Public Storage (PSA) is one of the largest REITs in the U.S., and has been a relative laggard to the sector, at least until recently. The company fell following a weak earnings report last fall, and, more generally, it has struggled due to concerns about too much capacity in the storage industry.

Shares have diverged from the market more recently, however. They fell with the February sell-off, but have firmed up to start the month of March, even as the rest of the market has tumbled:

In fact, Public Storage is actually up 5% year-to-date now. And that’s not as crazy as it may seem; Public Storage is favorably positioned given the current interest rate environment. Here’s why the stock has turned the corner, even as the market is in a slump.

PSA – And Other High-Quality REITs – Can Act Like Levered Bonds In The Short-Run

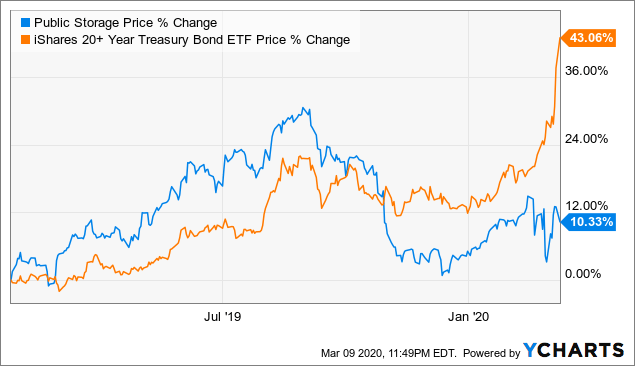

Over the past year, with one exception (earnings in October), Public Storage’s stock has essentially traded as though it were about a slightly-levered or high beta version of the long duration government bond ETF (TLT). When bonds are going up (TLT/orange line rising) that means that interest rates are going down. When interest rates go down, usually people are willing to pay higher prices (accept lower dividends) for income investments like REITs as well.

Really, aside from the earnings dip last fall, PSA’s stock was doing a great job of tracking bond prices until about a month ago:

Data by YCharts

Data by YCharts

Since then, however, bonds have gone on a rampage to the upside hitting new records. Meanwhile, Public Storage and other high-quality REITs have failed to keep up.

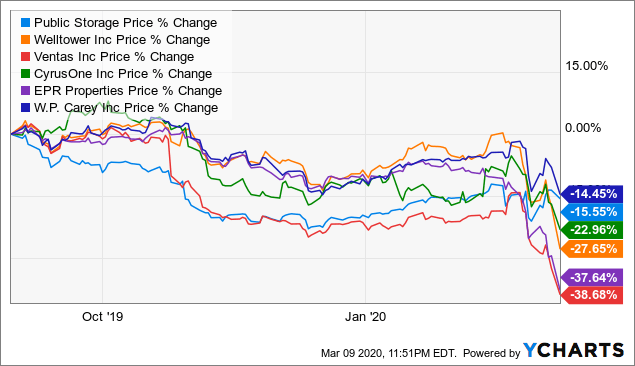

As you can see, the correlation had been high all year. Both investments rallied in tandem all summer in particular and topped at the beginning of September as the wave of recession fears finally crested and economic growth started to pick back up. Q4 brought significant corrections across a wide chunk of the REIT space across individual property types. And now, after January rallies, a whole bunch of well-respected REITs are in steep decline:

Data by YCharts

Data by YCharts

However, this is an opportunity for Public Storage (and other REITs) because they should be worth much more thanks to lower interest rates (see the above discussion) and yet they’re down significantly. Notably, though, Public Storage is starting to outperform within the REIT space (PSA is the light blue line – note how it has gone from worst to second best among its peers on that chart). And here’s why.

Public Storage has an ace up its sleeve as far as interest rates go because it funds itself with preferred shares, which has beautiful optionality. If interest rates go down, they can call in their preferred shares, issue new preferreds at even lower rates, and save money. If rates go up, they never pay back the preferred stocks and have access to absurdly cheap (below 5%) capital in perpetuity.

On the occasions when Public Storage does issue normal bonds rather than preferreds, it gets crazy cheap rates – they just issued some Euro bonds at 0.9% (yes, less than 1%) interest. Give one of the best management teams in REITdom capital at 1%/year and they’ll make us money, fear not.

But What About Overbuilding?

There’s too much capacity coming online in the storage industry. It’s been that way for a couple years. It appears the cycle is turning now, but there will be too much supply at least into 2021. I could show you charts and graphics, but there’s really no need. The bears are totally right on this point – and yet it’s largely irrelevant.

The bears complain and complain about overbuilding, yet Public Storage has some of the highest occupancy figures in the industry. This past quarter, they already returned to positive FFO growth (albeit only fractionally). Still, it’s far from a massive bust, at least as far as PSA’s numbers go. Public Storage is spending a ton on advertising to fill its units up. As is the usual during industry shakeouts, the strong get stronger. Public Storage can keep consolidating the industry, picking up independent locations and weaker operators with its fortress balance sheet. I’d be scared to own a small storage REIT with a shaky balance sheet given current occupancy conditions.

But the bears are totally wrong to make Public Storage the whipping boy of the storage overbuilding situation. That said, I am reluctant to go guns blazing with a call to buy more PSA stock simply because the short sellers are wrong. The fact is that storage is significantly oversupplied in many markets, and all the operators – even best-in-class Public Storage – are suffering as a result. PSA hasn’t raised its dividend since 2016 and it’s not hard to see why – FFO has been essentially flat for years.

Unlike – say – malls, however, storage will be fine. It’s cheap to build, and generally one of the lowest available uses of land. Meaning that you can repurpose the land for other and better uses if and when storage is no longer optimal. It’s also a great inflation hedge – the company owns a vast quantity of well-situated land in American cities. Over time, as long as the country becomes more prosperous, Public Storage’s assets will keep appreciating. In a world where money was expensive, it’d matter more if the storage business continues to underperform for a few more years. But when the company can borrow money for next to nothing, it’s still going to earn a strong return on our capital.

Over the long-haul, people buying PSA stock today should make a lot of money. Storage remains a highly-fragmented market, and this is great news for the industry leader. Public Storage has the best balance sheet, the cheapest cost of capital, and the most benefits of scale.

At the moment, Public Storage can borrow money via preferred stocks for under 5%/year with a duration of infinity. This is an insanely good deal! I get frustrated when bears argue that Public Storage is dumb for selling preferred stock at 4.7% instead of taking out loans at somewhat lower rates.

This overlooks the fact that not having to pay back your principal until a time of your choosing many decades in the future may easily outweigh paying more interest today. What happens if interest rates go back up to 7% and suddenly other storage REITs to say nothing of the small private operators suddenly have to refinance their loans at sharply higher rates? Meanwhile, Public Storage has their 5% preferred stocks they never have to pay back. This is an incredibly useful option – in fact, Public Storage is likely to be one of the few REITs that benefits from rising interest rates whenever they come around again as its competitors could get crushed by a rising cost of capital.

Then there’s inflation protection. PSA’s stock is the sort of thing you put in your portfolio as an inflation hedge. Their assets go up in price with any sort of inflation. Public Storage is, in one way, a massive U.S. land bank as, over time, they transform many of their properties into higher-value housing, office, or other types of urban developments. Throw a 1970s wave of inflation into the mix and PSA’s land values will shoot the moon. Meanwhile, it’s funded by absurdly cheap preferred stock that inflates away as rates rise.

I don’t think preferred stock owners have stopped to think about how terrible getting a 5% yield with no possible capital gains upside really is. If interest rates go up to 10% or 15% a year again, like in the 1970s, your preferred in this case is a total disaster. You lose gobs on money after inflation, still have to pay tax on your interest, and the price of your preferred plummets to the floorboards as it becomes clear that Public Storage will never call the preferred in at par.

Now flip those negatives around and you see how delightful a high interest rate environment would be from PSA’s perspective. Soaring land values, and you get to jack up your rental rates double digits ever year. Meanwhile, you pay out a paltry fixed sum to the folks that got stuck owning the preferreds. It’s a massive win for PSA.

And if interest rates stay low (or go even lower), then the value of PSA’s stock increases as its yield goes down to match interest rates. As with bonds, falling yield equals a rising price. With Public Storage being one of the few A-rated REITs in existence, it can survive just about any economic development (and storage is extremely recession-resistant as is). If interest rates go up, it has a huge leg up on its competitors, and if rates go down, its share price goes up as well.

When Does This Reflation Play Out?

When does the interest rates shooting up scenario occur? Probably not for a while. Maybe not in our lifetimes. There’s no guarantee that inflation spikes again dramatically anytime soon. Current trends in demographics suggest the odds are for even lower rates going forward rather than a sudden return of inflation.

But in case the consensus is wrong, Public Storage is positioned to make a boatload. Rather than buying something like gold, where returns tend to merely match inflation over the long-haul, and you get no dividend or other benefit from ongoing business, with Public Storage, you own a highly value-creating business that – in the unlikely event that high inflation returns soon – enjoys a huge benefit.

There’s also the land bank element. Public Storage owns large swaths of well-positioned real estate around the U.S. Storage is generally one of the lowest uses of land – it’s cheap to build and there’s not much public opposition if you later want to redevelop it into more high-use properties. At any point, Public Storage can cash in well-positioned pieces of real estate, sell them to apartment, office, or retail developers and make a windfall on their holding.

Public Storage Verdict

Now, you could fairly argue that Public Storage at almost no FFO growth for the next year or two and a high 3s dividend is hardly thrilling. And you’d be right. But there’s not a whole better available in American REIT-land at this level of safety. I was discussing a lower-quality restaurant REIT that trades around the same FFO multiple (21) as Public Storage with Twitter user Nelson Smith:

There’s plenty of REITs to avoid at this point. But it’s hard to skip over owning REITs entirely because they have been a good asset class historically. I consider there to be a ton of risky assets within REITs right now though, as prices are generally rising thanks to the interest rate discussion from above. REITs will keep going up thanks to lower interest rates but the ones backed by shoddy assets could be in for surprises. Public Storage won’t have that problem.

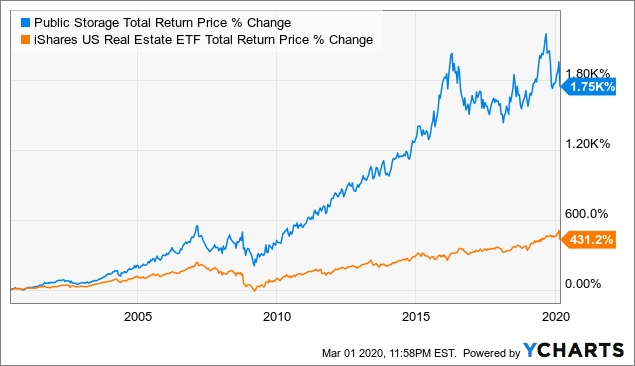

Storage may be boring and out of favor right now, but I’d rather hang out in a top notch asset like Public Storage rather than most other stuff. Since the first major Real Estate ETF (IYR) listed, Public Storage has produced a 1,750% total return, quadrupling the return of the sector ETF over the same span:

I know there are far higher-yielding REITs out there that have sustainable dividends, at least for the time being. And there are certainly plenty of other dividend stocks in other sectors that are down way more than Public Storage.

But if you’re after peace of mind, Public Storage, as one of the rare A-rated REITs out there, is a great choice. And I fully expect its mid-3s yield to turn into a 3.0% yield as it catches up to the rally in bond prices. That, in turn, would make for a $267 PSA stock price, even before the next dividend hike arrives.

This is an excerpt of an Ian’s Insider Corner report published March 2nd for our service’s subscribers. If you enjoyed this, consider our service to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.

Disclosure: I am/we are long PSA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment