shaunl

Thesis

We present a timely update to ZIM Integrated Shipping (NYSE:ZIM) stock after our post-earnings article. ZIM has collapsed 50% since our previous update, as we revised our rating from Hold to Buy on more attractive valuations.

However, we also cautioned investors to prepare for potential earnings and dividends compression if the market anticipates the downturn in the container shipping industry to slow further due to the coming recession.

Our analysis suggests that the Street has slashed forward earnings and dividend per share consensus estimates markedly, corroborating the recent collapse in ZIM. Therefore, investors need to ask whether ZIM’s fundamental model can weather the significant slowdown as a potential global recession approaches.

We remain cautiously optimistic about the secular growth drivers in container shipping, as addressed in our previous article. Therefore, we believe the recent downshift indicates a capitulation move to force some shareholders to raise their white flags and give up.

Despite that, we must caution investors that we have yet to glean constructive price action that could indicate a potential bottoming process. However, we are confident that ZIM’s valuation has been de-risked adequately, which should augur well for its subsequent recovery from the current levels.

Accordingly, we reiterate our Buy rating on ZIM.

The Earnings Compression Is Already Here

A recent study by Ned Davis Research highlighted that the risk of a global recession has risen to 98%, raising the threat to global shipping companies. It accentuated: “This indicates that the risk of severe global recession is rising for some time in 2023, which would create more downside risk for global equities.”

Recent shipping data also demonstrated that Chinese exports continue to be weak as global demand has softened further. As a result, importers are attempting to renegotiate shipping rates, as Bloomberg reported:

Many of the carriers’ customers want to re-negotiate for discounts. Agents and freight forwarders in Asia have received calls recently from cargo owners asking to lower their shipping costs, with some exporters complaining about the unfairness of paying almost twice as much on contracts than the spot market. Shipping companies want exporters to bulk up their volumes, but many are refusing to because of the weaker economic outlook. – Bloomberg

Leading shipping company Maersk also cautioned that “consumer spending patterns have both softened and shifted away from goods-heavy pandemic-era patterns and more towards the services and experiences unavailable during the Covid outbreaks.”

Therefore, we believe the market has been trying to price in a much weaker H2 for ZIM Integrated, with significant moderation in its earnings through 2024.

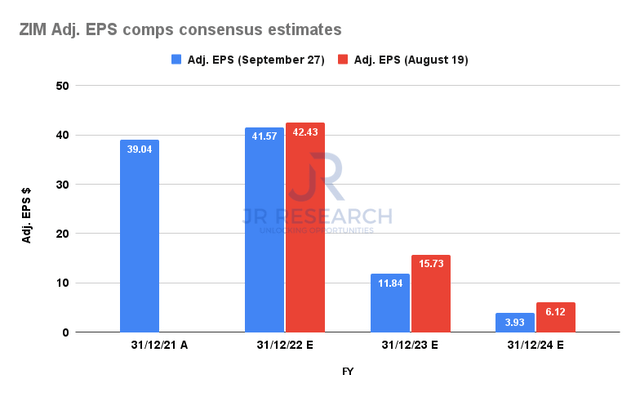

ZIM Integrated Adjusted EPS comps consensus estimates (S&P Cap IQ)

As seen above, ZIM Integrated’s adjusted EPS for FY23-24 has been revised markedly downward from August. Notably, the adjustment for FY24 was a significant 36% decline from August’s estimates.

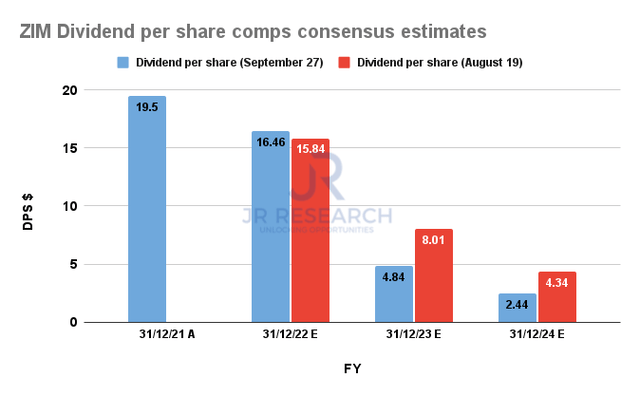

ZIM Integrated Dividend per share comps consensus estimates (S&P Cap IQ)

As a result, its dividend per share estimates have also been revised downward to $4.84 for FY23, down nearly 40% from August’s projections. As ZIM’s valuation has primarily been supported by its generous dividend payouts, we believe the battering seen in ZIM over the past month is justified, as the market downgraded its earnings and dividend expectations for ZIM moving ahead.

The Battering Has De-risked ZIM’s Valuation

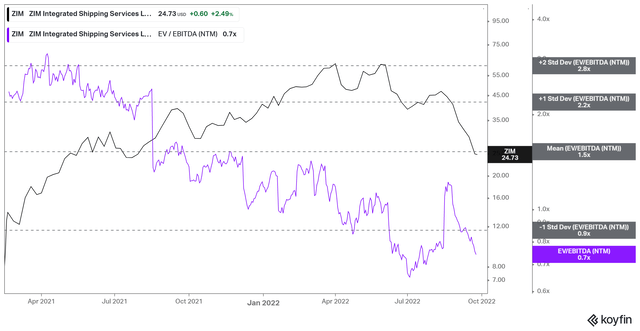

ZIM NTM EBITDA multiples valuation trend (koyfin)

As seen above, ZIM’s valuation reached its nadir in June at an NTM EBTIDA multiple of 0.6x. Despite the recent battering, ZIM’s valuation has not moved below June’s levels due to the downgrades in its earnings estimates.

However, we postulate that ZIM’s June bottom in its valuations should hold robustly, given the significant haircut in its earnings estimates. Moreover, the market has likely priced in further weakness in anticipation of a severe recession.

Is ZIM Stock A Buy, Sell, Or Hold?

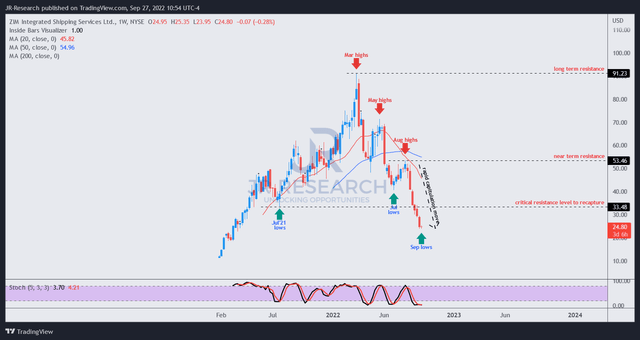

ZIM price chart (weekly) (TradingView)

We gleaned that the move to force the September lows is consistent with capitulation moves we have seen in other stocks. Also, ZIM appears to be at well-oversold levels, and the selling momentum seems to be subsiding.

Therefore, we believe a relief rally could ensue, even though the potential for further near-term downside volatility cannot be ruled out.

Notwithstanding, we urge investors to capitalize on the massive fear of a global recession which has likely driven the steep selling in ZIM.

We reiterate our Buy rating in ZIM.

Be the first to comment