Slavica

Investment Thesis

Ford’s (NYSE:F) expertise in the truck segment continues to show through its excellent sales in the US, which had 26.4% YoY growth in June 2022, easily accounting for the majority of its sales at 52.4% then. Notably, its EV segment has also performed excellently, with the E-Transit dominating the commercial van market and the F-150 Lightning continuing its legacy in the truck market for June 2022.

However, it is also evident that Mr. Market views Ford differently from the EV market leader, Tesla (TSLA), given the former’s projected delivery of up to 100K EV vehicles in 2022, compared to the latter’s nearly 1M of EV delivery in 2021 and the projected output of up to 2M by 2023. Therefore, it made sense that Ford reports a $47.7B in market cap, with TSLA towering above the industry with a whopping $746.4B in market cap, representing a 15.6-fold premium. Additionally, TSLA was often awarded the premium stock valuation for its proposed in-house FSD and robotics capabilities, potentially elevating the company from a standard auto producer, on top of its eccentric but internet-loved CEO.

In the meantime, there is also a chance that Mr. Market continues to put pressure on Ford’s valuations and stock price, given its “un-exciting” historical legacy status and slower EV ramp-up due to the global chips crunch and rising inflation. It will take quite some time for the stock to climb out of this dip, given the overly bearish market sentiments. We shall see.

Ford Continues To Impress In Its Future Planning

With the massive Lithium deposits found in California and Turkey, we expect Ford to produce more than enough batteries in its Joint Venture with SK On and Koc Holding, with a combined production capacity of up to 174 gigawatt-hours by 2025. Based on aggressive estimates of 8kg of Lithium per 100 kWh of energy storage (based on current technology), we may surmise that the three plants could potentially produce enough batteries for up to 1.7M cars, if not more, given the future technological advancement and improved energy density then.

Thereby, justifying the JV’s $7.8B in Capex investment, since these would eventually be top and bottom lines accretive. Of course, this is assuming little temporary headwinds from California’s recently approved levy on Lithium production.

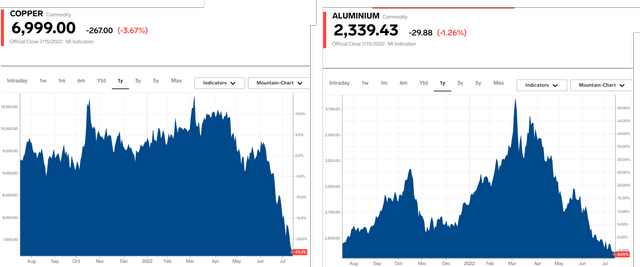

Falling Prices In Commodities

It is evident that Aluminium and Copper prices have also been falling fast in the past few weeks, potentially increasing the supplies of these raw materials to the global foundries at a much lower cost. As a result, Ford, which has been plagued by lowered semi-availability for a few quarters, could finally see its production output and deliveries increase from Q3 onwards. It will be a race against time that the company must win, in order to boost its market presence with the earlier F-150 release, since TSLA is expected to release its highly-in-demand Cybertruck in 2023.

However, given the market size, we believe there is enough room for multiple big players, especially given Ford’s long-term dominance in the truck market. Therefore, Ford investors need not fret as the stock remains a solid hold for the decade, since the global electric vehicle market is projected to quintuple to $823.75B by 2030 at a CAGR of 18.2% with a total of 39.2M units at the time. Ford will eventually get there. Time will tell.

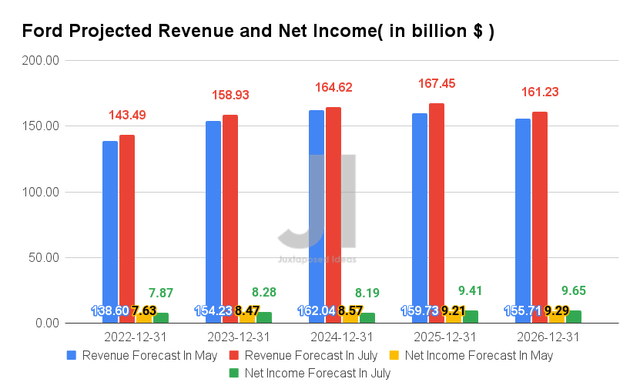

Ford’s Future Performance Has Been Upgraded – For Now

Since our last analysis, consensus estimates have upgraded Ford’s performance by 3.5% for the next five years. For FY2022, the company is now expected to report revenues of $143.49B and net incomes of $7.87B, representing a YoY improvement of 13.6% though a decline of -56.1%, respectively.

Nonetheless, it is essential to note that Ford’s reduced net income profitability is attributed to the loss in its investment value in Rivian (RIVN), instead of its core operation. Despite the continued fall in RIVN’s share prices in Q2, this is not a major concern in our opinion, given that they are non-cash corrections of the carried value and mostly an accounting implication, if any. Therefore, by omitting this particular investment, we are looking at a $2.46B of adj. net incomes and $3.12B of adj. FCF for FQ1’22, and speculatively translating to an excellent $13.8B of adj. net incomes and $5.4B of adj. FCF for FY2022, respectively. Impressive, given the macro issues, rising inflation, and global semiconductor crunch.

In the meantime, analysts will be closely watching Ford’s FQ2’22 performance with consensus revenue estimates of $35.08B and EPS of $0.45, representing YoY growth of 45.38% and 244.37%, respectively. Since the company has broadly exceeded consensus estimates for the past eight consecutive quarters, we expect FQ2’22 to be another decent quarter indeed, if not excellent.

For now, we encourage you to read our previous article on Ford, which would help you better understand its position and market opportunities.

- Ford: Potential $32B Of Enterprise Value Recovery In H2 Aided By F-150 Lightning

- Ford: Never Too Late To Join The EV Race

So, Is Ford Stock A Buy, Sell, or Hold?

Since our last analysis in May 2022, the Ford stock had unfortunately continued its downwards slide by -11.4%, from $13.41 on 17 May 2022 to $11.88 on 15 July 2022, thereby highlighting the bearish market sentiments and global concerns on the rising inflation. However, consensus estimates continue to rate the stock as an attractive buy with a price target of $18.14 and a 52.69% upside.

We expect Ford’s US sales to continue outperforming its Chinese counterpart for the rest of FY2022, given the latter’s Zero Covid Policy and President Xi’s upcoming re-election in November. In contrast, though there are legitimate concerns about a potential recession, we believe that there is a minimal impact for the short and intermediate term, given the massive backlog of consumer orders for the F-150 Lightning, amongst others, ensuring Ford’s top and bottom line growth in the intermediate term.

However, it is also clear that Mr. Market is still overly bearish, given how the S&P 500 Index had plunged by 21.8% in H1’22, with the market predicting either another plunge of 22% or a steep rebound of 24% by the end of the year. Nonetheless, long-term investors with a higher tolerance for volatility may still choose to nibble here, given Ford’s potential outperformance by H2’22 once semiconductor supply eases.

In the meantime, since we are nearing another earnings season, we prefer to exercise patience now and wait for more information from Ford’s FQ2’22 earnings call on 27 July 2022. We would be interested to know more updates about its chips and components availability, given the previous backlog of 53K vehicles in FQ1’22. Ford’s reiteration of FY2022 guidance will be crucial to its stock performance in the short term as well.

Therefore, we rate Ford stock as a Hold for now.

Be the first to comment