gorodenkoff/iStock via Getty Images

Looking for Opportunities in Healthcare Stocks

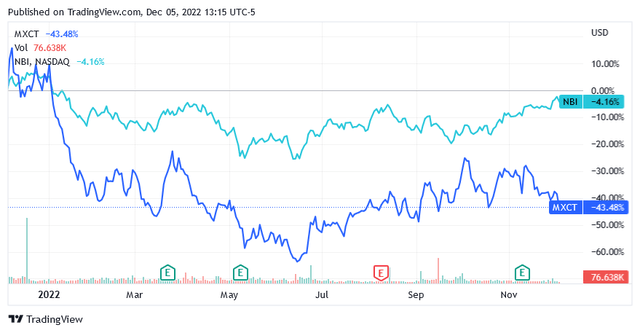

Healthcare stocks are showing some signs of recovery, but the sharp bearish sentiment that has dominated the U.S. stock market over the past year means healthcare stocks are still down more than 4%. NASDAQ Biotechnology (NBI) is the benchmark index for healthcare stocks.

The bearish sentiment has also hiked the likelihood of finding a bargain, as quality healthcare stocks may still be trading at very attractive prices.

For MaxCyte, Inc. (NASDAQ:MXCT), the sharp decline in the stock’s market value could lead to premature conclusions about the stock. However, given the company’s bright prospects, current prices should serve as an incentive to strengthen a position in this stock.

MaxCyte in the Healthcare Medical Device Industry

Headquartered in Rockville, [Maryland], MaxCyte, Inc. is active in the cell engineering industry, providing technologies that help biotech companies discover, develop and commercialize next-generation cell therapeutics and advance novel and cell-based scientific research.

The company has developed and commercialized a proprietary technology called Flow Electroporation, which enables complex engineering activities on a variety of cells.

Electroporation is a microbiological technique in which an electric field is passed through cells so that their cell membrane has augmented permeability. Once this is achieved, chemicals, drugs, electrode arrays, or DNA can be introduced into the cell [transfection].

Based on this type of technology, the company’s platform, called ExPERT, supports the very fast-growing cell therapy market and can benefit biotech companies throughout their process from discovery/development to commercialization of next-generation cell-based medical therapies.

ExPERT is the trading name of a product family that includes four instruments called ATx®, STx® GTx® and VLx™. These technologies are internationally protected by intellectual property rights and consist of disposable or proprietary processing assemblies, and software registrations.

All are electroporation tools, but while ExPERT ATx allows for small to medium-scale transfection, ExPERT STx allows for protein production and drug development in addition to expressing therapeutic targets for cell-based assays. Cell-based assays are methods for growing living cells in vitro to measure the biochemistry and physiology of either healthy or infected cells.

ExPERT GTx enables transfection on a large scale in therapeutic applications while ExPERT VLx is a suitable technology to perform cell engineering on a very large scale.

Third Quarter 2022 Financial Results

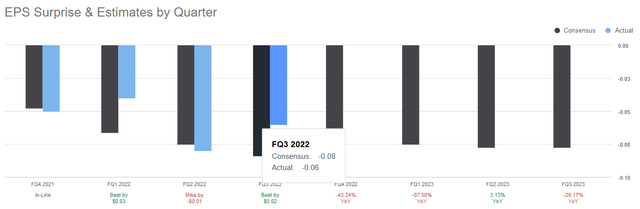

MaxCyte ended the third quarter of 2022 with a loss of about $0.06 per share, but outperformed analysts by an average of $0.02.

The bottom line deteriorated from the same quarter in 2021, when MaxCyte ended the period with a net loss of $0.03 per share.

That came as operating expenses increased nearly 47% year-over-year to $17 million in the third quarter of 2022, driven by the company’s increased number of salespeople and employees in its science and manufacturing divisions.

The company also incurred increased spending to help its customers advance pipelines of medical therapies.

The company also had to deal with increased cash expenses related to sales and marketing activities, as well as rent payments and expenses related to stock-based compensation, with the latter item increasing 39% year over year to $3.2 million.

Likewise, pro forma EBITDA for the quarter resulted in a loss of $7.1 million, a substantial deterioration compared to negative pro forma EBITDA of $2.4 million for the same quarter in 2021.

But the catalyst for higher share prices could potentially be provided by any additional increase in revenue until the bottom line for this growth stock doesn’t turn into a profit.

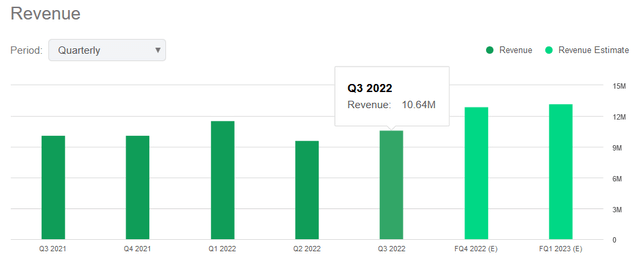

In the third quarter of 2022, total revenue advanced 5% year over year to $10.64 million. The company beat analysts’ median forecast by $0.17 million.

Approximately 93.4% of total revenue in Q3 2022 came from its core business, which comprised the sale of instruments and disposables to customers involved in cell-based therapy discovery and in cell-based drug discovery.

The remainder of the total revenue was related to the strategic platform licensing [SPL] program. Currently, the SPL supports several biotech companies around the world in the development of genetically engineered cell therapies, particularly in the areas of solid tumors and cancer, and provides support from a clinical and commercial perspective.

According to the company, cell therapy accounted for 74.2% of total sales [up 27% YoY], drug discovery [up 4% YoY] for 18.7%, and program-related [down 62% YoY] for 7.1%.

Further Positive Momentum from Core Business and Improvement of SPL to Support Ongoing Rise in Total Revenues

Regarding the program-related revenue segment, shareholders can expect improvement over the next few weeks as the company anticipates additional SPLs, according to the Q3 2022 Earnings Call.

MaxCyte is also promising healthy growth numbers for its core business to be announced later this year, but the operations it includes are performing well and on track. The launch of ExPERT VLx, which will initially focus on the production of proteins, is expected to provide a significant boost to the drug discovery segment of MaxCyte’s core business.

Meanwhile, sales are progressing well.

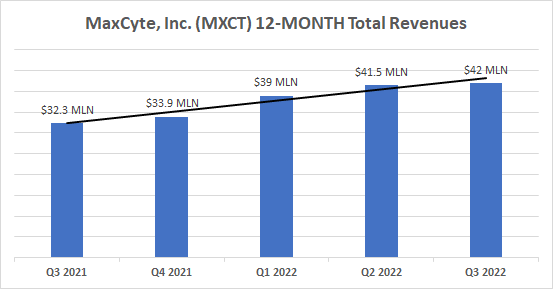

On a trailing 12-months basis, total revenues have progressed as the below chart illustrates, from $32.3 million as of Q3 2021 to $42 million as of Q3 2022.

Data source: Seeking Alpha

Outlook for MaxCyte

For the foreseeable future, the company expects revenue to benefit from the investments and aims to increase the popularity of its technology with customers to enable a broad range of cell types and address a wide range of indications.

Expected strong growth in the global cell therapy market will help MaxCyte, Inc. realize its ambitions to become an industry leader and switch to a positive income company. According to Precedence Research, this market is projected to grow nearly 22% annually over the next 8 years, from approximately $10.4 billion in 2021 to approximately $60.7 billion in 2030.

The main driver for the market will be the rapid emergence of some chronic diseases in the world population. These are mainly a result of the unhealthy lifestyle that is pervasive in today’s society, but the involvement of a hereditary factor cannot be ruled out.

In terms of incidence, diabetes is one of the fastest-growing diseases, along with cardiovascular disease and some types of cancer. Such a scenario offers more opportunities not only for the manufacturers of traditional treatments but also for the companies that want to develop innovative treatments. The latter may support conventional therapies or provide a further treatment option where conventional therapies have failed. Essentially, the goal of the biotech developer of novel treatments and the companies that provide the technologies, such as MaxCyte, Inc., is to improve the quality of life of patients from both a physical and psychological standpoint.

Developers of innovative therapies require the use of technologies from MaxCyte, Inc. and other similar players. For these reasons, demand for MaxCyte, Inc.’s technologies is expected to gain momentum in the coming years.

With this in mind, the revenues of MaxCyte, Inc. should continue to grow in the future. For the full year 2022, the company expects revenue growth of at least 30% year-over-year.

Revenues Estimate From Analysts

Looking ahead to full-year 2022, analysts estimate total revenues will go up 31.96% year-over-year to $44.73 million, while for full-year 2023 they estimate that revenue will go up 28.31% year-over-year to $57.39 million.

The improvements will be positive for the stock price, but headwinds from the ongoing bearish sentiment need to ease.

The Stock Valuation: Shares Look Cheap

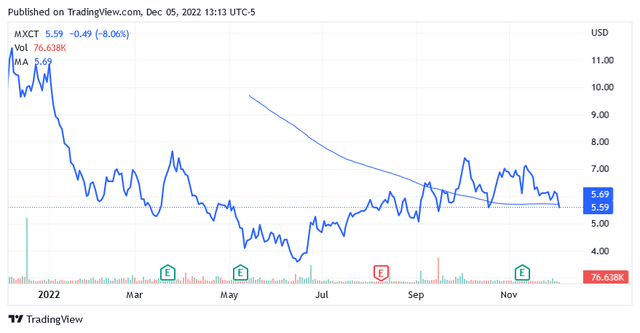

After falling more than 40% over the past year, shares of MaxCyte are now trading low, as evidenced by the following technical indicators.

The stock price was $5.59 below the long-term trend of the 200-day simple moving average of $5.70 and well below the midpoint of the 52-week range of $3.36 to $11.56.

But the stock price is not only low. It also looks cheap compared to the rosy prospects outlined above.

Of course, it is necessary that the strong headwinds of bearish sentiment, fueled by a range of macroeconomic and geopolitical issues such as inflation, monetary tightening, and war in Ukraine, stop exerting strong downward pressure on the share price.

However, the chart shows that the stock price has recovered in recent months, helped by rising optimism about the U.S. Federal Reserve’s effectiveness in containing elevated inflation and rising expectations of a mild recession following higher interest rates.

The stock market appears to be heading for a recovery and ending the decline that has hurt holding MaxCyte and other good stocks.

The Risk of Investing in MaxCyte

Investing in MaxCyte carries a risk currently defined by a 24-month market beta of 1.71 and an Altman Z-Score of 13.43.

The first index indicates that the stock is more volatile than the market. So the stock price will rise much faster in the event of a rebound in U.S.-listed stocks, or fall dramatically in the event of another economic or geopolitical shock that should disrupt the market.

Right now, the highest likelihood seems to be in the direction of a stock market rebound after Federal Reserve Chair Jerome Powell last week at the Brookings Institute hinted at a slowdown in rate hikes from the next FOMC meeting in mid-December.

The Altman Z-Score Index instead attempts to quantify financial risk.

The Altman Z-Score of 13.43 means that MaxCyte’s balance sheet is financially strong and that the risk of bankruptcy is virtually non-existent as the company stays in safe areas.

For beginners, if the index is between 1.8 and 3, the balance sheet is in gray areas and the risk of financial failure is moderate. If the Altman Z-Score is less than or equal to 1.8, the balance sheet is in distress zones with a high risk of bankruptcy.

As of September 30, 2022, the balance sheet shows a net cash position of approximately $218 million.

Conclusion

MaxCyte Inc. continues to show good sales performance while the outlook is positive as the global cell therapy market represents a fast-growing environment.

The stock has fallen dramatically over the past 12 months, but the cause doesn’t appear to be related to the company, its products, or the market. On the contrary, the bearish sentiment has hurt MXCT stock. The stock should rebound very nicely as bearish sentiment exits the overall U.S. stock market and investors regain confidence in risk.

The MaxCyte, Inc. stock price currently looks attractive relative to the upside potential.

Be the first to comment