ablokhin/iStock Editorial via Getty Images

Potbelly (NASDAQ:PBPB) continues to deliver strong sales performance, with its Q3 2022 revenues ending up near the high-end of its guidance for the quarter. Potbelly also guided for its Q4 2022 revenues to be 1% lower (at guidance midpoint) than its Q3 2022 revenues. This indicates expectations for continuing sales strength into the end of the year as Q4 revenues are historically at least several percent lower than Q3 revenues due to seasonality.

Potbelly also appears to be mitigating the impact of cost inflation well. It ended up around the midpoint of its guidance for shop-level margins in Q3 2022 and generally expects a modest improvement to margins for Q4 2022 (compared to Q3 2022 levels). Potbelly has increased its prices by a bit over 9% during 2022, with not much in the way of negative impact to unit sales.

Potbelly has exceeded my previous expectations around sales growth, so I am bumping up its estimated value to $6.50 to $7.50 per share, although I believe that it will still have challenges reaching its 2024 target for 16% shop-level margins.

Improving Sales

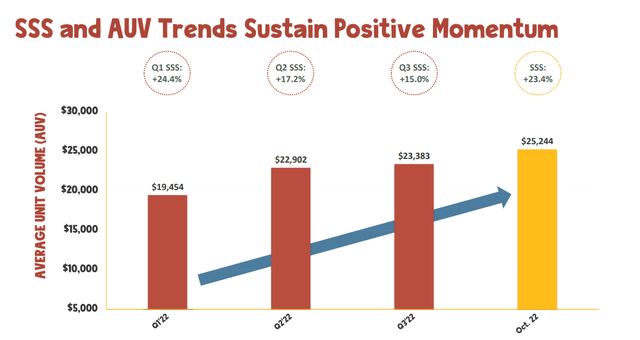

Potbelly expected to generate total revenues of $113 million to $118 million in Q3 2022. It ended up generating $117.6 million in total revenues in Q3 2022, resulting in strong same-store sales growth of +15%. Potbelly’s sales are now at an all-time high in terms of per store sales, so it has done quite well there.

Potbelly continues to believe its sales performance will be strong in Q4 2022, expecting revenues to end up between $114 million and $119 million. Historically, Potbelly’s revenues have ended up a few percent higher in Q2 and Q3 compared to Q1 and Q4. Thus Potbelly’s guidance for Q4 2022 appears to imply several percent in seasonally-adjusted revenue growth compared to Q3 2022.

Potbelly noted that its AUV (weekly sales per store) continued its positive momentum in October, increasing 8% compared to Q3 2022 levels. As well, October 2022 same-store sales were up +23.4% compared to October 2021.

Potbelly Sales Trends (potbelly.com)

I believe that the remainder of Q4 is typically seasonally weaker than October for Potbelly, but even after factoring that in, Potbelly’s revenues could end up around $119 million (at the high end of its guidance) in Q4 2022 based on the strength in October.

Potbelly mentioned that its Central Business District shops continue to recover, although those still have not reached pre-pandemic traffic levels.

Mitigating Cost Inflation

Potbelly appears to have done a solid job mitigating the inflationary environment. It noted that shop-level margins ended up at 10.6% in Q3 2022, which was in-line with its guidance range of 9% to 12%. Potbelly also mentioned that the last few weeks of the quarter were strong in terms of margins and thus has provided an improved guidance range of 10% to 13% for Q4 2022. This is up 1% from its Q3 2022 guidance range.

Potbelly mentioned that it increased prices by 3.6% during the quarter to help mitigate the impact of cost inflation. It has increased prices by a bit over 9% during 2022. As Potbelly’s same-store sales were up +15% in Q3 2022 and +23.4% in October 2022, it appears that its unit sales are up year-over-year despite the pricing increase. The continued post-pandemic recovery seems to outweigh any impact of the pricing increase on store traffic.

Potbelly’s pricing increases also seem reasonable in the context of overall food cost inflation, so it believes that it still is viewed as affordable compared to other alternatives.

Potbelly’s shop-level margins are also benefiting from its strong sales performance, helping offset some of the cost inflation. For example, Potbelly’s labor costs increased by 9% from Q3 2021 to Q3 2022. However, its revenues increased by 16% over the same period, so as a percentage of sales, Potbelly’s labor costs went down from 32.8% in Q3 2021 to 30.9% in Q3 2022.

Valuation Notes

Potbelly has been doing better than I expected in terms of sales, and if it can maintain October 2022 sales levels ($25,244 per store per week) over an entire year, that would result in full-year sales of $1.31 million per store. That would be in-line with Potbelly’s target for $1.3 million in sales per store by 2024.

It still has a lot of work to do to get to its 2024 target for 16% shop-level margins though, as it is expecting 10% to 13% shop-level margins in Q4 2022.

Due to Potbelly’s continued outperformance in terms of sales growth, I am bumping its estimated value to approximately $6.50 to $7.50 per share. At this point I believe that Potbelly is more likely to hit its per store sales targets for 2024 than its shop-level margin targets.

Conclusion

Potbelly has performed very well in terms of sales, delivering record per store sales in Q3 2022 and then reporting even stronger sales in October 2022. This puts it on track to hit the high-end of its sales guidance for Q4 2022. It has exceeded my expectations for sales growth.

Some of the increase in sales is driven by Potbelly raising prices (to combat cost inflation), but it appears that its price increases have not hurt unit sales growth. The strong sales and increased prices have allowed Potbelly to aim for 10% to 13% shop-level margins in Q4 2022, although it will probably have a tough time getting to its 2024 target of 16% margins.

Be the first to comment