HATICE GOCMEN

Summary

I reiterate a BUY rating on S&P Global (NYSE:SPGI). My view has not changed since my initial article on SPGI, and this article is meant to give an update on the thesis post 3Q22 earnings. Earnings-wise, 3Q22 was mostly in line with my initial expectations that the Ratings business would suffer, and I have accepted that the macro environment will cause temporary headwinds. SPGI is a long-term bet on the stock market, which is sensitive to economic growth. Investors can enter at the current price and expect a long-term IRR of 9.50%.

Earnings overview

SPGI reported a very successful quarter. EPS outperformed consensus estimates in the near term as revenue from non-Ratings businesses more than compensated for declines in Ratings revenue. SPGI’s new outlook calls for a 45-50% decrease in billed debt issuance in FY2022, which I believe is a conservative enough estimate to allow the company to meet or even exceed. Meanwhile, I anticipate that S&P’s non-Ratings businesses will maintain healthy mid-single-digit growth despite the macroeconomic uncertainty. To add to this, I believe that the merger’s smooth integration will hasten the realization of cost synergies, allowing it to realize even more than the 35% to 40% of total $600 million in cost synergies targeted by management in 2022.

Financial highlights

Third-quarter revenue was 7.9% lower than expected, primarily due to headwinds from debt issuance.

Since the issuance of debt around the world has slowed, revenue from ratings has dropped by 33%. The current economic climate may have an effect on short-term performance, so this finding is consistent with my original hypothesis.

Commodity Insights revenue increased by 4.6%, driven by Price Assessments and Energy & Resources Data & Insights (ERDI), offsetting slight declines in Upstream Data & Insights and Advisory & Transaction Services, while Market Intelligence revenue increased by 4.4% due to Credit & Risk Solutions and Data & Advisory Solutions. Exchange-traded derivatives drove a 3.4% increase in Indices revenue, which was partially offset by a 1% decrease in asset-linked fees due to market volatility.

The Boiler Pressure Vessel Code (BPVC) release in 2022 was a major factor in the growth of Mobility’s revenue (8.5%), while the absence of this code’s release resulted in a decline of 8.7% in Engineering Solutions’ revenue.

Negative operating leverage in Ratings was partially offset by cost synergies and lower incentive compensation accruals to cause a 2-percentage point decline in operating margins to 46%, which still exceeded market expectations.

Overall, EPS of $2.93 outperformed of the consensus estimate of $2.80.

Thesis updates

In its Ratings business outlook, S&P was appropriately cautious, predicting a 45-50% decline in global billed debt issuance in 2022. This assumes weaker performance than in 3Q22, when billed issuance fell 40%, which mitigates the risk of further negative estimate revisions. The key reason for me saying this is that SPGI’s direct comp Moody’s (MCO) only predicts a mid-30% decline in global debt issuance in 2022 (from MCO 3Q22 earnings). I find it hard to believe there could be a 1000bps difference.

Meanwhile, Non-Ratings revenue grew 4.5% in 3Q22, helping S&P weather the cyclicality. SPGI’s Mobility division saw particularly robust growth in the high single digits, and its Indices division saw attractive upside lifted by exchange-traded derivative volumes. This is a positive indicator that overtime SPGI could rely lesser on its core segment (Ratings).

S&P has signaled and taken the most important action necessary in my opinion, which is to speed up the realization of cost synergies to offset the impact of falling near-term debt issuance. SPGI is on track to realize slightly more than the $600 million in total cost synergies it had originally projected it would by 2022, or 35-40%. SPGI is also reaping the benefits of cross-selling its products to increase its bottom line, most notably in its Market Intelligence division. Half of the $350 million in total revenue synergies are expected to be realized by 2024, according to the company’s projections.

I would like to remind investors that SPGI’s short-term performance may be somewhat erratic. Earnings in 3Q22 show that rising interest rates and a macroeconomic slowdown are keeping a lid on debt issuance volumes for the time being (as expected). Revenue from Ratings fell by 33% in 3Q22, and management has lowered its forecast for Ratings revenue in FY2022 from the low-mid 20s to the mid-high 20s as a result. This decline has a huge impact on margins given the high operating leverage. Management anticipates Ratings operating margins will be in the mid-50s in 2022, down from 64% in 2021.

Growth in the non-ratings sector is positive, but could be even more rapid. Slowness in the equity and debt capital markets has a negative impact on Market Intelligence revenue, while falling asset management fees have a similar effect on Index revenue.

Guidance

I think this guidance is conservative and has reduced investors’ exposure to the risk of further downward guidance.

From the low to mid-single digit declines in revenue seen in FY21, SPGI now anticipates a mid-single digit decline in revenue for FY22. when considering the margin of profit. Operating margins are expected to rise to 44.5 to 45.0% in FY22 from 45.3 to 45.8%, and earnings per share are projected to rise to $11.00 to 11.15 from $11.35 to 11.55.

Valuation update

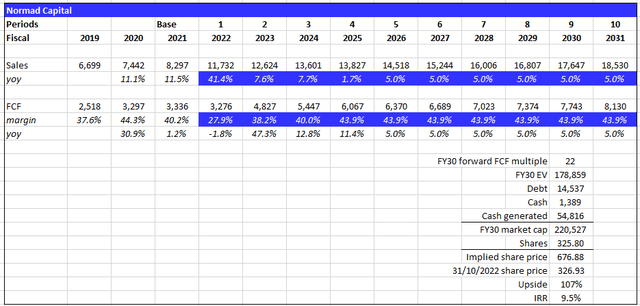

At the current stock price of $326.93 and 325.8 million shares, the market cap is ~$106 billion. I believe the current market price still presents a decent entry point for investors to enjoy a long-term stable IRR of 9.5% (2.5% lower than my initiated IRR).

Key changes to model:

- Sales: revised downwards in the mid-terms until FY25 according to consensus due to the weak macro environment and management’s commentaries

- FCF: revised upwards due to revenue and cost synergies pulled forward, thereby improve margins

3Q22 valuation (Normad Capital)

Risk updates

Heavy exposure to capital markets cycle

This remains a key risk in the current macroenvironment, and could very possible extend further than expected. While management has guided a very cautious outlook, things my get worse than expected.

Conclusion

SPGI has one of the best businesses in the world thanks to its powerful network effect, pricing power, and high incremental margins. Earnings-wise, 3Q22 was mostly in line with my initial expectations, which were that the Ratings business would suffer, and I have come to terms with the fact that there will be temporary headwinds due to the macro environment. To me, SPGI represents a long-term wager on the strength of the stock market, which is highly sensitive to economic expansion. For investors, the current price level represents a reasonable entry point that should generate an IRR of 9.5% annually over the long term.

Be the first to comment