The Good Brigade

Investment Thesis

Zillow (NASDAQ:Z) has seen its share price relentlessly punished as investors sold off its shares by more than 75% from their highs. This is the stuff that books on investing are written about.

Looking ahead, I believe that this asset-light business could be on a path to $550 million of free cash flow as a run rate over the next 12 months.

My assumptions put Zillow today at a 14x free cash flow multiple.

On the other hand, there are plenty of negative considerations for investors to weigh up. But on the other hand, with the stock already down so much, could investors already be pricing in too much negativity?

Zillow’s On Sale! Yeah, So What?

We are told that we should buy stocks when they are on sale. And yet, stocks go on sale when the outlook is horrible. There’s no other reason for stocks to go on sale.

Investors need a mixture of courage and patience. Sure, that helps. But let’s be honest. What investors need above all is fresh capital.

And that’s the problem with a bear market. It’s not so much that investors struggle to realize that something is available at great prices. It’s simply that very few investors have any capital left.

Anyone that had any capital left in 2022, probably spent it in the bear market rally that caught a bid in the summer. And since then, Zillow, like countless other stocks has lost nearly all its ground.

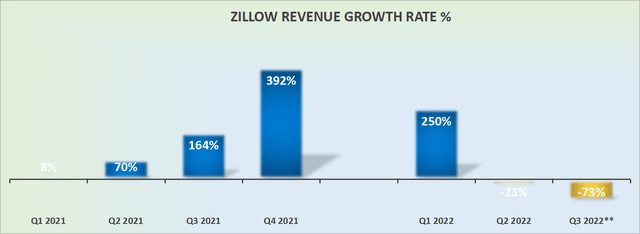

Difficult to Interpret Zillow’s Normalized Growth Rates

Part of the problem that investors are having with Zillow is that it isn’t immediately obvious what its sustainable growth rates could be. Obviously, part of the obfuscation comes from Zillow’s iBuying business which Zillow has now fully exited.

But the next part of the problem for investors is that since Zillow put out its Investors Day back in February so much has happened in the market.

Recall, Zillow put out its investor Day in mid-February, and its shares rallied, at least at first.

But since then, its shares proceeded to sell off by at least 40% to 50% as investors simply didn’t have enough confidence in Zillow’s prospects.

And now, as you know, the Fed has been raising rates at a backbreaking pace, which has dramatically slowed down the property market.

Hence, given all these vicissitudes, investors are struggling to get confident about what’s beyond the next 2 quarters.

In sum, even if investors see value in Zillow, they are understandably struggling to get any confidence around what Zillow’s normalized growth rates could be.

Z Stock Valuation – 14x Next Year’s Free Cash Flows

To the best of my estimates, I believe that Zillow’s EBITDA will be around $525 million in 2022. This figure is down from approximately $845 million, from just its IMT and Mortgages segment combined in 2021.

That being said, I believe that it’s fair to say that the real estate market won’t be in the doldrums forever. At some point, this malaise goes through the system.

Consequently, is it fair to assume that by this time next year Zillow could return to being on a $650 million EBITDA run rate? I believe that’s a very reasonable estimate.

In that case, the stock today is priced at approximately 12x next year’s run rate EBITDA.

What’s more, this is what Zillow stated in its recent shareholder letter,

[…] while growing our business in the capital-light manner we described when we exited iBuying.

Here again, we can see an echo of Zillow’s statement that the ongoing core business has very little capex requirements. You can see for yourself in its cash flow statement for the previous 6 months, where capex levels were at approximately $70 million.

Consequently, I believe that this means that of the $650 million of EBITDA, we can assume that nearly $550 million could end up as free cash flow as a run rate over the next twelve months.

This puts this business with a strong moat being priced at 14x next year’s free cash flows.

The Bottom Line

We are now investing through the most impressive period in more than a decade. Investors’ emotions range from apathy to fear to despair. We are probably on the cusp of a final capitulation.

As value investors, it’s seriously difficult not to get excited about where we are in 2022! Indeed, as I look around, I see so few investors that have anything positive to say about the real estate market.

This could be the time that investors will look back and say, ”oh well, that was a great time to invest in Zillow”.

As you know, there’s no bell that goes off when the bottom is in. When we know that the bottom is in, that will be too late to get involved.

The investing game is not so much about getting in at the bottom tick, but more about getting in low and selling higher.

And with Zillow’s shares now selling at less than 14x next year’s free cash flows run rate, the opportunity now is very strong. Perhaps, in hindsight, we’ll look to this period and see that it was ”obviously” a very attractive entry point. Watch this space.

Be the first to comment