Just_Super

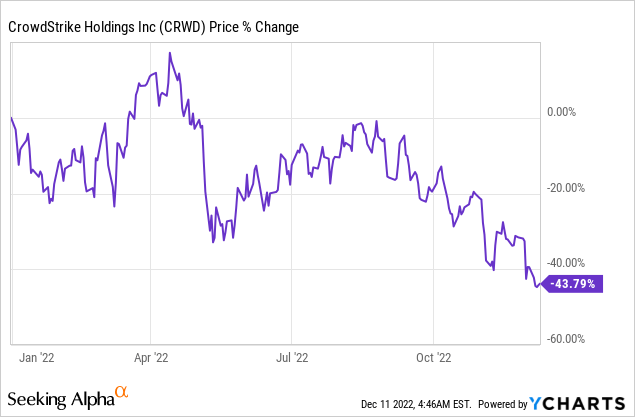

Shares of CrowdStrike (NASDAQ:CRWD) lost 44% of their value in 2022, but despite this huge draw-down in pricing I believe the cloud-based cybersecurity platform offers investors deep long term value. CrowdStrike is facing an expanding addressable market and the subscription business model is uniquely suited to the IT security business. Additionally, CrowdStrike is seeing strong momentum in subscription revenues and although the firm’s valuation is not cheap, the company’s trajectory justifies an upwards revaluation in the long term!

Large and growing addressable market

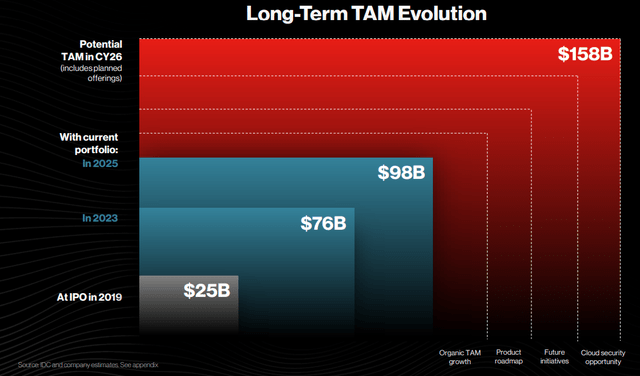

The IT security market is large and growing. A key driver of the expansion in the size of the addressable cybersecurity market is the ever-evolving security landscape. With thousands of new malware and viruses popping up each day, cloud-based security platforms that seek to protect their customers against such threats face strong long term growth tailwinds.

The total addressable market for CrowdStrike — whose core products and services include corporate endpoint security, managed security services, cloud security and threat intelligence — is set to be worth approximately $98B by FY 2025, showing an expected 13% year CAGR rate between FY 2023 and FY 2025. The potential long term TAM size, based on new product offerings such as cloud security, implies a total value of $158B for CrowdStrike’s longer term market opportunity.

CrowdStrike operates its business as a SaaS model which means customers pay on a recurring basis to use the firm’s product suite. This subscription model is perfect for cybersecurity companies like CrowdStrike for two reasons: (1) The threat landscape is constantly evolving (as mentioned above), meaning customers constantly need the latest tools to protect themselves against cybersecurity risks and (2) IT security becomes more important for companies as more workloads shift to the cloud.

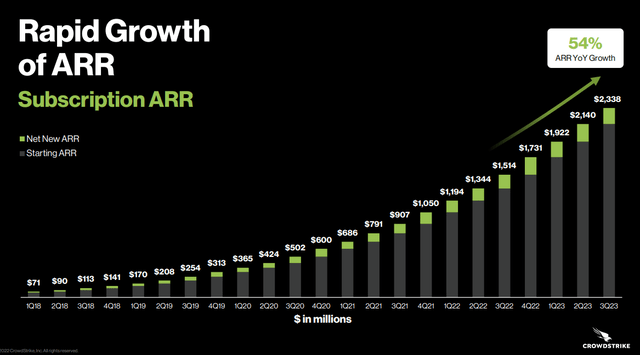

These drivers have resulted in rapidly growing subscription revenues for CrowdStrike’s security platform. Annual recurring revenues generated from subscriptions soared 54% year over year in CrowdStrike’s latest quarter (FQ3’23) to a record high of $2.34B and the firm consistently adds new recurring revenues through customer acquisition. Since the third fiscal quarter of FY 2019, subscription revenues have increased by a factor of 9.2 X.

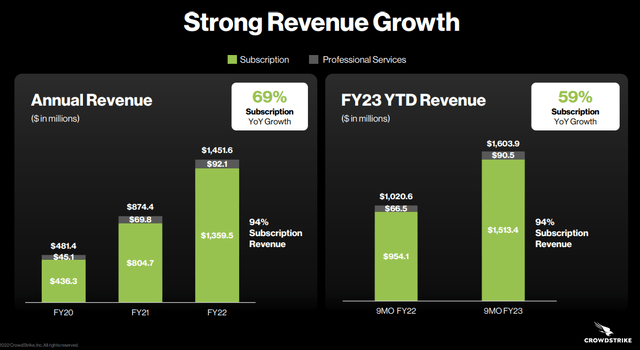

CrowdStrike generates about 94% of its total revenues from subscriptions which in FY 2022 soared 69% year over year to $1.36B. Total revenues, including professional services, soared 66% year over year to $1.45B. As per the latest guidance, the IT security provider projects $2.223-2.232B in revenues for FY 2023, implying a year over year growth rate of 53%. Although CrowdStrike’s top line growth is slowing, the firm is still expected to grow its revenue base by more than 50% compared to FY 2022 which is impressive.

Strong customer monetization and retention

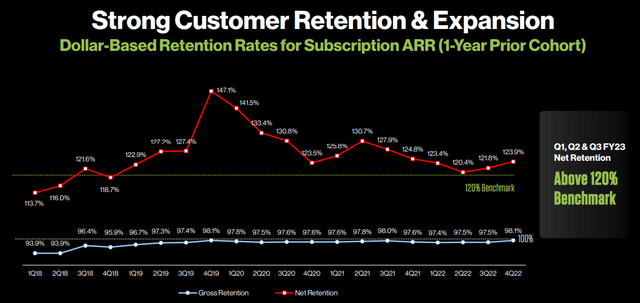

CrowdStrike has strong customer retention as shown by its dollar-based retention rate. Different software/cloud companies use different definitions to measure customer monetization, but they essentially all mean the same thing: they measure how effective companies are in growing their revenues internally, by up-selling customers or getting them to expand their subscriptions. In the case of CrowdStrike, the firm’s dollar-based retention rate consistently exceeded 120% in the last three years. A retention rate of 120% means customers spend 20% more on the firm’s platform products and services than in the prior period.

Operating leverage could drive income gains

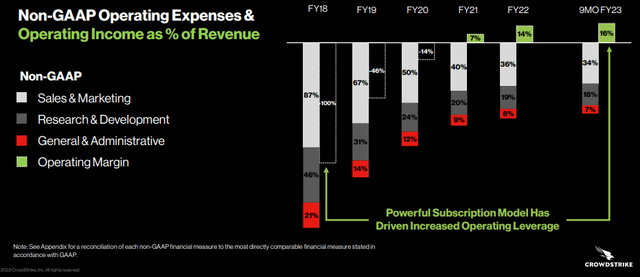

CrowdStrike is still not profitable: the SaaS business lost $55.0M in FQ3’23 and $136.8M in the nine months ended October 31, 2022, but CrowdStrike has, due to its growing scale, operating leverage that could result in an improved profit picture in the near term. CrowdStrike drastically cut back on sales and marketing expenses in the last three years which has been a key driver for an increase in operating income. CrowdStrike’s operating leverage has started to have an effect in FY 2021, which was the first year in which the company reported a positive operating income margin, and the firm has expanded on those gains ever since.

Attractive free cash flow margins

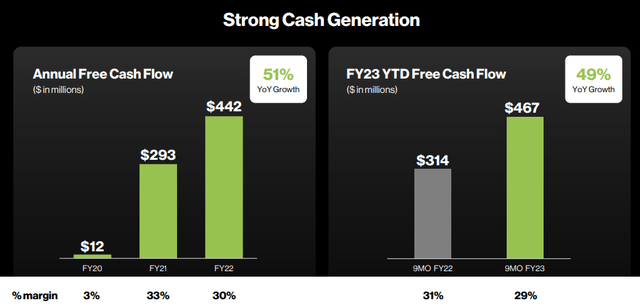

Because of strong customer acquisition and revenue momentum in the subscription business, CrowdStrike’s free cash flow is ramping up as well. The cybersecurity company disclosed $174.1M in free cash flow in FQ3’23, showing 41% year over year growth and a margin of 30%. CrowdStrike’s free cash flow for the nine months ended October 31, 2022 grew 49% year over year and had an equally impressive margin of 29%.

Strong cash position, low debt

CrowdStrike has a strong balance sheet that allows for sustained growth. At the end of the October-quarter, CrowdStrike had $2.5B in cash and cash equivalents on its balance sheet and only $740.6M in long term debt. With a low degree of leverage, CrowdStrike can fully concentrate on the expansion of its SaaS business model.

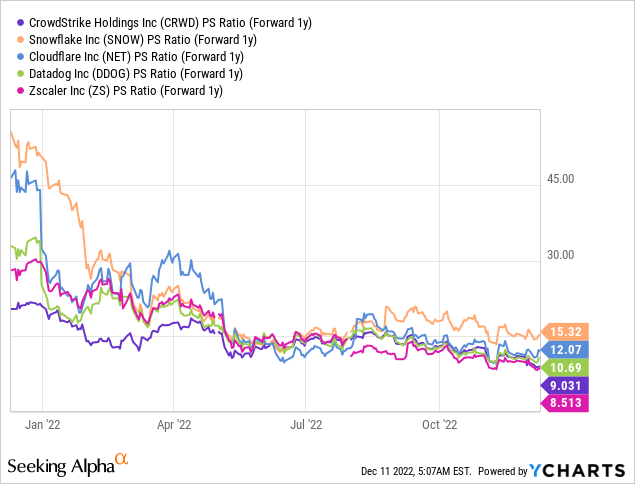

CrowdStrike’s valuation vs. other cybersecurity stocks

CrowdStrike is not cheap, despite a 44% draw-down in pricing this year. The stock currently trades at a P/S ratio of 9 X which is not unusually high for a cybersecurity company. A lot of stocks of cybersecurity/cloud-based software companies trade at a higher P/S ratios (see below). Considering that CrowdStrike is projected to grow its revenues 53% this year and 34% next year, I believe the firm’s valuation is justifiable.

Risks with CrowdStrike

The biggest risk for CrowdStrike, as I see it, is a slowdown in IT spending during a potential recession which could result in weaker customer monetization and retention. CrowdStrike is likely going to continue to grow rapidly given the need to consistently offer customers the best protection against currently known IT threats. However, a slowdown in top line growth and weakening customer acquisition/monetization could pose a risk to the firm’s valuation factor.

Final thoughts

Shares of CrowdStrike recently fell to a new 1-year low which, I believe, may be a good opportunity to reconsider the cybersecurity company. Considering the rapid growth of the total addressable market in which CrowdStrike operates, which itself is underpinned by the need to constantly buy up-to-date cybersecurity protection, the company faces attractive long term growth prospects. Although it is true that CrowdStrike is not cheap, the firm has considerable upside potential given its impressive top line growth, momentum in the subscription business and strong retention rate. For those reasons, I believe the company’s SaaS business model and market opportunity help make a strong case for a long-term upside revaluation of CrowdStrike’s shares!

Be the first to comment