marekuliasz

To really beat the market during this volatile time, investors often have to look in very unlikely places. In the case of GoPro (NASDAQ:GPRO), most investors probably have written the company off as a fad hardware company that can’t possibly have any relevance today.

This is short-sighted thinking. GoPro has found a niche of core camera buyers, while at the same time adding new use cases and target segments, making its cameras very relevant for drone video capture and bloggers. While it’s not necessarily a high-growth business anymore, it has found a profitable core to work with, and right now the stock is trading at a very good value against that profit.

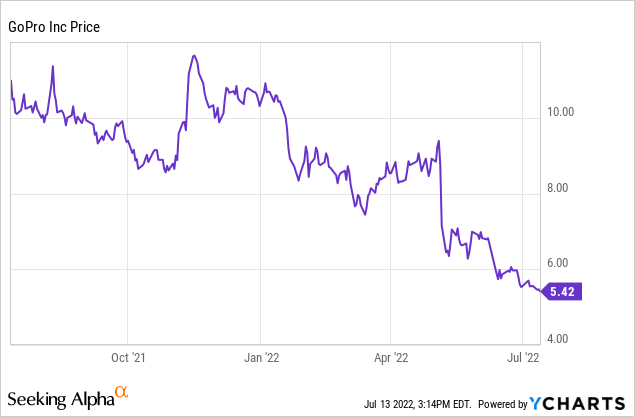

Year to date, shares of GoPro have shed 50% of their value, with losses extending after the company’s Q1 earnings release and Q2 guidance announcement in early May. In my view, it’s a great time to re-assess the bullish thesis for GoPro:

I remain bullish on GoPro, despite how contrarian of a position that may be. I appreciate both this company’s transition to a higher-end, niche hardware vendor as well as the company’s renewed focus on profitability and its commitment to not over-extending itself beyond its niche.

To me, here are the key reasons to be bullish on GoPro:

- High-end camera sales. GoPro now has three versions of its flagship camera in its lineup (from the HERO 10 to the HERO 8), ostensibly to capture buyers at every price point. Yet ASPs have been gradually climbing upward, and now ~90% of GoPro’s sales are from cameras priced above $300 (up from about two-thirds in the prior year).

- Successful e-commerce execution. Historically, GoPro has relied heavily on channel partners and resellers to drive sales, and typically at hefty trade discounts. The company made full use of the pandemic to execute on an online-first strategy, and sales on GoPro.com are contributing a record amount to GoPro’s revenue mix.

- Subscription offerings are taking center stage. GoPro continues to see its subscriber base expand, and a new app offering (Quik) at $10/year offers a limited subset of the $50/year GoPro subscription and has a chance to reach even more subscribers.

- Travel tailwinds. As the world moves on past COVID-19 and borders re-open for travel, demand for GoPro cameras (largely used as travel accessories) should benefit from macro tailwinds.

- Substantial profitability gains, driven by e-commerce gross margin benefits, subscription revenue mix increase, and headcount reductions.

Q2 guidance disappointment may not be as bad as investors think

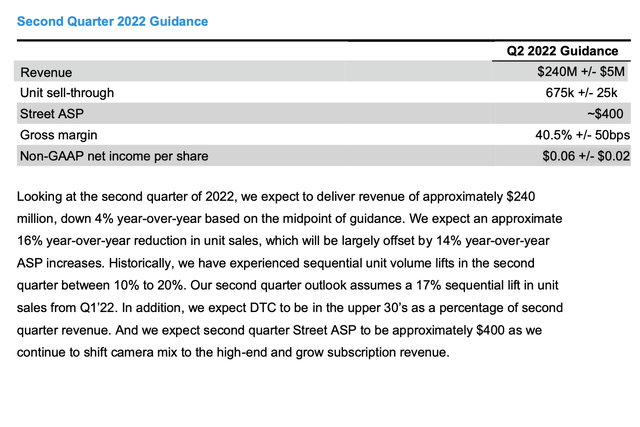

One big gray cloud hanging over GoPro right now is its Q2 guidance, where the company’s revenue range of $235-$245 million came in 12% lower than consensus expectations at the time. The key, however, is to read the underlying commentary behind the numbers:

GoPro Q2 guidance (GoPro Q1 management commentary)

GoPro is expecting that unit sell-through will be a 17% lift from Q1 to Q2, which is in-line (actually, a bit on the high side) of historical seasonality between 10-20%. At the same time, revenue is going to be down -4% y/y, even though ASP has been trending higher.

This probably means the company is either holding back on filling up channel inventory, or is building up backlog due to supply constraints and orders it cannot ship. Either way, as long as end-customer sell through holds up, GoPro will eventually have to ship (recognize revenue) units to refill its channel inventory.

In other words, it’s foolish to look at Q2 in isolation. GoPro doesn’t provide guidance further out than a single quarter, so my advice is to give the company the benefit of the doubt. As long as sell-through holds up, GoPro should catch up on revenue in the quarters following Q2.

Strong results through Q1

At the same time, results through Q1 don’t point to any signs of weakness. Take a look at the earnings highlights below:

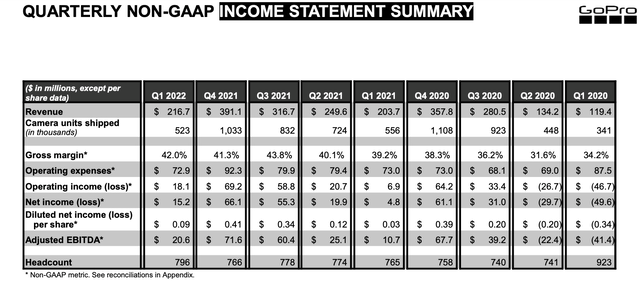

GoPro Q1 highlights (GoPro Q1 earnings deck)

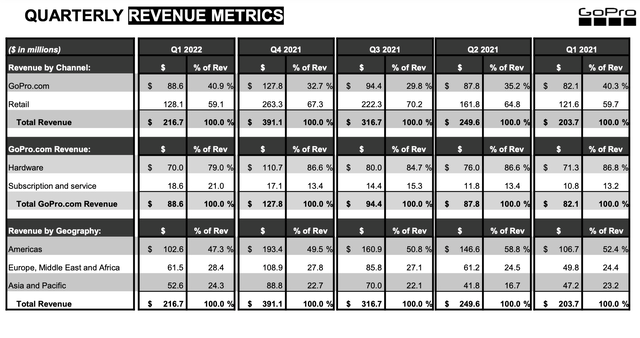

Revenue in the quarter grew 6% y/y to $216.7 million, in-line with Street expectations. A look at the revenue breakdown below shows that subscription revenue grew at a stunning 85% y/y pace to $18.6 million, as attach rates on GoPro’s premium subscriptions (which allow for cloud video storage as well as discounts on GoPro hardware) continue to rise. Subscription is now a 21% mix of GoPro’s total, up significantly from 13% in the prior-year Q1.

GoPro Q1 results (GoPro Q1 earnings deck)

The company notes that subscription attach rates to hardware are now 39%, a huge lift versus 18% last year. Here’s some commentary from CEO Nick Woodman on the drivers for that improvement, made during the Q&A portion on the Q1 earnings call:

A primary driver of why we’ve been able to improve that conversion rate from last year’s 18% to 39% in Q1 of this year, is because we’ve done a much better job of incorporating the benefits of being a subscriber into the Quik app, which is our GoPro app, and getting those benefits in front of users that have bought their GoPro at retail. And it’s just night and day, more clear to people why they — what the benefits are and why they should consider becoming a subscriber. And we’re not done. Later this year, the app will continue to evolve and make the subscriber benefits even easier for people to experience. And then, ultimately, we think that’s going to have a positive impact on converting them to being subscribers. Today, we’re primarily telling people and they’re converting and in the future we’re going to be making it more experiential for people. And we think that’s going to convert even better.”

The tilt toward subscription revenue, plus the uptrend in camera ASP, also has GoPro’s pro forma gross margins up to a record 42.0%, a 70bps improvement sequentially versus Q4 and a huge 280bps jump versus Q1 of last year.

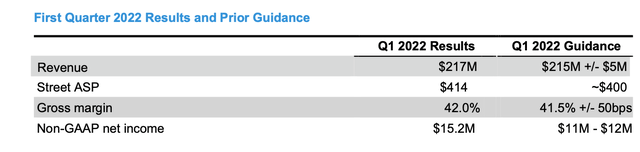

You’ll see in the chart below that all key metrics – revenue, ASP, gross margins, and pro forma net income – all came in at or above the high end of GoPro’s guidance for Q1 (again providing emphasis that investors shouldn’t stress too heavily about GoPro’s stated Q2 guidance).

GoPro Q1 results vs. guidance (GoPro Q1 earnings deck)

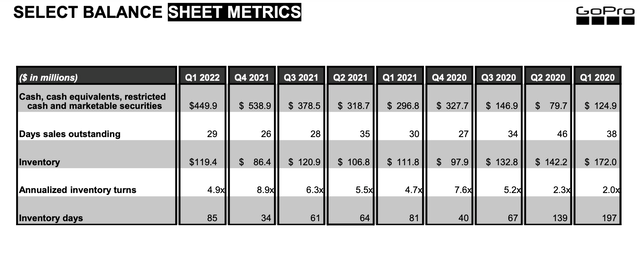

Lastly, a look at how inventory is stacking up on GoPro’s balance sheet also indicates that trends are healthy. The company’s $119.4 million of inventory stands at 29 days of sales outstanding, which is in line with historical averages.

GoPro balance sheet metrics (GoPro Q1 earnings deck)

Key takeaways

At current share prices just above $5, GoPro trades at a tiny market cap of $845 million; and after we net off the $450 million of cash and $265 million of debt on the company’s most recent balance sheet, its resulting enterprise value is $672 million.

Meanwhile, GoPro has consistently generated positive adjusted EBITDA over the past eight quarters, and relative to trailing twelve-month adjusted EBITDA of $177.7 million, GoPro trades at just 3.8x EV/trailing adjusted EBITDA – a huge discount for a company that is a proven quantity.

Don’t count GoPro out just yet.

Be the first to comment