Carl Court

Introduction

In this article I would like to share my long investment thesis on Airbnb and see how my story is playing out as the company is on its way to becoming a mature business. This is the third time I write about the stock after I shared my research in these two articles:

- This Is What Costco And Target Told Us About Booking And Airbnb

- Airbnb: When Growth, Low Debt And Profitability Walk Hand In Hand

Airbnb (NASDAQ:ABNB) is a stock that catches a lot of attention and makes people debate a bit about its valuation. I have seen this also on Seeking Alpha when I read how people comment articles on this company. As a matter of fact, it is one of these stocks where investors sometimes happen to be also fans of the company, while others just keep away from it because they either don’t like the business or have had unpleasant experiences using the platform.

I admit that before investing in Airbnb I was already using the platform and I was really enjoying it. I didn’t take part in the IPO as I saw the price skyrocket in an uncertain environment. To give further disclosure, this year I started picking up some shares as the stock traded down in the $150-$130 range. I then averaged down at a stock price of $105.

Most of my investing efforts go to building a dividend growth portfolio. However, I do like to allocate a small part of my savings into a growth portfolio where I pick companies that I expect to grow rapidly and profitably in the next 5-10 years.

Criteria for my growth investment

These are the criteria I have followed so far when picking those few stocks for my growth portfolio.

- The companies have to be ones I have experience with. I put this in the first place because too many a time, investors get excited about the “next Tesla” or the next disruptive healthcare company, without having the possibility to give a valuation of the product or the service the company offers.

- The companies have to have something unique about their business.

- They need to be profitable or on the verge of becoming such in no more than a year from my initial investment. When I look at profitability I consider: gross profit margin, EBITDA margin, ROCE and net income per employee. Besides profitability, the balance sheet needs to be healthy.

- They have ample room to grow either creating a new market or grabbing significant shares from the market leaders.

- The valuation metrics such as PE, EV/EBITDA and price/cash flow can be high at the moment of the investment. However, I try to project the share price 10 years ahead to get an idea of possible exit multiples.

Why I chose Airbnb

Regarding these criteria, here is how Airbnb checks them.

- I have been a user of Airbnb since 2019. I was particularly impressed by the fact that some hosts actually rented their home while they were away on vacation, using my rent to fund their holiday. During the pandemic, I actually used Airbnb more since it gave me the opportunity to travel to many places around my home where there are no hotels.

- Airbnb’s uniqueness is that it is not only a platform, but it is a community of hosts and guests where guests often become hosts. This is the reason why the company has reported more than once that it grew thanks to word of mouth more than marketing. Furthermore, its 4 million host community is now somewhat of a moat that prevents other platforms from entering disruptively into this market. Finally, although Airbnb faces some competition from Booking and Expedia, it is a brand that is strictly perceived as the go-to place to find a rental home pretty much anywhere.

- Up until last year, Airbnb wasn’t yet profitable. However, after Airbnb released Q1 results with a net loss of only $19 million and more than 100 million nights and experiences booked, I felt it was the right time to initiate a position as this year will be the first one ever where Airbnb earns money. Airbnb has now achieved gross profit margin of 82%, with an EBITDA margin of 18% which are grade by Seeking Alpha’s Quant ratings respectively with an A+ and an A-. The return on capital employed is 12%. Compared to Booking, Airbnb is a bit behind in these metrics. However, when we look at net income per employee, Airbnb has an outstanding 204k vs. Booking’s 79k. Airbnb is a bit less profitable than Booking, but it has a lighter structure than Booking and can thus enjoy better employee profitability. Finally, Airbnb’s balance sheet is very healthy, with $10 billion in cash and only $2.4 billion in debt. Given the fact that Airbnb is a capital light business with very low capex, the company has a balance sheet that will support it through any economic environment.

- Airbnb was the first one among the three industry leaders to recover and beat 2019 results. According to the recent McKinsey US Summer Travel Survey the travel industry seems to be more resilient than others as inflations eats away a part of consumers’ spending power. On the other side, even in case of a recession, Airbnb expects more people to turn to hosting and travelers to become more budget conscious. These two factors would benefit Airbnb more than Booking and Expedia. Moreover, thanks to its hosts, Airbnb is able to provide the chance to visit unique places where no hotels are.

- Airbnb trades at a fwd PE of 39, an EV/EBITDA of 24 and a fwd price/cash flow of 28. These metrics are, indeed, high, especially in a bear market that seems to keep on going on. However, the general consensus forecasts the company to reach around $23 billion in revenue by 2031, with EPS projected to be at $11. Now, if we add to this that Airbnb just announced a $2 billion buyback program and we can reasonably consider that Airbnb will execute share repurchases in the next decade supporting an EPS increase. Thus, the stock currently trades at a fwd 2031 PE of 10 and a fwd 2031 EV/EBITDA of 13 considering that Airbnb will reach an EBITDA of at least $5 billion.

Outlook

So far Airbnb has delivered impressive growth YoY. However, it has been pointed out by many that starting from the recent Q2 we see a YoY growth coming down to 27% in terms of gross booking value. The company is starting to lap over tougher comparables, since the big travel rebound started in Q2 2021 and was very strong in Q3 2021. Furthermore, Airbnb is clearly very exposed to Europe where around a third of its revenue comes from. Currently, the situation in Europe is becoming tougher as energy prices are out of control and worry many consumers as they prepare to pay astronomical bills in the winter. In addition, Airbnb has recently pulled out from China and is still suffering from the fact that Chinese travelers are still blocked by the recent Chinese lockdowns.

However, these headwinds the company is facing could help the company publish strong results in the next 1-2 years in case China will reduce its zero-Covid policy and the situation in Europe will become clearer. According to the US Travel Association, the US Travel Forecast shows that, although recovering, the travel industry is still behind its 2019 levels and that it will be in recovery mode until 2025.

Airbnb, however, doesn’t rely only on tourists. As it reported in its Q2 earnings report, long-term stays of 28 days or more remain its fastest-growing category by trip length compared to 2019. Long-term stays increased nearly 25% from a year ago and by almost 90% from Q2 2019. This proves that the company has been quick at picking up a trend that is linked to smart working and digital working.

In summary, although we may face a few quarters of slower growth, the company could then recover quickly to faster growth.

Valuation

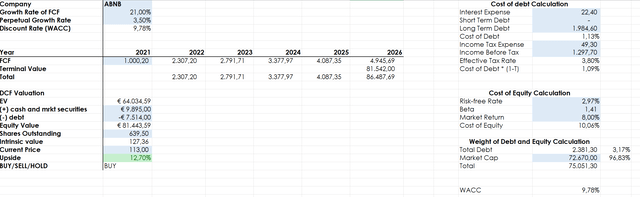

This is the discounted cash flow model I used to make my forecast and my valuation of Airbnb. Based on this model and on the reasons I shared I decided to start a position in the stock. As the model shows, I used the financials from the twelve trailing months except for the free cash flow data for FY2021. I am expecting that, after this year, the company will grow its FCF at a rate above 20%. I am confident Airbnb can do this because it is asset light and it can thus convert into profit mode very quickly. The result I get is that, at the moment, Airbnb has a 12% upside to reach its fair value.

Author with data from Seeking Alpha

Every model is, in fact, a model and things may go a way that wasn’t predicted. However, a model is not also able to distinguish between premium brand value and not. I do believe Airbnb, as I tried to show, has a quality business model that deserves a premium. This is why I reiterate my buy rating and I am indeed planning on adding on any future weakness.

Be the first to comment