Introduction

Last month, I wrote an article about JD.com (JD) and the coronavirus in which I argued that JD.com would benefit from the coronavirus. In this article, I will provide more details and numbers to further support that thesis.

Creating a lot of goodwill

Potential Multibagger JD.com is really navigating the difficult situation in China very well. As my fellow-contributor ALT Perspective also pointed out, JD creates an enormous amount of goodwill by the way it handles the situation.

The company leverages its top-notch distribution network to help where it can. It delivers everywhere, even in Wuhan and the couriers all say the same thing: we have a lot more work. That’s completely understandable. I would order online as well if I could, avoiding crowded supermarkets, if they are open and have enough suppliers that work to fill the racks.

JD also doesn’t forget the public relations side of the picture. For example, the company has donated fruit to hospital staff in Wuhan. In collaboration with Driscoll’s and Tiansui Huaniu Apples, it donated 1,500 cases of blueberries and raspberries and 1,320 cases of apples to staff at over 10 hospitals in Wuhan.

(Source)

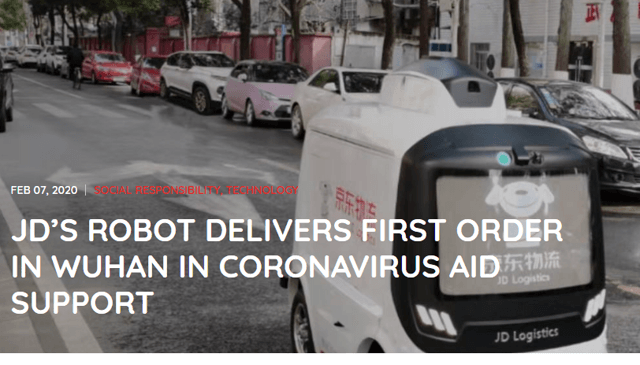

But JD has donated more than just fruit. It delivered 2,000 free sets of feminine care products and 630,000 adult diapers to Wuhan hospitals. JD provided medical supplies to the frontline of the anti-epidemic battle by using an automated logistics robot.

(Source)

JD also started drone delivery two weeks ago. The first delivery by drone was done in one of the most dangerous zones.

(Source, for illustrational purposes, not the drone that delivered recently)

There are many more donations and deliveries from JD in the most critical areas. Each day, JD communicates about what it does and where. The press, desperate to show some more positive news, often brings these stories, which means, of course, a huge commercial tailwind for JD. After all, the best publicity is publicity that looks like objective news. The goodwill that JD creates by working hard to help people is really priceless and I’m sure that this will pay off once the U-or V-shaped recovery (depending on the time horizon) sets in for China.

Online orders explode

JD recently announced that residents of Wuhan and China in general order much more online because of the coronavirus, just as I had foreseen a month ago. After the outbreak of the coronavirus, JD launched a fresh produce emergency team. Fresh Food sales on JD grew by an impressive 282% YoY. Products such as beef, mutton, poultry and eggs all saw their sales increase by 400% and more, 450% more vegetables were sold on JD.com and leafy greens even grew by a jaw-dropping 3,600%. That growth shows that JD can leverage its world-class distribution network, more than any other company in China, including Alibaba (BABA).

But, as you can expect, people don’t only order food. Over-the-counter drug sales have exploded too. A very popular and typically Chinese product like ban lan gen, a herbal medicine that is known for its anti-viral qualities, was in massive demand, just as vitamin C, paracetamol and other over-the-counter drugs. Sales of these products went up by a staggering 550%.

Sales of oximeters went up by 1,800% and sales of thermometers by 1,100%, those of sterilizing alcohol 2,000%. But there is much more and not all sales are food- and drugs-related. People do not only want necessities but also entertainment when they are not allowed to leave their houses. Again, JD can deliver that to them.

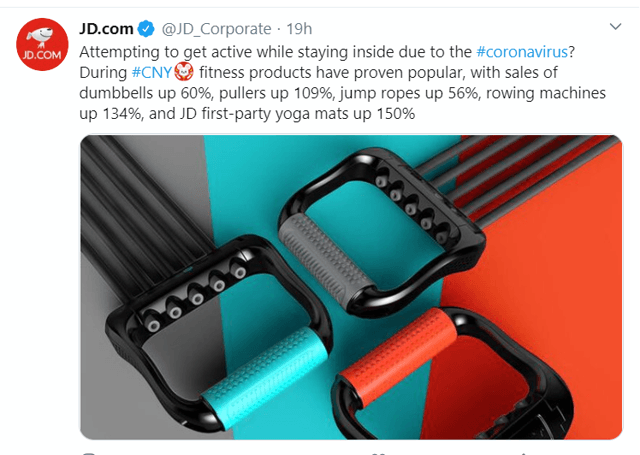

People who have to stay at home can’t be lazy couch potatoes all day, though. They want to move and again this shows in the numbers:

(Source: JD’s Twitter account)

I could go on and on summing up products that have a huge tailwind from Covid-19, but I think that the point is clear: JD is clearly and meaningfully benefitting from the coronavirus and the effect it has on society.

The impressive thing is that JD is not only able to provide the products but also to deliver them in the very difficult circumstances couriers have to work in. The dedication of the couriers is stressed in every single communication of JD and justly so. It’s they who are on the frontline and take the most risks.

Richard Liu has always made it a point of honor to pay his couriers better than all other delivery platforms in China. That got him some critical comments from investors. Liu didn’t stop there and he also committed to being a courier at least once a year, to see what their struggles are, what their pain points are and where he could alleviate some of the pressure points. Those commitments really pay off now and Richard Liu can now show to those who criticized him earlier what a network of dedicated and loyal couriers is worth.

An overlooked element: JD Health

JD Health, a subsidiary of JD, which was spun-off, but in which JD still has the majority of the shares, is often overlooked in the JD story. But it shows its power in 2020. First, it was announced that JD Health was the second biggest unicorn in the world with a valuation of $7B. If that was not already impressive enough, it was already profitable. The biggest? Uber’s (UBER) not-so-profitable self-driving unit Uber Advanced Technologies Group, which is estimated to be worth $7.3B.

JD Health operates an e-commerce platform that originally sold products such as vitamins, nutritional supplements, medical devices and lenses. It then added telehealth services that we associate with Teladoc (TDOC). That means health checks online. JD also added beauty services and gene testing, partnering with specialized offline institutions of good reputations. After a change in Chinese healthcare laws, JD Health can now even deliver prescription drugs. I think you can imagine that the orders really have exploded over the last month.

JD Health has opened up its online consultations for free 24/7 since January 26. A lot of coronavirus patients are quarantined at home. They choose JD Health for both physical and psychological support. But many more people do the same since they are afraid to go to their GP or to hospitals, where there could be coronavirus patients and there is a danger of contamination. So they prefer to stay at home and do a consultation online.

JD is definitely doing the right thing here, both ethically and commercially. The company lowers the threshold for a lot of consumers to use a wide variety of its products. Once they have ordered online or done an online consultation, the step to do it the next time is much easier. This bodes very well for JD Health. I think it’s safe to say that JD will get a boost from Covid-19.

Conclusion

JD.com gets a really big goodwill push by what it does to help people affected by the coronavirus. In these times, the company can really show the power and flexibility of its world-class delivery system and it doesn’t fail to communicate that. The message is picked up by Chinese media hungry for some positive news and that gives JD priceless free advertisement time. I really like what I see there.

But the company doesn’t just do that to gain now. What it does is in line with what it has always done. JD couriers are more committed because they have always been paid better than those of other deliverers and Richard Liu has always taken a genuine interest in them. That investment pays off now.

The sales growth for some products like food, drugs, medical devices, disinfectants, entertainment technology and fitness accessories grew impressively. JD Health, which has opened its telehealth service 24/7 for free, will definitely benefit from lowering the threshold once the virus is gone. If you don’t know what to buy in Covid-19 times, JD may be one of the best stocks. It shows that it can prosper even in these difficult times.

If you have enjoyed this article and would like to read more articles from me, feel free to hit the “Follow” button next to my name.

In the meantime, keep growing!

As investors we all dream of multibaggers, stocks that go up 10 times or 100 times in value over the years and that is exactly what Potential Multibaggers focuses on.

Potential Multibaggers is not for those who trade in and out of stocks a lot. It’s for long-term investors who want to fill their portfolio with life-changing returns. The results are there, with an average of more than 30% alpha per pick versus the S&P 500.

At Potential Multibaggers, you get exclusive updates, several live portfolios, a watchlist and much more. Feel free to start the free trial now!

Disclosure: I am/we are long BABA, JD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment