MARKET DEVELOPMENT Analysis

GBP/USD Rise Curbed, EUR/USD Dips, Stock Market Bounce Fades

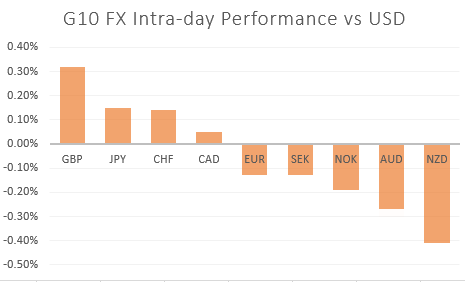

Equity markets: The early morning bounce across global equities had faded quickly with European indices paring its initial gains. As such, this could see a more protracted pullback across the equity space. That said, while commodities and equities have been notably volatile in recent sessions, the reaction from currencies have been relatively tame thus far. Looking ahead, market participants will be eying whether the WHO raise the alert to pandemic, alongside potential chatter of a vaccine.

GBP: Yesterday, GBP/USD briefly dipped below the 1.2900 handle, however, with the lack of negative triggers, the pair had been supported to remain within a tight range. At the same, a lack of follow through to break above 0.8400 in EUR/GBP has also contributed to the support in the Pound, which is modestly outperforming its counterparts. The spread of the coronavirus has had a relatively muted impact on the Pound and instead will look to the beginning of the EU/UK trade talks next week.

GBP/USD Longs Poses Asymmetric Downside Risks

EUR: The Euro has pullback back from the high 1.08s with vanilla options curbing further upside. Alongside this, the economic outlook remains soft for the Euro with investors finding little incentive to push the Euro higher and thus risks continue to remain tilted to the downside.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 9% | 1% |

| Weekly | 0% | 8% | 2% |

Source: DailyFX, Refinitiv

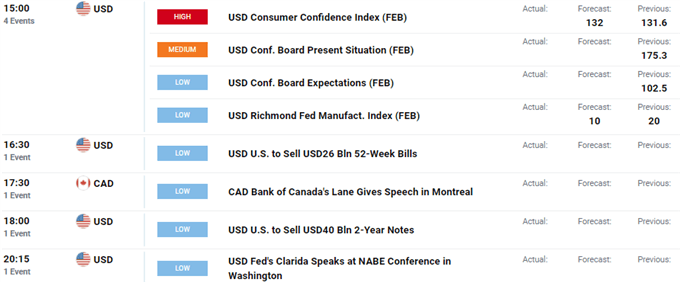

Economic Calendar (25/02/20)

Source: DailyFX,

WHAT’S DRIVING MARKETS TODAY

- “USD/CAD: Eyes on Breakout Levels – Canadian Dollar Price Outlook” by Mahmoud Alkudsi, Market Analyst

- “DAX 30, CAC 40 Trading Off Towards Test of 200-day MAs” by Paul Robinson, Currency Strategist

- “Japanese Yen Forecast: Safe-Haven Battle May See USD/JPY Extend Drop” by Justin McQueen, Market Analyst

— Written by Justin McQueen, Market Analyst

Follow Justin on Twitter @JMcQueenFX

Be the first to comment