Funtay

British American Tobacco (NYSE:BTI) has a neat dividend yield of 7.2%. While it’s not quite inflation beating as would be ideal, it comes close and that’s saying a lot in the current environment. Its share price has also risen some 6.5% year-on-year (YoY) at the time of writing, even while the S&P 500 has seen a 12.5% decline, likely because it’s a financially healthy defensive stock in an uncertain time. However, high inflation and low growth are now beginning to take their toll on BTI. This article looks at its recent performance in the context of the macroeconomy and particularly what it means for the company’s dividends. It then considers the company’s market valuations to assess whether its share price can continue to rise. Finally, it concludes that it’s best to hold the stock for now in light of the current difficult environment.

Can British American Tobacco thrive in a weak economy?

The three big challenges for the macroeconomy right now are low growth, high inflation and rising interest rates, which are all linked to each other of course, but their impact can be assessed distinctly for companies. In doing so, as in some of my previous articles, demand for the company’s products, its pricing power and its ability to pay for its obligations are analysed.

Demand steady, but expected to slow down

While the downside to BTI might be limited, it isn’t immune to fluctuations in revenue. Its revenues, as measured in its home currency, GBP, have declined YoY in five of the last ten years. In 2022 so far, however, its trends are encouraging. As per its latest half-year report (H1 2022), revenues showed a 5.7% rise YoY after declining by 0.8% in H1 2021. Notably, its non-combustibles segment is gaining ground, which is positive from a long-term perspective even while combustibles still account for 84% of the revenues.

However, for 2022, the company acknowledges that it’s subject to the current macroeconomic environment. This also reflects in an expected slowing down in revenue for the full-year 2022 to 2-4% revenue at constant currency rates, compared to the above 5% growth expectation it had pencilled in for the year before. While market exchange rate movements can make a difference to its headline revenue growth, it’s still clear that real growth is expected to slow down.

Earnings under pressure

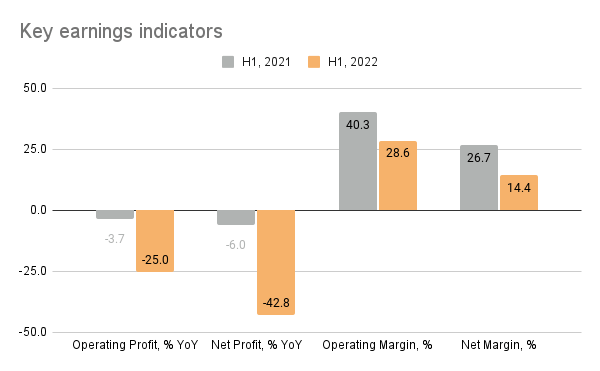

A demand slowdown might take longer to show up in its numbers, but BTI’s earnings are clearly under pressure as costs rise fast. Its operating costs showed a 26.5% YoY (H1 2021: 1.3%) rise, indicative of inflation’s impact on the company. This is visible in earnings, as operating earnings fell by 25% (H1 2021: -3.7%) while net earnings declined by an even bigger 43% (H1 2021: -6%). This also translates into a sharp decline in margins, with a fall in operating margin to 28.6% (H1 2021: 40.3%) as well and the net margin saw an over 12 percentage point fall to 14.4% from H1 2021.

Sources: British American Tobacco results, Financial Times, Author Estimates

Clearly, this means that BTI is struggling to pass on higher costs to consumers. This is a red flag and considering that it expects earnings per share (EPS) growth to come in at “Mid-single figure constant currency adjusted EPS growth”, which could well be a further slowing down from the 5.7% rise seen in adjusted diluted EPS at constant currency H1 2022. Its margins still don’t look too bad when looked at in isolation. But if earnings keep coming off, there could be risks to dividends because its dividend coverage ratio is already lower than comfortable, which I talk about in some more detail later.

Contained debt

Next, let’s look at its debt picture in light of the fast-paced interest rate hikes. A decline in earnings has impacted its interest coverage ratio, which is now down to 4.9x (H1 2021: 6.5x) despite a marginal fall in actual interest expense. It has not dropped to a critical level, but I would watch this number going by the recent earnings trends. Other debt indicators like its debt-to-equity ratio at 0.6x look good as does its current ratio at 0.9x, indicating that BTI is well positioned financially if the company were to come under stress.

What’s next for dividends?

The clear highlight from the three macro-health checks for BTI is the pressure on earnings. This is directly linked to its dividends. The company has increased its dividends each year for the past four years, an encouraging trend, but if we go back more in time, that’s not been the norm. It actually cut dividends each year for the four years to 2017. This suggests that if the situation gets worse, it could well slash them again.

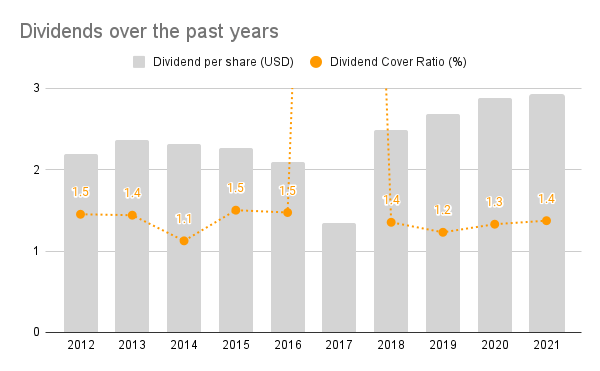

Its dividend coverage ratio based on the payout expected in the current financial year and consensus EPS estimates for 2022 is projected to be at 1.4x. Now, this is slightly lower than an ideal number of at least 1.5x, but some solace can be found in the fact that BTI has historically maintained a slightly lower ratio (see chart below). The only exception in the past 10 years has been 2017 when its acquisition of Reynolds temporarily resulted in a huge spike in EPS.

Sources: Seeking Alpha, Author Estimates

If its earnings come in as projected, this ratio won’t be a problem even now. But given the unpredictability of the current macroeconomic environment and the weakness in its profits, I wouldn’t put any bets on it. It’s worth noting that among different aspects of dividends like growth, yield and consistency, Seeking Alpha’s Dividend Scorecard rates BTI dividend safety the lowest, which further indicates the risk to its dividends.

The question of valuations

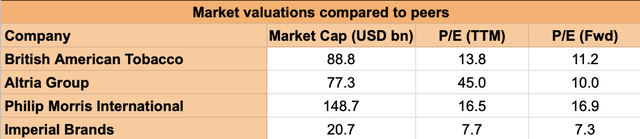

Yet, its price-to-earnings (P/E) ratio at 13.8x is lower than that for the S&P 500 at 19.1x and 21x for the consumer staples sector. This could indicate far more upside to the stock, but let’s not get too carried away. It isn’t too badly valued compared to other tobacco companies (see table below). In fact, its forward P/E is the highest among its peers at 11.2x, save Philip Morris International (PM). While defensives could continue to post some share price gains as the economy tanks further, the expected decline in both revenue and earnings growth for BTI in 2022 suggests that they will be muted. I’d also bear in mind that its share price has barely moved in the past three years and there is no particular reason for it to rise now. And if it happens to cut its dividends, it could in fact fall.

Conclusion

BTI is a financially strong company with relatively limited downside compared to cyclical stocks. However, it’s still vulnerable to inflation as evident from a double-digit rise in its operating costs recently. This has been a drag on its earnings, which is a big concern given its elevated dividend yield. An already lower than comfortable dividend coverage ratio at a time of reduced earnings growth implies a risk to passive earnings from the stock. If dividends do get cut, its share price could also take a hit after remaining unchanged over the past three years, making it a risky stock to buy. I’d hold for now.

Be the first to comment