Hello my names is james,I’m photographer.

Investment Thesis

Kinross (NYSE:KGC) is a larger gold mining company that has had a challenging 2021 following a fire at the mill at Tasiast in Mauritania, which meant production fell short of the initial guidance last year. 2022 has not been without its challenges. The invasion of Ukraine led to the divestment of the Russian assets, for relatively little money.

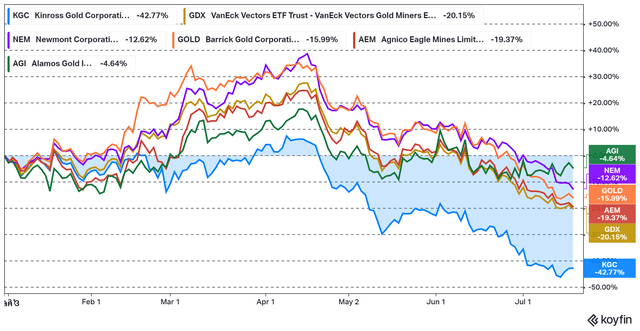

The stock price has dropped substantially from the highs in 2020 and has underperformed most larger gold miners in 2022 by quite a lot.

This excessive share price decline has led to a very attractive valuation for the company, both on an absolute level, and compared to other gold mining companies.

I do think this very cheap valuation is unlikely to last longer term given the decreased jurisdictional risk, some interesting development projects in North America, and the fact that the company is set to decrease the leverage going forward.

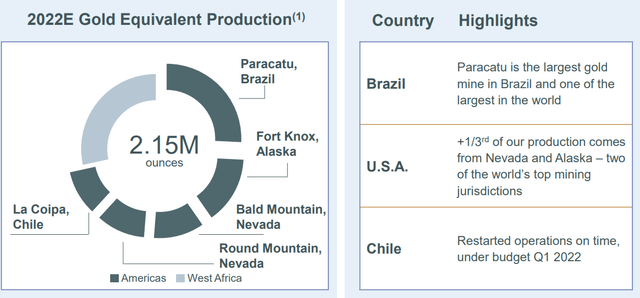

Figure 2 – Source: Kinross June 2022 Presentation

Relative Valuation

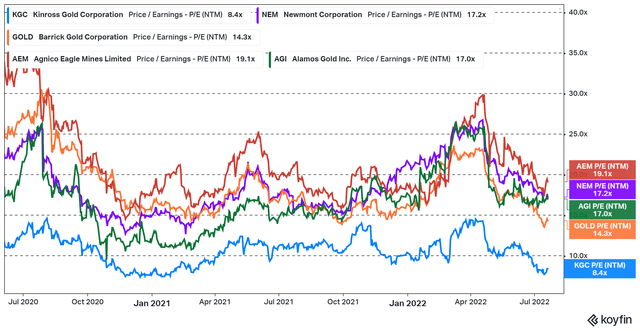

Kinross has historically traded with a valuation discount to some of the larger gold mining peers, most likely due to the Russian and other less desirable exposure. However, the company has in 2022 sold the Russian assets for $340M and the company has received $300M so far. Kinross has also announced the sale of its assets in Ghana for another $225M. So, the geographical exposure is starting to look relatively attractive, with much of production coming from the United States and Brazil.

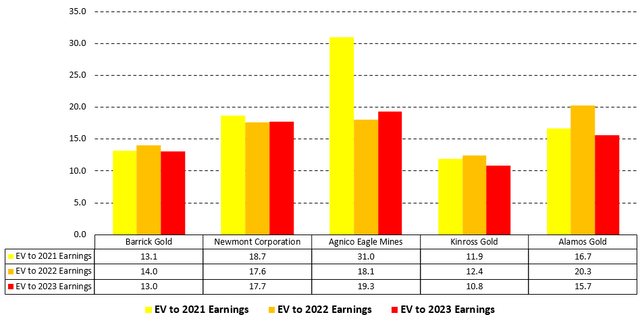

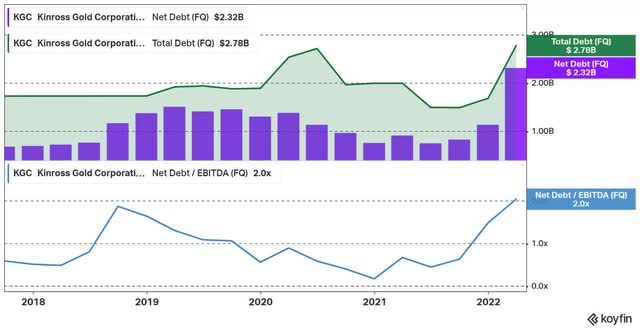

The above chart highlights the forward price to earnings multiple over time, where we can see how cheap Kinross really is with a price to earnings ratio as low as 8.4. However, Kinross does have more leverage than the other companies. This is partly because of the Great Bear acquisition recently. The Net Debt to EBITDA is presently around 2.0, but the company is targeting a level of 1.0 by the end of 2022 already.

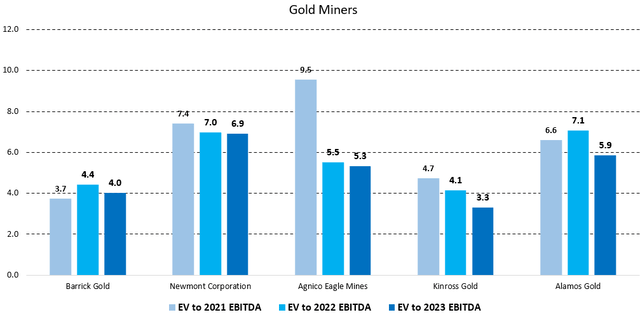

In the two charts below, we will take the cash and debt into account, and turn to the enterprise value, where we look at EV to EBITDA and EV to Earnings.

Figure 5 – Source: Data from Multiple Source – Estimates from Koyfin

Figure 6 – Source: Data from Multiple Source – Estimates from Koyfin

We can clearly see that much of the valuation discrepancy remains even after adjusting for cash and debt. The EV to 2023 Earnings ratio is as low as 10.8, which is significantly lower than most peers.

It is also worth noting that if Kinross is able to lower the Net Debt to EBITDA to 1.0 by the end of this year, we are probably talking about a net debt decrease of about $1B. The current market cap of Kinross is only $4.1B and the enterprise value is $6.4B. So, a $1B net debt reduction would have a substantial impact on the enterprise value, further lowering the valuation multiple, and increasing the difference with the other gold mining companies. Debt reduction is usually one of the easiest and most reliable ways of improving the valuation of a company.

Great Bear Acquisition

Kinross did in late 2021 announce the Great Bear acquisition, where the total purchase price of around $1.4B for an asset without a resource looks rather steep judging by today’s valuations.

However, the sentiment was better at the time of the announced acquisition, there are also few assets of this size and grade in good jurisdictions. Given that most of the payment was made in cash, I am not overly critical. The initial resource is expected in conjunction with the Q4-22 financials, when we will get a much better handle on the project even if it looks very interesting at this point.

Figure 7 – Source: Q1-22 Report

2022 Guidance

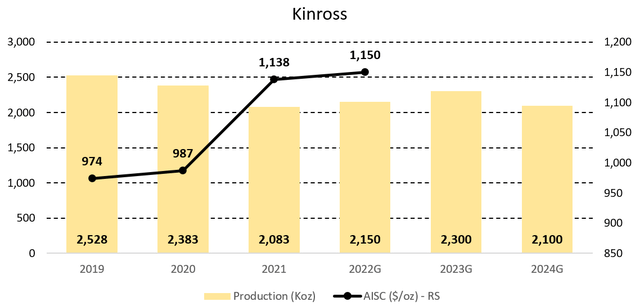

Kinross is in 2022 guiding for an annual gold production of 2.15Moz with an AISC of $1,150/oz. Note that it does not include any production in Q1 & Q2 from the divested assets, so total production in 2022 will likely be slightly higher. Production is, despite the challenges and divested assets, expected to hold up quite well going forward.

While costs have increased lately, which is something we have seen industry wide, Kinross still has relatively low costs with an AISC around $1,150/oz.

Figure 8 – Source: Annual Reports & 2022 Guidance

Conclusion

Most gold mining companies are presently trading with relatively low valuations, but Kinross is especially attractive. I typically invest in slightly smaller natural resource companies, but Kinross is too good to pass on at this level. So, I have recently added it to the portfolio.

Apart from the attractive valuation, the company pays a dividend yield of 3.7%, will deleverage during 2022, and is expected to continue with buybacks over the next few years. There is very little to dislike about the company at this level.

There are also several development updates going forward, which have the potential to be positive catalysts for the company, where any North American milestones will be of specific importance.

Be the first to comment