Source: Kendall Capital

We are in turbulent times. Desperate times call for desperate measures. This is particularly important for new investors. Old-time investors have seen bigger corrections and volatility than we are currently witnessing. In a period like this, investors can be lost for ideas on what to do. We have the upcoming US election, which could change the course of geopolitics. Throw in the current Coronavirus worries and the concerns about asset valuation frothiness, and we have the perfect recipe for investors to start preparing to rotate into safe havens.

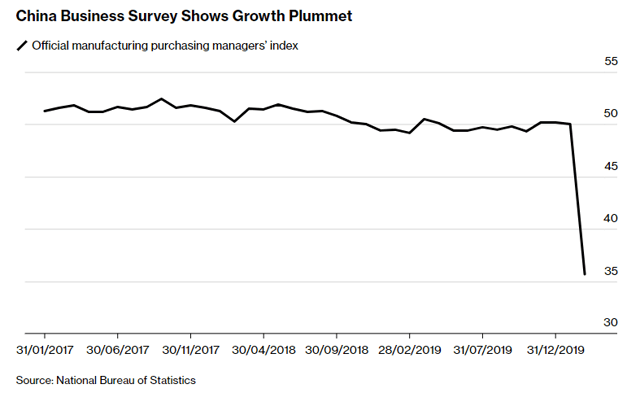

While central banks are cutting rates to pad the downside effect of the blow to supply chains and overall market outlook, which has turned sour, the next earnings season will herald disappointing results by public companies with huge exposure to APJ. Also, investors should bear in mind that most tech stocks were trading at all-time highs before the Coronavirus outbreak. The market has been in a serious investing mode for a lot of tech companies to expand their reach across the globe as they activate their globalization chip to justify their double-digit sales multiples. That call option might have expired heading into the second quarter of the year. Given that it is tough to quantify how deleterious the worst case will be until the Corona pandemic is contained, the extreme and expedient measures to ensure human capital preservation will have a ripple effect on international sales, marketing activities, and events across all sectors and industries. For investors in cybersecurity (HACK) stocks, two things matter.

Understand the underlying impact on your short/long term exit strategy

If you are ever curious about what other investors who have a long position will do during turbulent times, here is a chance for you to assess that factor and remodel your portfolio valuation and risk exposure accordingly. I use periods like this to study stocks that are highly exposed to geopolitical risks and other tough to model or predict events. I also use this period to reassess the value/supply chain of the stocks in my portfolio. The end goal is to learn from previous biases and mistakes. Recently, I learned that Eventbrite (EB) is going to take arguably the most knock from the Coronavirus fears as conferences across the globe are canceled. This spillover immediately affects all stocks along the event management supply chain. This mostly revolves around travel, hotel, and tourism stocks. This boosts demand for remote communication platforms like Atlassian (TEAM), Slack (WORK), Microsoft Teams (MSFT), and Zoom (ZM). This is going to raise boardroom discussions about locking down these platforms as a fail-safe for future pandemics. The arguments and case to adopt remote work productivity tools have never been more convincing. I expect small and large enterprises to adopt at least one remote work platform to hedge the risk of a future pandemic. Also, digital marketing platforms such as Facebook (FB), Alphabet (GOOGL), and Twitter (TWTR) will benefit from this as marketing budgets allocated to conferences, events, trade fairs, and meetings are rotated into online ads and campaigns. I expect to see a lot of media buying on interactive platforms like Youtube and Snapchat (SNAP). This is a win for cloud security stocks (SIEM, log management, DDOS protection) as the volume of data in transit assessing cloud platforms increases significantly. The conclusion is that you shouldn’t be worried about the demand for cloud security stocks. However, appliance-based security players selling heavily into APJ should be carefully hedged.

Identifying the mispriced assets on your radar

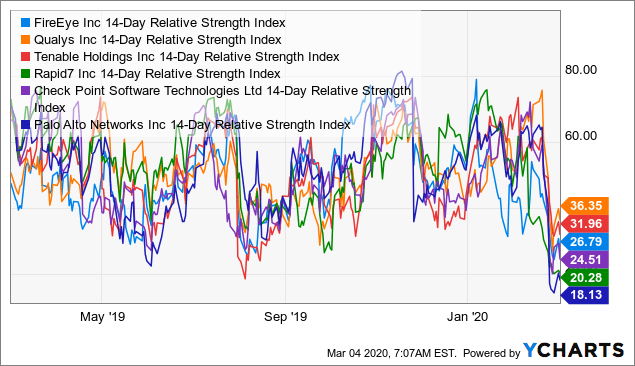

Data by YCharts

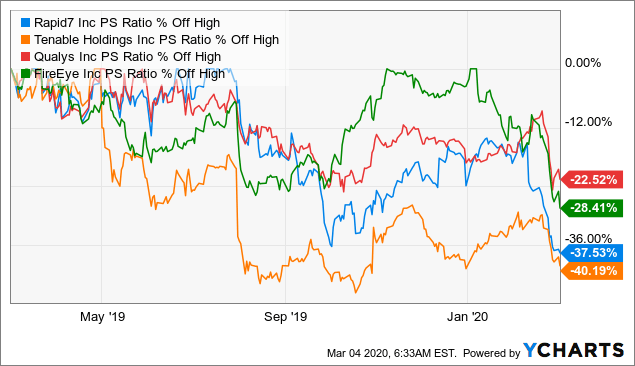

Data by YCharts

Times like this, I’m more interested in the market than ever before. Given that I’ve placed my bets in a mix of safe havens and volatile assets with favorable risk/reward, I use this period to take a closer look at the market. In periods like this, I study market behavior and the reaction of investors who own stocks I find attractive but expensive. If the FOMO-FUD froth thickens, I swing in after a sell-off of an attractive stock on my investment radar. While most SaaS assets are still trading at elevated valuation multiples, a number of vulnerability assessment platforms have recorded more drawdowns than their counterparts. This includes players like Rapid7 (RPD), Qualys (QLYS), FireEye (FEYE), and Tenable (TENB). While this was partly induced by the weaknesses reported by Palo Alto (PANW) and Zscaler (ZS), I believe these stocks are oversold when you consider their future potential as they will continue to play a bigger role alongside leading DevOps platforms (Elastic (ESTC), and Datadog (DDOG) in assessing the security threats embedded in web security assets as digital transformation projects go mainstream.

Data by YCharts

Data by YCharts

The stock market is an open research lab. It is important to know your opponents at their weakest point. Seasons of market turbulence affords you the opportunity to understand market makers who are strong and market makers who are bluffing. In the words of Warren Buffett: “when the tide goes out, we identify those who are swimming naked.” This is why you have to pay attention now.

Understanding what other investors will do when they have their backs against the wall will help you strengthen your conviction in the stocks you own.

Conclusion

Investors should use this period to study the conviction and faith of market makers in the stocks they own. It is important not to miss critical volatility signals. Cloud stocks have recorded solid earnings this season, though the global fear of a Coronavirus pandemic has masked the after earnings spike in valuation. As usual, stocks with huge exposure to emerging markets will take the biggest hits. Failure to anticipate these drawdowns can lead to fear-induced decisions.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment