NEW YORK (March 6) – The February jobs report printed at a very strong 273,000 new jobs, well above the consensus estimate of 175,000. Revisions for December (+37,000) and January (+48,000) netted 85,000 additional new jobs.

Average jobs printed strong in both the three-month and six-month average categories, as shown in our chart here:

The seasonally adjusted unemployment rate ticked down slightly, to 3.5% from 3.6% in January and down 30 bps from last year. The seasonally adjusted U-6 Unemployment, at 7.0%, was up 1/10th of a percentage point from January, and down 20 bps since last year.

Nominal year-on-year average weekly wages increased by 3.0%, at a rate higher than inflation. Real wages increased by 0.94%, assuming the January Trimmed Mean PCE inflation rate of 2.06%. Month-on-month nominal average weekly wages increased $5.94, or 0.6%, although average weekly hours, were up 1/10th of an hour month-on-month, although they remained steady year-on-year 2019.

ANALYSIS: DETAILS AND OUTLOOK

Monday’s January ISM Report printed up at 50.1, down 80 bps from last month’s 50.9. Overall, the report says the economy remains in growth, but is slowing. Inventories are declining more quickly, and may finally support, albeit belatedly, our view from our 2019 Q3 GDP and 2019 Q4 reports that inventories have been largely burned off and will have to be re-stocked. We had predicted a jump in the prior two quarters but now anticipate it in 2020 Q3 because of the COVID-19 virus.

As we discussed first in our earlier jobs reports, we foresaw a slowdown, but not a recession in 2019. We’re confident in that, notwithstanding the COVID-19 virus. The Fed’s more dovish stance on interest rates, its cut of 50 bps on Tuesday, the 2019 GDP printing at 2.3% (though we anticipate a downward revision of Q4) and a growing realization among the public and health officials that COVID-19 is not deadly to most healthy, younger, people tend to support our more optimistic view.

COVID-19

We still do not expect the COVID-19 virus to morph into a “black swan”, for the reasons we explained in our flash report for 2020 Q4. China will suffer (and harder than the CCP has allowed to be reported) and so will companies that manufacture there and companies with a large part of their market share there (like some of the multinational hospitality and QSR restaurant chains). In the US and other Western democracies, though, public health officials have been zealously containing the virus, although there has been community spread in some instances.

The fear seems to be more of catching the virus than of the virus itself. Health officials here in New York say something like 80% of those who catch the virus “self-resolve”, meaning those who are sick recover on their own, at home, without hospitalization or special treatment.

Nevertheless, we have arrived at a whole new, albeit temporary, world with the COVID-19 virus. The last two to three weeks have disturbed what had been a mostly optimistic economy. We are in a “blind spot” for the time being, with an infinitesimal percentage of Americans diagnosed (though additional testing will raise that number) and aggressive, even heroic, efforts by public health authorities to contain a larger spread. We are not China or Iran. And our public health officials likely had greater forewarning of COVID-19 than their unfortunate counterparts in Korea and Japan. (We do not believe the Italian public health system is as robust as those two Asian democracies.)

The next four to six weeks will be telling in terms of the trends of contagion in the US. By May, we should know whether there is reason to have grave concerns. We are optimistic that vigilant containment and monitoring by public health authorities will permit a more optimistic economy – and stock prices – to emerge by then. That said, public fear is real for now and will continue to affect global markets. We have four central concerns from COVID:

- Negative interest rates and deflation: With cash flowing into the bond market and the 10-year now printing at 0.7% with core inflation at 1.6%, bond investors are effectively paying for the safety of Treasury bonds.

- Supply side – Companies that rely heavily on foreign, and particularly Chinese and Korean, suppliers will likely be unable to meet their demand. In the USA, service-related businesses that have “battened down the hatches” against COVID-19 will likely see reduced productivity.

- Demand side: There is a risk of deflation as demand drops off as people hunker down to avoid the virus. This could be troubling for heavily leveraged companies where cash flow may require debt restructuring. Continuing low oil prices may affect deep well and fracking operations, causing layoffs of well-paying jobs. Stock losses by retail investors may also impact the wealth effect in consumer spending.

- Defaults on Offshore Corporate Dollar Bonds (OCDB) – Our central concerns now are liquidity and contagion from defaults in China. China owes American, European, and British banks and other creditors, including Asian/Chinese investment funds. Our concerns about the rollover of dollar, euro, and pound denominated debt continue and are exacerbated given cash flow concerns in Chinese entities arising from COVID-19. This affects even SOEs, which – as we have explained previously – the CCP have allowed to default.

FOREIGN AFFAIRS

Global Economies

Euro-area GDP increased just 0.1%, in 2019 Q4 and preliminary 2019 GDP printed at 1.2%, up from 1.0%. China’s GDP increased just 6.0% in 2019 Q4, matching the new lowest on record and unchanged from of 2019 Q3. China’s 2019 GDP is pegged at 6.1%. We now believe the Wuhan Coronavirus could drop 2020 Q1 GDP by as much as 200 bps, exasperating China’s record level of defaults, the worst in its history. Japan’s 2019 Q4 printed down -1.6%, for a full-year Japan’s GDP of -0.4%.

Some of the European political considerations that weighed on our prior jobs reports have been exacerbated since out last jobs report.

Germany

While the SPD has named new party leaders and pledged to seek a better deal with Chancellor Merkel for their constituency, Merkel’s hand-picked successor to lead the CDU/SCU has resigned, thus putting the governing coalition at risk. A new CDU/SCU leader will be named in April, raising the prospect there could be snap elections in the early part of 2020 if no governing coalition is maintained. The rightmost AfD party has also elected a more radically right leadership, and politics in some of Germany’s provinces have grown chaotic, as occurred recently in the central German state of Thuringia, where a far-right candidate was elected and had to resign.

France

Protests but not strikes continue over Emmanuel Macron’s plans to reform generous government pension plans. A motion to debate a vote of “no confidence”, which would have removed the government if successful, was tabled this week by Macron’s majority. But another national protest to protest the pension reform measure is scheduled for March 31st.

GEOPOLITICAL AND CONFLICT CONCERNS

Iraq

As discussed more fully in our article on Iraq and Iran, we continue to expect a campaign of low-intensity cyber war directed principally at economic targets through the November US elections, together with a terror campaign directed at American targets in the Middle East and North Africa waged by Iranian proxies. But none of that, barring war directly between the United States and Iran, should be sufficient to trigger a recession. It will, however, eat into US profits, as explained further in that article.

The flashpoint at the Straits of Hormuz that we have been expecting for some time, since the Joint Comprehensive Plan of Action (JCPOA) was abandoned, is benign for the moment, but unpredictable, day-to-day. Direct country-to-country kinetic war between the USA and Iran remains unlikely. We reiterate our view that there will be cyber attacks and proxy kinetic attacks in MENA. We anticipate ongoing harassment, such as indirect fire and rocket attacks in the Green Zone of Baghdad, but little else.

As of March 2nd, USS Harry Truman (CVN 75) remains just outside the Gulf of Oman in the Arabian Sea, close enough to be within striking distance of the Straits of Hormuz if need be, but not so close as to be provocative. USS Bataan, an amphibious response group, is just off the coast of Oman.

The USS Eisenhower CSG (CVN 69) is in the Mediterranean, apparently poised to relieve the Truman group or, perhaps, to address the Russian-Turkish tensions that arose over Syria.

Turkey and Russia have agreed to a ceasefire in the belligerence that started last week.

Hong Kong remains in recession, although protests have abated due to the COVID-19 virus. There is still an active movement of independence advocates, though shuttered behind closed doors for fear of contagion.

China has not been forthcoming about the COVID-19 virus and there are reports of Chinese angry at the CCP’s response to the pandemic. Secretary Pompeo, Vice President Pence, and President Trump have spoken or acted in what we believe is the most adversarial manner towards China in at least 30 years. The effect of this change in US policy remains to be seen, but we believe the Trump Administration would welcome internally-driven “regime change” in China and we would not be surprised at all to see anti-CCP domestic rebels emerge from the COVID-19 virus. US lawmakers have also nominated the Hong Kong protesters for the Nobel Peace Prize, a development that will certainly antagonize China’s CCP leadership, particularly if the nominees win.

We have never been terribly concerned over China trade wars. We feel likewise about the consequences of the COVID-19 virus there, except insofar as it affects US and European creditors. The total value of the US economy is about $20.5 trillion. The total value of US goods imported from China is about $539.5 billion. That works out to about 2.6% of the US economy. Our exports to China are about $120.3 billion. That works out to 0.58% (58/100ths of a percentage point) of the US economy. Chinese belligerence toward us and our allies, and their espionage activities, are far more threatening from geopolitical and military perspective than an economic one.

As with Iran, we think Xi Jinping and his counselors are awaiting the outcome of the 2020 elections before committing to any serious or permanent trade deal. We think the current optimism towards a trade deal is significantly overstated, particularly given the belligerent tone from China since President Trump signed the Hong Kong Human Rights and Democracy Act. More hostile comments from China have been issued since the COVID-19 virus erupted, with CCP propaganda laying blame at the USA.

The China trade agreement signed on January 15th is not terribly significant in the scheme of things. We tend to think of it more in terms of a letter of intent to make a deal rather than a “deal”, and even now, China is seeking at least a temporary escape hatch over the COVID-19 virus outbreak.

Given the now considerable risk to US and foreign holders of Chinese OCDBs, and the effects of COVID-19 in China, we anticipate the president will not rigidly enforce trade restrictions on China for at least another year. That said, we still hope as talks are ongoing with China, that the president will engage America’s Asian and European allies to step up to join a “coalition of the willing” to challenge China’s decades-old unfair trade practices and thefts of intellectual property because the one-on-one dispute could simply trigger mutual retaliation. There is more power in American dealings with Xi from a multilateral “we” than a unilateral “us”. A coalition of the willing strategy would also lend itself to a more predictable tariff regime as our allies would, perhaps, temper the president’s sometimes seemingly mercurial “on-again, off-again” tariff threats so that businesses could operate with greater certainty. But given Europe’s failure to step up on China’s brutal repression of China’s Hong Kong protesters last year, and its weak economies, we do not expect leadership across the Atlantic to show much fortitude. That leaves it to the president and the USA.

We believe both Beijing and Tehran are awaiting a less disruptive, more traditional, less populist, and more “establishment”-style president, one more oriented to – and prone to more globalist and multinational inclinations – in hopes of getting better deals and improved relations. Those hopes are unlikely to be realized, as of now, because over the last 100 years incumbent presidents are historically re-elected, barring a recession (Hoover, Carter, and Bush 41).

North Korea has hinted at further belligerence with recent missile tests, but the situation remains unclear and unstable.

India and Pakistan tensions over Kashmir have ebbed considerably and rhetoric has calmed in the new year in view of the COVID-19 virus. India has even arranged to airlift Pakistani students from Wuhan and restored internet service to Kashmir after a seven-month blackout.

MACROECONOMICS

The yield curve inversions and rate narrowings that have troubled us for some time have receded somewhat since the Fed’s rate cut and the 3 Mo/10Yr spreads improved in 2019 but are now again precipitously low.

We continue to have overall concerns about US demographics, particularly the aging of the US population, an increase in the average age of marriage and family formation, student debt levels, and retirements from skilled trades that are not being filled by new entrants to those professions. The latter concern could slow housing starts, boost wages and inflation, and create supply chain shortages in the medium to longer term.

We’re also wary of the simple length of the recovery. While recoveries don’t die of “old age”, there is still a business cycle that merits respect. The “rolling correction” of the last two weeks has lessened pressure on markets and what we anticipate will be a slowing of the economy will relieve some of the pressure on the “long-in-the-tooth” recovery.

Overall, we remain at a “green light”. The slowing US economy we identified back in our August jobs report continues, but we reiterate our sense that a recession (i.e., two consecutive quarters of negative growth) is unlikely through the rest of 2020. The closest possible start of a recession we foresee is 2021 Q1, but, again, that will depend on data. A “black swan”, such as a widespread pandemic of the COVID-19 virus – which remains unlikely in our view – would obviously alter that view. Keep apprised of our outlook by checking our jobs reports here on Seeking Alpha.

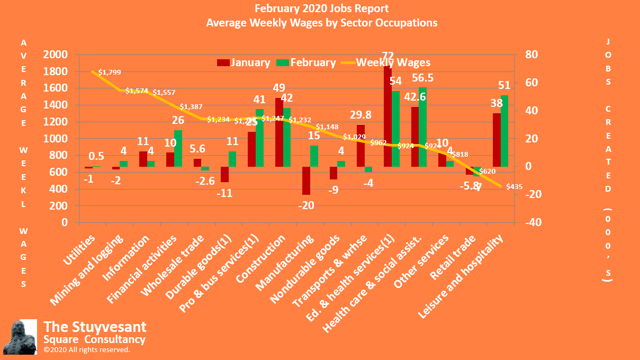

Let’s look at our exclusive schedule of jobs creation by average weekly wages for the July jobs report:

October Jobs Creation by Average Weekly Wage Source: The Stuyvesant Square Consultancy, compiled from BLS Establishment Data for October, 2019.

October Jobs Creation by Average Weekly Wage Source: The Stuyvesant Square Consultancy, compiled from BLS Establishment Data for October, 2019.

The number of people employed in February was 158,759,000, up 45,000 from January and 1,893,000 from the same period last year. Some 164,546,000 individuals were in the workforce, down 60,000 from last month and up 1,499,000 from last year. The labor participation rate held steady at 63.4% from last month and up 30 bps from 63.1% from last year.

Macroeconomic Data

As we review economic data, please take note that the COVID-19 virus first became mainstream in the USA after December; so, data is lagging. Data reporting January and February activity is a far better indicator of the effect of the virus on the US economy than earlier lagging data from 2019.

Fuel prices continue below the $3 per gallon threshold, at $2.533. Gasoline prices for February are 9.22% higher than last month, and 5.85% higher than last year.

Oil prices, as measured by West Texas Intermediate crude, have decreased 9.22% from last month as of today, and are 16.73% lower than the same time last year.

The JOLTS survey for December, the latest available data, released February 11th, showed 364,000 fewer job openings from November, and 1,056,000 fewer jobs than had been created in December 2018. The year-on-year slowdown in jobs creation has been significant and consistently from the year-on-year change from the December 2019 JOLTS report, when 1.666 million more new jobs had been created than had been created in December of 2018.

Advance US retail and food services sales for January (which is adjusted for seasonal variation and holiday and trading-day differences, but not for price changes) were $529.8 billion, an increase of 0.3% from the previous month, and 4.4% above January 2019. The next report is due St. Patrick’s Day. New orders for manufactured durable goods in January decreased $0.4 billion or 0.2 %, to $246.2 billion.

Other Macroeconomic Data Points

For December, the latest available data, the TSI printed at -0.4, down from November’s 0.1 and up from last year’s -0.8.

Debt service as a percentage of household debt is moving downward again. We were heartened that people are taking home more cash from the 2017 tax cut, so that debt service accounted for a lesser percentage of disposable income. Data for 2019 Q3 showed debt service as a percentage of disposable income at its lowest level, 9.6902%, since records started being kept 40 years ago. It ran over 13% prior to the Great Recession.

M-2 velocity dipped further in 2019 Q4. We would have liked to see the improvement in M-2 velocity that seemed to be on track in 2018. But while we are disheartened that it continues to fall, we note it is likely attributable to Fed easing. We would like to see the Fed stop paying interest on excess deposits to free up cash in the economy, which would boost M-2 velocity, a position we have advocated for some time. Instead, the Fed actually raised the excess deposit rate slightly. We note these other developments since our November jobs report:

- The wholesale trade report for December, reported this morning, showed sales down 0.7%, month-on-month, and up 0.8% year-on-year. Inventories were down 0.1%, month-on-month and up 0.5% from last year. The November inventory to sales ratio was 1.36, up from 1.34 last year.

- Building permits for January, released February 19th, were up 9.2% from December and up 17.9 from last year. Housing starts decreased 3.6%, month-to-month, but up 21.4% year-on-year.

- The ISM Manufacturing report for February, released Monday, showed growth at 50.1, down from 50.9 in January. The ISM Non-manufacturing report for February, released Wednesday, printed at 57.3, up from 55.5 in January.

- Personal Income & Outlays for January, released February 28th, showed disposable personal income up 0.6% in current dollars, and up 0.5% in chained 2012 dollars. Personal income in current dollars was also up 0.6% over last month.

- Personal consumption expenditures (PCE) for November was up 0.2% in current dollars. In chained 2012, PCE was up 0.1%.

- The IBD/TIPP Economic Optimism Index, at the end of February, declined 5.9 points, or 9.9% from from the end of January to 59.8, to 53.9. It is the biggest decline since October 2013. (Anything above 50 indicates growth.)

- Labor productivity in 2019 Q4 increased 1.4%, while average unit costs increased by the same percentage. Average hourly wage increased at 2.8% however, outstripping labor productivity by 100%. It may be that the Phillips Curve has been moribund but is not yet dead.

- Trimmed mean inflation for personal consumption expenditures, less food and energy, or “Real PCE” for the Dallas Fed is at 2.1%, year on year. The real PCE price deflator, reportedly the Fed’s preferred measure of inflation, printed at 1.6% for January.

Fed Actions

We think it was a mistake for the Fed to cut rates on Tuesday; it was reactionary and likely unsettled the markets. It will have little effect on fears so as to drive demand, although it may boost re-financings and home sales in the next quarter. Data received through May would have been a better decision data set, in our view, for the Fed to decide whether to cut rates.

We would like to see increased growth in Gross Domestic Investment, aside from inventory growth (i.e., in fixed investment) with growth in that component of GDP consistently under-performing the rest of the economy. The yield curve, which had been widening, is again narrowing to precariously low levels. We started 2018 with a spread of the 3-Month/10-year yield curve two of nearly 102 bps, just half the 200 or so bps that started 2017. We started 2019 just 24 bps apart; 2020 34 bps. As of today, March 6th, the 3-Month/10-year yield curve was separated by 29 bps, courtesy of the Fed rate cut.

While we agree with the Fed’s John Williams that “the yield curve is not a magic oracle” of predicting recession, we believe that the Fed’s tightening last year is far more likely to cause recession than President Trump’s tariff policy. (Milton Friedman’s Nobel Prize would seem to hold with that view, as he blamed the Great Depression on Fed policy far more than the Smoot-Hawley tariffs that have become veritable legend as conventional wisdom and four decades of propaganda promulgated in Paul Samuelson’s text in Econ 101 classes at America’s leading universities.) That said, not willing to ignore the “herd instinct” of ignorant investors who buy into the grand lie that “tariffs cause (or worsen) depressions”.

INVESTMENT THESIS

We expect 2020 Q1 GDP to print at 1.5 to 1.8 percent, down 30 bps on the lower end from last month’s jobs report. March will be weak; so will April in all likeliness. But we expect upside in May and June, so that 2020 Q2 will print around 2.0%, +/- 15 bps.

We advise investors to stand pat with their portfolios and to have a shopping list of high-quality companies. Traders should be looking at longer-term calls in quality stocks in anticipation of the COVID-19 virus concerns – if not the virus itself – ultimately burning out by around May. In equities, we’re inclined to mostly stand pat and hold with these sectors from our 2019 Q4 GDP report:

Outperform: Trucking and delivery services on speculation of consolidation and acquisition; consumer discretionaries and retail in the higher- and luxury-end segment; higher-end QSRs and casual dining; and REITs that own real estate in sectors identified as “opportunity zones” under the Tax Cut and Jobs Creation Act of 2017. We continue to believe CHF is a safe haven from domestic and geopolitical uncertainty, probably more so than gold.

Perform: Consumer discretionary and retail across middle-market and low-end sectors; consumer staples, energy, utilities, telecom, and materials and industrials; and healthcare; currencies of developing nations, such as INR; and the GBP and EUR

Underperform: Financials; the asset-light hospitality sector on speculation of declining GDP and the China Wuhan virus, especially lower end hospitality as US consumer confidence and lower fuel costs allows domestic travelers to “trade up” to the lower end of luxury brands (for example, lower-end Marriott (MAR) brands, like Fairfield, from a Choice Hotels (CHH) brand); airlines, again on Wuhan; and technology; lower-end, low-quality QSRs (e.g., McDonald’s (NYSE:MCD), Domino’s (NYSE:DPZ), Yum Brands (NYSE:YUM), etc.) on greater US delivery competition and Chinese location closings. We do, however, believe there may be buying opportunities in those sectors for “patient money”.

___________________________________________________

Note: Our commentaries most often tend to be event-driven. They are mostly written from a public policy, economic, or political/geopolitical perspective. Some are written from a management consulting perspective for companies that we believe to be under-performing and include strategies that we would recommend were the companies our clients. Others discuss new management strategies we believe will fail. This approach lends special value to contrarian investors to uncover potential opportunities in companies that are otherwise in a downturn. (Opinions with respect to such companies here, however, assume the company will not change). If you like our perspective, please consider following us by clicking the “Follow” link above.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The views expressed, including the outcome of future events, are the opinions of the firm and its management only as of today, March 6, 2020, and will not be revised for events after this document was submitted to Seeking Alpha editors for publication. Statements herein do not represent, and should not be considered to be, investment advice. You should not use this article for that purpose. This article includes forward looking statements as to future events that may or may not develop as the writer opines. Before making any investment decision you should consult your own investment, business, legal, tax, and financial advisers. We partner with principals of Technometrica on survey work in some elements of our business.

Be the first to comment