insta_photos/iStock via Getty Images

Real estate investment trusts (“REITs”) (VNQ) are down nearly 30% year-to-date, and they appear to be only going lower day after day. In fact, if you read comments on REIT-related articles on Seeking Alpha, you will find that a lot of people appear convinced that REITs will suffer much larger losses in the coming quarters.

What’s their bear thesis?

I have seen many theories, but it really boils down to two main things.

-

Bear thesis #1: rising interest rates will hurt REIT profitability.

-

Bear thesis #2: rising interest rates will cause property values to decline.

Let’s review both points one by one:

Bear thesis #1: rising interest rates will hurt REIT’s profitability

Yes, in theory, if all else is held equal, then higher interest rates would result in lower profits and slower growth for a leveraged company.

But in real life, all else is never held equal, and there is a reason why interest rates are rising. Today, interest rates are rising because of high inflation, which results in growing rents.

Therefore, you cannot ignore other important factors like inflation as you attempt to determine the impact on profitability.

The question to ask yourself is which has a bigger impact: the rising interest rates or the high inflation?

And the answer is very clear: the high inflation has a far greater positive impact on revenue than the rising interest rates have on costs.

That’s because:

-

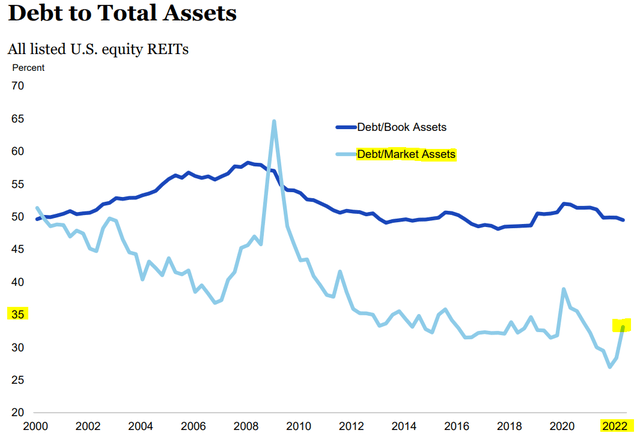

Most REITs use little debt with a 35% LTV on average.

-

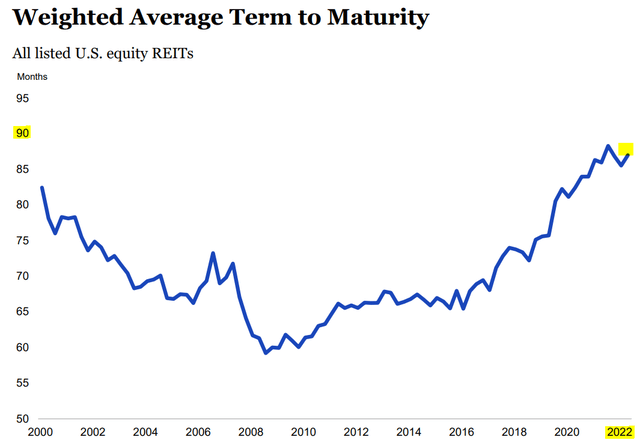

Most REIT debt is fixed rate and maturities are long.

-

Inflation is today at a 40-year high, reaching nearly 10%.

-

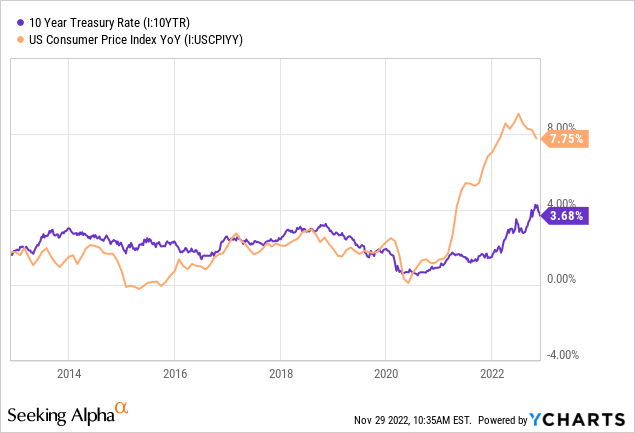

Even post-rate hikes, interest rates remain low relative to inflation.

-

REITs retain a lot of cash flow and can pay off their small debt maturities with retained cash flow and/or capital recycling.

Therefore, the positive impact of high inflation is a lot greater than the negative impact of rising interest rates. The inflation rate is far greater than the interest rates and inflation affects 100% of the assets, whereas debt affects only 35% of the assets. Besides, even that’s not really true, since that 35% does not need to be refinanced any time soon. The average debt maturity is 8 years in the REIT sector, which means that their rents will often have many years to grow before they even feel the impact of rising rates. This also leaves REITs the flexibility to pay off some of that debt before it matures, if desired.

So the #1 bear thesis, which relates to REIT profitability, is clearly flawed. REIT cash flow has been growing far faster than its historic averages, with some property sectors experiencing some of the fastest rent growth in decades. Over 100 REITs have also hiked their dividends in 2022, and with only a few exceptions have cut it, which again shows you that this thesis is wrong.

Profitability is rising, not declining. But perhaps, there is more to the second thesis:

Bear thesis #2: rising interest rates will cause property values to decline

This point is more complicated, and there is more substance to this bear thesis.

Commercial real estate is valued based on two main things:

-

Its net operating income, or NOI in short.

-

Its capitalization rate, or its cap rate in short.

The higher the NOI, the higher the property value (and vis-versa):

And the lower the cap rate, the higher the property value (and vis-versa).

The cap rate is mainly a function of the risk of the property and its growth prospects, but also the risk-free rate, which has an impact on the investor demand for real estate.

Therefore, all else held equal, you would expect a higher risk-free rate to result in higher cap rates, which then result in lower property values and NAVs for REITs.

In some property sectors, cap rates had dropped to historically low levels in the past years and this was at least in part due to the low interest rate environment. Therefore, the higher interest rates certainly could cause cap rates to expand in some property sectors like apartment communities, which today still sell at exceptionally low cap rates.

But here is why this is not so clear:

Firstly, the NOI is also rising rapidly in many property sectors, which naturally, causes property values to rise. To give you a few examples: Terrano’s industrial properties (TRNO), Camden’s apartment communities (CPT), and Extra Space’s storage facilities (EXR) have all been growing their same property by 10%+. So yes, cap rates could expand some, but since NOI is rising so rapidly, it does not mean that property values will decline.

Secondly, most property sectors still offer a nice spread over the risk-free rate. Today, the risk-free rate of treasuries might be 4%, but high-quality net lease properties offer a 6-7% cap rate, which represents a generous risk premium. What investors appear to forget is that when interest rates hit 0%, the spreads were temporarily abnormally high. Now, the spreads are simply normalizing in many property sectors and so it does not mean that cap rates will expand across the board. They may expand in some property sectors, but not all. Being selective is key as always.

Finally, the investor demand for real estate is not just a function of interest rates. Again, we cannot just ignore other factors which are important today. Inflation is a particularly big one. Investors fear it dearly, especially the bigger ones like pension funds, which are really driving most of the demand for commercial real estate.

Yes, the risk-free rate is now 4% and it leads many to wonder, why would someone want to buy an apartment community at a 4% cap rate. There is no spread and it is riskier they claim. But what they forget is that it is the “real” risk-free rate that really matters. Today, if you buy treasuries at a 4% interest rate, you are guaranteed to earn a negative return after taxes and inflation, and therefore, it is simply not sustainable for most investors to go all in on treasuries. The inflation is at 8% so that’s a guaranteed loss.

This is very unusual:

Sure, you could say that the real returns of the apartment community likely won’t be very high either and you would be correct, but at the very least, the investor is protected against the long-term impact of inflation as rents will grow and so will the replacement cost of the real estate. If the property is well-located, the long-term growth in rents and value will more than makeup for the near-term lack of real returns.

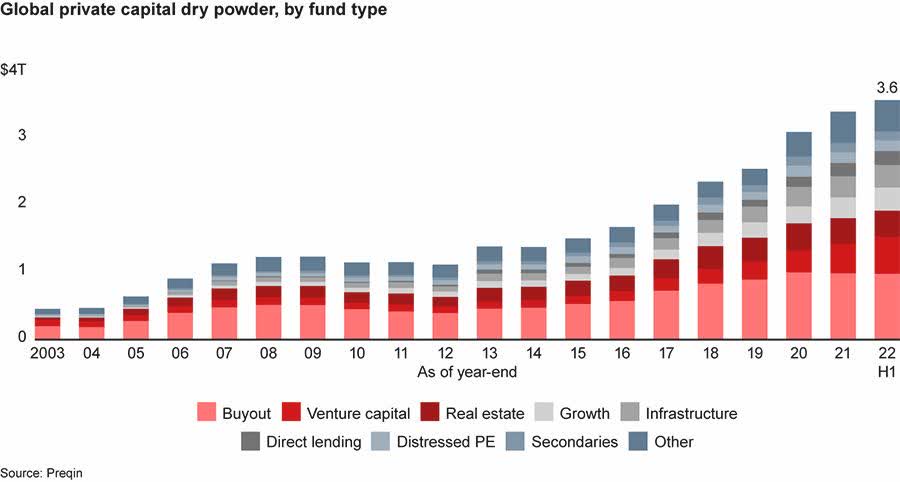

So I don’t expect the demand for commercial real estate to dry up anytime soon. Blackstone (BX), Brookfield (BAM), and other major private equity firms are today sitting on more cash than ever before and this cash needs to be put to work for them to start earning fees:

Prequin

It also explains why cap rates haven’t moved much or at all.

Armada Hoffler Properties, Inc. (AHH) recently sold a few triple net lease properties at a 4.75% cap rate.

AvalonBay Communities, Inc. (AVB) has been recycling capital and selling properties in the high 3s or low 4s, and these are some of its oldest, slower-growing apartment communities.

There are a lot of other examples, but you probably get the point here.

Cap rates and interest rates are not perfectly correlated because there are lots of other factors to take into account. Today, the high inflation is pushing a lot of investors to buy real estate, even if the spreads are now lower. They are simply accepting lower returns to protect themselves.

So to conclude here, yes, some properties may suffer some cap rate compression, but I would not expect anything significant, and the NOI is also rising rapidly, which is another stabilizing factor.

Investors worry more about real interest rates than nominal interest rates.

Bottom Line

The bottom line is that there are lots of REITs that are deeply undervalued in today’s market.

REITs are down heavily due to fears that are overblown. Investors overestimate the impact of rising interest rates and underestimate the impact of inflation on the profitability of REITs and their long-term fair value.

Right now, there are some REITs that trade at just 50 cents on the dollar or even less. This essentially means that you are getting $200,000 worth of real estate for every $100,000 that you invest. Even if the real estate dropped a little in value, you would still likely come out well ahead in the long run.

Where else can you get such deals today?

Be the first to comment