Sundry Photography

Qorvo (NASDAQ:QRVO) has reported a decent quarter, but inventory adjustments and lower production will impact its revenue and profitability in the coming quarters, something that is not fully priced in its shares.

Background

As I’ve covered in a previous article, I invest mainly in secular growth trends, including 5G and the Internet of Things (IoT), and therefore, took a look at Qorvo a few months ago to see if it provided a good alternative to other stocks that I own in this investment theme. However, its business overlap with Skyworks Solutions (SWKS) was significant and the company’s relatively high revenue exposure to Apple (AAPL) was also an issue for me.

While Qorvo is well positioned to benefit from industry secular growth trends in this investment theme, I decided to pass on Qorvo at the time. As the company has released its most recent quarterly figures, I decided to take a look again to see how its business has progressed in recent months and if it shares are now a better investment or not.

Qorvo Q2 FY23 Earnings Analysis

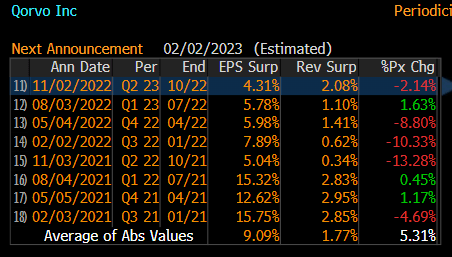

Qorvo announced its Q2 fiscal year 2023 earnings on November 2, 2022, beating estimates both on the top and bottom lines, as shown in the next graph, and also above the company’s midpoint outlook provided in the last quarter. However, its EPS beat was the smallest in the past eight quarters, and the revenue surprise was in-line with its recent history, which led to a muted share price reaction in the day.

Earnings surprise (Bloomberg)

Qorvo’s revenues amounted to $1.158 billion in the quarter, representing a decline of 7.7% YoY. Investors should note that the company reorganized how it reports its operations, now being split into three segments, namely high-performance analog (HPA), connectivity and sensors, and advanced cellular.

Its revenues were impacted by headwinds in consumer markets, namely for smartphones, leading to inventory reductions from original equipment manufacturers (OEMs), which represented a headwind for revenues in the connectivity and sensors (previously split between mobile and IDP). This shows that while Qorvo’s business is highly exposed to secular growth trends, like electrification, sustainability, and connectivity, its business is still significantly exposed to mobile and until it reaches higher diversification across industrial end-users, it remains somewhat exposed to economic cycles.

Taking this backdrop into account, Qorvo has taken a few measures to adapt its business to the current downturn, namely adjusting its own inventories and reducing factory loadings, to not be in a position of excess inventories in the coming quarters, which could lead to lower pricing power. On the other hand, it continues to invest in product development, such as its new SAW products, which are complementary to its BAW products, and increase Qorvo’s integrated placements and product differentiation compared to peers.

By operating segment, HPA revenue was $243 million in the quarter, up 47% YoY, while connectivity and sensors reported revenue of $143 million, down 19% YoY. Its largest segment, advanced cellular, reported revenue of $787 million, down 15% YoY, due to lower smartphone unit volume within the android ecosystem.

Due to lower revenue, Qorvo’s gross margin decreased to 46.5% in the last quarter on a GAAP basis (vs. 49.5% in Q2 FY 2022), impacted by inventory-related charges and lower factory utilization. Operating expenses were $277 million, up due to R&D expenses and higher staff, while operating income amounted to $261 million. By segment, both HPA and advanced cellular reported operating margins of around 34-35%, while the connectivity and sensors unit reported a negative operating margin of 7%.

Qorvo’s net income was $188 million (GAAP basis), a decline of more than 40% YoY, and its diluted EPS was $1.82. The company’s free cash flow in the quarter was $220 million, while capex amounted to only $47 million. As the company continues to generate cash on an organic basis, Qorvo repurchased $160 million of its own shares during the quarter and has authorized another $2 billion share buyback program, which substitutes the current one that had still a remaining balance of $350 million, at the beginning of October.

Regarding its balance sheet, Qorvo ended the quarter with a net debt position of about $1.1 billion, while its annual EBITDA related to FY 2023 is expected to be about $950 million, which means that Qorvo’s net debt-to-EBITDA ratio is close to 1.15x. This is a relatively low level of leverage and Qorvo does not have any meaningful debt maturity in the short term, thus it can continue its strategy of returning cash to shareholders through share buybacks, as the company does not pay dividends, given that it does not need to retain much cash.

Regarding its guidance for Q3 FY 2023, Qorvo expects to generate quarterly revenue between $700-750 million, which represents a sequential decline of more than 30% at the midpoint of its guidance, and gross margin is also expected to drop by about six percentage points, and non-GAAP EPS of $0.50-0.75 is expected. This weak guidance was way below market expectations, which were expecting revenue of about $980 million and EPS of $1.69.

This weak outlook is justified by soft end-markets with the company expecting a significant inventory adjustment in the current quarter, especially in consumer electronics areas, and a higher-than-expected adjustment from OEMs in the android ecosystem. Qorvo expects the current quarter to be the lowest point in the current downturn and some recovery sequentially in the March quarter, but macroeconomic uncertainty is high right now, thus this outlook has a significant risk of not materializing.

Due to lower factory utilization and relatively high inventory levels, Qorvo’s operating margins are expected to drop in the second half of the fiscal year, as fixed costs are not covered by lower revenue. The company is cutting costs in its factories to offset to some extent the impact of lower volumes, but nonetheless, its operating margin should drop in the next few quarters.

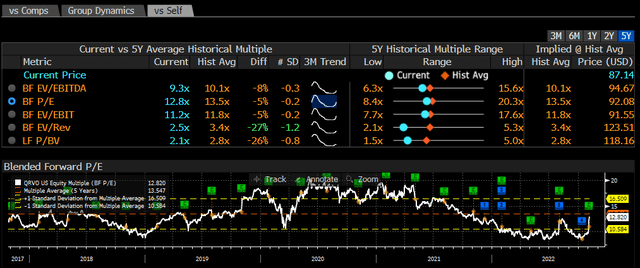

Regarding its valuation, Qorvo is among the cheapest stocks in the semiconductor sector trading at less than 13x forward earnings (based on GAAP), but much higher than Skyworks for instance that is currently trading at only 8.5x forward earnings. Moreover, Qorvo’s valuation is close to its historical average of the past five years, which means that it is not trading at a depressed level, despite its operating momentum being quite weak.

Given that both Qorvo and Skyworks have a significant exposure to Apple, while other companies such as Qualcomm (QCOM) or Broadcom (AVGO) have much less revenue exposure, I see Skyworks as a better peer and therefore don’t see Qorvo as being particularly cheap right now.

Conclusion

Qorvo has reported a decent quarter, beating market estimates by a slim margin, but its outlook for the current quarter was quite poor. This shows that the current market downturn has not reached its bottom and Qorvo’s expectations of a rebound at the beginning of calendar 2023 may be too optimistic as the global economy is likely to enter a recession.

Therefore, its valuation is not cheap enough, both on an absolute basis and relative to Skyworks, thus for me personally I will continue to pass on Qorvo and prefer Skyworks instead in the 5G/IoT investment theme space.

Be the first to comment