adj. gross margins would have been 54.4% in 2022 vs. 59.0% in 2021.

Figure 2 – SPH 2022 COGS (SPH 2022 10-K Report)

The revenue increase from higher commodity prices mostly offset the gross margin decline, leading to gross profit declining only by 1.7% YoY to $789.4 million.

Expenses Climb With Inflation

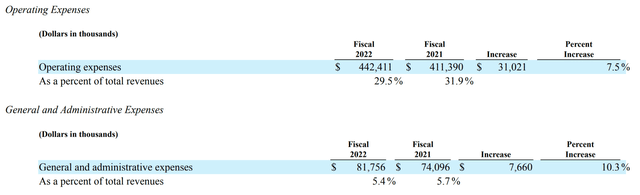

Operating and G&A expenses increased by $38.7 million or 8.0% to $524.2 million on the back of inflationary pressures on payroll and operating costs (Figure 3).

Figure 3 – SPH 2022 operating and G&A expenses (SPH 2022 10-K Report)

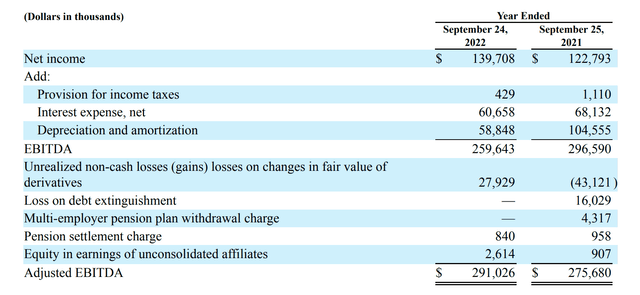

Although gross profit was lower YoY and total expenses were higher, net income actually increased 13.8% to $139.7 million on the back of lower intangible amortization and interest expenses. Adjusted EBITDA, which excludes the unrealized gains and losses from MTM changes in derivatives increased 5.5% to $291.0 million (Figure 4).

Figure 4 – SPH 2022 adjusted EBITDA (SPH 2022 10-K Report)

Distribution Maintained

Suburban Propane maintained its quarterly distribution rate of $0.325 / unit, or a 7.8% current yield. With diluted net income of $2.18 / unit and operating cash flows of $220.5 million or $3.45 / unit, the distribution appears well covered.

Leverage Ratio Continues To Improve

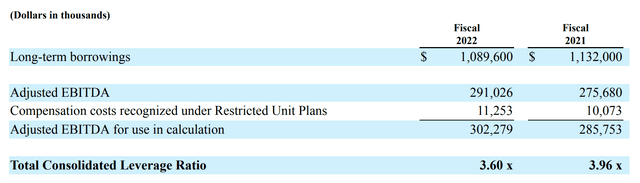

One of the key risks I highlighted in my previous articles was Suburban’s significant leverage, with $1.1 billion in long-term debt. Although SPH did not pay down any debt in the fourth quarter, for the year, debt was reduced by $42 million and the Consolidated Leverage Ratio (“CLR”) improved to 3.60x, from 3.64x at the end of Q3 and 3.96x at the end of 2021 (Figure 5).

Figure 5 – SPH Leverage Ratio (SPH 2022 10-K Report)

Still In Uptrend

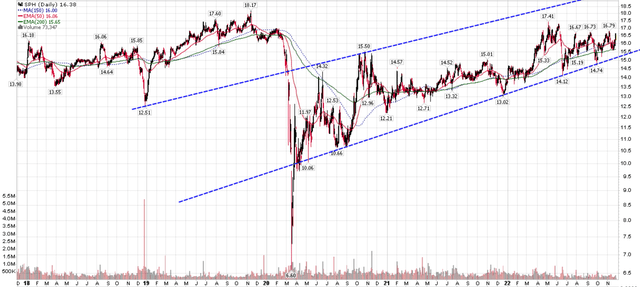

Looking at Suburban’s stock price performance, it continues to trade well within the uptrend I originally highlighted in my initiation article (Figure 6).

Figure 6 – SPH still in uptrend (Author created with price chart from stockcharts.com)

Risks To Monitor

Although Suburban’s fourth quarter and fiscal 2022 results were well within expectations and continue to highlight the stability of the retail propane distribution business, there are several risks worth highlighting.

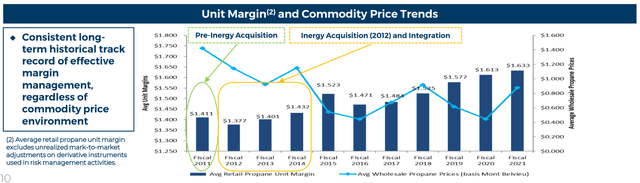

First, historically, SPH has done a good job managing unit margins despite volatile commodity prices (Figure 7). However, as a commodity flow business, there is always the risk of wrong-way bets on derivative instruments leading to large non-operating losses.

Figure 7 – Historically, SPH has done well managing margins (SPH investor presentation)

Also, it is important to recognize that operating and G&A expenses grew at an alarming 8.0% rate for 2022. Although net income also grew YoY, that was mostly on the back of a reduction in intangible amortization from $104.6 million in 2021 to $58.8 million in 2022. A reduction in intangible amortization of this magnitude is unlikely in future periods. So investors need to monitor Suburban’s expenses control.

Conclusion

Overall, Suburban Propane continued to deliver on my thesis of stability, as the company was able to manage a difficult macro environment to deliver a respectable set of results for 2022. Adjusted EBITDA increased 5.5% in 2022, despite margin pressures and higher expenses. Looking forward, I don’t see any near-term reason to change my current rating on Suburban Propane. I continue to view its distribution as relatively safe and the stock as a good place to ride out market volatility.

Be the first to comment