Tiziano Cremonini/iStock via Getty Images

Over the last few years, insiders as a group have been huge sellers of technology stocks. The need to diversify their holdings combined with stock prices that had been bid up to levels unhinged from reality contributed to these large divestitures.

The tides have turned in recent months with more insiders of technology companies stepping up to buy shares on the open market. This buying is more opportunistic than the structured buying we saw of companies like Asana (ASAN) by its founder and CEO Dustin Moskovitz through a 10b5-1 plan last year and early this year.

Two recent insider purchases of technology companies that caught my eye last week have been discussed below. Given the current macro environment this may not be the right time to start buying these companies but I have always liked how insider purchases have been a source of ideas for me. I build a watchlist of ideas based on various event-driven strategies and insider purchases. This allows me to act quickly when challenging market conditions present favorable investment opportunities.

Datadog (NASDAQ:DDOG)

Datadog is a cloud software company that initially started out as a infrastructure monitoring solution and over time has added various features to its software solutions ranging from log management to the more recent database monitoring. As I reviewed the company’s suite of products, I was impressed by the breath of their offering and how it was possible to purchase solutions à la carte at reasonable monthly subscription prices without having to get on a call with an enterprise sales representative.

A customer that purchases one product is likely to add others over time and we have seen this with the growth of Datadog customers that spend over $100,000 on its solutions. As of Q3 2022, the company had 2,600 customers and 44% of these customers had an ARR spend of over $100,000.

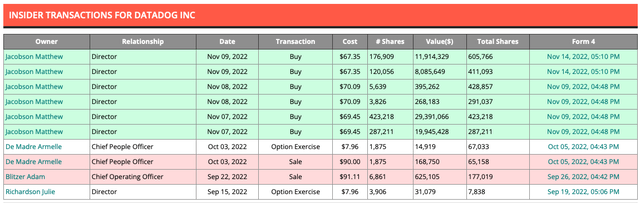

While working on our daily Inside Arbitrage Event Driven Monitor series of posts last week, I noticed that Matthew Jacobson, a Director of the company purchased 719,894 shares at an average price of $69.45 totaling $50 million.

These purchases were made indirectly through various ICONIQ funds. I have written about insider purchases by ICONIQ several times this year after they purchased shares of Procore Technologies (PCOR) in March 2022 and Braze Inc. (BRZE) a couple of months ago. I wrote the following about ICONIQ earlier this year,

ICONIQ is a San Francisco-based private asset management company with $83.5 billion in assets under management (as of 12/31/2021). The firm provides wealth management services to high net worth clients such as Mark Zuckerberg, Sheryl Sandberg, Jack Dorsey and Jeff Weiner. ICONIQ was founded by Divesh Makan, Michael Anders and Chad Boeding in 2011 and Will Griffith joined the firm in 2012. ICONIQ has been a 10% owner in various companies like Snowflake (SNOW), Fastly (FSLY), Datadog (DDOG) and Procore Technologies (PCOR).

ICONIQ is not the only fund purchasing shares of Datadog after the big decline in the stock this year that has seen the stock price cut in half. The legendary Stanley Druckenmiller’s Duquesne Family Office increased its stake in Datadog (DDOG) by 165% from 298K to 789K shares as of the end of Q3 2022. Growth focused Tiger cub Chase Coleman also boosted Tiger Global’s stake by more than 200% from 1.81 million shares to 5.77 million shares.

Interestingly as I was working on this article, I noticed another $20 million insider purchase by ICONIQ that was filed after hours on Monday.

Inside Arbitrage Database

Market participants were encouraged by these purchases and bid up Datadog stock nearly 10% on Tuesday. The stock now trades at nearly 17 times trailing sales and 62 times cash flow. Despite the pullback in growth stocks and the shrinking of their multiples, Datadog continues to trade at a premium valuation because of its high growth rate and the fact that the company actually makes money. Datadog grew Q3 2022 revenue by 61% and in a move that is not often seen these days, increased its full year revenue forecast above consensus to a range of $1.650 billion and $1.654 billion. Revenue growth next year is expected to moderate to 35% but that is still well above other software companies that have seen a significant deceleration of their growth rates.

GAAP net income is negative but free cash flow is solidly positive. Over the trailing twelve months, the company posted a net loss of $14 million but free cash flow was a strong $392 million. Datadog has been consistently cash flow positive and that has helped net cash on the balance sheet grow to over $1 billion. As you probably guessed, the big non-cash charge that accounts for this difference between net income and free cash flow was $307 million in stock-based compensation expenses. I discussed excessive levels of stock-based compensation in an article titled Qualtrics: Balancing Employee Compensation With Shareholder Return earlier this year.

To determine the intrinsic value of Datadog, I decided to build a DCF model, assuming a starting EPS of $1.25 in 2023, growing 40% to $1.75 in 2024 and then declining 3% a year through 2032, a 10% discount rate and a 2% terminal growth rate, I get an intrinsic value of $97.52 per share. The stock currently trades at a nearly 22% discount to that intrinsic value.

The starting EPS estimate is a little north of consensus analyst estimates of $1.15 for 2023 because the company has handily beaten analyst estimates in each of the last four quarters. The $1.25 per share in 2023 is also close to what I get by dividing $392 million of free cash from the trailing twelve months by 316 million diluted shares outstanding. Whether the company manages to grow earnings in 2024 remains to be seen. If interest rates continue to increase, then the 10% discount rate might also be conservative.

A financial model or a DCF model is only as good as its assumptions and it’s entirely possible that the future may unfold in a different manner.

I will be monitoring Datadog in the future both as a potential investment and as a potential customer for some of their products.

Redfin (RDFN)

I’ve been an investor in Zillow (Z) for several years following insider buying by both long-serving Director Jay Hoag and CEO Rich Barton in late 2018. At that time, Zillow’s founder Rich Barton was Executive Chairman and Zillow was run by Spencer Rascoff. Following Zillow’s purchase of competitor Trulia, I viewed the online real estate advertising space as a duopoly with Zillow and Redfin dominating the space. Unfortunately for both these companies, they embarked on a merry misadventure of flipping homes called iBuying, which generated a ton of revenue but was a low margin, high risk business.

Investors were unhappy with this turn of events and Zillow came to its senses last year. They decided to exit the business while the housing market was still hot and by the time they reported Q2 2022 results in August, their inventory had dwindled to just 25 homes without a sale contract. The company managed to get out with minimal losses and partnered with Opendoor to offer its customers iBuying options. I discussed Zillow’s decision to exit iBuying in an article titled What Does Zillow’s Exit From IBuying Mean For Opendoor? last November.

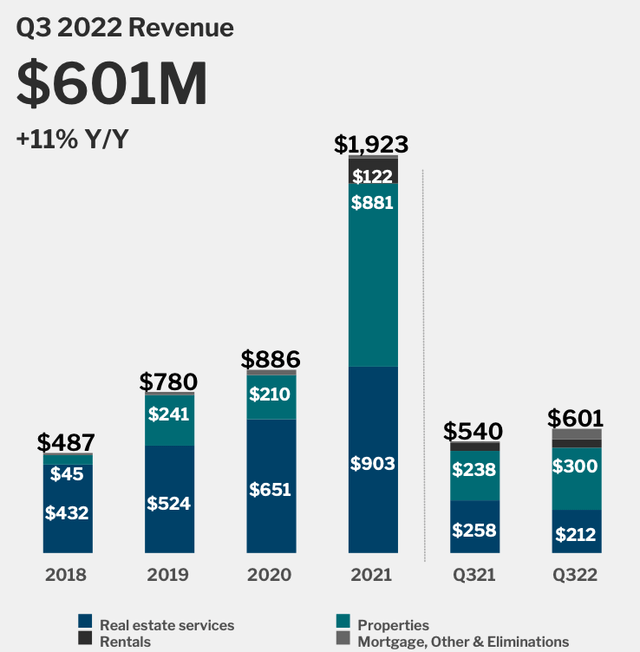

Redfin on the other hand delayed the inevitable and finally announced last week that they were also going to exit the iBuying (properties) business. Unfortunately for Redfin, the macro environment is significantly worse than it was when Zillow chose to exit and their iBuying business represented nearly half of their $601 million of Q3 2022 revenue.

Redfin Investor Presentation

Redfin’s iBuying business also accounted for nearly half of the company’s $90 million loss in Q3 2022. The company lost money in every single division including real estate services and mortgages. It was little consolation to see that the real estate business posted an Adjusted EBITDA profit of $4.4 million.

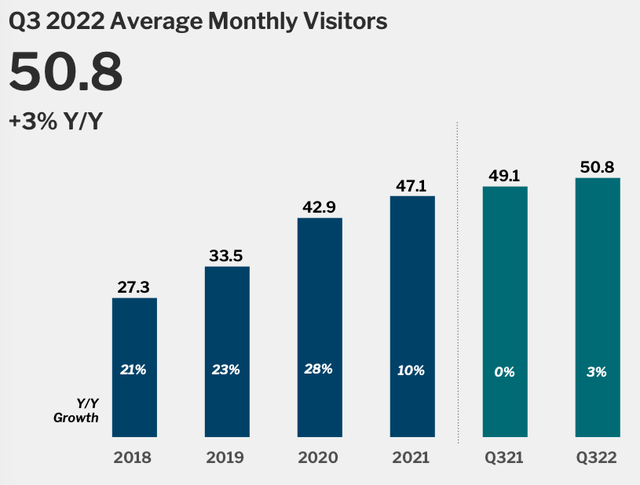

The only bright spot from the earnings report was the continued growth in average monthly users as you can see from the graph below.

Redfin Investor Presentation

To put this in perspective, Zillow had 234 million monthly active users in Q2 2022 but growth was anemic with users up 2% year-over-year and visits up 5% year-over-year.

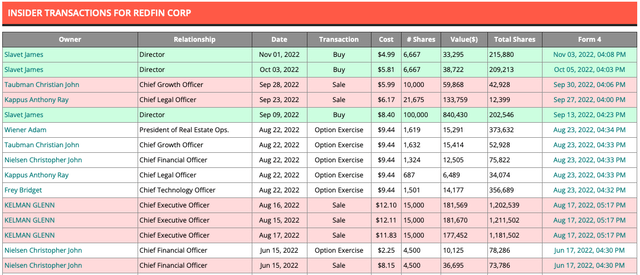

A sign I have been looking for among beaten down technology stocks is insider buying and I am yet to see it at Zillow. The situation is different at Redfin with an independent Director, James Slavet, purchasing shares over the last three months. Mr. Slavet has served on Redfin’s Board of Directors since November 2009 and is a partner at venture capital firm Greylock Partners. As you can see from the list of insider transactions for Redfin below, the rest of the executive team does not appear to share Mr. Slavet’s enthusiasm for the stock.

Inside Arbitrage Database

Both Redfin and Zillow are going to face a challenging housing market for the next few quarters and I expect results to deteriorate further before they get better. Redfin is going to find it particular difficult given its negative free cash flow and significant net debt on the balance sheet.

Conclusion:

Insider buying is not a sufficiently strong signal to purchase stocks without further research. It does bring up interesting ideas worth exploring further and it would have been unlikely that I would have looked at Datadog or its products had I not encountered the stock during my nightly review of form 4 filings by insiders. The two stocks discussed above are good examples of how it unearths companies that are both attractive and not ready for prime time yet.

Be the first to comment