Enphase (ENPH) has seen its stock price explode since the company released its Q4 earnings results. The company’s valuation rose approximately 40% to ~$7.3 billion over the past few days. This stunning surge epitomizes the dramatic rise of MLPE (module-level power electronics) companies in the solar industry. Enphase, along with its competitor SolarEdge (SEDG), have changed the solar landscape in a matter of years.

Enphase’s Q4 revenue of $210 million represents 17% Q/Q growth and 120% Y/Y growth. What’s more, the company ended the year with a cash balance of $296.1 million. Enphase is quickly emerging as one of the most dominant players in the MLPE space. The company is using its momentum to further expand its business to the broader home energy management market.

Expanding Business Model

Enphase has cemented itself as a dominant force in the MLPE industry with 2.1 million inverters shipped in the quarter alone. The microinverter’s ability to optimize individual solar panels has helped transform the solar industry, especially in residential solar. Enphase’s success in the MLPE space is now allowing the company to branch out to potentially even more promising energy markets.

Enphase’s energy management Ensemble technology captures the company’s growing ambitions outside of purely microinverters. Ensemble helps integrate Enphase’s different energy products to form a larger energy ecosystem. The company’s growing energy ambitions include energy storage in the form of its Encharge battery. The exploding popularity of electric vehicles will help further legitimize and advance energy storage technologies to the benefit of Enphase.

Lithium batteries are experiencing rapid declines in costs driven by increasing innovation in the electric vehicle space. Given that lithium batteries will likely continue to be the primary energy storage for electric vehicles, lithium batteries should continue to fall in price. Tesla (TSLA) alone has made lithium batteries far more cost-effective than anyone would’ve ever imagined just a few years ago.

Given that Enphase’s Encharge uses lithium, the company should benefit tremendously from the general innovation occurring in lithium batteries. Demand for the Encharge appears to be healthy by all indications as the company prepares to ship this product. While microinverters and other such products will likely be the main driver of growth in the near-term, the Encharge battery could become a large contributor to overall sales.

The energy storage market could potentially be one of the largest segments of the overall solar and even energy industry. According to Wood Mackenzie, the energy storage market quadrupled since last year and is expected to skyrocket to 15 GW by 2024. If Enphase can successfully cement a strong foothold in the burgeoning energy storage industry, the company will have a significant slice of a potentially massive industry.

Energy storage has and will likely continue to experience consistent price declines for the foreseeable future.

Source: Wood Mackenzie

Strong Financials

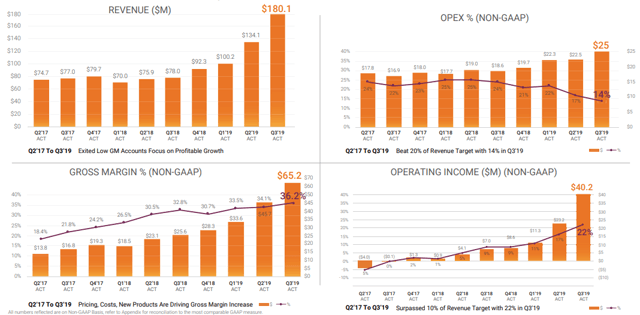

Enphase has consistently improved his financials over the past few years. The company posted a GAAP gross margin of 37.1% and an operating cash flow of $102.3 million in Q4. On top of these improving financial metrics, the company continues to experience exponential sales growth. Enphase has clearly cemented itself as a leader in the burgeoning MLPE space.

Enphase is improving in nearly all the important financial metrics.

Source: Enphase

Growing Competition

Enphase has had the privilege of being one of the very few MLPE companies dominating the industry over the past few years. This has allowed Enphase to take full advantage of the growing popularity of MLPE products. Of course, Enphase itself has had a huge part in popularizing MLPEs like microinverters. The success of Enphase has already started to attract better-equipped competitors like Generac (GNRC).

Although Generac does not have that much experience in solar, the company has done exceptionally well in the industries that it is involved in. In fact, the company is either number one or number two in many of the industries it is involved in. Generac could very well break the duopoly held by SolarEdge and Enphase in the US residential solar market. Generac’s most recent earnings call suggest that the company is ramping up its efforts in power electronics and other solar markets like solar-plus-storage.

Despite the growing competition, Enphase has enough of a lead in the industry that it will likely remain a force for the foreseeable future. While Enphase will almost certainly lose market share in the long-term, the MLPE industry will be large enough for many major players to thrive. Moreover, Enphase is diversifying into other promising energy markets, which should diminish the risk of growing competition in the MLPE industry.

Conclusion

Enphase is now one of the most valuable solar companies at its market capitalization of $7.3 billion. Despite Enphase’s recent surge and relatively high forward P/E ratio of 44, the company still has upside. The company essentially has a duopoly over the massive US residential solar market and is expanding to other major markets like energy storage. Enphase’s momentum will likely continue for the foreseeable future, making the company one of the most promising solar companies in the industry.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment