Jorge Villalba

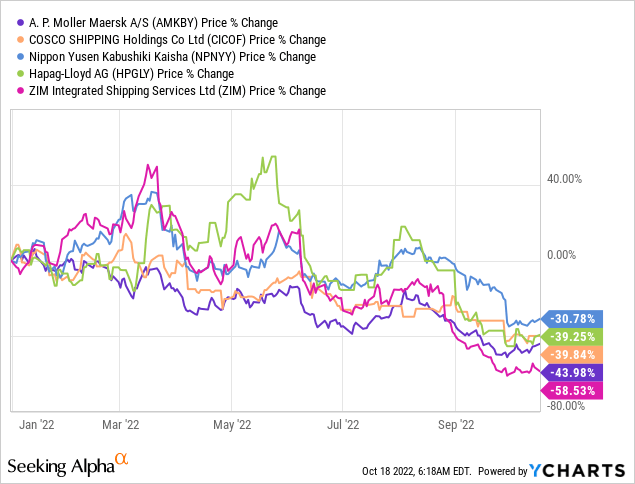

Shares of ZIM Integrated Shipping Services (NYSE:ZIM) are suffering from collapsing container shipping rates… and it may get a whole lot worse before it gets better. ZIM’s share price has fallen from $90 in March to about $24 yesterday due to a repricing of earnings prospects in the shipping industry and I believe shares could revalue lower in the event that a major recession grips the global economy. ZIM Integrated Shipping’s TTM dividend yield exceeds 100%, according to Seeking Alpha, while the forward dividend yield is 78%. Container freight rates dropped another 6% in the week ending last Thursday and continual pricing weakness in the container market is a major risk for the shipping company going forward!

ZIM Integrated Shipping’s share price is a measure of the health of the global economy

Container freight rates continued to fall closer to pre-pandemic levels in October as economic uncertainty and weak consumer demand are weighing on the shipping sector. As a consequence, large shipping companies have seen a major revaluation this year.

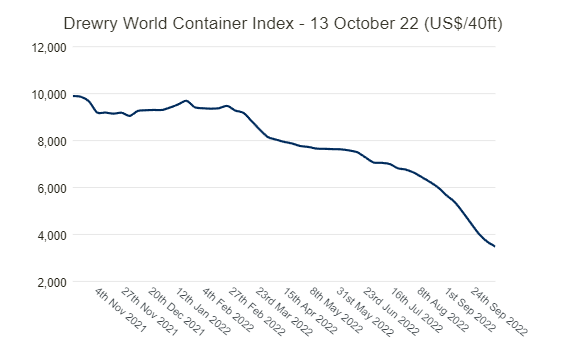

But it looks as if things are getting worse for the shipping industry and the reason for this is collapsing freight rates. According to the Drewry World Container Index, shipping rates for a 40-foot container declined another 6% in the week ending October 13, 2022 and declined 33 weeks in a row. Shipping a 40-container costs $3,483.19 in the week ending Thursday. Just two months ago, the price was more than $6,000, and it cost more than $10,000 to ship a 40-foot container a year ago when the supply chain was heavily clogged and container slots on freighters filled quickly.

Drewry World Container Index

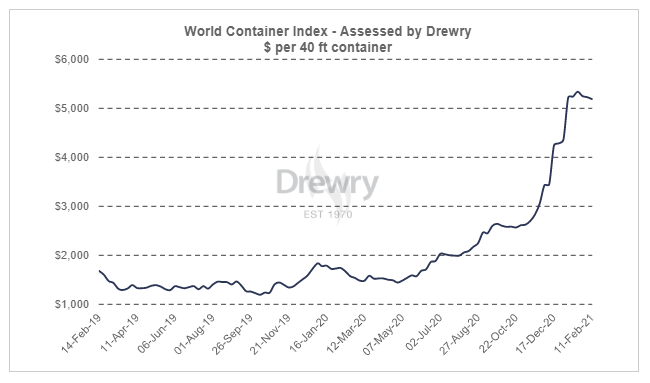

Since then, however, a lot has changed. Shipping rates in 2022 have been in free-fall and the market owes this largely to clouds gathering over the global economy which indicate much weaker demand for container slots on cargo ships going forward. A cautious consumer is now driving the drop in freight rates, according to CNBC, which referred to a 20% drop in ocean freight orders in September and October. The fall in order volumes apparently affects a broad range of products such as household goods, industrial products and machinery. Since shipping rates are still much higher today than they were before the pandemic — it costs much less than $2,000 to ship a 40-foot container in 2019 — I believe freight rates will face continual pricing pressure.

Source: Drewry

The IMF recently warned of a slowdown of global growth which is set to affect freight rates and ZIM Integrated Shipping’s earnings prospects. A decline in consumer spending, driven by high inflation, could dramatically lower shipping volumes and a global recession surely wouldn’t help the sector.

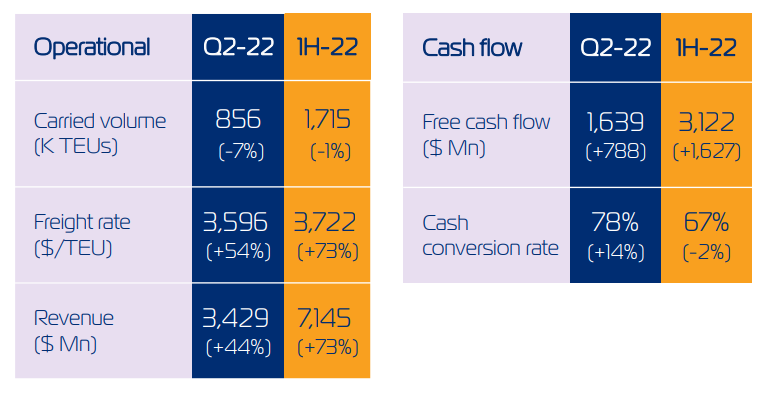

Soaring freight rates in 2021 and 2022 were the reason behind ZIM Integrated Shipping’s surging operating results regarding revenues and free cash flow in recent quarters. The shipping company’s revenues, as an example, saw a 73% increase to $7.1B year over year in the first six months of FY 2022. The surge in freight rates fully and completely explains the surge in ZIM’s revenues.

Source: ZIM Integrated Shipping

Down-side potential

ZIM Integrated Shipping’s shares may be more expensive than the earnings multiplier factor suggests. ZIM is currently trading at a forward P-E ratio of 3.0 X which implies that the stock price is too high relative to the company’s estimated earnings potential.

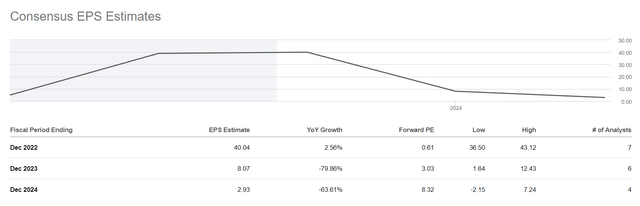

ZIM Integrated Shipping is estimated to generate $8.07 per-share in earnings in FY 2023 and just $2.93 per-share in FY 2024, indicating that the shipping company is expected to see a major earnings recession.

Seeking Alpha: ZIM EPS Estimates

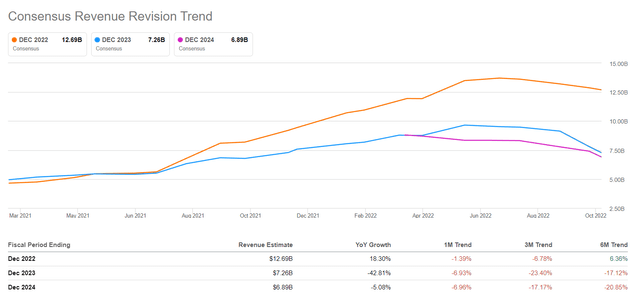

ZIM Integrated Shipping’s revenue estimates have also started to drop as more analysts see the writing on the wall and react to collapsing shipping rates. ZIM Integrated Shipping’s revenues are expected to decline 43% in FY 2023.

Seeking Alpha: Annual Revenue Estimates

Risks with ZIM Integrated Shipping

The biggest commercial risk for ZIM Integrated Shipping is the onset of a major global recession that could lead to a broad-based decline in shipping volumes, lower vessel utilization, a continual erosion of container freight rates and negative earnings growth in the next one or two years. Container freight rates are now down more than 65% compared to the same period last year and unless the global economy can avoid a recession, ZIM Integrated Shipping’s stock is likely to make new lows.

Final thoughts

The container freight rate bubble and ZIM’s yield bubble are bursting, and the stock has almost nowhere to go but down as clouds continue to gather over the global economy. While ZIM Integrated Shipping’s >77% dividend yield is already signaling to investors that the pay-out of the past is highly unlikely to be sustainable, investors must recognize that ZIM Integrated Shipping’s shares have considerable down-side risk as a recession threatens the shipping market and investors no longer buy into the promise of a massive dividend payout going forward!

Be the first to comment