Nikada/iStock via Getty Images

I last wrote about Broadcom Inc. (NASDAQ:NASDAQ:AVGO) in April 2021, or 17 months ago. It’s been a pillar in my portfolio, generating an 18% return then and outperforming the overall market by 21%.

In my last article, I gave Broadcom a hold (neutral) rating, stating that:

The market knows about Broadcom’s growth potential, and its shares are currently valued accordingly. Nearly all of Broadcom’s valuation metrics are at all-time highs. PE ratio at 53.69. PS ratio at 7.64. PEG ratio at ~2.

Based on these metrics and a DCF analysis, I give Broadcom a neutral rating as I don’t see a good entry point at these valuations.

– Keyanoush, April, 30th, 2021

Broadcom has been a part of my low-volatility portfolio for over two years, and it’s done a fantastic job over this timeframe.

At the end of my article, even after anticipating the growth rates of the industries in which Broadcom operates, I was very cautious about giving it a positive rating because of heightened semiconductor risk and valuation.

Introduction & Thesis

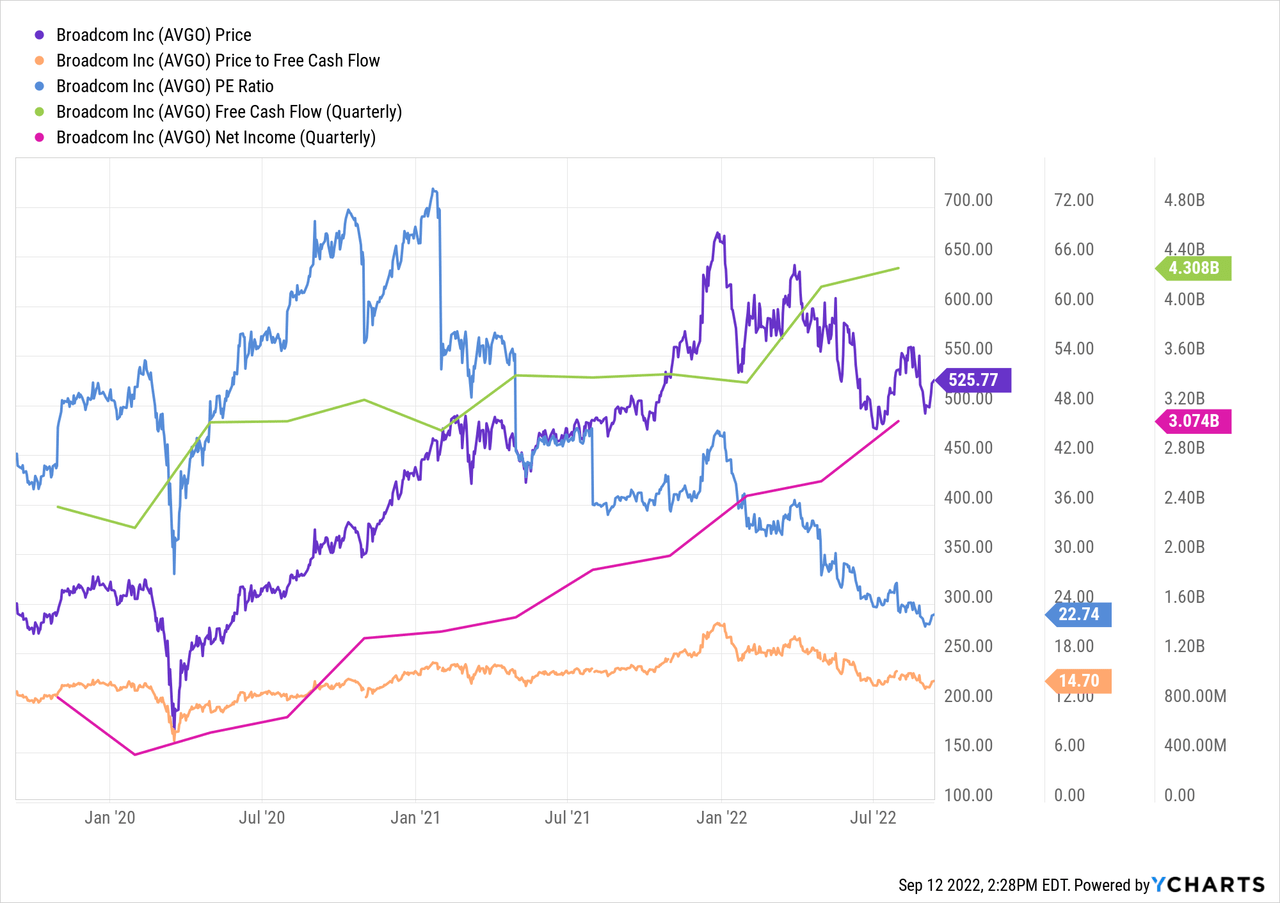

Broadcom’s business has been growing over the last 17 months. Earnings expansion pushed valuations down even though the company’s share price increased.

From December 2020 until now, Broadcom more than doubled its net income, which decreased its P/E ratio from 60 in 2020 to 23 now. Price to FCF (free cash flow) decreased from 14.21 to 12.8 over the same timeframe.

The broad semiconductor downturn affected Broadcom less than many other vendors in this sector. Last year, the maximum drawdown of the iShares Semiconductor ETF (SOXX) was 39%. Broadcom’s maximum drawdown over the same period was 28%.

Broadcom has an extensive product portfolio that is, to a large extent, not dependent on end-consumer demand. Its contracts with OEMs are, by design, non-cancellable, which means its backlog is not prone to large cancellations.

Hock Tan noted: “…our backlog and our terms are very clear. We do not allow cancellation on our backlog.”

Broadcom’s largest end-consumer customer is Apple (AAPL), whose iPhones are in the premium category, which wasn’t affected as much by dwindling demand as was the rest of the smartphone market. The premium smartphone segment seems more resilient to the market downturn and economic distress than the general smartphone market. IDC expects the premium segment even to continue growing. Q4 of 2022 is always a favorable quarter, with Christmas in front of the door and a new iPhone release.

I maintain a sizable position in Broadcom, but remain cautious with worldwide semiconductor momentum dwindling.

Semiconductor Market Downturn

The semiconductor market is cooling down. The macroeconomic environment reduced demand for luxury goods across the board. Some outliers include Samsung’s foldable phone lineup and the high-end smartphone segment.

Yet, the broader semiconductor industry is experiencing bloating inventory numbers and the general focus on improving working capital due to lower-than-expected consumer demand.

I discussed this topic in more detail when I wrote an analysis about Qorvo (QRVO) – Qorvo – Around The Sweet Spot – and about Skyworks (SWKS) – Skyworks Solutions: Cheap? Yes; Cheap Enough? Maybe

Global Foundries warned investors that they expect capacity utilization to fall in the year’s second half. Qorvo admitted that it wrongly estimated demand for wireless solutions in the smartphone segment, which led to impairment costs in its recent quarter. Skyworks’s situation has been better due to a constant demand from Apple, which makes up nearly 60% of Skyworks’ revenue.

We’re still in the early innings of the semiconductor market downturn. The effects are slowly transitioning throughout the industry and hitting different parts at different times.

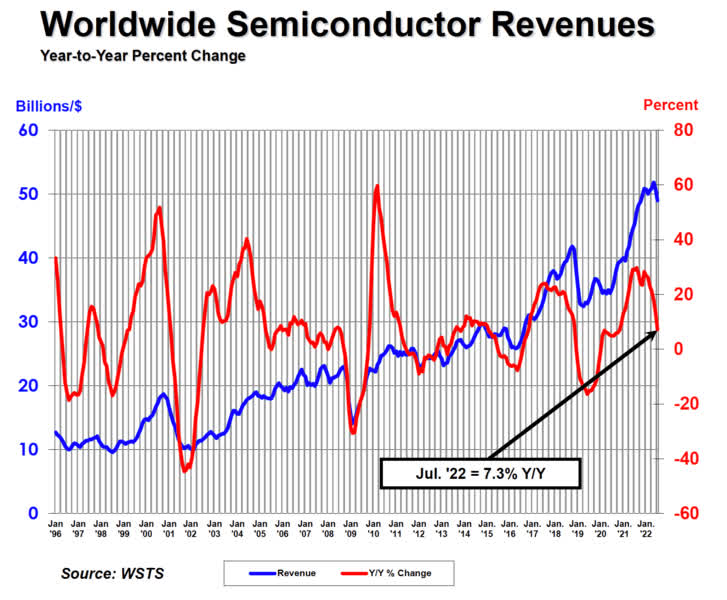

Worldwide Semiconductor Revenues (WSTS)

Broadcom has a slight edge due to its broad portfolio. While it experiences some customer concentration, Apple and Broadcom’s top five customers make up 20% and 35% of its revenue, respectively. Its product portfolio covers industries that are not tight to the end consumers, like data centers, enterprise solutions, the telecom market, and embedded networking applications.

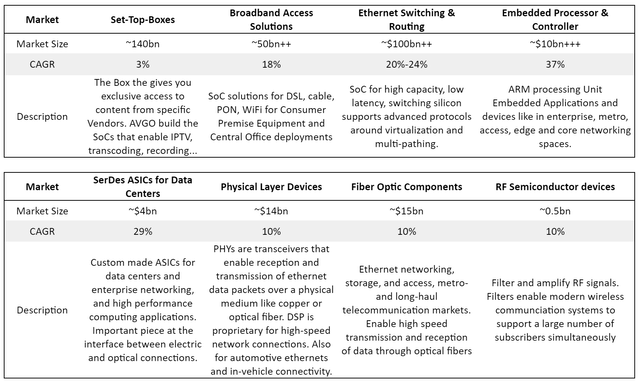

Keyanoush’s Compilation of Broadcom’s Market Segment (Broadcom Annual Report)

In the table above, you see the markets in which Broadcom operates. Except for the Set-Top Boxes segment, each segment has a growth rate greater than 10% over the next five years.

There will certainly be a slowdown in the growth rates of each segment through 2022 and 2023, but overall, Broadcom’s broad product portfolio looks promising.

Risks

Apple’s supply and licensing agreements with Broadcom end in 2023, and we’re facing some uncertainty about whether Apple is already able to produce its WiFi and Bluetooth chips in-house.

If so, we could see Broadcom’s Semiconductor segment take a hit. 20% of Broadcom’s revenue results from its supply and licensing agreements with Apple. Apple would rely more on Broadcom’s licenses and less on the supply of new chips. The transition will be interesting. I wouldn’t be surprised if Apple’s contribution to Broadcom’s revenue is cut in half.

The semiconductor super cycle comes to an end. Even though Broadcom’s backlog remains solid, I don’t expect this trend to be sustainable throughout 2023 when hyperscalers, OEMs, and telecom reduce their CAPEX.

VMWare Acquisition

VMware (VMW) is an excellent company in the virtualization space. I work in the telecom industry, where it continuously crosses my path. Major telecom providers use VMware virtualization offerings to build their virtual RAN platforms.

Yet, I observed uncertainty around this deal. VMware grows much slower than Broadcom’s semiconductor business, and its offerings deviate from Broadcom’s. Maybe a discussion within the comment section helps to bring light into the darkness.

Broadcom’s CEO has a track record of creating value from mergers. They have done so with LSI, Broadcom, Brocade, CA Tech, and recently Symantec.

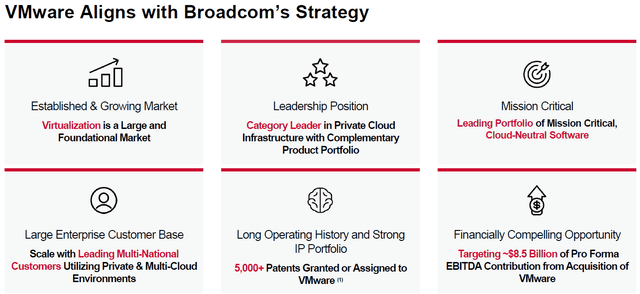

Broadcom VMware Synergies (Broadcom)

VMware has an EBITDA of $3bn, which is $5.5bn below the $8.5bn Pro Forma contribution Hock Tan showed to legitimize the merger. VMware’s total revenue is $10.7bn with $2.2bn COGS, $5bn in SG&A and $3bn in R&D expenses.

The most significant opportunity could be the Telcos, with whom Broadcom already has close ties. But even when we consider that Hock Tan can reduce SG&A realistically by half to $2.5bn, we’re still missing those extra $3bn.

Broadcom is not very transparent about how they would generate these synergies and in which area they lie. The uncertainty, as well as the amount of leverage and dilution Broadcom is adding, leads to a reduction in my rating.

Outlook

The short-term outlook is murky at best. As discussed previously, the semiconductor market is experiencing a downturn. Broadcom has been less affected, but I expect growth rates to fall in 2023.

Using this information and inserting them into a discounted cash flow (“DCF”) analysis can provide us with an outlook on Broadcom’s growth potential.

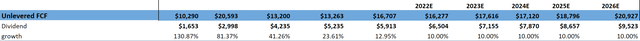

Broadcom just ended the third quarter, which has been pretty strong. For the year 2022, I used a growth rate of 16%, which puts Broadcom’s revenue at ~$32bn. For 2023, 2024, 2025, and 2026 I used 10%, 5%, 10%, and 10% as growth rates respectively.

Interest expenses are a slight worry of mine. With nearly $40bn in long-term debt, Broadcom is paying almost $2bn in interest. These are my rough unlevered FCF projection for the next 5 years.

Unlevered Free Cash Flow Broadcom – Projected until 2026 (Keyanoush)

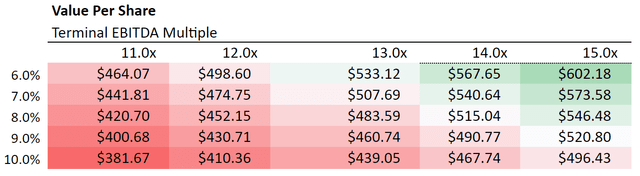

Inserting these numbers into our EBITDA multiple DCF analysis, we get the following projections.

DCF Analysis – Broadcom (Keyanoush)

With the growth rates, increase in working capital, and high-interest payments, the DCF analysis shows a relatively neutral outlook. The variance of this projection is wide. If Broadcom experiences a valuation expansion, the returns could be favorable.

Conclusion

Broadcom is a mixed bag. Broadcom sells its products across various industries, most of which are not directly tight to end consumer demand. This could’ve led to Broadcom’s outperformance against its peers.

The market downturn could have delayed effects on Broadcom. Broadcom is processing a >$60bn deal to buy VMware, providing little guidance for investors about its impact on margins and how VMware would be newly structured in the combined company.

Broadcom operates in many growth segments, and an area that I especially like is its custom silicon accelerators. Broadcom designs and manufactures ASICs for the data center and transport and routing segment. General computing is inherently inefficient in doing complex task-specific calculations. An ASIC does one type of calculation or process exceptionally efficiently, thus reducing power consumption and processing tasks much faster. Designing and manufacturing ASICs requires domain expertise within the area in which they are deployed, which creates dependencies on Broadcom.

Based on my DCF analysis and a murky industry outlook, I have a neutral stance on Broadcom’s stock performance. Broadcom remains a part of my low-volatility portfolio, as it’s a cash flow generating and dividend-paying company with a stable outlook.

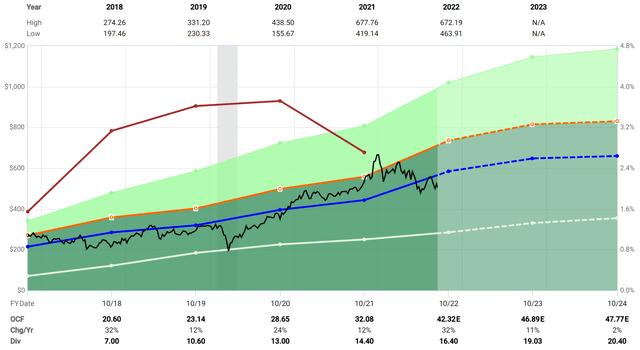

Broadcom Fastgraphs Historical (Fastgraphs)

Historically, Broadcom is trading right around its historical valuation. The margin of safety of investing in Broadcom at the current valuation and the macroeconomic environment is meager.

This article should only be regarded as the first step in your due diligence process.

I always welcome constructive criticism and open discussions. Please feel free to comment about my calculations and/or sources that I use in my articles.

Be the first to comment