Khanchit Khirisutchalual

Thesis update

This is an update to my original Ziff Davis (NASDAQ:ZD) thesis.

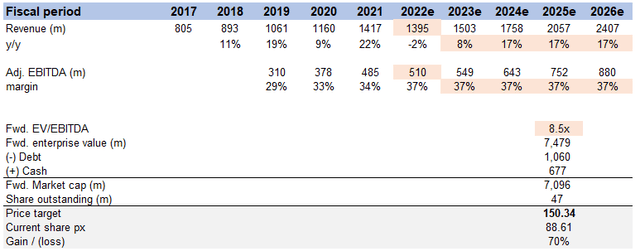

I still recommend buying ZD ($88.61 as of this writing). With its robust digital portfolio, the company is well-positioned to profit from the growing digital advertising market and provide the capital necessary to support the leadership’s acquisition plan. I’ll say it again: the management team’s proven track record of successful acquisitions over the years gives me confidence in the company’s sound direction. Based on my forecast that it will generate $900 million in adj. EBITDA in FY26, its equity value would be $150 per share, or 70% more than it is worth right now, using a forward EBITDA multiple of 8.5x.

Earnings update

ZD stock is up 15% since the company announced its third-quarter results. A strong indicator that I picked up was that management only lowered its 2022 forecast by 2% due to resilience in other parts of the portfolio, despite the soft advertising market weighing on 3Q revenue. With adjusted EBITDA remaining relatively flat in the quarter and management increasing their 2022 EPS forecast by a small amount, the focus was primarily on ZD’s ability to preserve profit. A key thing that I liked about ZD is they have always placed a premium on balancing growth and profitability, which has led to slower growth than some peers in prior years but, in my opinion, positions ZD well to outperform in the current market environment. In FY22, ZD expects to see low-single-digit growth in revenue, mid-single-digit growth in EBITDA, and high-single-digit growth in earnings per share. Until the state of the advertising market improves, I anticipate slow organic growth, but strong overall growth thanks to mergers and acquisitions in FY23. Management has been slow to spend its over $600 million in cash reserves, but I expect that to change in the near future as the climate for M&A improves.

Financials

ZD’s $342 million in revenue was down from the expected $346 million, with a drop of 6% attributable to both advertising and subscription revenue. Diving deeper, there was a double-digit decline in technology ads, a mid-single-digit increase in gaming ads, and a flat year-over-year performance in health ads. The 6% drop in Cybersecurity/Martech was more than made up for by the 20% growth in Connectivity within Subscriptions.

Profit-wise, ZD met expectations with an adj. EBITDA of $120 million and beat expectations with adj. non-GAAP EPS of $1.58. One thing to highlight is that, headcount, which represents roughly 40% of total company expenses, has decreased by 10% year-to-date, as reported by management.

Tracking data

FY22 outlook lowered

ZD has tightened its revenue guidance to $1.39-1.40 billion (a decrease of 2% from the prior midpoint), lowered its adjusted EBITDA guidance to $507-513 million (a decrease of -0.6% from the prior midpoint), and raised its adjusted non-GAAP EPS guidance by 1% to $6.70-6.80. In my opinion, the new guide makes no allowances for either an improvement or a worsening of the macro environment. That is, if the economy as a whole improves, ZD should be able to beat its projections by making smart use of its resources.

Valuation

Price target update

My price target for FY25 has risen from $126 to $150. This reflects an increase in forward EBITDA multiples from 7.2x to 8.5x. I believe the market is beginning to recognize ZD’s ability to execute and grow, resulting in the valuation increase. While I like this valuation movement, I don’t think we’ll see another one anytime soon, as ZD’s 10-year average forward EBTIDA multiple is 8.9x. I continue to believe that ZD can grow at industry levels in the future, with a gradual recovery from FY22e to 17% in FY24e.

Own’s estimates

Risks updates

Weak macro-environment impact ad budgets

Sixty percent of ZD’s income comes from online ads, but in the current macro environment, online advertiser budgets are likely to remain constrained. Because of this and the fact that ZD’s digital media properties aren’t market leaders and grow organically at a slower rate than the secular growth of online ads, ZD could take a double hit if the macro-environment continues to deteriorate.

Conclusion

In conclusion, I maintain that ZD is undervalued at its current price in the market ($88.61 at the time of writing). ZD, in my opinion, is a digital media company that is attractive because of its large size, rapid expansion, and high profitability in comparison to its competitors, as well as its successful M&A strategy, over $600 million in cash on hand, low leverage, and annual FCF of $300 million. Now that it has separated its cloud fax business, I think ZD is a more compelling digital media story and could re-rate higher and trade more in line with its peers.

Be the first to comment