Tatiana Dyuvbanova

It’s been about five weeks since I wrote my comparative piece about Carnival Corporation & plc (CCL) and Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH), and in that time the shares of Carnival are up about 43% and the shares of Norwegian are up about 28%. In the article, I suggested that Carnival was the superior investment, so that’s gratifying on some level. Norwegian has just published results, and so I thought I’d review the name again. Although I didn’t prefer the stock when it was trading at $13.30, it may actually be a good buy at $17.30 if the financial results were strong enough. I’ll review the financials and the relative valuation to see if it’s time to pivot out of my Carnival position and into Norwegian.

I should also point out that I’m willing to take on only so much risk. For that reason, I’m only ever willing to buy a single cruise line. If a stock doesn’t represent the best relative reward, I see no point in buying the “also ran.”

Welcome to the “thesis statement” portion of the article. I offer this at the beginning of every article because I know that my writing can be a bit much to take for some. They may want to know my thinking about a given name, but they may want to avoid the constant bragging, for instance.

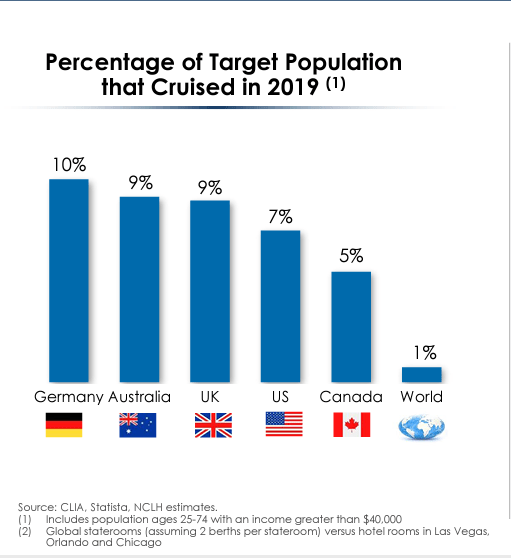

Additionally, this stock has many moving parts, and there is a need to keep articles to a reasonable length. This means that, for the sake of brevity, I can’t include every supporting data point. Each of these data points may not constitute an argument, but I think they are relevant. For instance, it seems that Germans cruise at the highest rate in the world, followed by Australians, British, and then Americans. The German economy is expected to enter a recession as a result of fuel disruptions, and that may impact cruise line revenues, obviously. Additionally, fuel may become more dear, with obvious consequences. So, to use a maritime analogy, each of the following arguments represents the “tip of the iceberg”, and they are consistent with a host of other issues that I foresee here. I see no reason to “climb aboard” this stock at the moment.

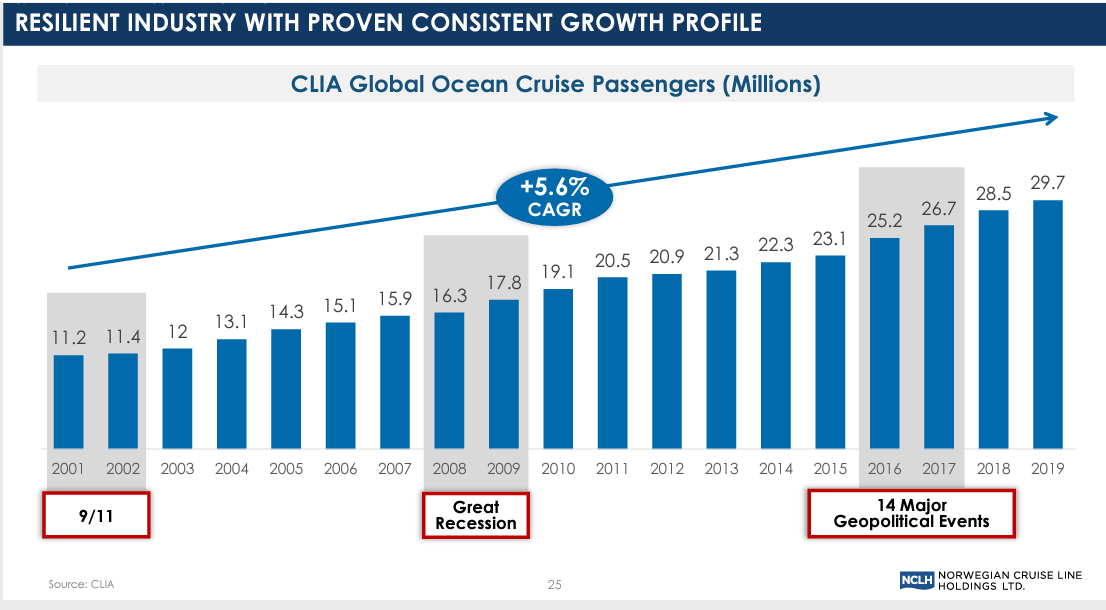

Geopolitical Risk?

Before getting into the analysis proper, I wanted to reply to a conversation I had with a colleague about the Cruise industry years ago. He expressed some fear that cruise lines would be negatively impacted by geopolitical events, and that geopolitical risk wasn’t properly priced into shares. I argued aggressively with this perspective, but I didn’t have much data to go on. In preparing, and then dramatically editing, this article, I came upon the following slide from Norwegian’s latest investor presentation. It seems to validate the view that this is an industry that’s largely insulated against geopolitical risk. Thus, if you were worried that the war in Ukraine will have a direct impact on the industry, fret no further. There will likely be no direct impact from that conflict.

That written, some geopolitical conflicts have second-order effects, and I think these will impact cruise lines. For instance, it seems that Germans love to cruise per the graphic below. That’s troublesome for the cruise industry among others because it seems that that country is heading into recession.

Popularity of Cruising By Country (Norwegian Cruise Line investor presentation)

The conflict may also raise fuel prices globally, obviously.

Cruise demand and crises (Norwegian Cruise Line investor presentation)

Norwegian Cruise Line Financial Snapshot

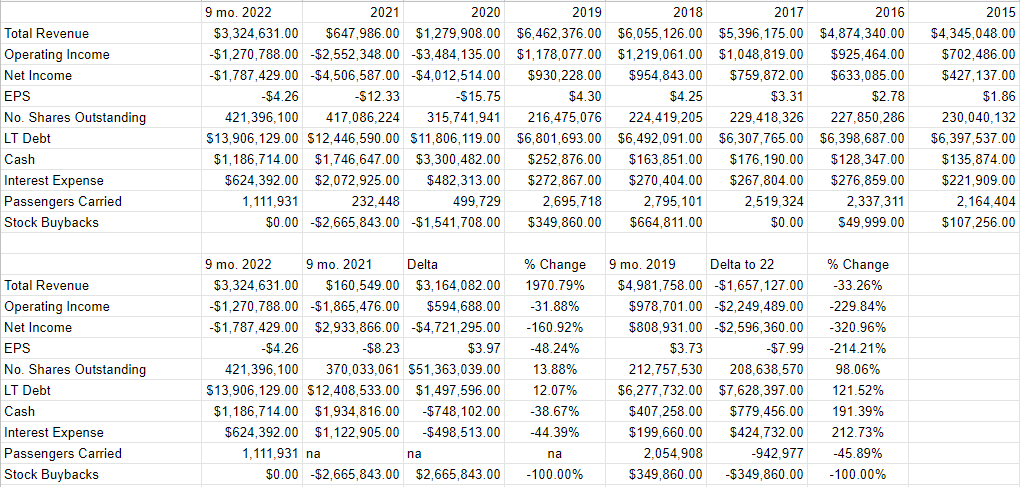

You may recall that the world was in the grip of a pandemic in 2021 that hit firms like Norwegian Cruise Lines particularly hard, and thus a comparison to that period may be unhelpful. Given that, I think it prudent to compare the most recent 9-month period to the same time in 2019, before this Covid unpleasantness. When we make comparisons to that period, things look far less rosy. For instance, revenue for the first nine months of 2022 is about 33% lower than it was in 2019, and net income is down dramatically, from a positive $809 million to a loss of $1.8 billion. Fuel, “other”, and marketing expenses were particularly troublesome in 2022, up 69%, 37%, and 34% respectively, but most costs increased across the board. In fact, only 2 significant sources of cost (commissions and “onboard”) were lower, down by 19% and 17.5% respectively. So, I think it’s reasonable to suggest that the firm has not yet recovered from the pandemic, and it may be the case that fuel (representing about 11% of total expenses) may be permanently elevated given what’s going on with oil and refining markets.

Norwegian Cruise Financials (Norwegian Cruise investor relations)

NCLH Stock

It may not seem obvious to regular readers, but I don’t actually try to be boring. With that in mind, I’ve written so many times in the past that the stock is distinct from the underlying business that maybe a small percentage of my readership might be starting to possibly get bored of me droning on about it. For the vast majority of people who obviously aren’t bored of reading this for the 900th time, let me express the case again. I’ll do so in bullet points, because I was taught in business school that people love bullet points.

-

The company sells leisure services, and its profitability is largely impacted by the number of passengers carried, how much food those people stuff into themselves, fuel and labor expenses as previously discussed. Additionally, the company spends a fair bit on marketing because there’s some significant overlap between their target markets and the people who might be more susceptible to illness than most.

-

The stock, meanwhile, is a supposed proxy for the business that is traded often, and goes up and down in price depending on the crowd’s ever-changing views about the future profitability of the company.

-

The stock may also be buffeted by the pronouncement of a fashionable analyst who may opine on this or a related company.

-

The stock is also buffeted by the crowd’s changing views about the health of “the market” and the attractiveness of “stocks” as an asset class.

Thus, the stock is a much more volatile instrument, affected by many factors beyond those impacting the business.

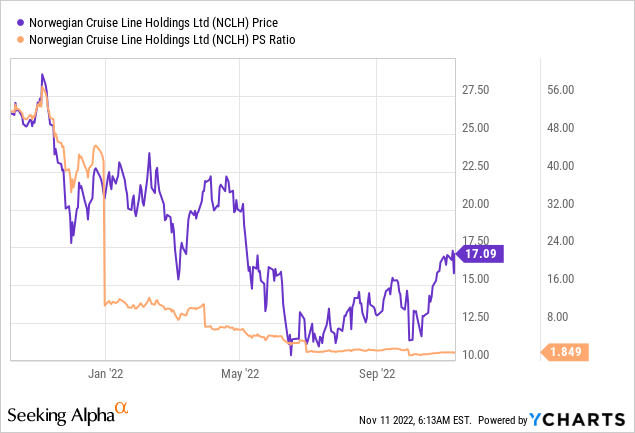

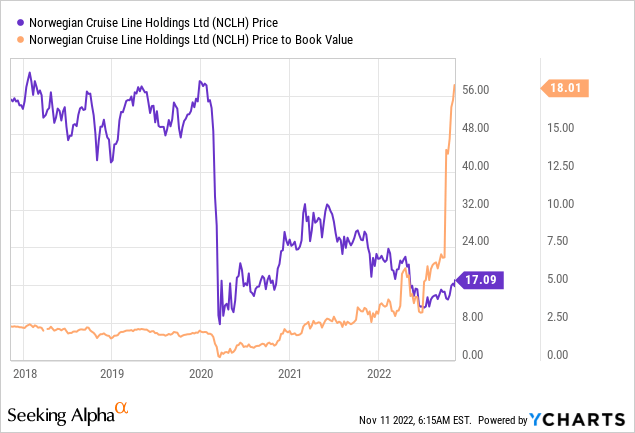

In my experience, the only way to make money trading stocks is to spot discrepancies between the crowd’s current views about the future and subsequent reality. It’s also my experience that cheaper stocks make better long-term investments. This is why I insist on trying to only ever buy stocks when they’re cheap, and eschew them when they’re dear. My regulars know I measure whether or not a stock is cheap in a few ways, from the simple to the complex. On the simple side, I look at the ratio of price to some measure of economic value, like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. In my previous missive on this name, one of the reasons I suggested that Carnival Cruise Lines was a superior investment was because it was cheaper. Norwegian was trading at a price-to-sales and price-to-book of 2.036 and 5.55, respectively. This was significantly more expensive than Carnival. I found this odd, especially given my opinion that Carnival did a superior job of containing costs. Fast-forward to the present, and things are cheaper in some ways, given that the market is paying about 7.5% less for $1 of sales than it did when I last reviewed this name. The price to book has skyrocketed, though, per the following:

In order to validate (or refute) my view that this stock is still too expensive, I want to try to understand what the crowd is currently “assuming” about the future of a given company. If you read my articles regularly, you know that I rely on the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit dense, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using stock price itself as a source of information, and then infer what the market is currently “expecting” about the future.

Anyway, applying this approach to Norwegian Cruise at the moment suggests the market is assuming that this company will not grow at all from its current levels, which I consider to be reasonably pessimistic. So, in some ways the shares are cheap, and in some ways, they’re quite dear. Given that I’m in the mood to preserve capital at the moment, I’ll err on the side of caution and simply remain on the sidelines for the moment. Additionally, I think the argument I made earlier about Norwegian Cruise Lines relative to Carnival still stands. Carnival is trading at a price-to-sales ratio of ~1.2 at the moment. Given that I only have so much capital, and given that I only want so much exposure to the cruise line industry, I’ll continue to eschew Norwegian until something changes.

Be the first to comment