hapabapa

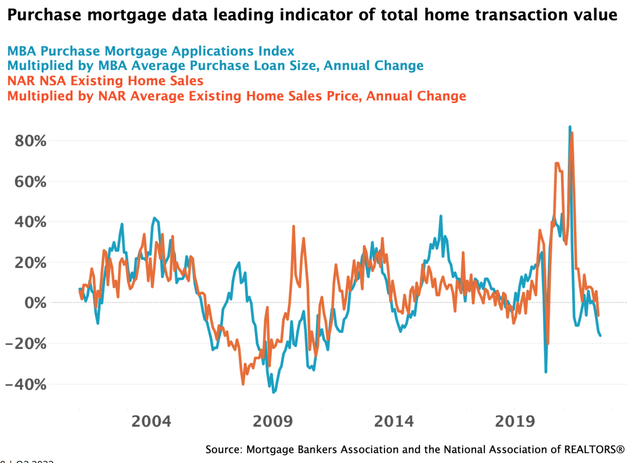

Zillow Group (NASDAQ:Z) is the number one online real estate platform in the US. It’s portals had 234 million monthly unique users in the second quarter of 2022, which estimates to be a staggering 70% of the US population (333 million people). Despite this the company has announced underwhelming earnings in the second quarter, heavily impacted by rising interest rates and a high inflation environment which has affected the affordability of housing. As you can see from the chart below, The MBA Purchase Mortgage Applications (the number of people applying for a mortgage) multiplied by the average loan purchase size is down nearly 20% year over year (blue line). In addition, the NSA existing home sales, multiplied by the average sales price is down by ~6%. Does this mean people are never going to buy houses again? Of course not, the housing market is cyclical. The housing market crashed in 2020, for a brief period before rebounding with a decade high spike in mortgage applications and home purchases in late 2020 and early 2021. Now we are going through the next phase of cyclicality.

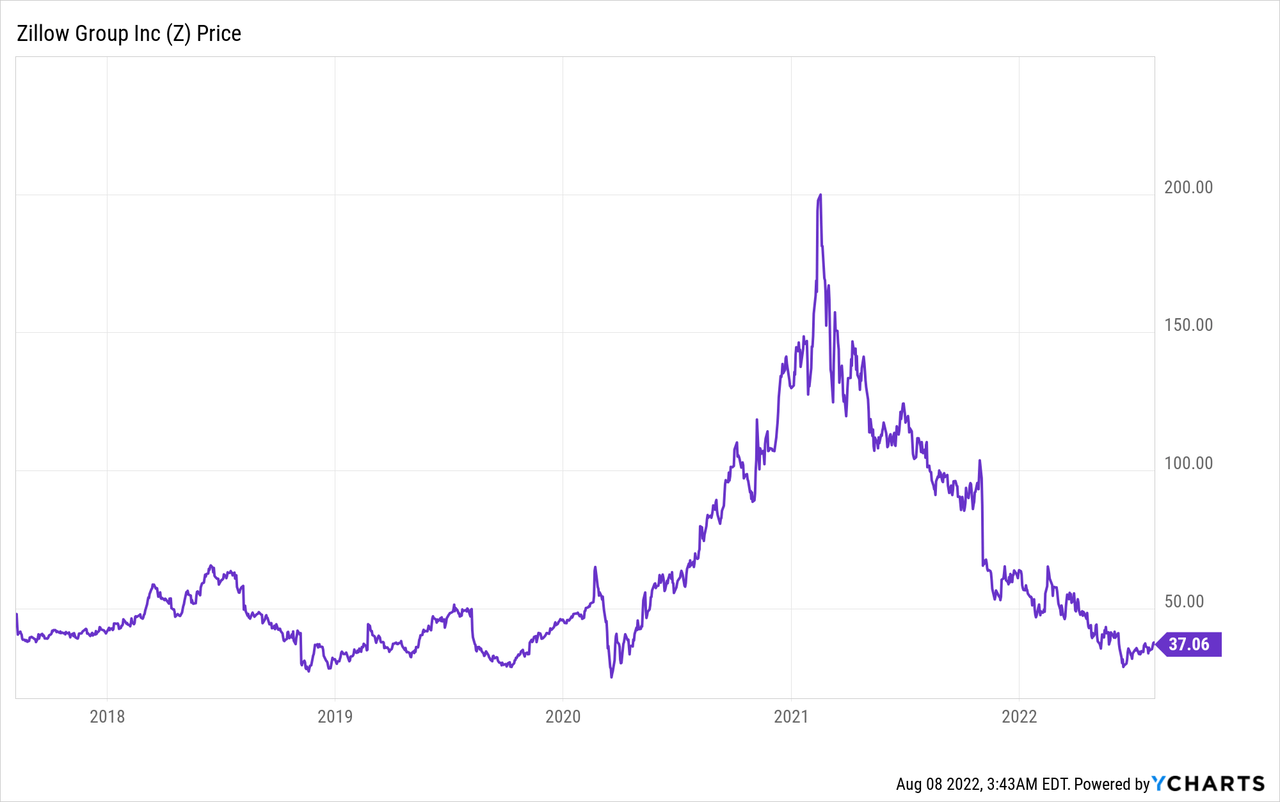

Zillow’s share price has been butchered and is now down ~82% from it’s all time high, due to the aforementioned housing market woes and its disaster in home buying. But the company does have a few positives, such as the veteran Founder and CEO Rich Barton who has a vision to create a “Super Housing App”. In addition, the stock price is undervalued or “on sale” at the time of writing. Thus in this post I’m going to break down the latest earnings report for Zillow and forecast what the future may hold for this decimated stock, let’s dive in.

Second Quarter Earnings Breakdown

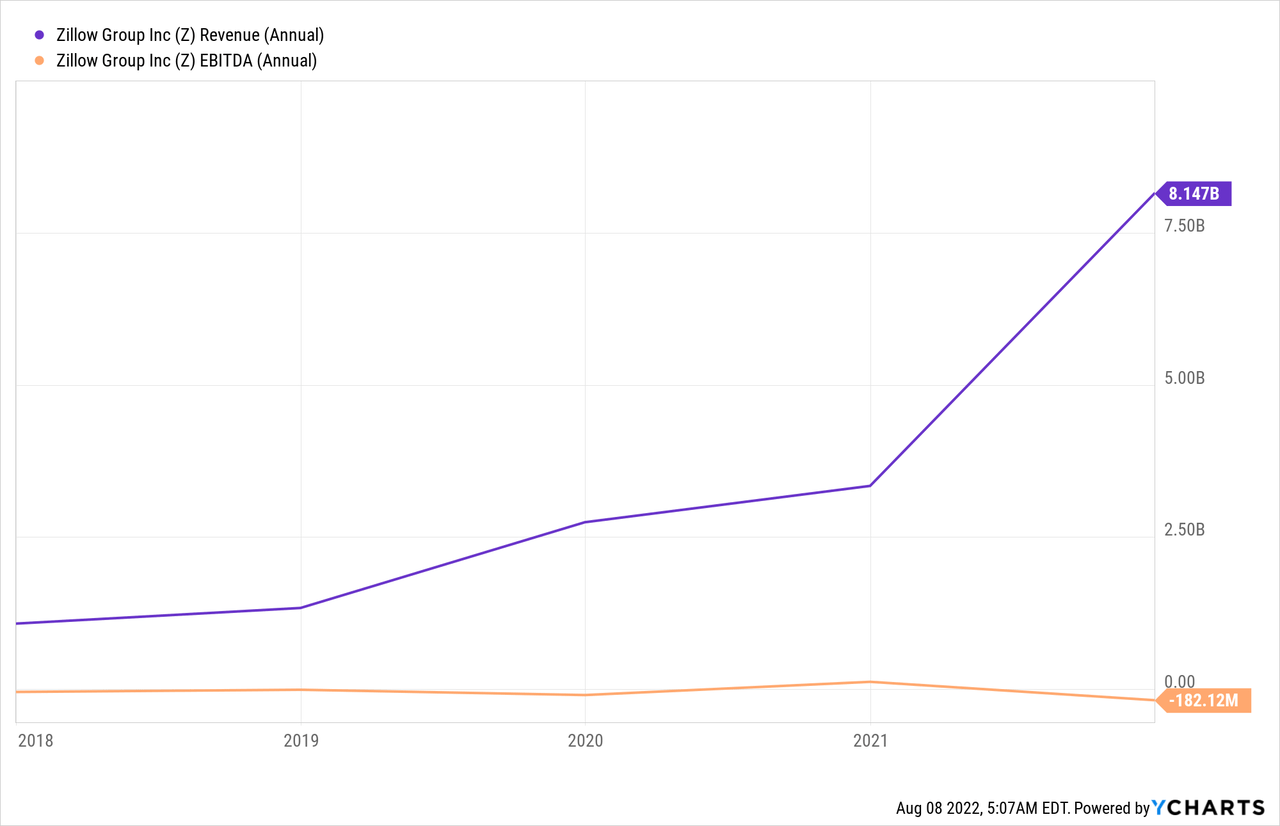

Zillow announced it’s financial results for the second quarter of 2022. Consolidated revenue was $1 billion, which was down -22% year over year (due to the exit from home buying). However, revenue beat analyst expectations by $25 million, which was above the midpoint of Zillow’s prior guidance. As mentioned in the introduction, Zillow’s website traffic is still strong at 234 million monthly unique users, up 2% year over year. In addition, Q2 website visits were up 5% year over year to 2.9 billion. This means a large percentage of people are still looking at houses to buy for the future and thus this represents pent up demand. A portion of the website traffic will include “dreamers” who are looking at mansions they will never buy. But I would rather them to be using the Zillow platform to do this and even the “dreamers” will one day purchase or rent more realistic homes, as everyone needs somewhere to live.

Zillow’s IMT (Internet, Media, Technology) segment reported revenues of $475 million, which was flat year over year. While Premier Agent revenue was $333 million, down 5% year over year, which was a notch below the company’s prior guidance. Mortgages segment revenue was $29 million in Q2, slightly below the prior outlook range. As mentioned in the intro these poor revenue results were mainly impacted by the depressed housing market and the macro economic environment. Rental Revenues were also down by 3% year over year to $71 million, but was better than expectations.

Consolidated Net Income was $8 million in Q2. Income by segment was $69 million for IMT, -$14 million for Homes and -$38 million for Mortgages.

Consolidated Adjusted EBITDA was $164 million in Q2, which wasn’t great but did exceed the midpoint of managements outlook. This was driven by higher than expected margins in the IMT segment and better unit economics on homes sold in the Homes segment.

Another area of good news for Zillow, is total operating expenses were down 11% year over year to $425 million. This was driven by lower holding and selling costs in the home segment. The company also reduced its marketing expenses which partially offset the increased headcount costs in the IMT segment.

iBuying Wind Down and Open Door Partnership

Zillow’s Home segment revenue was $505 million, which beat managements prior guidance as the company wound down it’s disastrous iBuying operation “Zillow Offers” faster than expected. However, it was a surprise to see Zillow hasn’t completely closed the door on iBuying. The company has struck a multi year partnership with former competitor Opendoor (OPEN) which is now the king of iBuying. This “Coopetition” is a smart move as people will still want to sell their home fast and now they can do it directly from the Zillow website, without having to leave for a competitor. The beautiful thing about this setup, is when a seller requests to sell their home through Opendoor, they will be put through to a “Licensed Zillow Advisor”. This advisor will help compare a quote from Opendoor to the open market price. If the seller chooses Opendoor, Zillow will receive a referral fee and if not, Zillow will receive a fee from it’s “Premier Agent Partners” Win, Win.

Zillow announced to have incurred $173 million in total iBuying wind down related costs for Q2 and expect the total to be approximately $175 million.

Housing Super App by 2025

The Opendoor partnership fits nicely with Zillow’s vision of building a housing “Super App”. The company aims to pursue a capital light strategy which focuses on being the ultimate middle man, that can offer mortgages, escrow and other services to suit the buyer and sellers needs. The company has laid out a product road map, complete with a set of financial targets for 2025. These targets include; Increasing Engagement, Increasing Transactions, Increasing Revenue per Transaction.

To accomplish this its plan will be built out across five main growth pillars;

- Financing

- Touring

- Seller Solutions

- Integrating Our Services

- Enhancing Our Partner Network

Zillow Super App (Investor Presentation)

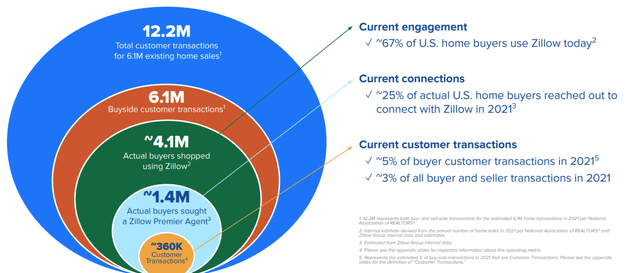

Financing is key growth opportunity given Zillow only captures approximately 3% of the $300 billion real estate transaction market and thus has plenty of runway for growth.

Real Estate Transactions (Zillow Investor Presentation)

Zillow has already made changes to it’s apps which has resulted in pre approvals for mortgages doubling between January and June 2022. Due to this, purchase origination volume increased by 58% sequentially in the second quarter. Management stated they are in the “early stage” of this journey and still have a lot of work to do. However, it was noted that the majority of customers who visit Zillow don’t have a real estate agent yet. This has given management confidence in their ability to introduce Zillow Home Loan Customers to Premier Agent Partners.

The OpenTable of Touring?

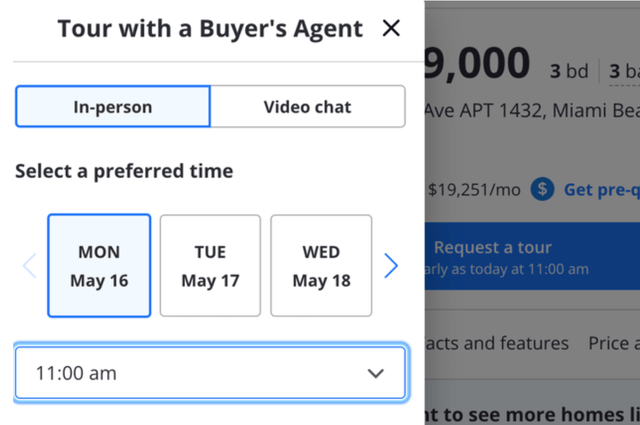

Touring is a key area Zillow has expanded substantially. The company has now integrated its acquisition of ShowingTime in order to show real time availability of viewing slots across 74% of listing. The aim of this is to become the “OpenTable of Real Estate Tours” which will lower the friction associated with booking a trip. This will also make the life of real estate agents easier as they won’t need to take 100 calls, check calendars, book slots etc. Thus this will enhance the appeal of Zillow vs competitors.

Our goal continues to be to integrate the ShowingTime functionality on our customer-facing apps and sites, making it as easy to book a home tour as it is to book a restaurant reservation online. – Zillow CEO Rich Barton

Zillow has a solid balance sheet for future growth and have estimated cash and investments of $3.5 billion in the second quarter. This was down slightly from the $3.6 billion in the first quarter, after management showed confidence with a $249 million in share buyback. In addition, they have a further $850 million in share repurchase authorizations from the $1.8 billion total. Management also conservatively reduced their debt position to $1.7 billion at the end of Q2, down from $2.5 billion at the end of Q1’22 after paying down all remaining iBuying debt.

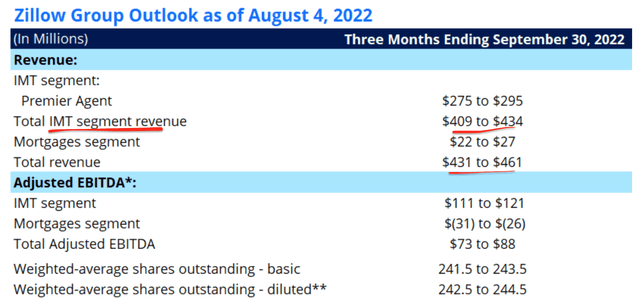

Management has offered low guidance for the third quarter of 2022, with Q3 consolidated revenue of $446 million expected at the midpoint of our outlook. IMT Revenue makes up the lion’s share of this and is expected to be between $409 and $434 in the quarter, down 12% year over year at the midpoint. This would also be sequentially less than the $475 million in IMT revenue for Q2’22. The main factors for this expected revenue decline is due to the depressed housing market which is forecasted.

Zillow Guidance Q3,22 (Earnings Report)

Advanced Valuation

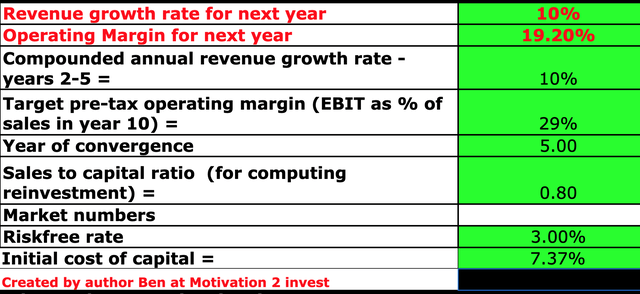

In order to value Zillow I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a conservative 10% revenue growth (IMT and Mortgage only) for the next five years. This forecast is based upon a recovery in the housing market in 2023, after a sluggish 2022 which is inline with the company’s own guidance.

Zillow Stock Valuation 1 (created by author Ben at Motivation 2 Invest)

In addition, I have forecasted a substantial 29% operating margin over the next 5 years as the company creates it’s “Super App” and they capture a larger percentage of real estate transactions. I have also capitalized the company’s R&D expenses and carried over prior operating losses to increase the accuracy of the valuation.

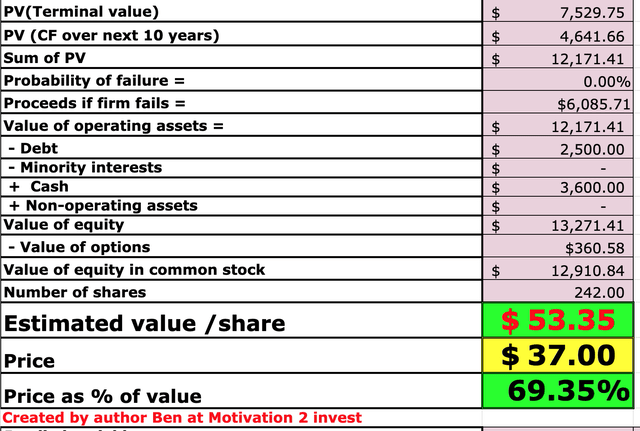

Zillow Stock Valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $53/share, the stock is currently trading at $37/share and thus is ~30% undervalued.

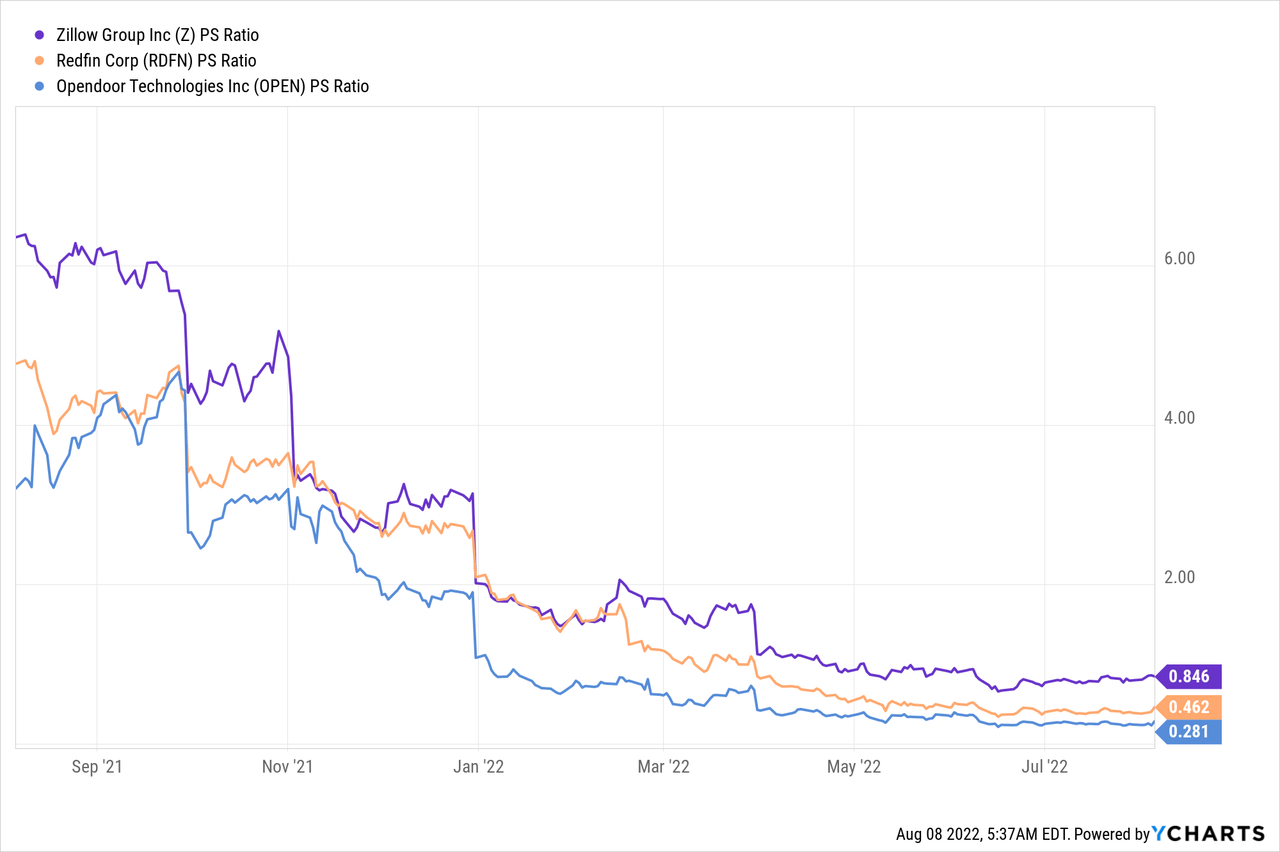

As an extra datapoint Zillow is trading at a Price to Sales Ratio = 0.89 which is ~85% cheaper than it’s 5 year average. Zillow is trading at a higher valuation than competitors such as Redfin (PS = 0.463) and Opendoor (PS = 0.281) but I believe this is justified due to their dominate market position.

Risks

Depressed Housing Market and Recession

As mentioned in the introduction, the high inflation and rising interest rate environment is making home affordability harder than ever. This trend is expected to continue into the next quarter, which is inline with managements guidance. A forecasted “Recession” could also impact Job security for many and thus reduce the number of people purchasing new homes.

Final Thoughts

Zillow is the dominant leader in online real estate and management has bold plans to create a housing “Super App”. In the words of CEO Rich Barton, “We swung for the fences and missed” with regards to Zillow’s iBuying disaster but the partnership with Opendoor is a positive. A bet on Zillow is really a bet on the cyclical housing market and the experienced Founder CEO Rich Barton. As a remainder, Barton is a serial entrepreneur who founded Expedia (EXPE), Glassdoor and Zillow. His net worth is approximately $2.1 billion. However, the fact he continues to lead the company shows he has faith in it’s long term vision. The stock is undervalued and thus suitable to buy now. However, I expect the housing market and Zillow to have troubles up until 2023. Therefore things may get worse before better and thus one may wish to hold or buy after the third or fourth quarter results.

Be the first to comment