Options can help investors generate income and bridge the gap between bull markets by softening the economic impact to investors. Justin Sullivan

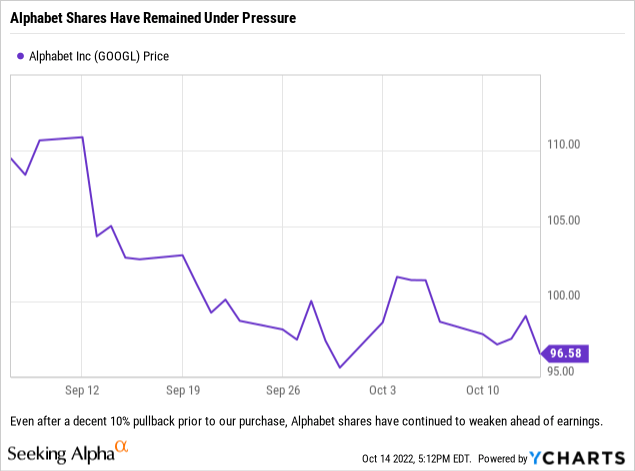

Just over a month ago we discussed how some of our portfolios had become underweight technology as we had spent most of 2022 adjusting portfolio weightings to assume a more conservative posture and that we had a need for high quality tech exposure at a reasonable price. Our choice was to focus on a name that had already experienced a decent pullback, was trading at a reasonable P/E multiple (current and forward) and had earnings that would not in our opinion quickly erode over the next 12-18 months. We decided to add exposure to Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) and have done that over the last month or so by utilizing options to pick our entry points – and once we own the stock we have been utilizing options to help create some cash flows and help provide some outperformance vs. the underlying stock.

What Was The Trade We Placed?

If you remember, we sold the September 16, 2022 $108 Puts, which were essentially at-the-money, or ATM, back on September 7th. We collected an options premium of $2.36/share, or $236 per contract. The shares retreated, as we anticipated, and thus we had the shares put to us. Our cost basis in those shares is $105.64/share for tax purposes.

What Have We Done With The Position?

So this is where it gets interesting. We own the shares because we need to own the shares – basically we have to have market exposure, within certain sectors/industries and we were under allocated in this name. However, one of the things we have learned over the years when managing money, especially in a bear market, is to not leave any money on the table. Sometimes you have to make the best out of a not so great situation. So, after the shares were assigned to us, we turned around and sold some call options.

Since the shares were not trading too far from the $108/share level where we originally started transacting at, we wrote a contract with an expiration date of October 7, 2022 at the $108 strike price to allow the shares to be called away while locking in a decent profit on a bear market trade. The other benefit of the October 7th date is that it allowed us to have an expiration date prior to the company’s earnings announcement after the close on October 25, 2022 which would allow us to evaluate premiums and positioning ahead of that event. The October 7, 2022 Calls with a $108 strike price netted us $1.21/share, or $121 per contract on September 19th. In total, we had now received roughly $3.57/share in option premiums.

On October 4th, with shares rallying into the close, we repurchased the October 7th $108 calls we had sold in order to lock in an attractive option further out – we wanted to extend and lock in a premium as we did not think that the rally would last. We repurchased those calls for $0.03/share, or $3 per contract however, our sale of new calls was not triggered prior to the close. At this point, our net options premiums came out to roughly $3.54/share.

On October 5th we came into the office and extended out past Alphabet’s earnings date in order to lock in options premiums as we thought that the shares could pull back further ahead of the announcement – with this being a bear market and all. We chose to sell the November 11, 2022 $108 Calls which generated an options premium of $2.04/share or $204 per contract. Currently we have generated net options premiums of roughly $5.58/share.

Logic Behind Our Moves

We feel that the market is on shaky ground, however when you have to have market exposure you need to find ways to minimize your losses. We believe that Alphabet is one of those names which could actually have a strong rally higher on good earnings or simply because of a bear market rally. Because of that, we are reluctant to transact in the shares below the $108/share level we initially showed interest at. By sticking to that strike price, if we do see a large rally and we are called on our position, the shares will basically have no loss generated, and our gain will be the sum of all of the options premiums. In short, by sticking to the original strike price utilized, we are able to keep the entirety of our net options premiums generated and count that as our profit.

So, if Alphabet were to beat on earnings and the shares rose sharply, and ended the trading day on November 11th above $108/share, then we would be forced to sell our shares at the $108/share price, and our only profit would be the net options premiums we pocketed. The $5.58/share would be our profit, which would come out to a gain of about 5.17%. That is not a super impressive gain, but for a stock that does not pay a dividend, that is a respectable gain for selling into a bear market rally with a relatively short holding period of roughly a quarter.

Closing Thoughts

Sometimes losing money is unavoidable. It is a mechanism of markets when sentiment moves strongly to the bearish side and it is a cleansing mechanism that shakes out the weaker hands. It is our belief that during these times, alpha can be created by recognizing where you would be a buyer or seller of shares and utilizing options in order to generate what can add up to substantial options premiums over the course of a quarter or year by simply automating transactions on dates and at prices where you would have been a buyer or seller. Even if you do not show an overall paper profit on the trade at the end of any given period, your portfolio will show outperformance against the underlying share price over your holding period if you are not called on your position.

Further, if you utilize the same strike price for your position throughout your trading, then you are able to dictate to the market that you will not be realizing a loss on the position and instead will simply generate income for your portfolio as you wait for the shares to rebound. This is a strategy we like to utilize when establishing long-term holdings in bear markets, however the one thing we would point out is that the uglier the bear market gets, and the lower your shares trade from your entry level, the lower the prices go for your call option premiums (when at the original strike price/entry level).

With earnings season coming up, and many market pundits believing this will be the last strong earnings season, this might be a strategy for investors to use to prune holdings from their portfolios that they are not in love with, or to take advantage of implied volatility and lock in what should be decent option premiums over the next few weeks.

Be the first to comment