Wagner Meier/Getty Images News

In January, I wrote a bullish article about Petrobras (NYSE:PBR, NYSE:PBR.A), and the investment thesis worked out very nicely. The share price has risen, and all investors have received massive dividends. Right now, there seems to be a lot of uncertainty about what will happen in the future. This uncertainty is political and comes mainly from the elections that are coming up soon. Therefore, I want to investigate how significant the risk is and what concrete info we have. I remain bullish and believe these risks are already priced in, given the very low valuation.

A quick recap on the bullish thesis

I recommend reading my article for the big picture, but in short, the bullish thesis derives from several points. Nothing major has changed on all these points. Also, the company did not give any further updates to its presentation “Strategic Plan 2022-2026”.

- a dependence on oil that will continue for several decades

- less and less is being produced in Western countries

- Petrobras plans to increase its production by 26% by 2026

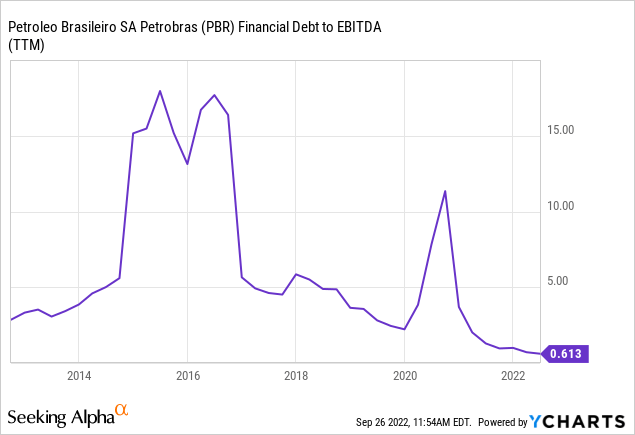

- and has managed to reduce its debt burden since 2014 sharply

- a new dividend policy, with double-digit dividend yields expected due to low valuations

Finances continue to improve rapidly

Long-term debt was only $31B as of June 30 (vs. $35.7B at the end of 2021). The 2021 target and a requirement to pay dividends are debt below $60B. The debt/EBITDA ratio is the lowest it has been in a long time.

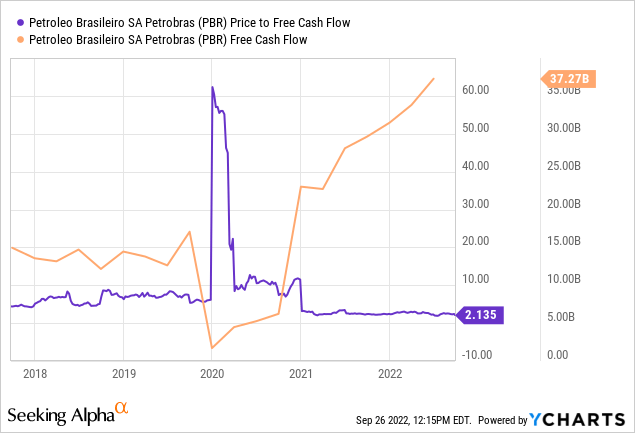

At this rate, the company could be debt free in a few years. In the first half of 2022, the company spent $900M on interest on debt, which is $300M less than in the first half of 2021. This has been possible so far due to the substantial increase in free cash flow. In terms of price/free cash flow, the stock continues to trade at an extremely cheap level.

As a reminder, Petrobras’ forward break-even point in terms of oil prices is $20. Oil prices have softened somewhat recently due to the global economic slowdown, but they are still at a relatively high level, and I don’t expect to see prices below $50 per barrel for a long time. The market is too tight for that, OPEC countries will cut production if necessary, and soon 1M barrels per day will drop out of the market when the US stops withdrawing them from its SPR.

The political danger, not only in Brazil

From my point of view, it seems that politicians worldwide are playing a blame game, where oil and gas companies are blamed for the fact that these same politicians have previously made bad decisions. Among other things, they have helped to make financing more difficult. The looming current oil shortage did not occur this year but has been slowly developing for a long time. Accordingly, prices were rising, as they always do in a market economy. What usually follows is that more is produced, so the price falls again. The cure to high prices is high prices.

Exxon made more money than God this year. Exxon, start investing. Start paying your taxes.

Instead, this market mechanism is threatened to be prevented by windfall taxes. If the high profits are skimmed off by the government, what money should be invested? In addition, there is general uncertainty about the future, climate and ESG regulations. In an uncertain environment, no company likes to invest. And especially in the energy sector, planning security is fundamental because of the high investment sums.

In my opinion, the global political danger is if developments in the energy sector lead not only to high prices but to real shortages. Then governments worldwide could intervene even more, and global trade would likely be affected by restrictions as governments try to secure their supply.

How this affects Brazil

First, it is important to know that Brazil exports oil but imports about 30% of its diesel needs. More than 50% of that currently comes from the United States. Bolsonaro said on July 11 that a deal with Russia was almost ready to import additional diesel.

But diesel prices skyrocketed after Russia invaded Ukraine and the global economy started to recover, causing a series of price increases as state-led Petrobras maintained domestic prices at parity with international imports. Import-parity pricing is required as part of a 2019 antitrust agreement, but industry officials also say it’s needed to keep windows open for third-party importers. Petrobras has warned the government that Brazil could face potential supply shortages in the second half of 2022 if the import-parity pricing policy wasn’t maintained, but Bolsonaro wants the policy scrapped and has installed two CEOs at Petrobras this year in an effort to end its use.

This deal will not sit well with the U.S. as part of the Russia sanctions it is trying to enforce around the world. This, combined with the fact that diesel stockpiles in the U.S. have reached 20-year lows, could lead to imports from the U.S. falling. This would lead to a diesel shortage in Brazil. Theoretically, this would not affect Petrobras so much since its oil and diesel would then be needed more urgently than ever. However, politicians and desperate people like to find scapegoats. So what would happen to a company like Petrobras in such a case is very unclear. After all, this company distributes billions in dividends while the population could suffer from a shortage. It could well be that the government wants to set an example here and carry out something in the direction of more state intervention.

What could happen after the election?

On October 2, there will be a presidential election in Brazil, and the current President Bolsonaro is trailing his challenger Luiz Inacio Lula da Silva in the polls. First, it must be said that no matter who wins, political pressure is likely. Inflation is currently in double digits in Brazil, and the population’s pressure is growing. Bolsonaro called the company’s profits “absurd”. In addition, in recent months, he has repeatedly fired against Petrobras and said, among other things, they are systematically working against the Brazilian population. At the same time, however, it must be noted that the gasoline prices in Brazil are also so high because of taxes, and the Brazilian state earns twice because it receives billions in Petrobras dividends per year. What Bolsonaro will ultimately do is unclear; perhaps it is only talking in the election year and will later fizzle out.

At least Lula has made somewhat more concrete statements. But here, too, it is unclear what will ultimately come to pass. Politicians talk a lot when it comes to votes.

An oil and gas industry study commissioned by the campaign of former President Luiz Inacio Lula da Silva for the October elections will recommend bolstering Petrobras’ refining capacity, including through the reversal of refinery privatizations, one of the study’s authors (William Nozaki) told Reuters.

Brazil’s Lula advised to buy back Petrobras refineries (source)

But William Nozaki also mentions that “nothing will be done in a traumatic way for shareholders or Petrobras’ investments.” Given that oil is exported, but diesel is imported, it seems to make sense to increase domestic production. However, it becomes problematic when companies are forced to do so. But maybe there is a way to make it work for Brazil as a country and Petrobras as a company.

The plan to separate local oil prices from the world market seems even more drastic. That sounds too much like a socialist centrally planned economy for my taste.

We are not going to keep the price in U.S. dollars. I think that shareholders in New York and Brazil are entitled to get dividends when Petrobras makes a profit, but it is important for us to know that Petrobras also has to take care of the Brazilian people. I cannot make an American shareholder richer and impoverish a local housewife that will pay more for a bag of beans because gasoline prices have gone up.

– Lula

However, I have not found any concrete figures on this. I believe that Petrobras will still make a good profit even in the worst-case scenario, especially since this is also in Brazil’s interest. As described earlier, the break-even point is a $20 oil price. Especially since Lula is more concerned with gasoline prices, while Petrobras makes most of its profits from oil production, which is partly exported; here, Lula is certainly not interested in price caps.

This is now the third time that the president of the republic is not satisfied and wanted to mess with the company and its pricing policy and this is the third time he has seen that this is not possible.

– Marcelo Mesquita, an independent board member

How I proceed with the shares

I believe the Brazil-specific political and currency risks are already priced in. Otherwise, it would not be possible for such a large and essential company to trade with a P/E ratio of 3 and a dividend yield of about 30%.

I sold my shares recently because I think in the run-up to the upcoming elections, there will be even more share price declines. In addition, oil prices are under pressure due to global recession concerns. But the further we get into the fall, the more likely I think oil prices will pick up again. Two drivers for falling oil prices were the release of the U.S. SPR and weaker demand from China. In addition, I expect that if oil prices fall even further, OPEC+ will cut production.

I want to get back into Petrobras, but I am waiting for slightly lower prices. I think a 10-20% discount on the current price is still possible. By the way, I will buy PBR.A and not PBR.

However, if you don’t want to trade, I recommend holding the shares or even buying them now. I think the downside risk is low due to the low valuation and the upside opportunity or the chance of another two decades of high dividends is significantly greater. Also, a reason why I sold was that I had made a mistake and bought PBR instead of PBR.A, these I wanted to replace anyway at some point.

Conclusion

Overall, there are a lot of general talks but few ideas and even fewer concrete ones. The government in Brazil is under the same pressure as many other governments worldwide. Petrobras is so profitable and cheaply valued that even if profits halve, it is still a highly profitable company with a double-digit dividend yield. However, I would like to mention again that it is high-risk, high-reward. There are not only Brazil-specific risks but worldwide risks as the energy market is in a reorganization, and there is the risk of even more political interference; what that could lead to exactly is impossible to predict. Overall, I am still bullish on the oil market, as long as you are diversified in your portfolio.

Be the first to comment