pixelfit/E+ via Getty Images

Investors are starting to turn on their risk engines again and prepare for a rebound. After several months of painful declines, especially in small/mid-cap growth stocks, the market seems to finally be letting go of macro pressures like the Russia/Ukraine war and rising interest rates, and return focus back to individual stocks and fundamentals.

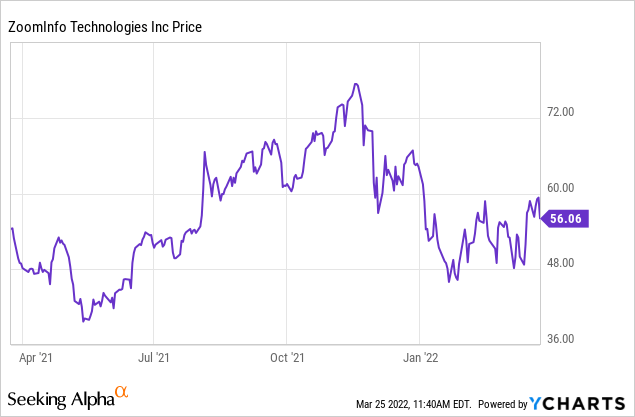

Among high-growth tech stocks, ZoomInfo Technologies Inc. (NASDAQ:ZI) stands out as one that hasn’t seen a massive correction. Year to date, shares of ZoomInfo are down only ~9% – despite the fact that many of its peers, especially those that used to trade as at rich of a valuation as ZoomInfo does now – have lost close to half their value. In my view, there’s nothing specific to ZoomInfo that should afford it this relative outperformance.

As we get closer to a full-on rebound, my portfolio focus is on scooping up high-quality growth names that are now trading at substantial discounts to their prior peaks. On ZoomInfo, which has passed through this period relatively unscathed, I remain stoutly bearish.

There are several large hesitations I have that form that recommendation:

- Lack of unique technology. To put it in a nutshell, ZoomInfo isn’t rocket science. ZoomInfo is a sort of “digital yellow pages” in which salespeople can source and contact leads. The company’s biggest proprietary asset is its database of contacts, which in some cases it pulls from its own customers (it offers companies a discounted subscription rate if they also provide contacts from their own company to be added to the database to be cold-called). ZoomInfo competes with a number of other lead-gen platforms (LinkedIn, actually, is a notable one) as well as general CRMs like Salesforce.com (CRM).

- M&A-assisted growth. Do ZoomInfo’s growth rates look astounding? Sure, they do. But we note as well that ZoomInfo is starting to pivot into the classic software playbook of buying up companies to bolster growth. ZoomInfo’s September acquisition of RingLead, in part, is what allowed the company to generate ~60% y/y growth in Q4.

- Can ZoomInfo’s growth pace scale? For next year, ZoomInfo is guiding to roughly ~35% y/y revenue growth, which is far less than its current pace. Will the company’s premium valuation multiples hold then, when growth has slowed to a much lower pace? Again, once M&A tailwinds fade, ZoomInfo’s growth may not look so impressive.

- Debt load. ZoomInfo is already in a fairly deep net debt position, unlike many other SaaS stocks – hence, its firepower to buy up new companies is going to be limited.

- Valuation. ZoomInfo’s valuation is already incredibly rich; and doesn’t leave much room for upside when many fellow high-quality growth stocks are currently on sale.

More details on the point above: at current share prices near $56, ZoomInfo trades at a market cap of $22.63 billion. After netting off the $326.7 million of cash and $1.23 billion of debt on ZoomInfo’s most recent balance sheet (a $906.2 million net debt position), the company’s resulting enterprise value is $23.54 billion.

Meanwhile, for the upcoming fiscal year, ZoomInfo has guided to $1.01-$1.02 billion in revenue, which as previously mentioned implies 35-36% y/y growth:

ZoomInfo outlook (ZoomInfo Q4 earnings deck)

This puts the company’s resulting valuation at 23.2x EV/FY22 revenue – a price at which I can confidently say, there are far better bargains to be had in today’s market.

Some far better alternatives I’m favoring, which were once Wall Street favorites and have since been cut down to much smaller valuations: Docusign (DOCU), Coupa (COUP), C3.ai (AI), Zoom (ZM), and Roku (ROKU) are all much better buys right now.

But the bottom line for ZoomInfo: I don’t see the sense in paying a ~23x forward revenue multiple for a stock whose growth is tipped to fade once acquisition tailwinds are in the rearview mirror, and whose product competes with a plethora of much deeper-pocketed rivals. Steer clear here.

Q4 download

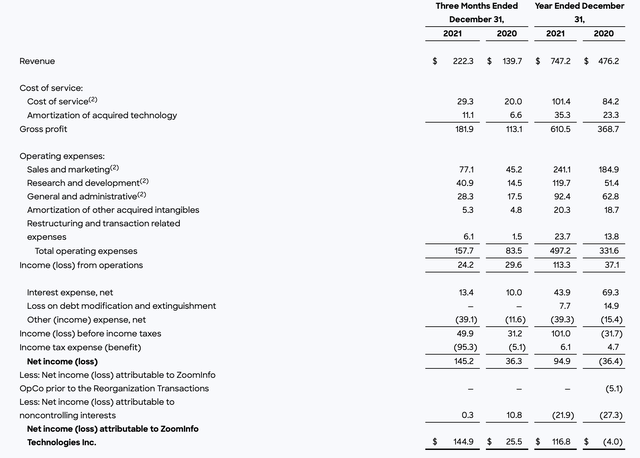

Let’s now discuss ZoomInfo’s most recent quarterly results in greater detail. The Q4 earnings summary is shown below:

ZoomInfo Q4 earnings results (ZoomInfo Q4 earnings release)

ZoomInfo’s revenue in Q4 grew 59% y/y to $222.3 million, beating Wall Street’s expectations of $207.7 million (+49% y/y) by a ten-point margin. Growth largely tracked in-line with Q3’s 60% y/y growth pace.

However, note the contribution from acquisitions here. ZoomInfo closed on its acquisition of RingLead just in the month of September (and in July, the company had purchased another company, Chorus.ai; the combined cost of both of these acquisitions was $665 million), so Q4 actually included a full quarter of RingLead contribution versus a partial contribution in Q3.

Here’s some commentary from CEO Henry Schuck’s prepared remarks on the Q4 earnings call, detailing the performance of these recent acquisitions:

We enabled more reps to sell the Chorus solution and accelerated investments in artificial intelligence, transcription, scalability and platform integration to innovate faster than the rest of the market. We believe our accelerating growth rates on Chorus to make us the fastest-growing conversation intelligence provider in the market. Another testament to the power of our go-to-market motion is demonstrated through RingLead, where in Q4 we’ve added more than 2x the amount of ACV than it did independently in Q3.

We have consistently proven our ability to acquire well, integrate quickly, innovate on top of and accelerate the growth rates of the technologies that we acquire. As we exited 2021, international revenue eclipsed a run rate of $100 million and for the year international revenue was up 91%. As Cameron will detail, we expect our momentum across all of these initiatives to continue into 2022 with our initial guidance for the year calling for revenue growth of 36% and over $425 million in unlevered free cash flow.”

ZoomInfo reports that without the benefit of companies acquired over the past year, organic growth stacked up to 52% y/y. The company also does continue to organically grow its core platform; in February, it launched “RevOS”, a new go-to-market software platform that provides data visibility to sales, operations, marketing, and even recruiting teams.

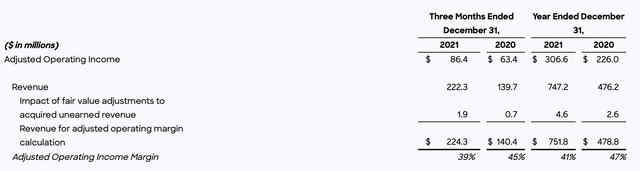

Now, from a profitability perspective, we do admit that ZoomInfo does stand out versus other SaaS names, even if its primary operating margin metrics come with a lot non-standard addbacks with respect to its acquisitions.

ZoomInfo’s adjusted operating margins in Q4 hit $224.3 million, growing 60% y/y. We note, however, that adjusted operating margins fell by six points to 39% in the quarter.

ZoomInfo adjusted operating margins (ZoomInfo Q4 earnings release)

We do note that on a full-year basis in FY21, ZoomInfo did manage to generate positive GAAP net income of $116.8 million (versus roughly breakeven in FY20). But with fully-diluted GAAP EPS of $0.43 for the year, it’s still too early to be able to justify ZoomInfo’s share price based on the bottom line alone.

Key takeaways

ZoomInfo has long carried a hefty valuation premium that is difficult to justify, and it’s quite a surprise that the company has largely managed to retain its share price amid volatility for other growth stocks this year. Given the expectation of decelerating organic growth and the sizable debt load on ZoomInfo’s existing balance sheet which will cap its ability to freely pursue M&A going forward, I recommend staying on the sidelines here and waiting for ZoomInfo’s enormous premiums to come down before buying.

Be the first to comment