Galeanu Mihai

Investment Thesis

Zscaler (NASDAQ:ZS), the network infrastructure solution will be one of the last cybersecurity firms to announce its fiscal Q4 results, in September.

Palo Alto Networks (PANW) reported last week, and investors at the time welcomed their results. While CrowdStrike (CRWD) will report later tonight when I suspect we’ll see fireworks on the upside, as investors welcome their results too.

Zscaler is clearly one of the leading cybersecurity companies and any serious investor with a well-diversified portfolio would do well to pick up this name, as Zscaler continues to execute well against a challenging backdrop, particularly as its share price is down more than 50% from its previous highs.

On the other hand, for investors that are running a slightly more concentrated portfolio, I believe that although the stock is a lot cheaper than this time last year, the valuation isn’t ”jaw-droppingly” cheap.

Hence, altogether, I rate this stock as a tepid buy.

Revenue Growth Rates Will Probably Hit 60% in Q4 2022, But What’s Next?

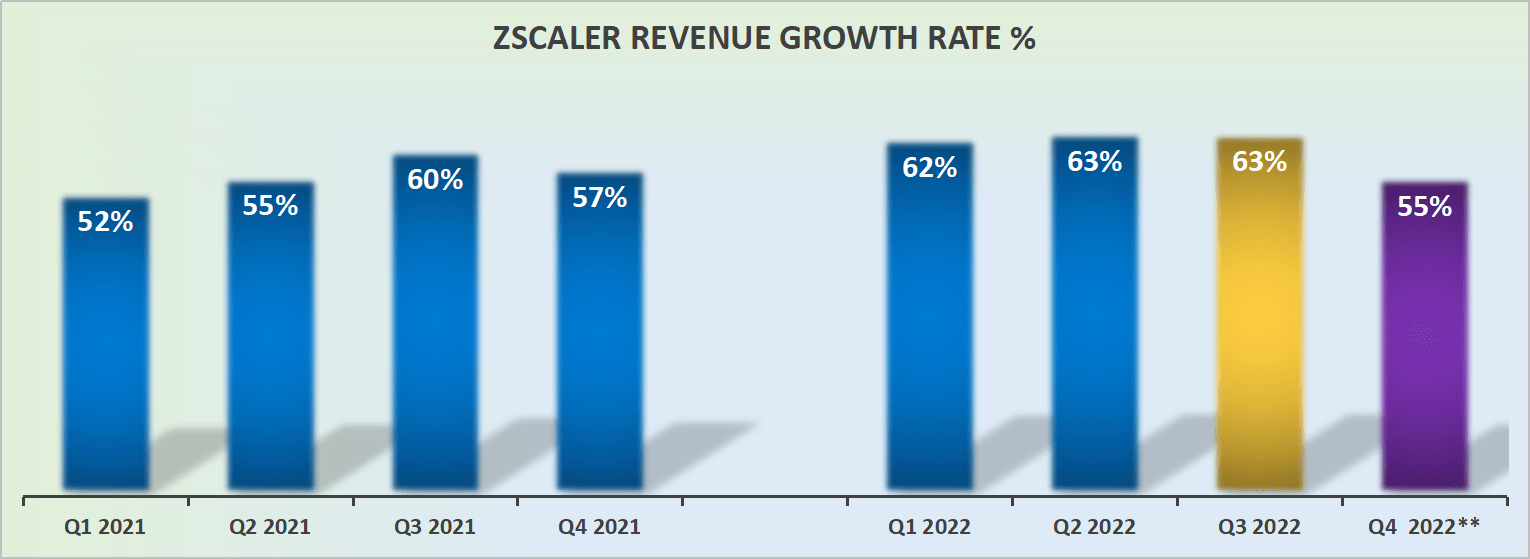

ZS revenue growth rates

We are now just days away from Zscaler’s reported fiscal Q4 2022 results. And given all that’s happening globally, investors will be laser-focused on management’s commentary around their confidence for the fiscal year ahead.

Lucky for Zscaler, its results will be behind CrowdStrike’s, so its earnings report will have removed a lot of the sting out of its guidance if investors don’t see Zscaler’s guidance pointing to north of 35% CAGR for the fiscal year ahead.

Nonetheless, ideally, investors will really need to see Zscaler’s guidance coming in at higher than 40% CAGR for fiscal 2023. And even then, that would be a 20% deceleration from fiscal 2022, so investors will be on their toes and asking tough questions about their investment. That’s something that you don’t want.

Why Zscaler? What to Think About?

The market has been really bifurcated of late. Investors have been clamoring to return to high-quality growth names, only to have to withstand unrelenting, indiscriminate, and dispassionate sell-offs. Simply put, we are facing all the trademarks of a bear market.

Indeed, this is really what defines a market. Still, bear markets are a healthy part of any market. We need bear markets to remove the hubris that comes from the bull markets. Without a properly functioning market, investing becomes an impossible task. Thus, repeat after me:

We need bear markets. Bear markets are good!

Indeed, during bull markets, many companies build their whole business model on growth at any cost and a strong PR campaign, with no realistic path to profitability in mind. Yes, SentinelOne (S), I am talking about you.

Moving on, Zscaler is a network solution provider. Zscaler allows users to securely access externally managed applications. It’s very well positioned to embrace several tailwinds coming together, from cloud shift, and mobility, not to mention rising threats and the rise of IoT.

What’s more, as more and more enterprises have to protect their data as employees work from anywhere, across a multi-cloud environment the need for a zero-trust cloud platform that works at scale becomes very rapidly evident. On this front, Zscaler is well positioned.

What’s more, as I’ve been making the case for a while, we are about to face a weakening macro environment, and investors should preferably seek out companies that are well positioned to withstand a recession.

It’s no longer good enough to simply think of the best revenue growth story, without thinking through the underlying constituents of that revenue line.

Along these lines, as you can see below, we see that Zscaler is finding strong customer traction. Indeed, I’ve made the argument many times that investors seeking high-quality companies, should turn their focus to companies’ customers’ adoption curves, which for Zscaler was up 77% for customers on $1 million of ARR.

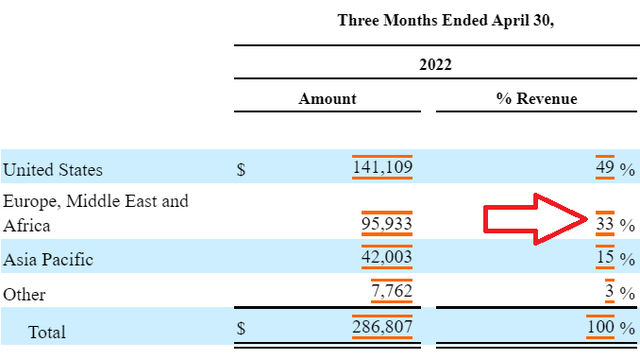

ZS Q3 2022 10-Q

But what’s particularly noteworthy about Zscaler is that practically 50% of its revenues come from the US.

Right now, with all the trials and tribulations that European economies are facing, you want minimal exposure to European markets. With that in mind, having just a third of revenues spread between Europe, Middle East, and Africa, supports the bull case for Zscaler.

ZS Stock Valuation — 16x Forward Sales

Zscaler is priced at 16x forward sales. This is not the cheapest cybersecurity company out there. But it’s also far from the most expensive. Palo Alto Networks (PANW) and Fortinet (FTNT) both are roughly priced at 8x sales.

On the other side of the spectrum, as a reference point, CrowdStrike, which reports earnings after hours tonight is priced at approximately 17x next year’s revenues.

Meanwhile, SentinelOne lies somewhere in between at approximately 12x next year’s revenues.

Of course, most of these companies don’t report a clean GAAP profit, particularly the faster-growing cybersecurity companies.

Yet on the other hand, I don’t believe that the market is unduly concerned about these companies’ elevated stock-based compensation. For now, everyone is viewing these pesky costs as non-GAAP, non-cash, and non-important.

The Bottom Line

One thing we can be sure about is that demand for cybersecurity will only go up over time. Yet, at the same time, the multiples that investors are willing to pay have certainly come down in the past year.

Consequently, I believe that this offers investors a positive risk reward. You have a rapidly growing company, with superior technology, a strong presence in 40% of the fortune 500 companies, at a valuation that’s more attractive than it’s been for a while. Hence, I assert this stock with a tepid buy rating.

Be the first to comment