gorodenkoff

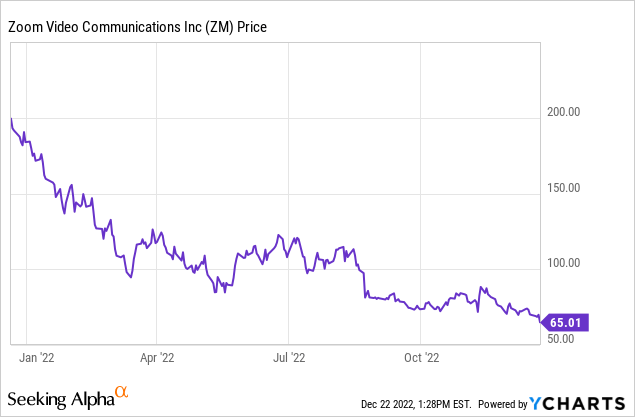

It’s no surprise that this year, some of the pandemic’s biggest tech stock stars have been relegated into the penalty box. Zoom (NASDAQ:ZM), in particular, the poster-child Wall Street darling of 2020, has had an incredibly rough year as the company struggles to comp against COVID-era revenue growth rates. No longer a growth star, investors have a bit of confusion on where to bucket Zoom.

Zoom stock has lost 65% of its value year to date – and that’s after spending most of 2021 in the toilet as well. Versus 2020 peaks above $500, the company has shed more than 85% of its peak value. Interestingly, Zoom is now trading below where it was pre-COVID, when the stock was hovering in the $70-$80 range. We have to ask ourselves now: even though Zoom isn’t growing like a weed anymore, is it fair to take back the entirety of the last three years’ gains, when the business has scaled substantially (from both a top and bottom line perspective) since then?

The bull case is still vibrant

Owing to my confidence in the stability of Zoom’s revenue base, plus the horrendous drop in share prices since the start of the year, I am reiterating my very bullish view on Zoom. It’s time to buy this stock aggressively and wait for a rebound.

There are many reasons to be bullish on Zoom:

- Zoom may not be growing as quickly as during the pandemic days, but its technology is incredibly sticky. The post-pandemic era has shown us that remote or hybrid work is here to stay. Web conferencing has not dwindled post-pandemic even as we return to the office. Once installed, Zoom becomes a mission-critical part of company operations and is very difficult to rip out.

- A plan for everyone- Zoom is applicable to the tiniest start-ups to the largest Fortune 100 companies. It is a truly horizontal software company with use cases for every industry at every size.

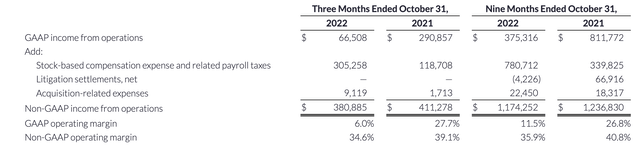

- Rich margin profile and inclusion in the “Rule of 40” club- Zoom has not shrunk since the pandemic; while it may no longer be growing like a weed, the company has still managed to maintain its scale. And with that scale comes immense profitability; its mid-30s pro forma operating margins are among the best in the software industry. An overlooked fact is that Zoom is part of the “Rule of 40” club (a revenue plus pro forma operating margin profile in excess of 40) which very few software companies ever attain.

- Immense cash reserves- Zoom has more than $5 billion of cash on its books with no debt. The company has not yet tapped into a tried-and-true software growth playbook of expanding through M&A, but it certainly has the firepower to (and now, with multiples in the tech sector at multi-year lows, it may be quite an opportune moment to start).

In the near term, there will be noise. The company’s seat-based pricing model will suffer in the wake of layoffs and smaller firms shuttering their doors. FX headwinds will continue to eat at optical growth rates. But at the end of the day: Zoom is one of the few software companies that can actually be valued from an earnings basis.

Valuation check

A quick check-up on valuation: at current share prices near $65, Zoom trades at a market cap of $19.11 billion. After we net off the $5.16 billion of cash on Zoom’s latest balance sheet, the company’s resulting enterprise value is $13.95 billion.

For next fiscal year FY23, meanwhile, Wall Street analysts are projecting Zoom to generate $3.62 in pro forma EPS on $4.61 billion in revenue (+5% y/y). If we assume a ~35% pro forma operating margin on that revenue (roughly flat to this year), pro forma operating profits would land at $1.61 billion. As such, Zoom’s multiples shake out to:

- 3.0x EV/FY23 revenue

- 8.6x EV/FY23 pro forma operating profits

- 17.9x forward P/E

- 13.0x forward P/E ex-cash

For a company with low churn, and a high margin recurring revenue base, I think these multiples are quite low.

Q3 download

Sure, Zoom’s performance this year leaves a lot to be desired, especially as growth rates come down and opex inflation eats somewhat into profit margins. This doesn’t fully justify, however, the massive 65% deflation in Zoom stock since the start of the year. There are still positive highlights in the results to mention.

Take a look at the Q3 earnings summary below:

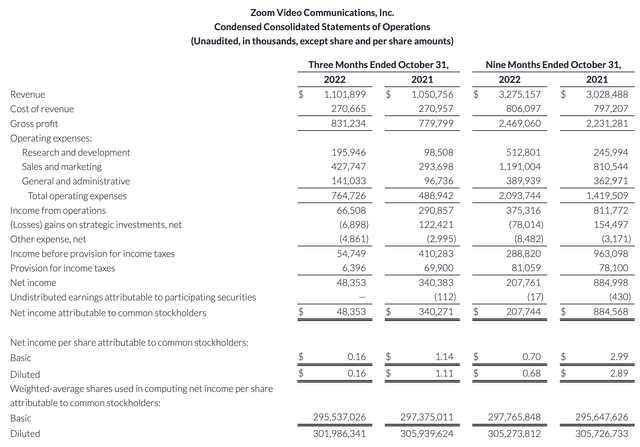

Zoom Q3 results (Zoom Q3 earnings release)

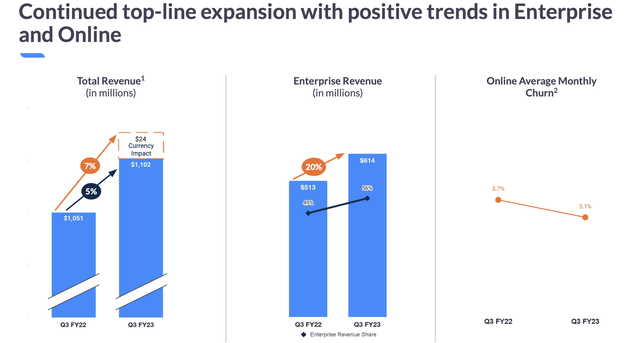

Zoom’s revenue grew 5% y/y to $1.10 billion, in-line with Wall Street’s expectations. FX headwinds, like for many other companies, weighed on the quarter’s results – in a constant currency scenario, the company would have seen revenue grow at 7% y/y.

In spite of the disappointment of single-digit overall revenue growth, however, Zoom achieved 20% y/y growth in enterprise revenue to $614 million, now representing 56% of overall revenue. The boost in Zoom’s enterprise presence is important because it solidifies the company’s ARR base – corporate clients are far less likely to rip out Zoom because of both bureaucracy and the disruption that software changes have on day-to-day business.

Zoom enterprise metrics (Zoom Q3 earnings deck)

Furthermore, the amount of enterprise customers grew 15% y/y to 209.3k, while the trailing twelve-month net expansion rate for enterprise was 117%: indicating that enterprise clients on average are spending 17% in the following year, through both product upsells and seat expansion.

Eric Yuan, the company’s CEO, notes that more and more enterprises are purchasing a complete Zoom suite, per his prepared remarks on the Q3 earnings call:

As we enable customers to drive greater efficiency, we also are focusing on our own efficiency. We have always been judicious with investments, prudent about spending and we have commanded robust margins since our IPO, so this is not a major shift for us. We will continue to drive innovation, customer value and platform expansion, balanced with an increasing emphasis on efficiency and profitability.

We continued to see strong traction with customers spending greater than $100,000 in trailing 12 months revenue, which was up 31% year-over-year. What’s more, these customers are increasingly seeing value in buying the whole platform, with thousands of customers already buying Zoom One packages. From an industry perspective, the largest deals came from tech, media and financial services, and we also had notable wins in retail, transportation and pharma.”

From a profitability perspective, Zoom’s pro forma gross margins rose 360bps year over year, driven by economies of scale and the company’s optimized usage of public cloud services. This was offset, unfortunately, by a seven-point increase as a percentage of revenue in both R&D and sales and marketing costs; as a result, pro forma operating margins fell -460bps y/y to 34.6%.

Zoom margins (Zoom Q3 earnings release)

We still note, however, that a ~35% operating margin on top of a 5% revenue growth rate still puts Zoom in the “Rule of 40” designation; and that a mid-30s pro forma operating margin stacks up very favorably against other peers in the SaaS industry – many of which have struggled just to reach breakeven.

Key takeaways

Once one of the most expensively traded stocks on the market, it’s almost unfathomable that Zoom is now trading at a P/E discount to the broader S&P 500 (when we exclude cash from its market value). In my view, Zoom’s rich margin profile, its steady enterprise recurring revenue, and its powerful earnings base can’t be ignored for much longer. Load up here while you can.

Be the first to comment