thamerpic/iStock Editorial via Getty Images

We recently published a Q4 and FY update on Zurich Insurance Group (OTCQX:ZURVY). The company performed a quarter in line with our internal estimates and therefore, we confirmed our neutral rating. Since then, Zurich’s stock price performance has been pretty resilient.

Today, we are updating our estimates that feed our internal model and we provide some information on Zurich Russia’s exposure.

No Russia Exposure

To be very brief, we have done some due diligence across the latest Zurich Annual reports and Russia has been named zero times. What we have found is that Zurich has decided to remove its Z logo from social media after the letter became a symbol of Russian support following Moscow’s invasion of Ukraine.

“We are temporarily removing the use of the letter ‘Z’ from social channels where it appears in isolation and could be misinterpreted,” the company told Reuters in a statement.

A spokesperson for the Swiss insurer told InsuranceERM that they had “stopped underwriting new business in Russia and are not renewing policies from existing domestic customers in Russia”. Adding that Zurich has “a very limited property and casualty exposure to Russia and Ukraine” and the exposure to Russia through Zurich’s investment portfolio “is very low“.

Updating our estimates

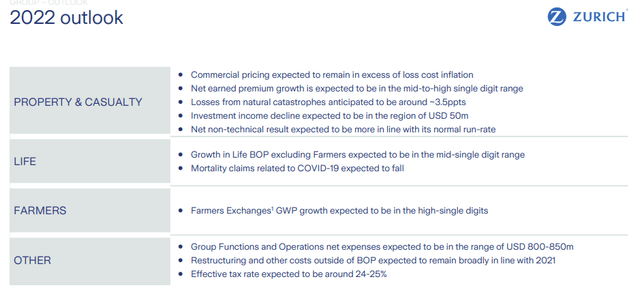

Our internal team has increased 2022 and 2023 forecast estimates. Why?

- We believe that the company will experience a better bottom-line margin.

- More precisely the property and casualty division will improve, benefiting from a lower combined ratio mainly thanks to pricing power.

- Very similar to what was stated in point 2) the Farmers division is very well positioned to benefit from inflationary increase with limited potential claims risks. Due to macroeconomic events, we are overweighting US exposure. Top management is confident to achieve high single-digit in the division thanks to rate increases as well as MetLife’s latest acquisition.

- Zurich has again strengthened its capital reserves. The solvency ratio stood at 212% in the latest report which is well above the regulatory requirements. We need to highlight the company’s ability to build an additional reserve to navigate uncertain times and black swan events that, unfortunately, are happening more often than what we are used to. The solvency ratio is not incorporating the positive benefit of the Italian sales life business.

- Safe haven currency.

- As already mentioned, despite being a European insurer, the company has no exposure in Russia and in Ukraine.

Conclusion

Having said that, our internal team believes that Zurich is currently quite attractive. Looking at the P/E ratio we believe that now the company is trading at some discount versus European peers. Inflation pressure will support rate increases and this will favour Zurich’s businesses. We derived a target price based on a sustainable ROE across the cycle. After that, we discount Zurich’s capital generation and we calculate the excess capital to derive our valuation. We value Zurich at 475 Swiss francs per share.

We previously provided a 10-year analysis on Zurich and we done some substantial coverage on European insurers:

Be the first to comment