vzphotos

Thesis

Micron Technology, Inc.’s (NASDAQ:MU) underwhelming performance, followed by guidance that suggested a 50% cut in capital spending, didn’t surprise us. Readers who have followed our articles over the past few months would have known that we repeatedly reiterated that Micron’s business is cyclical.

We highlighted that the market has “refused” to re-rate highly cyclical memory players like Micron because their underlying operating performance is closely tied to the semi business cycle. As a result, average selling prices (ASPs) would be critical determinants in the health of their business performances, impacting their growth prospects and profitability. The current malaise indicates that this continues to dominate Micron’s thesis through the current cycle, and investors are urged to follow the valuation guidance provided by the market: memory players should remain cheap.

Notwithstanding, the secular growth drivers undergirding the medium-term prospects of Micron remain intact. As the technology leader between Samsung (OTCPK:SSNLF) and SK Hynix, Micron is well-positioned to ride the recovery in the memory upcycle after it gets through the current downturn.

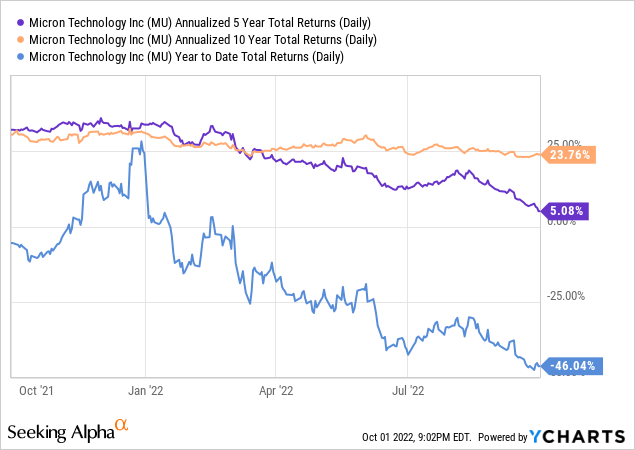

However, investors don’t have to wait till the end of the inventory digestion in their end customers before putting money to work in MU. As the market is forward-looking, MU has suffered significant damage in its valuation since January 2022, despite its seemingly “low valuations.” Accordingly, MU has underperformed the iShares Semiconductor ETF (SOXX) and the SPDR S&P 500 ETF (SPY), as it posted a YTD return of -46%.

However, we explain why investors have reasons to be sanguine that MU has already collapsed to its long-term support levels, coupled with constructive valuations. Hence, we are confident that investors can use the current pessimism to add more positions and ride with MU through the cycle.

We reiterate our Buy rating on MU.

The Street Cuts Micron’s Forward Estimates

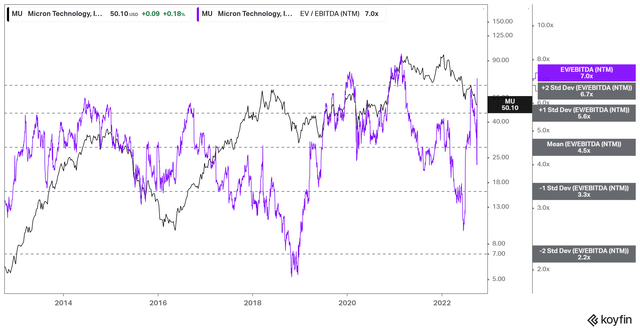

MU NTM EBITDA multiples valuation trend (koyfin)

Investors in cyclical businesses need to be aware that investing through the bust in the business cycle would behoove significant cuts in their forward earnings estimates.

As seen above, the Wall Street analysts have slashed Micron’s NTM EBITDA estimates. As a result, it led to its EBITDA multiples (7x) surging well above the two standard deviation zones over its 10Y mean (4.5x), even though MU’s price levels remain just under June lows.

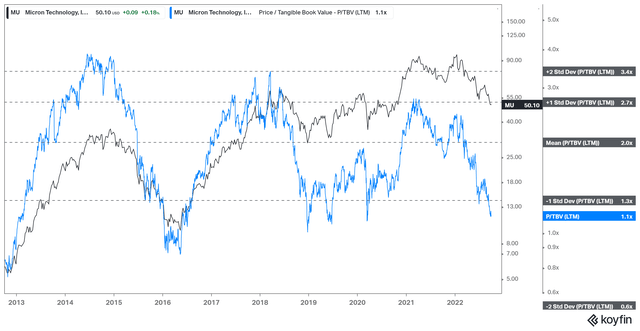

MU TTM P/TBV valuation trend (koyfin)

Consequently, investors need to refer to MU’s closely-followed P/TBV to discern the extent of the damage.

Accordingly, MU’s TTM P/TBV (1.1x) has dropped below the one standard deviation zone under its 10Y mean (2x). MU has seen robust valuation support undergirding its forward recovery when its valuations have been battered to similar levels over the past ten years.

As a result, we believe the battering in MU is nearing its long-term bottom, even though there could be near-term downside volatility. However, this is not the time for investors to be fearful but to be greedy.

Investors Need To Expect Weak Results Through 2023

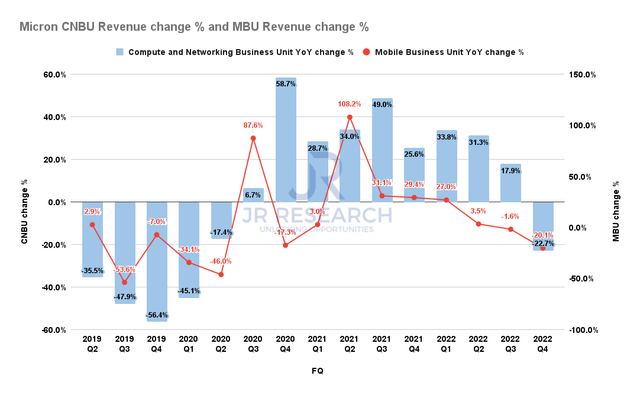

Micron CNBU Revenue change % and MBU Revenue change % (Company filings)

Micron’s weakness is broad-based, which impacted all its revenue segments. As seen above, the downturn in the memory cycle affected its two leading segments, Compute and Networking Business Unit (CNBU) and Mobile Business Unit (MBU) significantly.

Using 2019’s down cycle as an indicator, we believe the current downturn has just started. Micron’s commentary also suggested that investors could expect a recovery in its revenue growth only from H2’23.

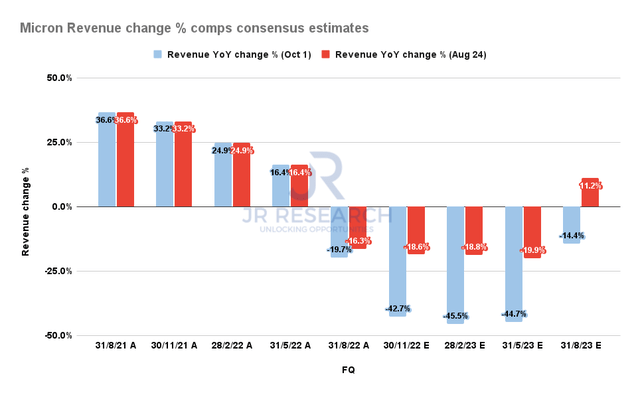

Micron Revenue change % consensus estimates (S&P Cap IQ)

As seen above, the revised consensus estimates (bullish) suggest that Micron’s recovery could occur from H2’23 (exiting FQ4’23), consistent with our previous analysis.

Notwithstanding, the Street has finally gotten the message that Micron’s revenue decline could be worse than anticipated. Consequently, it led to the analysts cutting their estimates substantially from August’s metrics, as seen above.

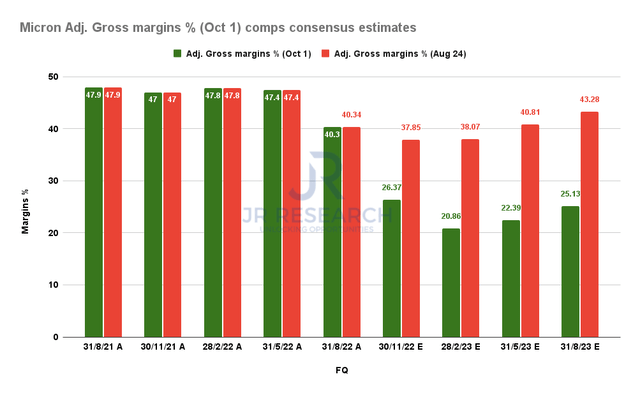

Micron Adjusted gross margins % comps consensus estimates (S&P Cap IQ)

With Micron revising its gross margins markedly outlook for FQ1’23, the Street also cut Micron’s gross margins estimates further through FQ4’23, as seen above. However, given the extent of the cuts, we are confident that further significant downside revisions are unlikely.

Is MU Stock A Buy, Sell, Or Hold?

As a result of the battering in 2022, the market has sent MU’s YTD total return spiraling down to -46%. Consequently, its 5Y total return CAGR has also been impacted markedly, falling to 5.1%. However, investors need to look ahead from these levels.

While the normalization is deserved, MU’s 10Y total return CAGR of 23.8% indicates it has outperformed for investors over time. Therefore, the critical question is whether investors can be confident that the market could support MU at the current levels, lifting it from its current malaise through the cycle.

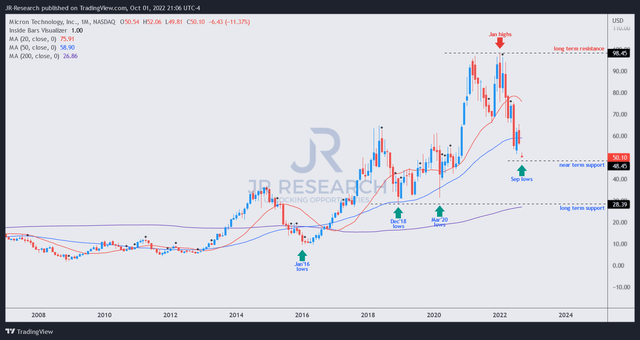

MU price chart (monthly) (TradingView)

We believe investors have many reasons to be optimistic. As seen above, the battering in MU in 2022 has sent it down to its long-term support levels.

Notably, the 50-month moving average has consistently supported MU’s long-term uptrend through the past memory downturns.

Furthermore, the post-earnings reaction suggests that a significant level of damage had already been inflicted on MU, as it continues to trade close to its June bottom.

Therefore, we are confident that MU could stage its bottoming process from the current levels, given the significant de-risking in its forward estimates by the Street.

Accordingly, we reiterate our Buy rating on MU and urge investors to leverage the downturn in MU to add more to their positions and hold through the cycle.

Be the first to comment