courtneyk/E+ via Getty Images

EPAM Systems (NYSE:EPAM) is a speculative buy that I believe is likely to recover over the rest of this year. The company’s price at its current levels makes it too good to ignore. The stock violently lost 57.1% in Q1 this year following EPAM withdrawing its previously posted guidance over Russia’s invasion of Ukraine.

Although over half of the company’s revenues come from areas outside of the European theater, EPAM has a sizable number of employees in Ukraine, of which it pledged $100 million in aid money. The company also stated that it would no longer serve customers in Russia.

Central to my thesis is the company’s historically strong performance, its reliance on asset-light consulting services to lead its clients into digital transformation, and the geographic placement of its main clients.

Company Overview

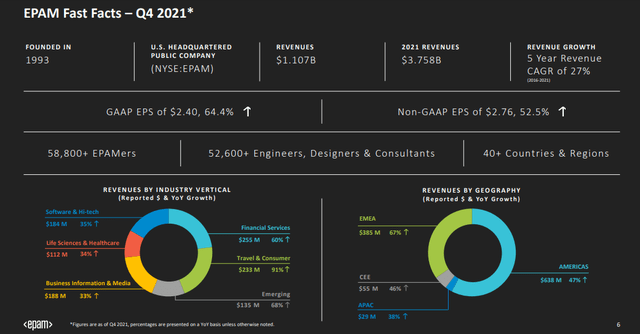

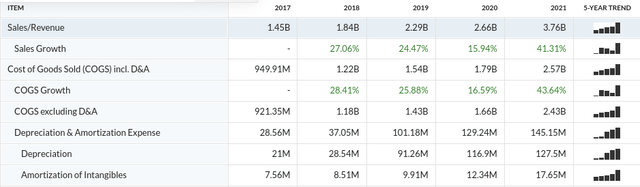

EPAM was historically a strong performer before Russia’s announcement that it would invade Ukraine. Last quarter it beat both its EPS and revenue guidance estimates. The company finished on an EPS of $2.76, beating it by $0.25 and a revenue figure of $1.11B, beating it by $20M and representing a 53.4% Y/Y growth.

For the rest of the year the company stated that it would reach a revenue figure of at least $5.150B with a Y/Y growth of 37%. GAAP income from operations would fall between 13.5% to 14.5% of revenues.

I have no doubt that EPAM will fail to meet these estimates now, and the company so far has not posted a new guidance to reflect the ongoing conflict in Ukraine. However, I believe its revenue figures will recover, albeit with much uncertainty.

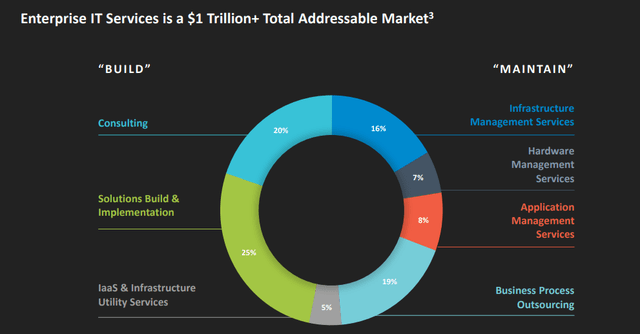

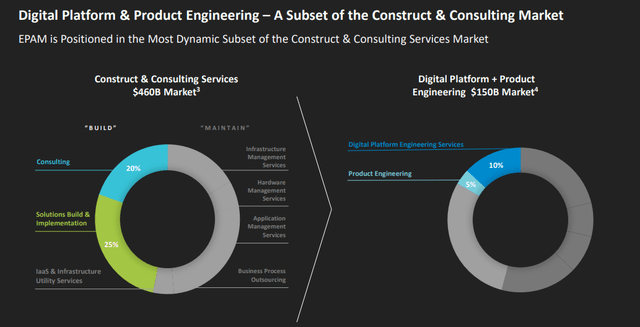

An overview of the company’s business model was given in its released investors slides. It shows that the company is asset-light in the high margin business of consulting as it helps its clients achieve digital transformation. Other aspects of the business include the operation and optimization of these systems.

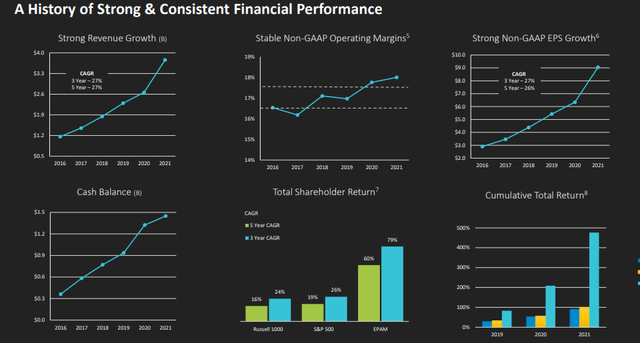

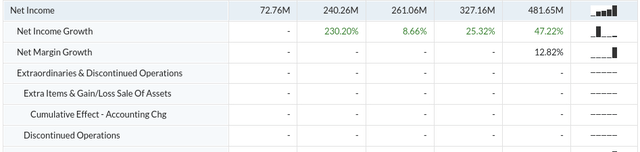

Although past performance is no guarantee of future performance, EPAM’s historical financial strength should be noted in this analysis. It previously boasted strong revenue growth and blazing fast EPS growth (42.7% for last year), which resulted in outsized returns for its shareholders.

Industry analysis

EPAM serves clients across a broad geographical area across the world, and a sizable portion of those clients are in Europe according to earnings slides released by the company. The Americas is the region that contributes most to its revenues, with the rest coming from tiny fractions in other areas. This is a big risk for the company, as I believe that its European clients will see a dramatic slowdown in their projects.

Some good news for the company is the quality of clients on its books. EPAM boasts that over half of its top 100 clients are blue chip, Fortune 500 or Forbes Global 2000 customers. I suspect that most of these clients are diversified against the risk of the Ukraine war due to their geographical spread, but certainly will also have a lot of assets and operations tied up in Europe or are otherwise directly in the war theater itself.

A positive for the company in this situation is that its business model has a focus on offering services such as consulting as well as solutions build & implementation. This means the business is not constricted by supply chain issues and can more easily make strategic pivots away from conflict zones. The delivery of such services again is unclear with a large number of its employees situated directly in the conflict area of Ukraine.

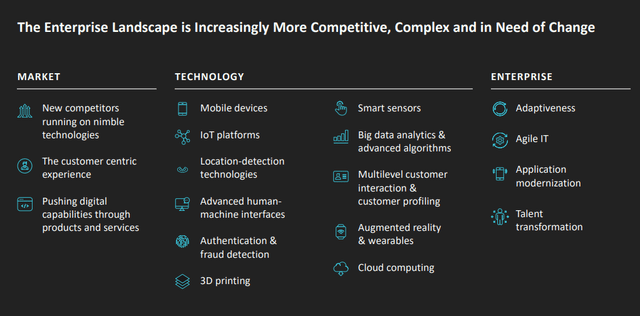

Looking ahead, EPAM is strategically positioned to take advantage of the digital transformation supercycle, which again shows its emphasis on its asset-light and high margin consulting business. On a broader scale, digital transformation is set to grow at a CAGR of 14.9% until 2030. I believe that the importance of digital transformation will only become more important over time, especially for the high number of blue chip clients on the company’s books as the digital and online space becomes increasingly more competitive.

Some of the factors that are catalyzing digital transformation were also provided by the company in its investors slides. These included other supercycles such IoT, 3D printing, big data, and cloud computing.

Financials

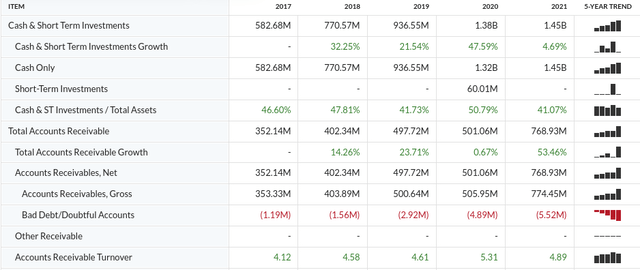

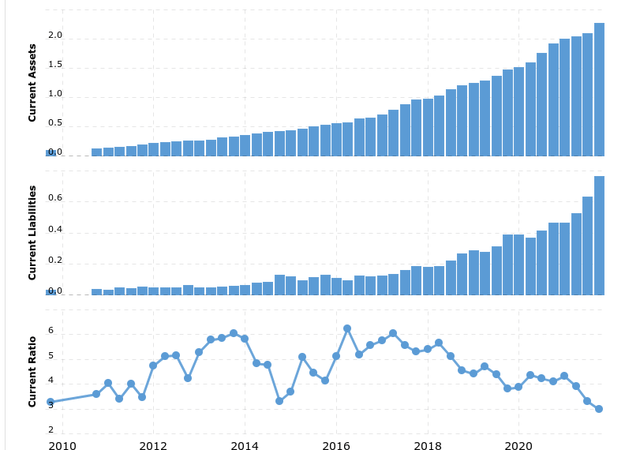

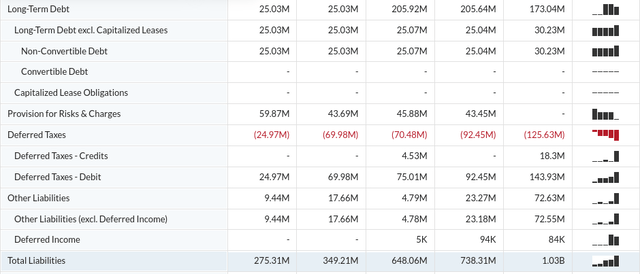

Although these figures will undoubtedly be different next FY, the company’s financial performance has been consistently strong for the last few years. The company also has plenty of cash and short-term investments to help it navigate the complex geopolitical arena, which currently sits at $1.45B in 2021.

EPAM does have a considerable amount of long-term debt and liabilities as this figure currently rests at $1.03B. The business however has a healthy current ratio of 2.97.

Before the war, EPAM recorded surging revenue growth with mid double-digit percentage increases each FY. The company also consistently increased its net income.

Competitive Analysis

Some of EPAM’s competitors include IBM (IBM), Accenture (ACN), and GlobalLogic. The first most obvious difference that EPAM has between its peers is the fact that these companies have a different geographic spread in its operations and that they are not predominantly concentrated in an active war zone.

What I believe will allow EPAM to come out on top of its competitors despite its adversity is its heavily reduced share price and the flexibility of its business model. If management can successfully divert its staff to its main market of the Americas or other locations, then it may help mitigate some of the damage done to its operations. Prioritizing on growing clients who are not in Europe or who do not see the conflict affecting their revenues is also a vital step to me.

Valuation

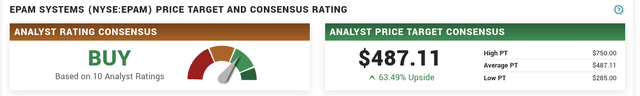

The consensus of analysts regarding EPAM’s share price is that it is undervalued at the current levels. If this consensus holds true, then there is a 63.49% potential upside to $487.11. Analysts gave the stock a low PT of $285 and a high PT of $750.

It should also be noted that the majority of analysts have lowered their price targets while still giving the stock a solid buy recommendation. I would consider EPAM a buy only if one is willing to make a speculative buy and has a high risk tolerance.

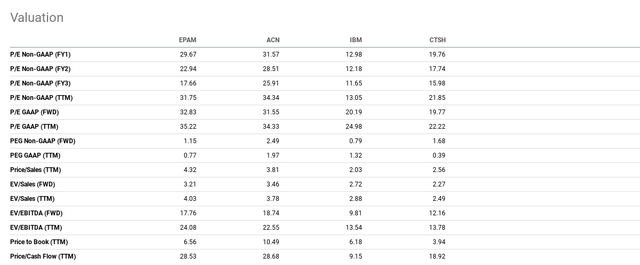

EPAM’s shares are not the cheapest nor the most expensive when put side by side of its comparable companies. However, they can still be bought for a hefty discount when compared to previous levels.

Besides its most recent history due to the sell-off in its stock, it has superior total returns with 1,298.83% over the last ten years. It should also be noted that the YTD return for many of its competitors also took a hit following the headwinds of raising interest rates, inflation, and the market’s rotation out of tech stocks.

Seeking Alpha

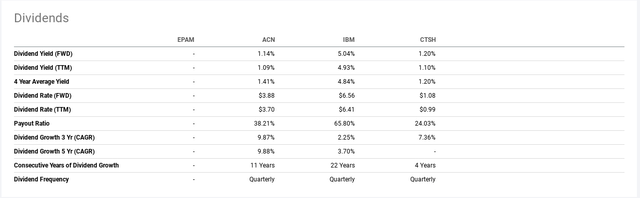

EPAM does not pay a dividend, which is a major weakness when compared its competitors. The highest dividend fwd dividend yield is paid by IBM at 5.04%.

EPAM has the highest P/E GAAP fwd ratio at 32.83 but this is not much higher than its trailing competitor ACN at 31.55. The distribution of these ratios are also similar for its EV/EBITDA fwd at 17.76, while ACN is slightly higher at 18.74.

Overall I feel that EPAM is competitively priced to its competitors and I believe it has the competency to convert its low share price into sizable gains for investors who buy in now.

Risks

EPAM might not have hit the bottom yet despite consolidating on the daily charts. Although it is not a falling knife, some more bad news from Ukraine could easily see its share price plummet further. Optimizing entry for this pick therefore is difficult and risky.

Then there’s the risk of conflict itself. The company is looking after its employees, but the operational damage to the company cannot be understated. It will take a considerable amount of time for EPAM to resume normal business activities, and this disruption could last for the rest of the year or even longer. War is unpredictable and could escalate at any moment, which also threatens to destabilize the rest of Europe.

Management also has a mammoth task of repositioning its business away from the active war zone and into safer geographical areas. It’s unlikely that its team has the experience or even knowledge of how to successfully navigate such a transition, thus there is an apparent execution risk which cannot be ignored.

Conclusion

I believe that EPAM’s share price is too good to ignore given its consistent financial performance, the sectors it serves and its strategic positioning in the digital transformation supercycle. It is indeed a risky and speculative play and due to the war in Ukraine its share price could dip lower unexpectedly. Still, I think it’s more likely than not that the stock will recover as management is undoubtedly aware of the risks of being involved in an active war zone and will be moving its operations staff outside the danger areas and focus on growing clients who are not affected by the war.

Although it is a little greedy, a 63.49% potential upside from current levels is great compensation for an equivalent amount of risk, so I am rating this stock a buy.

Be the first to comment