Garmin Ltd. (GRMN) recently surprised to the upside with its 4Q19 numbers – pro forma EPS came in at $1.29 on total revenue of $1,102 million, up 18% YoY, driven by strength across the Fitness, Aviation, Marine and Outdoor businesses. Further, operational momentum across its diverse portfolio of offerings also drove 120 bps of margin expansion as operating margins reached 25.1%. While the coronavirus impact has been minimal, management has been encouragingly prudent in maintaining a healthy inventory buffer as a precaution. While the results reaffirmed the bull case, the hefty valuation premium (the stock currently trades at an ~29% premium to historical EV/EBITDA levels) leaves me cautious.

A Closer Look at the Results

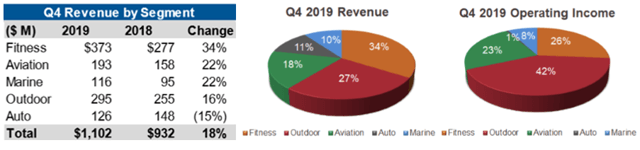

Broad-based top-line strength: GRMN posted strong double-digit top-line growth in four of its five business segments, which led to an 18% YoY growth in total revenue to $1,102 million (ahead of management’s guidance of $994 million). The Fitness segment was the standout performer and saw its revenue growing by an impressive 34% YoY, followed by the Aviation and Marine segments, each growing by 22% YoY, while Outdoor grew 16% YoY. However, the Auto segment remained a drag and posted a revenue decline of 15% YoY.

Enviable operating margins and solid earnings: Despite an overall 11% increase in operating expenses (R&D up ~12% YoY to $162 million, advertising up ~15% YoY to $63 million and SG&A up 10% YoY to $138 million), GRMN’s operating income still rose by 24% YoY to $277 million. This represents an operating margin of 25.1% (implying a 120 bps YoY improvement), owing to the solid top-line growth, which outpaced the growth in expenses. Coupled with a lower pro forma tax rate of 15.5% (vs. 15.7% in 4Q18), Pro-forma earnings per share reached an impressive $1.29.

Source: Company Presentation

A Review of the Business Segments

Fitness: 4Q19 revenue grew 34% YoY to $373 million, driven by the strong demand for existing as well as refreshed product lines in advanced wearables, along with an increased contribution from the recently closed Tacx acquisition. Operating income increased by 26% YoY to $74 million, representing an operating margin of 19.7%, down 137bps YoY.

Outdoor: Driven by the strength in demand for the Fenix 6 series adventure watches, the segment’s revenue increased by 16% YoY to $295 million. Operating income grew by 20.8% YoY to $116 million, representing a margin of 39.2%, up 160bps YoY. GRMN’s latest collaboration with the World Central kitchen to provide inReach satellite communication devices to support disaster relief and emergency response efforts was also a key positive.

Aviation: Driven by strong aftermarket and original equipment manufacturer (OEM) sales (ADS-B was a major contributor), the aviation segment’s revenue grew 22% YoY to $193 million. Operating income increased by 18.4% YoY to $63 million, reflecting operating margins of 32.5%, down 98bps YoY. The margin contraction was attributable to the change in the allocation of SG&A expenses, which was partially offset by stronger volumes for the quarter.

Auto: The segment continued to be a drag, reporting a revenue decline of 15% YoY to $126 million. Lower Portable Navigation Device (PND) and OEM sales weighed on the segment’s operating income, which came in at $3 million, reflecting an operating margin of 2.3% (down 440 bps YoY).

Marine: Strength in demand for chart plotters, advanced sonars, and the new Force trolling motor drove 4Q19 revenue from the segment higher by 22% YoY to $116 million. The increased sales volume, along with favorable mix and a change in the allocation of SG&A expenses, led to a solid 154% YoY improvement in operating income to $22 million, reflecting an expanded operating margin of 18.7%.

Source: Company Presentation

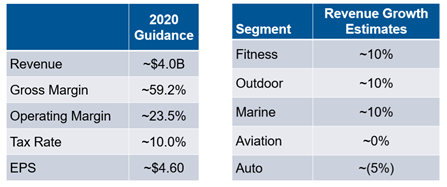

Encouraging 2020 outlook, but operating margin guidance points to a decline: Management guided to 2020 revenue of ~$4 billion, above consensus estimates of $3.84 billion on higher revenue from the Fitness, Outdoor and Marine segments (~10% YoY), with Aviation guided to be flat. Meanwhile, the Auto segment implies a growth inflection for auto OEM demand toward the back half of the year, which is expected to reduce the pace of its decline.

Operating margins for 2020 is expected to be ~23.5%, implying a ~160bps YoY decline. The expected decline is understandable, given the lower relative contribution from the Aviation business implied by guidance, as well as the incremental operating expenses guided. As a percentage of revenue, operating expenses are guided to grow by 150bps YoY, driven by higher investments in auto OEM production and new manufacturing facilities. I would note that the lower pro forma tax rate of 10% in 2020 (vs. 15.4% in 2019) should partially offset the higher operating expense, however. Buoyed by the expected decline in the tax rate, GRMN expects 2020 pro forma EPS to benefit by ~$0.38, leading to the $4.60 guide.

With regard to taxes, one of the key reasons for the lower tax rate was GRMN’s eight-year inter-company license agreement related to the migration of consumer IP ownership from Switzerland to the US. I view this multi-year agreement as an effective tactic to take advantage of the shifting global tax rules and regulations and expect the resultant tax benefit to be a continuous one rather than a one-off benefit.

Source: Company Presentation

Limited production exposure in China keeps the impact from COVID-19 minimal: GRMN operates a single manufacturing facility in China, which is used predominantly for the production of Auto OEM and European Auto PND products. Additionally, the company sources just a handful of components from Chinese vendors. This limits GRMN’s production exposure to China, which, to date, has kept the impact from the recent COVID- 19 epidemic minimal.

As a precaution against a potential worsening of the scenario, the company has prudently maintained a healthy inventory of components. Management believes the mitigation efforts underway for the epidemic will start yielding results soon and remains optimistic about the operations in China coming back online soon.

Free cash flow down YoY on elevated accounts receivable and inventory: While GRMN did generate $208 million in FCF during the quarter, I would point out that FCF was actually down on a YoY basis, primarily as a result of the drag on working capital from elevated accounts receivable and inventory levels. Management attributed the higher levels of accounts receivable to strong sales during the holiday quarter, while the elevated inventory level reflects its precautionary measure to mitigate any supply chain disruption risks, as well as the integration of Tacx. Nonetheless, FCF conversion remains strong at 68% for the full year.

Making progress on capital deployment: GRMN’s liquidity position remained strong, with the company maintaining $2.6 billion in net cash ($13.65 per share) at the end of the year (vs. $13.24 per share at the end of September quarter). The outsized amount of cash on the balance sheet reflects the company’s conservative approach toward managing its balance sheet. There has been progress on the capital deployment front, however, with management planning to increase dividends by 7% YoY to $2.44 per share and with recent M&A activity (e.g., the acquisition of Tacx in 2Q19), both of which are encouraging signs. GRMN’s dividend payout implies a ~2.3% yield, offering the stock some downside protection given the current low-interest rates environment.

Hefty Valuation Premium Caps the Upside Potential

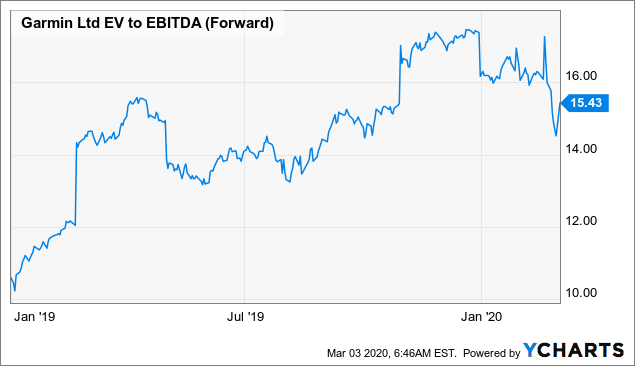

While GRMN’s 4Q results were admittedly strong, the market has reflected much of the optimism, with the stock currently trading at an EV/EBITDA multiple of ~15x – a significant premium to its historical valuations.

Data by YCharts

Data by YCharts

However, with 2020 guidance reflecting an HSD growth scenario, I find it difficult to justify owning the stock at such a hefty premium. Further, I see plenty of risks ahead, from a faster-than-expected deceleration in wearables growth to Aviation share gains proving more volatile/less sustainable than expected, both of which could lead to a de-rating in the current premium multiple.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment