Kunakorn Rassadornyindee/iStock via Getty Images

The analysis from other contributors regarding Zoom (NASDAQ:NASDAQ:ZM) has mostly been from the financial perspective. But the financial perspective doesn’t always tell how the business is directed, especially when the industry is fast paced, as it is backward rather than forward looking.

In Zoom’s case, it appears to be that Microsoft (MSFT) has the dominant advantage and Zoom’s chances of further grow are slim. Maybe in a better economic environment it could be acquired by an aspiring competitor, but on a standalone basis it appears it will likely be headed for difficult times. I support this assertion with the following observations:

- The user perspective: What’s lacking from the financial perspective is the user’s perspective. From a corporate user’s perspective, Microsoft Teams is good for not just holding meetings, but also creating collaborative workgroups, sharing files etc., in other words, everything needed to work collaboratively to solve a work problem. As Microsoft Team’s tagline goes (paraphrased) “Meetings are just another tool” (I’m not sure if the MS team had a competitor in mind when they came up with this motto) but it’s definitely quite valid. Zoom also has collaborative functions etc but from the user’s perspective it feels the Microsoft Teams works more seamlessly with the other Microsoft tools. Even if you don’t agree with this assertion, the quality of both services is at least largely equal, without much of an edge to Zoom (if any).

- Microsoft is in a must-win battle and the tech is not rocket science:

- The work arena solutions is integral to Microsoft, so Microsoft is not going to cede ground on it. If Microsoft loses the video conferencing arena, then that could lead to a domino effect (cloud services etc), so naturally Microsoft will fight tooth and nail.

- The tech is not rocket science: Apparently it wasn’t too hard for Microsoft to launch and grow Teams to 270 million monthly active users. As the tech is not too hard, Zoom cannot rely on tech as a moat.

- User stickiness is low but organizational stickiness is high:

- By low user stickiness, I mean the average user can send a conference call link in Zoom, Cisco Webex, Teams, whatever suits the situation. Send a few links using any platform and you’ll be used to using it. There is very little user stickiness. More importantly, many users (especially those working at slightly bigger corporates) don’t get to choose their preferred app – the organization they work at does the choosing for them.

- Organization stickiness is high as customer captivity and switching costs are high, because large companies are IT-risk conscious nowadays, which means it is a pain to get approval for each new app to install on all computers. It’s much easier to just rely on a trusted large brand and get approval for a new service from Microsoft (hey, it’s Microsoft after all, and if it doesn’t work, don’t blame me!) than go through the hassle of getting approval for one app just for video conferencing (not to mention the extra personal career risk from recommending these non-big player suppliers, one security breach from a non-big player supplier and that guy who recommended it would be getting a lot of “I told you so” from the entire organization).

- This might be what Charlie Munger calls the “institutional imperative”, however given the fact that the main videoconferencing apps are not that far apart from each other in terms of quality, the institutional imperative will take over when it comes to deciding which provider to choose.

- Network externalities: Microsoft also has network externalities working for it.

- A big corporate uses Microsoft teams and then the meeting invites it sends to its customers/vendors will also be using Microsoft Teams. So after a while, even smaller companies get used to using Microsoft Teams so they can do business with larger companies. This “viral” form of spread is very beneficial to Microsoft but makes life harder for Zoom.

- Large organizations often choose different video conferencing vendors for different reasons, for example some very large corporations might not be able to open a Zoom link because their security department blacklisted it. Eventually everyone will just literally meet at what’s workable for everyone and I foresee that will be Microsoft (or Cisco etc). If some organization doesn’t use Microsoft Teams, it’ll end up getting complaints from its customers/vendors about what they think is wrong with Microsoft Teams that they can’t use it when just about everybody does? Hard for an IT security department to argue with that!

I want to make it extra clear that I am not being negative about the Zoom product or company. I used it and was quite fascinated with how well it worked at the start of the Coronavirus pandemic. While we all love to root for the little guy, however, in this case, the economics are heavily stacked against it and it is likely Microsoft will dominate this niche.

The above is just user experience and observations. Next let’s see how the numbers stack up.

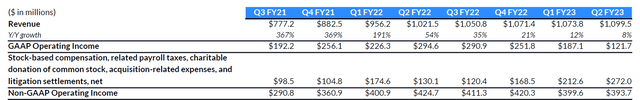

Flatlined revenues over 5 quarters: Zoom’s revenues have flatlined in the past 5 quarters as shown below. Now I can give a growth stock (priced at 6X sales) the benefit of doubt if it’s had a rough quarter or two. But this is 5 consecutive quarters! GAAP operating income has plummeted in those 5 quarters, though Non-GAAP operating income is only slightly down (difference between GAAP and non-GAAP is mainly due to higher share based payment costs).

Zoom Quarterly revenue, GAAP and non-GAAP operating income

Zoom quarterly revenue, GAAP and nonGAAP income (zoom investor presentation)

Source: Zoom investor presentation

Note that Zoom has a January year-end, so Q2 FY23 ended in July-22 and Q4-FY22 ended in Jan-22.

So how has Zoom’s nemesis fared in the same period? We can’t really see revenue but we can compare user numbers. Though Microsoft Team’s monthly active users is not an apples to apples comparison with Zoom’s customers > 10 employees, it’s the only metric we have, and it’s probably indicative enough of the overall trend. Since Sep-20 Microsoft Teams’ metric has grown faster than Zoom, especially during 2021, where Microsoft almost doubled its users from Mar-21 to Dec-21 while Zoom flatlined during that entire period.

Users comparison

|

Microsoft Teams |

Q1-FY21 (Sep-20) |

Q3-FY21 (Mar-21) |

Q4-FY21 (Jun-21) |

Q2-FY22 (Dec-21) |

||

|

monthly active users |

115 million |

145 million |

250 million |

270 million |

Not further disclosed |

|

|

Growth rate (%) |

n/a |

26% |

72% |

8% |

||

|

Zoom |

Q3-FY21 (Oct-20) |

Q1-FY22 (Apr-21) |

Q2-FY22 (Jul-21) |

Q4-FY22 (Jan-22) |

Q1-FY23 |

Q2-FY23 |

|

Customers > 10 employees |

433,700 |

497,000 |

504,900 |

509,800 |

502,400 |

492,500 |

|

Growth rate (%) |

n/a |

15% |

1.5% |

1% |

-1.5% |

-2% |

Source: Author, with data from Zoom investor presentations and Microsoft earnings calls

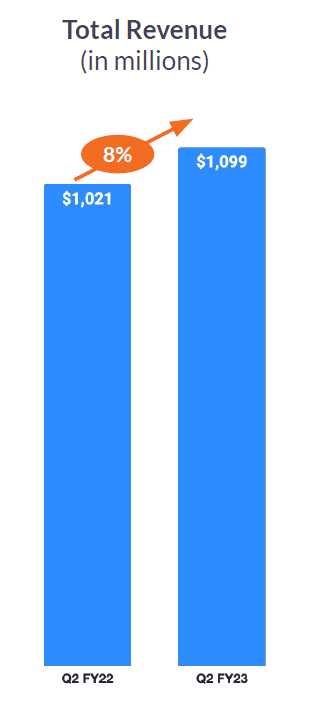

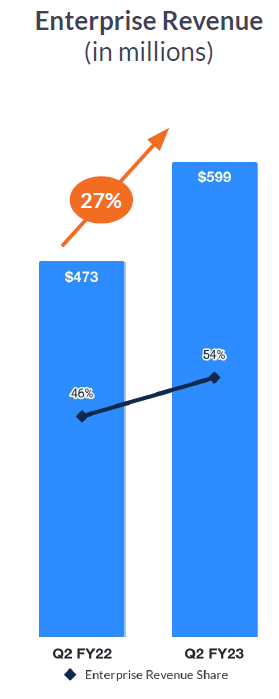

Non-enterprise revenue declined 10% YoY: Zoom’s revenue is growing increasingly reliant on enterprise revenue, as total revenues increased by 8% and enterprise revenues increased by 27%, which works out actually a YoY decline for non-enterprise revenues from $548m to $500m – almost a 10% YoY decline! This means Zoom is getting more reliant on enterprise customers but as we see above, this will be facing very stiff competition from Microsoft Teams.

Zoom quarterly revenue (zoom investor presentation) zoom quarterly enterprise revenue (zoom investor presentation)

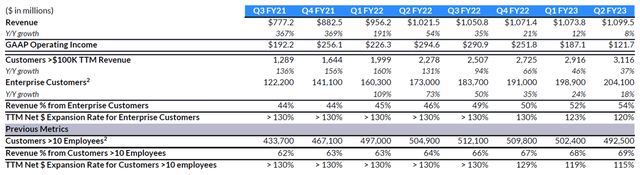

Furthermore, showing YoY figures allows Management to present a higher growth rate. Shown in the back of Zoom’s investor presentation slides are the quarterly revenue/customers etc, and we can see that customer growth by any dimension has been stagnant for several quarters. The “Customers>$100K TTM revenue” indicator keeps increasing, but it appears that would be due more to the full-year effect of previous customers signed on, rather than new customer growth.

Zoom quarterly detailed figures (Zoom investor presentation)

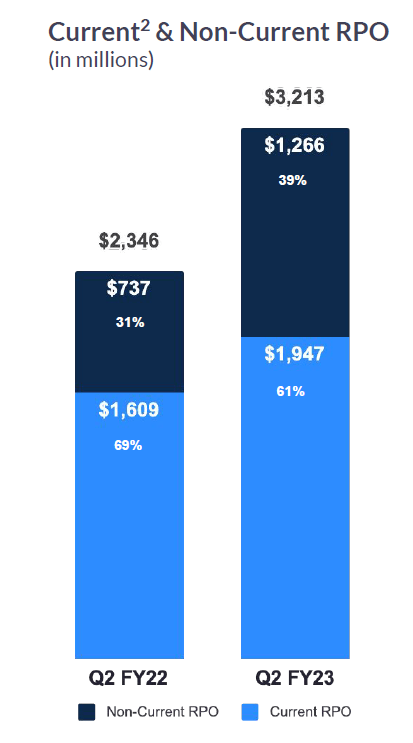

Limited unrealized revenue in contracts: Though Zoom states it locks in revenue via multi year contracts, it appears there isn’t that much gas left in the tank – there is only $3.2 billion revenue under contract which is less than a year’s worth of revenue.

zoom unrealized revenue under contract (zoom investor presentation)

Since Zoom states many of these contracts are multi year, so contracts signed won’t roll off immediately, so it’s going to take some time for the stagnation to show in terms of negative QoQ revenues. Once they start to materially decline, then expectations will cascade negatively unless some company looking to enter the arena does a buyout. But a company entering the arena would face the same daunting challenges and would not pickup many customers even if they bought Zoom for $25 billion (3,000 paying customers above $100,000 revenue) it might make more sense for that company to build up the product and user base from scratch.

If Zoom’s core business is stagnating and Microsoft is dominant, these may not be competitive enough to support a P/S of 6. Now to be fair, Zoom has fallen 85% from its peak, there is a possibility that Zoom somehow survives and thrives:

- Zoom has been launching new products and services though Microsoft also stated it has added 450 functionalities in the past year per its latest earnings call. If Zoom manages to find niches that Microsoft Teams has not or will not take advantage of, Zoom may be able to carve out a niche in the market for itself.

- Companies might want to diversify their suppliers and avoid reliance on Microsoft (though for a service that costs just $10+/month per user, the prominence of this factor should not be overstated at this stage).

To sum up, I fear that the industry economics weigh against Zoom and unless Management is able to pull a rabbit out of the hat, it is probably not going to recover and may very well face even more hardship ahead, if so, the current P/S of 6 may still be richly valued despite already falling c.85% from highs. Ultimately, meetings are just another tool and faced with quality parity and corporate politics, it seems more likely enterprise users will choose Microsoft.

Be the first to comment