ipopba/iStock via Getty Images

Investment summary

As investors look to construct portfolios in H2 FY22 valuations are indeed an integral component of asset selection and allocation. Whereas over the past two years investors were happy to pay exorbitant premiums on unprofitable names, the market picture is different in FY22. Value and quality strategies are agreeing with investors the most and hence, we advocate investors to search for an approximate 20% margin of safety to absorb another 20% decline in US earnings.

Alas, our posture on Bio-Techne Corporation (NASDAQ:TECH) shares is neutral as we see a dislocation in valuation to the downside. We see a lack of upside capture to harvest in the name and a wide breadth of valuation gives us less predictability over a price objective for the company. Despite two regulatory catalysts in the last two months, the risk/reward calculus is balanced in our view. In that vein, we rate TECH neutral.

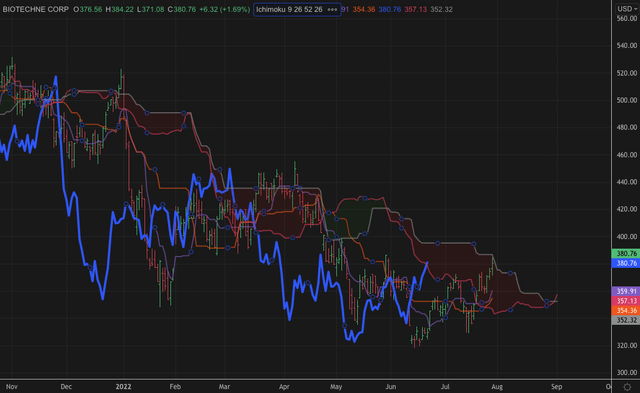

Exhibit 1. TECH 6-month price action

Catalysts to move the needle: Regulatory Momentum

In late June TECH announced it acquired Namocell. It is noted to be a provider single cell sorting and dispensing platforms. Single cell sorting is a method to sort a heterogeneous mixture of cells based on various cellular properties. Methods fall into two main categories, fluorescence activated cell sorting (“FACS”) and immunomagnetic cell sorting (“ICS”). Both are integral for workflow in clinical and bio-diagnostics.

However, both methodologies have their criticisms. There is potential stress to tissues, and each can be costly on operation as large cell populations are required to obtain accurate outcomes. Namocell’s instrument portfolio attempts to overcome these hurdles. We see evidence of this throughout the clinical literature. Findings from Petelski et al. (2021) demonstrated that its single-cell ProtEcomics protocol was superior in cost and automation capabilities when comparing FACS to other methods for peptide sequence identification, noting that “…single-cell dispenser, such as Namocell, might also be usable…” within isolating single cells within 1 hour 20 mins. Suppositions from Tejwani et al. (2021), Brem and co-authors (2020) and Marchant and colleagues (2021) also demonstrate the efficacy of Namocell in various, diverse applications. TECH expects the deal to close in FY23 and we’d be keeping a close eye on this to understand when it will begin to book income or realize synergies from this acquisition.

Following on from this, in July, TECH then advised the launch of its RNAscope ISH Probe High Risk HPV (“RIPH”). As a quick background, human papillomavirus (“HPV”) is a known major precursor of oropharyngeal squamous cell carcinoma (“OPSCC”). HPV is therefore a diagnostic tool for OPSCC. However, issues exist in misdiagnosis rates of HPV in OPSCC, with estimates ranging from 5% to as high as 20% using the conventional IHC test (identification of the E6/E7 mRNA strand).

TECH’s RIPH is designed to be a tool used in RNAscope ISH assays. RNAscope ISH has high validity and reliability “with more than 6,000 peer review publications” per TECH. Specifically, it is used for the qualitative detection of HPV E6/E7 mRNA in formalin-fixed paraffin-embedded (“FFPE”) tissues. As such, it aims to overcome the misdiagnosis shortcomings of the current standard of testing. The aim is to increase the accuracy of OPSCC diagnosis by reducing misdiagnosis rates of HPV within the condition. This is a potential long-term compounder especially as it challenges the current gold standard with data that holds up well. As such, we look to further updates for this catalyst in the upcoming earnings call.

Valuation

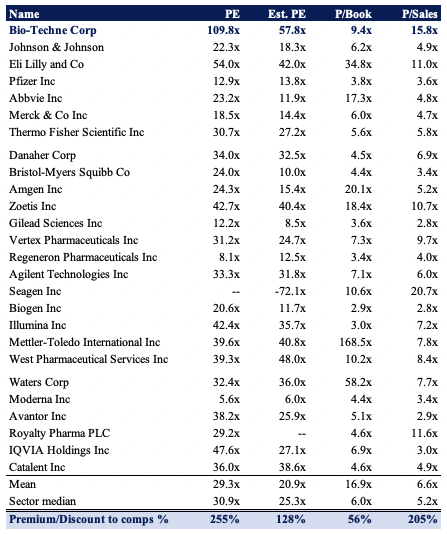

Shares are very richly priced at more than 109x P/E, although notably, are trading at ~58% forward P/E – 128% premium to the GICS peer median. This suggests the market is expecting an above-average earnings result from TECH in FY23 and beyond. Moreover, shares are richly valued at more than 9.5x book value and 16x sales. As seen in the chart below, TECH trades at a substantial premium across key multiples used in this analysis. The question is if this premium is warranted, against such a strong performing peer group. With comparable names trading at far more respective multiples, the case for relative valuation is weak for TECH.

Exhibit 2. Multiples and comps

Data: HB Insights

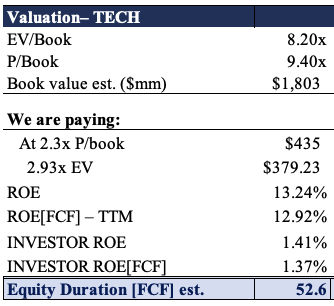

Moreover, the TECH share price appears to be converging towards its bottom-line fundamentals, as seen in the chart below. It has separated from long-term P/E values whilst converging towards tangible value (measured by FCF yield). With the stock trading at a premium, continued movement of this trend could see a positive re-rating. We look to upcoming earnings as further guidance on this.

Exhibit 3. Converging to the upside from bottom-line fundamentals. Further trends could see positive re-rating relative to the sector

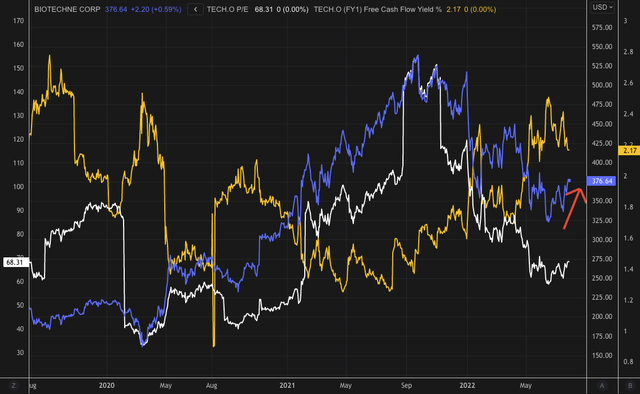

As value strategies are agreeing with investors this year, it’s in our best interest to gauge some kind of absolute value. As seen below, at 8.2x EV/book value we’d theoretically be paying $379, suggesting the stock could be fairly priced at the minute. We agree with this sentiment and note that TECH appears to be in ‘prove it’ territory with respect to valuation, with respect to the above and below charts.

Moreover, TECH’s FCF ROE comes in at a reasonable 13%. However, this is the company’s return on equity from FCF, not ours. We paid more than 8x the book value and hence our FCF ROE is only 1.37%, producing an equity duration of 52 – not attractive in the current climate.

Exhibit 4. Relative to equity value it appears as if we could be overpaying, or at least paying fair price

Data & Image: HB Insights Estimates

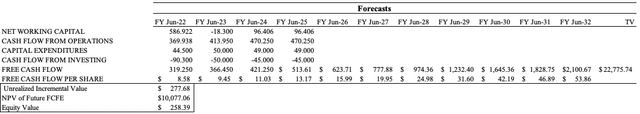

Further evidence of this dislocation in value to the downside is observed in the table below, summarizing our DCF output for TECH. On this, we see TECH fairly priced at $277. The breadth of ~$100 in valuation inputs in this series of estimations gives us less confidence around using the arithmetic mean of $328.

Exhibit 5. DCF summary

Technical studies

On a 9-month daily cloud chat, shares have pushed back up through the cloud and look to break through, as seen below. The lag line is also testing cloud support and if it were to break through, we could look to this as bullish confirmation as the near-term uptrend. It has tested this level before, back in May, however, didn’t have lag-line support and hence there appears to be more momentum behind this latest move.

Exhibit 7. 9-month cloud chart

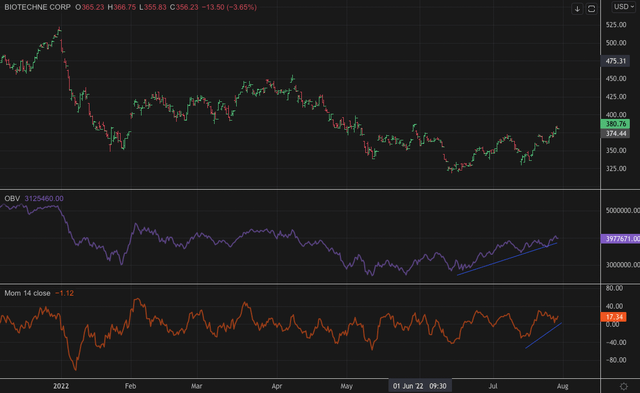

Further evidence of the near-term uptrend forming is seen on the chart below. On balance volume has ticked up since June, reversing a longer-term downtrend, and momentum has begun to curl up was well. Importantly we note the uptick in OBV preceded the stock price and this suggests there could be long-term buying support forming behind TECH. From our estimate, these chart setups are turning bullish and we look to further confirmation on each of the trend indicators to suggest there is weight behind a potential upside move.

Exhibit 8.

In short

Valuations are unsupportive for the risk/reward calculus in TECH’s case. Despite a series of regulatory catalysts over the past two months, the market has yet to price these in, suggesting these may need more time to play out. In spite of this, we are optimistic on both updates and believe there is interesting economics yet to be tied into its new HPV detection test. Should it move in as the standard of care, there is a deep and wide market opportunity on offer with a long-tail of asset returns.

On the valuation front, however, it appears as if the stock may be fairly priced and we’d be overpaying at ~8.2x EV/Book. Hence, we look to other names within the life sciences and tools universe.

Be the first to comment