Robert Mora/Getty Images Entertainment

Overview of eBay

eBay Inc. (NASDAQ:EBAY) has gone a long way since founder Pierre Omidyar demonstrated proof of concept of an online trading platform in 1995 when he successfully sold a broken laser pointer online to a collector of broker laser pointers for $14.83. Company legend has it that Pierre built the platform so his fiancée could trade Pez candy dispensers, but that reportedly was a story concocted by the company’s marketing department to create a human-interest story for media consumption. During the 1990s Beanie Babies craze, eBay become known as the go-to online venue to trade difficult-to-find items, and Beanie Babies accounted for 10% of listings around the time of its IPO in 1998.

Since these beginnings, eBay has grown into a leading global e-commerce company with both consumer-to-consumer and business-to-consumer trading sites. Its marketplace platforms connect over 147 active buyers and 17 million sellers in over 190 countries around the world and facilitated over $87 billion in GMV (gross merchandise volume) in 2021. To put this into context, Target’s total revenue for the year was $104 billion, Walmart’s (WMT) online business handled over $70 billion in GMV (out of its total revenue of $572 billion), while Amazon facilitates over an estimated $600 billion in sales.

eBay Inc. derives a majority of its GMV from parts and accessories, consumer electronics, and home and garden. On its recent earnings calls, management noted that its faster-growing categories include collectibles, luxury goods, and jewelry.

eBay also owns $8 billion of investments in unconsolidated companies, including a 33% stake in Adevinta ASA (OTCPK:ADEVF) – which it acquired (in addition to $3 billion in cash) from the sale of its Classifieds business, Adyen (OTCPK:ADYEY) – its current payment processor, Emart (139480.KS) – which acquired eBay Korea, and KakaoBank in Korea.

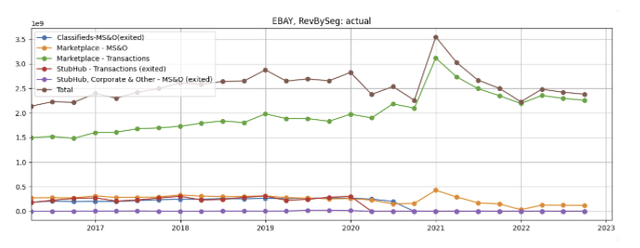

The vast majority of eBay’s revenue is generated by marketplace transactions (figure 1, green line) with the remainder from marketplace marketing services and other revenues (orange line). The company exited its classifieds (blue line) and StubHub (red and purple lines) businesses in 2020.

Figure 1: eBay Inc. revenue by segment

Created by authoring using publicly available financial data

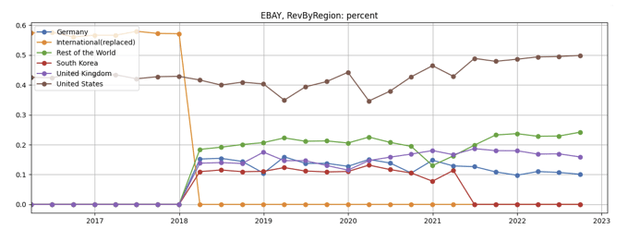

After the sale of eBay Korea in 2021 (figure 2, red line), the company derives just under 50% of revenues in the United States (brown line), with the balance from the United Kingdom (purple line), Germany (blue line), and other international markets (green line).

Figure 2: eBay Inc. revenue by geography, in percentages

Created by authoring using publicly available financial data

Investment thesis

eBay Inc.’s leading market position is driven by its role in reducing friction across trades, brand name, network effects from scale, and ability to instill confidence between counterparties.

1. Role in reducing friction across trades: many trades done on eBay today would not have been possible without a vibrant online platform. eBay has enabled the sale of brand-new items, “re-ecommerce” of used items (e.g., used handbags or electronics), as well as trading of highly specialized, hard-to-find items (think broker laser pointers, auto parts for specific vintage cars, and specialized vintage jewelry). This is good for the environment and optimizes society’s resources as it takes underutilized or “previously loved” items out of closets and puts them back into use for new owners.

2. Brand name and network effects: This is a phenomenon where the value or utility a user derives from a good, service, or website, depends on the number of users of the good, service, or website. As described in Wikipedia:

[As] the number of users grows on eBay, auctions grow more competitive, pushing up the prices of bids on items. This makes it more worthwhile to sell on eBay and brings more sellers onto eBay, which, in turn, drives prices down again due to increased supply. Increased supply brings even more buyers to eBay. Essentially, as the number of users of eBay grows, prices fall and supply increases, and more and more people find the site to be useful.

Upon reaching critical mass, a bandwagon effect can result. As the network continues to become more valuable with each new adopter, more people are incentivized to adopt, resulting in a positive feedback loop.

3. Ability to install confidence between counterparties: in the early days of online e-commerce, transactions were risky and prone to fraud. Sellers would send the products sold without knowing if they will receive a payment, if the payment they will receive is good; while buyers would send a check without knowing if they will actually receive the item or if the item they purchased is authentic and as described. eBay Inc. solved the payment problem with the acquisition of PayPal (which it has since spun out and ended its relationship with and now works primarily with Adyen as its primary payment processor) and is creating a program to verify and authenticate high-value items to reduce sales of fakes (more on this later).

4. A platform like eBay should demonstrate recession and inflation-resistant characteristics. In difficult or inflationary economic times, we can expect people to buy more previously owned items at a lower cost to save money as well as sell their under-loved and under-utilized possessions to raise cash. As management stated on their Q3 2022 earnings call:

The war in Ukraine, inflationary pressures and rising interest rates continued to weigh on consumer confidence and demand for discretionary goods. In addition, recent currency volatility widened the FX headwind to our reported GMV growth to approximately 6 points in Q3 compared to roughly 4 points in the prior quarter. Despite of these headwinds, our business remains resilient and markedly healthier than when we entered the pandemic, boosted by returns from our investments in focus categories and site-wide innovation across the eBay platform.

Management continues:

As consumers in our major markets face persistent inflation, higher interest rates and rising home energy costs, they are increasingly turning to eBay for better value. This is leading to growth in GMV of used and refurbished goods. In fact, in a recent survey, we found that more than three-quarters of sellers used eBay to sell pre-owned goods.

A vibrant market sets the pricing for various products, which facilitates the “invisible hand” (as described by Adam Smith in the Wealth of Nations) that helps manufacturers in their production and resource allocation decisions.

As an early mover, eBay could have dominated many more categories. However, I believe it has probably over-relied on the strength of its network effect and stayed too closely to its roots as a marketplace platform. It has rested on its laurels while its smaller competitors innovated relentlessly and took share in arts/home decor (Etsy (ETSY)), fashion (Poshmark (POSH)), motor vehicles and parts (CarParts.com (PRTS), Copart (CPRT) and Carvana (CVNA)), and others. Amazon (AMZN) has built a leading logistics and delivery system that has shortened delivery time to next day delivery and widened its competitive moat considerably.

Today, eBay is more well-suited to selling one-off, used, discretionary, and less non-time-sensitive items due to its lack of an efficient warehouse system and heavy reliance on third-party shippers that are not able to deliver items as quickly as Amazon.

Strategy and initiatives going forward

Focus on key categories

eBay Inc. has identified key focus categories, including motor parts & accessories, collectibles, luxury goods, and refurbished products, which are growing at 7 points faster than the rest of the platform as a group.

Motor parts and accessories is the largest category the company has invested in and is still below but nearing market rates of growth. In contrast, competitors CarParts.com and Carvana grew 130% and 269% over the last 3 years respectively. Structurally, I believe it is difficult for eBay to compete with multi-channel autopart retailers like O’Reilly (ORLY), AutoZone (AZO) (see my previous article), Carparts, or Amazon on speed of delivery to customers who need the parts in their hands as quickly as possible, and it is more well-suited to serving less time-sensitive customers and the discretionary part market.

Boost user confidence and trust

For the collectibles and luxury categories, two very large and still under-penetrated categories, eBay has introduced innovations to boost customer satisfaction and increase trust between buyers and sellers. The company launched eBay Vault for trading cards, which enables sellers to pre-load inventory for storage, provide an authentication guarantee for ungraded cards above $750, make instant transfers of ownership, and fast deliveries to buyers. eBay Inc. sees an opportunity to hold up to $3 billion of inventory in the vault over the next few years, which will widen its moat in the category. eBay Inc. has also introduced an authentication program for collectible sneakers.

In the luxury category, which has higher ASPs (average selling prices), eBay has also introduced an authenticity guarantee for watches over $2000 and for jewelry above $500 in the US, and it plans to expand this offering into additional categories.

In refurbished products, management noted on its Q2 2022 earnings call that it has introduced money-back guarantees and warranties for refurbished laptops, tablets, and smartwatches.

These moves will almost certainly boost customer confidence and net promoter scores as well as drive users away from traditional brokers to eBay, which will help fuel the company’s long-term growth.

Analysis of financial and performance metrics

Revenues by segment

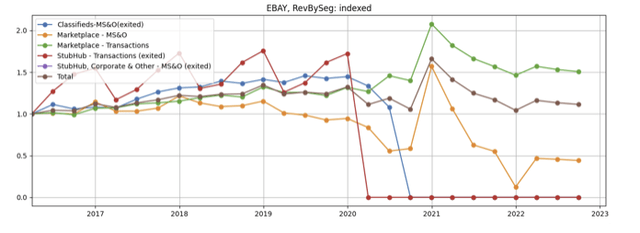

The company’s revenues have been flat (figure 3, brown line) over the last 5 years even though its focus categories are growing at higher rate, largely due to the divestment of its StubHub, classifieds, eBay Korea, and other businesses. The marketplace segment has continued to grow steadily and was up by 50% over the last 7 years (green line), for a decent but not breathtaking compounded annual growth rate of about 6%. (I note that 2022 quarterly revenues were down compared to strong COVID-fueled 2021 numbers but appear to be regressing to its long-term growth trend).

Figure 3: Revenues from transactions vs marketing services

Created by author using publicly available financial data

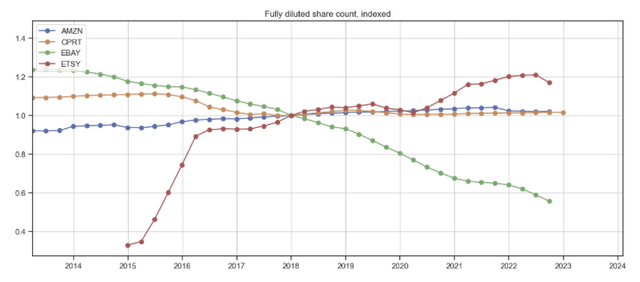

Shares outstanding

The 2017 Tax Cuts and Jobs Act enabled companies to repatriate cash back into the US without incurring a large tax bill. eBay Inc. has also received significant cash proceeds from divestments of its non-core divisions and has used the cash to aggressively repurchase shares. The company’s share count has shrunk by over 40% over the last 5 years (figure 4, green line), more than any of its peers. Furthermore, it has instituted a dividend, which currently yields 2%. The company continues to have authorization to acquire an additional $3.1 billion in shares as of Q3 2022, but I expect the pace to moderate as the excess cash on its balance sheet begins to go down.

To incorporate the effect of divestments on revenues, I believe the application of per share operational and financial metrics provide a better indication of the company’s performance.

Figure 4: Fully diluted share count

Created by authoring using publicly available financial data

Per-share active buyers and GMV

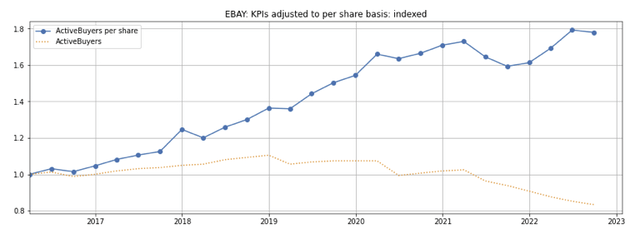

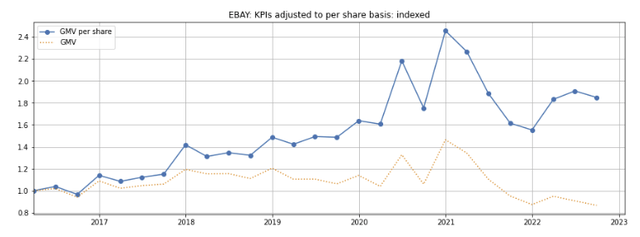

In the last seven years, the number of active buyers and GMV have declined by over 10% as a result of divestments (figures 5 and 6, dotted lines) and customer churn. However, on a per-share basis, the number of active buyers and GMV have both increased by about 80% (solid lines), indicating that the divestment and share repurchase transactions have been accretive for shareholders.

Figure 5: Active buyers – actual and per-share, indexed

Created by authoring using publicly available financial data

Figure 6: GMV – actual and per-share, indexed

Created by authoring using publicly available financial data

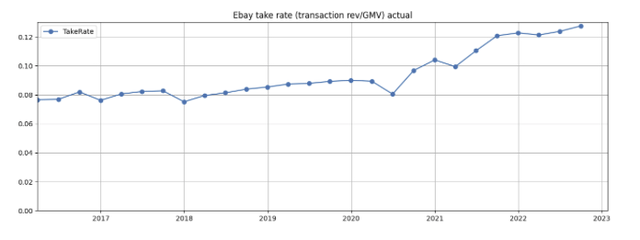

Since 2018, eBay Inc.’s take rate, i.e., the transaction revenue to GMV, has increased by 50% from about 8% to over 12% (figure 7), which I posit was boosted because the divested businesses have lower take rates.

Figure 7: eBay Inc. take rate

Created by authoring using publicly available financial data

Per share revenue growth

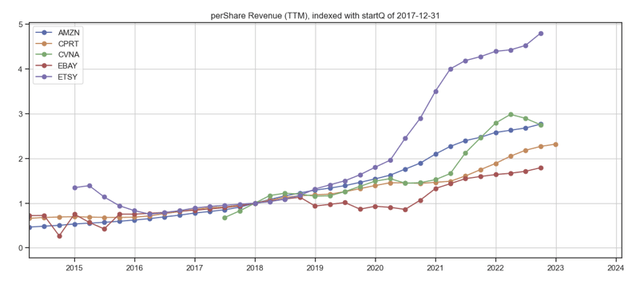

While eBay’s per-share revenue growth since 2018 is respectable (figure 8, red line), it is lower compared to its online marketplace peers.

Figure 8: eBay Inc. per-share revenue growth compared to peers, indexed

Created by authoring using publicly available financial data

Margins

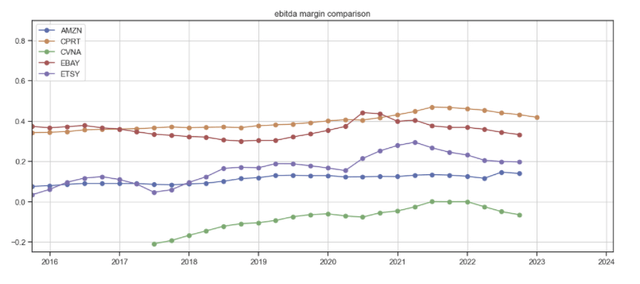

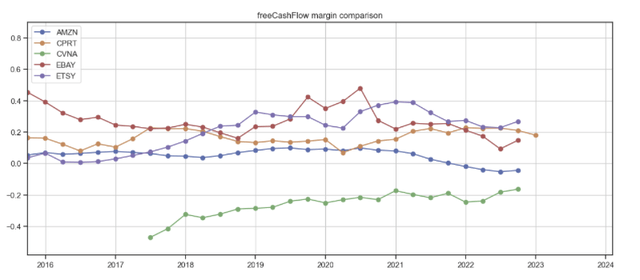

eBay Inc.’s EBITDA and free cash flow margins (figures 9 and 10, red lines) are high relative to its competitors but have not expanded as expected, and it is disappointing that the company has not benefited from operating leverage.

Figure 9: eBay Inc. EBITDA margins compared to peers

Created by authoring using publicly available financial data

Figure 10: eBay Inc. free cash flow margins compared to peers

Created by authoring using publicly available financial data

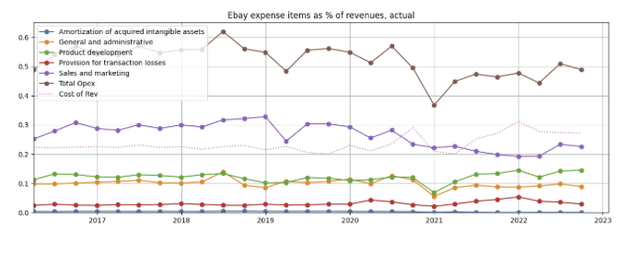

Expense items

Delving down an additional layer, I note that even though operating expenses as a percentage of revenues has declined due to a reduction in sales and marketing expenses (figure 11, purple line), it has been offset by a corresponding increase in cost of revenues (dotted line). Management attributes the increase in cost of revenues to the increased variable cost of managed payments which is expected to be offset by fewer fixed expenses (author’s note: my conjecture is that this is driven by the switch from PayPal to Adyen).

Figure 11: eBay Inc. expense items as a percentage of revenues

Created by authoring using publicly available financial data

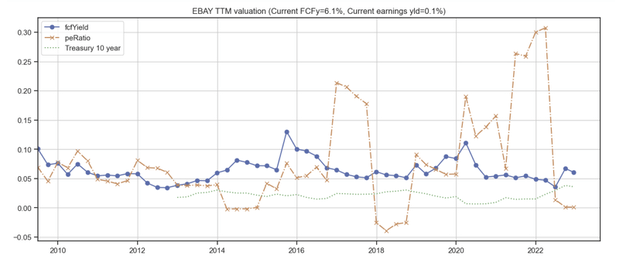

Valuation

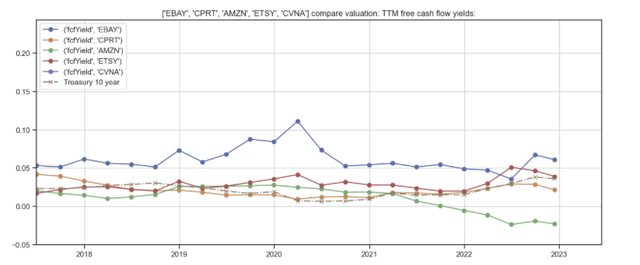

eBay Inc.’s current valuation, as measured by it free cash flow yield, is within its 12-year historical range (figure 12, blue line). This is cheaper than most of its peers (figure 13, blue line), which I attribute to the company’s comparatively slower growth (see figure 8 above).

Figure 12: eBay Inc.’s valuation, as measured by free cash flow yield

Created by authoring using publicly available financial and stock price data

Figure 13: eBay Inc.’s free cash flow yield compared to peers

Created by authoring using publicly available financial and stock price data

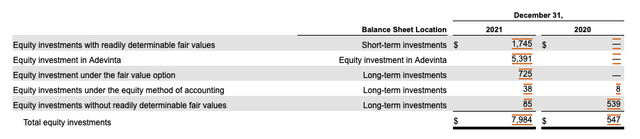

The company also holds about $7.3 billion in cash and short-term investments, which is offset by about $9 billion in short- and long-term debt. It also owns minority, non-controlling stakes in several private companies, including Adevinta, Adyen, Emart, KakaoBank, and others valued at $8 billion. These positions are not consolidated into its income statement and can be realized for cash or traded in the future (figure 14).

Figure 14: eBay Inc. equity investments

At a 6% free cash flow yield, I consider the stock reasonably valued, provided the company can continue to grow per-share revenues and earnings over the long term.

Outlook

Following the sale of its classifieds and StubHub businesses, eBay Inc. is now a streamlined company that is focused on its marketplace business. Even though eBay has missed opportunities and lost out to smaller competitors in some areas, its focus categories continue to present large TAM (total addressable market) opportunities, particularly in high-value segments such as collectibles, luxury items, and refurbished electronics, where it is well-positioned to disrupt existing offline exchanges by adding value through programs such as eBay vault and authenticity guarantees. I see this as a large opportunity that, with proper execution, should continue to drive eBay’s longer-term growth.

eBay Inc.’s EBITDA margins have been flat over the last 7 years, but I believe they should expand over the long term due to operating leverage inherent in its business model. Management observed in the Q2 2022 call that “while these variable costs (i.e., cost of revenue) will increase as Payments revenue grows, the incremental revenue provides leverage for our fixed expenses, most notably Sales & Marketing and G&A.”

Even though eBay has reduced its share count by over 40% over the last five years, I note that these purchases were funded from proceeds of divestments and the $9.1 billion in cash (as of December 31, 2017) previously “trapped” overseas that can be repatriated to the US in a tax efficient manner following the enactment of the 2017 Tax Cuts and Jobs Act. As I do not expect more cash inflows from additional divestments or the repatriation of still more “trapped” cash, the share count reduction is unlikely to continue at the same rate.

Concerns

Continuing to underperform its full potential

Even though eBay was one of the earliest internet e-commerce companies and had a first-mover advantage, I believe it has fallen far short of its potential compared to the likes of Amazon, Alibaba (BABA), and MercadoLibre (MELI). Furthermore, it has ceded market share to smaller competitors in areas it was well-positioned to dominate, such as Poshmark in fashion, Copart and Carvana in motor vehicles, and Etsy in arts and home decor.

I do not see any catalysts that will cause things to change anytime soon, but I believe this underperformance is likely factored into its stock price.

Continued market share erosion to Amazon

Throughout its history, eBay Inc. has focused on its competency of being an online trading marketplace. However, it has lost out to Amazon in many categories, particularly those that generate recurring orders or that require quick delivery. Even as eBay sellers continue to rely on third-party shippers, Amazon is expanding its sophisticated network of warehouses and next-day delivery capability – a competitive moat that continues to widen and encroach into eBay and its other competitors’ territory.

In summary

eBay Inc. revenue has been flat over the last five years in part due to the divestments of non-core divisions, but these divestment transactions have been accretive as the company used proceeds to repurchase shares, driving up per-share operating and financial metrics.

New initiatives to provide authenticity and money-back guarantees on high-value collectibles, luxury goods, and refurbished electronics will boost trust between buyers and sellers, expand eBay’s addressable market, and drive growth over the mid to long term.

EBITDA margins have been flat over the last 7 years, but management expects operating leverage on incremental revenues from sales & marketing and general & administrative expenses

eBay Inc.’s valuation is lower compared to peers’ due to its slower growth – it is reasonable but not a steal, particularly in the current environment of rising interest rates.

I rate eBay a hold given the lack of strong near-term catalysts, but the stock could be attractive for longer-term investors.

Be the first to comment