Robert Way/iStock Editorial via Getty Images

Last week, Ermenegildo Zegna (NYSE:ZGN) released its three-month numbers to the investor community. Financial performances were mixed but we confirm our long-term investment thesis based on a growth story recovery from COVID-19 outbreaks and a compelling valuation coupled with a solid balance sheet.

Starting with the CEO’s words, he confirmed that “Zegna Group continues to make progress as the company executes its strategic plan, despite ongoing macroeconomic and geopolitical instability”. He also explained how the company is moving on with its plan based on three pillars: i) Zegna One brand development, ii) Thom Browne division’s full potential and iii) strong recovery in the third-party textile division (thanks to the company’s unique capability).

Zegna’s key strategic priorities

Half-year results

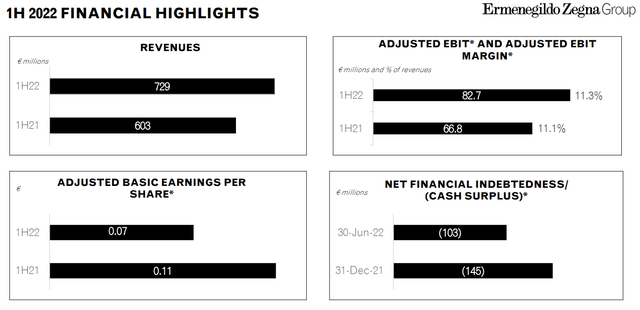

In the first half of the year ended on June 30th, the company delivered a turnover of almost €729 million (up by 21%) of which €351.4 million (+16%) was generated in the second quarter alone. On the other hand, the profit slowed by 35%, from the previous €32.2 to the current €21 million with an EPS of €0.06, while the half-year adjusted EBIT rose from €66.8 to €82.6 million with an EBIT margin of 11.3%. Cross-checking the negative profit results, we note that half-year results were impacted by unfavorable currency development, a one-off impact due to a put option liability on the Thom Browne remaining equity stake (10%) that Zegna does not own and also to higher expenses for marketing/advertising and corporate costs centre.

Looking at the divisional level, the adjusted EBIT of the Zegna brand was €51.1 million confirming a plus 31% and reaching a margin of 9.2% compared to last year’s six months result. Regarding the Thom Browne label, the division continued to strongly contribute to the group’s overall growth with a 30% increase in revenues to €185.8 million. This was due thanks to the development of all lines, in particular womenswear, and the launch of e-commerce on Tmall in Greater China, which took place in the second half of 2021. The operating profit amounted to €31.6 million with a plus 13% and a margin of 17%.

In detail, the group’s overall performance was driven by the continued strength of the Zegna brand. A result that reflects the success of the Zegna one strategy and the repositioning of the brand’s product lines. Leisure-time luxury footwear and clothing continued to perform well, while tailoring and the made-to-measure segment recovered, particularly in the United States and the EMEA area.

The first half of 2022 also witnessed a strong rebound in the B2B activities of the made-in-Italy luxury textile platform and in the production of third-party brands.

Conclusion and Valuation

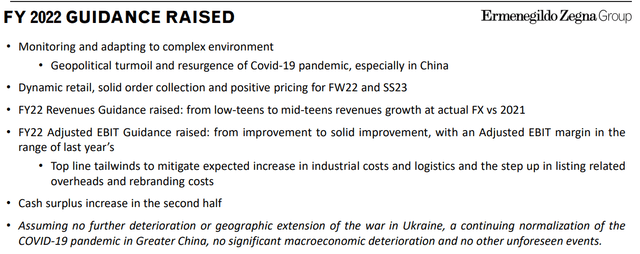

At the geographical level, the second quarter was impacted by the prolonged Chinese lockdown and our internal team expects revenge spending in Q3. Despite the global uncertainties, Zegna confirmed its guidance with the dual objectives of achieving €2 billion in top-line sales and an adj. operating profit of at least 15% (presented during the CMD held at the Oasi Zegna last May). Important to report is also the new partnership signed with the Spanish football club Real Madrid that will contribute to increasing the group’s “visibility to reach millions of fans and expand the number of customers“. Concerning the valuation, the company stock price has barely moved since our last update. Zegna is still trading at a discount compared to its luxury peers so we reiterated our buy rating with a 30% upside against the current stock price. A detailed risk paragraph is also included in our initiation of coverage.

Be the first to comment