lcva2

Thesis

Microsoft Corporation (NASDAQ:MSFT) will report its FQ4 and FY22 earnings release on July 26. It will be a highly-anticipated earnings card that SaaS investors will assess for any material slowdown, given the recent macro headwinds.

The Street has also been actively revising software estimates and price targets ((PTs)). The analysts have attempted to account for a reduction in enterprise spending. In addition, Microsoft is expected to be impacted by the headwinds in consumer electronics, notably in its More Personal Computing (MPC) segment. Therefore, investors are urged to parse whether its cloud computing business can help to compensate for these headwinds.

We believe that MSFT’s valuation is well-balanced and within our fair value zone. Adding at fair value is a reasonable proposition for a fundamentally-strong stock like MSFT.

Notwithstanding, its price action indicates that MSFT could face a steeper sell-off if the company communicates weaker than expected guidance, given its growth premium. Therefore, we urge investors to consider layering in when adding exposure, taking advantage of dollar-cost averaging opportunities.

Accordingly, we reiterate our Buy rating on MSFT, heading into its FQ4 release.

Cloud Business Needs To Overcome Its Consumer Weakness

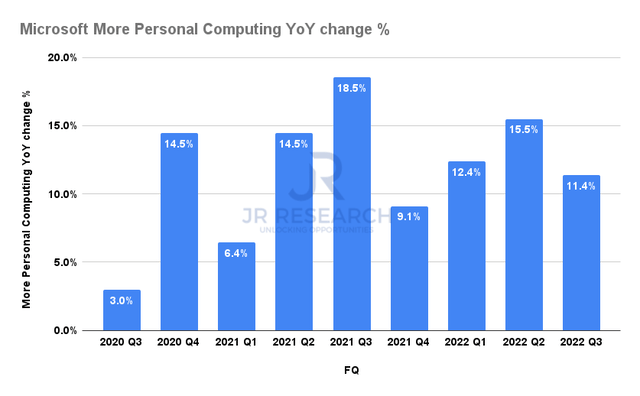

Microsoft MPC revenue change % (Company filings)

BofA (BAC) highlighted in a recent note that the current PC and consumer electronics headwinds could also impact Microsoft’s MPC segment. It added (edited):

“There could be as much as $300M-$400M in weakness from our $14.7B estimate to its More Personal Computing group, which houses Windows, given lower PC shipments in calendar Q2.”

In addition, we also noted that MPC has been slowing Microsoft’s revenue growth cadence since FQ3, as seen above. MPC delivered revenue growth of 11.4% YoY (Vs. total revenue growth of 18.4% YoY). As a result, MPC’s current weakness could continue to impact Microsoft’s growth in FQ4.

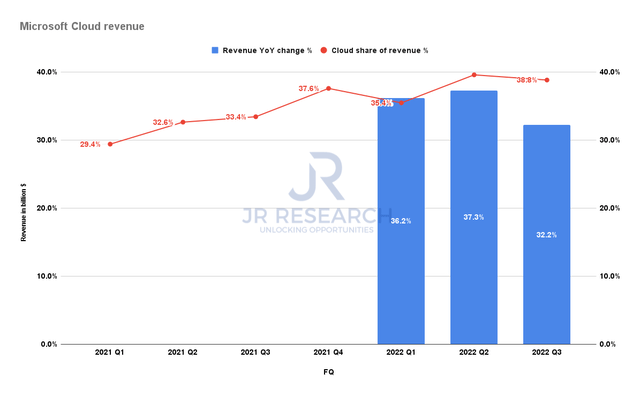

Microsoft cloud revenue (Company filings)

Notwithstanding, we believe that Microsoft’s cloud computing business should help to compensate for the consumer headwinds, given Azure’s robust performance. Therefore, a better-than-expected performance from Azure could help lift its critical cloud revenue, which delivered revenue growth of 32.2% in FQ3. In addition, BofA also accentuated the strength of Azure (edited):

Partner commentary suggests solid sustained workload migration to the Azure cloud platform from pull-through across Power Apps, Dynamics, Server Annuity/hybrid and Office 365. – Seeking Alpha

Notwithstanding, BofA expects currency headwinds to pressure Azure’s topline lift, estimating its growth to come in at about 44-45% in FQ4.

Still, Microsoft Should Be Able To Navigate These Challenges Confidently

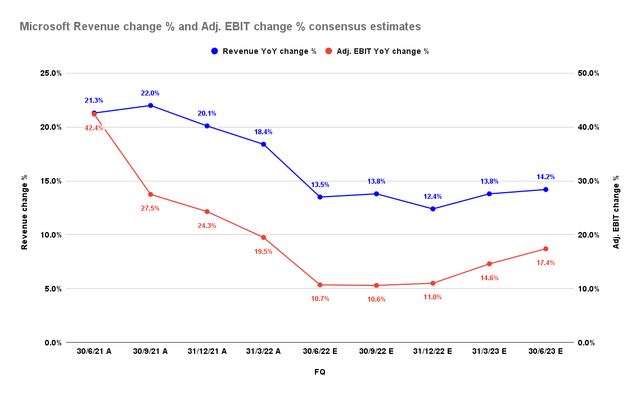

Microsoft revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

Notwithstanding, the Street’s estimates suggest that Microsoft’s near-term challenges are unlikely to be structural.

However, its revenue growth is expected to moderate significantly, given 2021’s tough comps. Still, its growth cadence should climb out of its nadir by FQ2’23 (quarter ending December 2022) and improve through FQ4’23.

But, investors need to parse management’s commentary on whether it anticipates a material slowdown in corporate IT spending. Morgan Stanley (MS) also cautioned in a recent update (edited):

Signs of decelerating IT budget growth expectations and a weakening consumer warrant increased focus on the durability of growth. Microsoft screens well relative to many software peers, but is not immune to macro headwinds. – Barron’s

MSFT’s Valuation Looks Well-Balanced, But Don’t Expect Outperformance

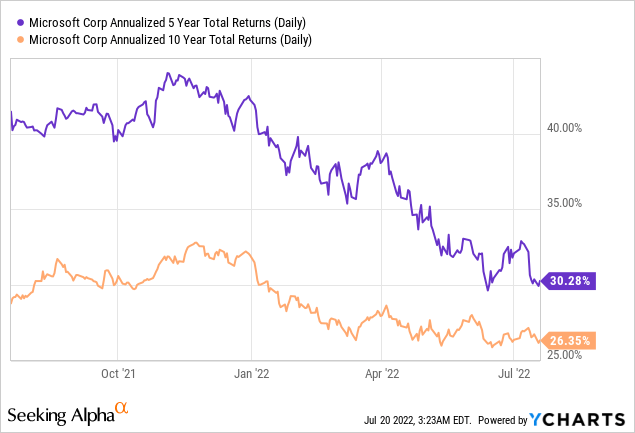

MSFT has been a massive winner for investors over the past ten years. It delivered a 5Y and 10Y total return CAGR of 30.28% and 26.35%, respectively. As a result, it has easily outperformed the SPDR S&P 500 ETF (SPY).

Notwithstanding, our valuation model suggests that such outperformance is unlikely moving forward.

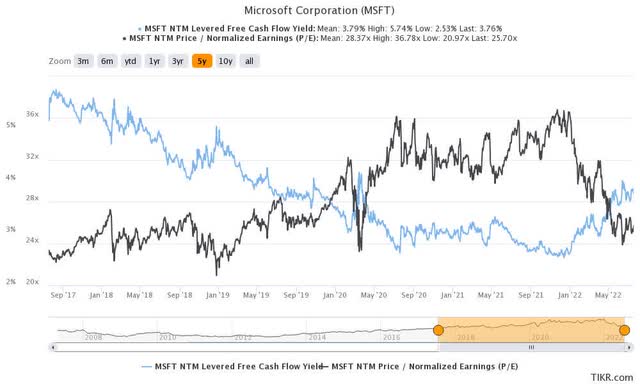

MSFT 5Y valuation metrics (TIKR)

Microsoft delivered a 5Y revenue CAGR of 13% and a 5Y EPS CAGR of 25.8%. However, the consensus estimates indicate that Microsoft’s adjusted EPS growth is expected to moderate to the mid-teens, with FY24’s growth estimated at 16.4%.

Moreover, MSFT last traded at an NTM FCF yield of 3.76%, in line with its 5Y mean. But, given markedly slower profitability growth, it makes sense for the market to ask for even higher yields to compensate for the risks of holding MSFT moving forward.

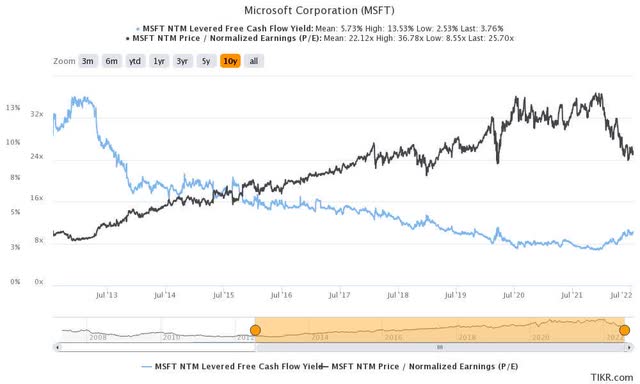

MSFT 10Y valuation metrics (TIKR)

As seen above, MSFT posted a 10Y mean of its FCF yield of 5.73%. Its 10Y revenue CAGR of 9.2% is markedly slower than its 5Y average, as discussed previously. Its 10Y EPS CAGR of 11.6% is also significantly lower than its 5Y mean.

Therefore, we believe that the market has correctly de-rated MSFT’s valuation in the face of potentially slowing growth.

Investors are encouraged to use appropriate FCF yields to account for such a potential slowdown in their valuation models. Therefore, we suggest a level between 3.76% and 5.73% is reasonable.

Is MSFT Stock A Buy, Sell, Or Hold?

We reiterate our Buy rating on MSFT.

MSFT’s valuation is well-balanced, but not undervalued. Therefore, investors should not expect market outperformance at the current levels. Moreover, if the company’s guidance over corporate IT spending weakens, MSFT’s valuation could further compress to account for even slower growth.

Therefore, we encourage investors to layer in their exposure accordingly. On the other hand, if they are strictly looking for better risk/reward to improve their chances of market outperformance, consider waiting at lower levels to enter their positions (but there’s no guarantee the price will fall further).

Be the first to comment