pjohnson1

Overview

I believe Yum China Holdings, Inc. (NYSE:YUMC) is still 20% undervalued, and my initial thesis remains the same. I think the market will come to appreciate YUMC’s true worth as long as the company keeps executing and expanding, and the current valuation gives investors a chance to profit from this mispricing.

Performance review

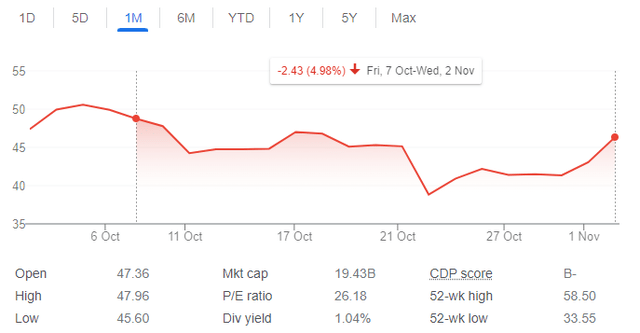

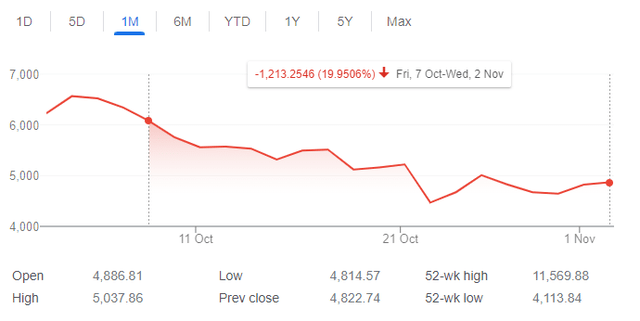

YUMC share price has dropped by 5% since my coverage in early October, which seems relatively alright when compared to how the other U.S.-listed Chinese companies fared. The Nasdaq Golden Dragon China index fell 20% over the same duration.

YUMC stock chart (Google) Nasdaq Golden Dragon China Index (Google)

Earnings review

SSS recovery and store size rationalization

After a low base year caused by the Delta variant, management noticed a sequential SSS recovery in July and August 2022, with August performance exceeding that of the previous year. SSS fell by a mid-single digit percentage in September and continued to face headwinds in October due to the increased enforcement of regulations pertaining to COVID. Suspended stores rose from 400 in July to 1,400 in October.

I’m glad to hear that the majority of this year’s newly opened stores can break even within three months, and that new store performance has remained strong (takes 2-3 years for new stores to ramp up to the mature level). This is solid evidence that YUMC has room to expand. The majority of Pizza Hut and roughly half of KFC locations that recently opened were smaller establishments. This confirms my initial report’s prediction that YUMC’s store rationalization strategy will promote store expansion.

Margin expansion was solid

YUMC’s impressive 3Q22 margins were the result of increased sales leverage brought about by seizing the peak season growth opportunity in July and August, occurring in the context of a stabilizing COVID situation and cost-cutting initiatives. Increases in labor productivity through the sharing of restaurant management teams across stores since the beginning of this year, as well as the use of product innovation to mitigate the effects of rising costs of raw materials, are among the long-term cost-cutting strategies touted by the company’s management. For me, this is where YUMC’s scale pays off. Because of the close proximity of the stores, it is easier to switch between managers (i.e., from 1 manager in 1 store, to 1 manager overlooking 2 or 3 stores).

In addition, in an effort to cut costs, the company is on the lookout for more favorable lease terms and rent flexibility options. The composition of stores shifts as more data is contributed from secondary and tertiary cities, and the impact of small stores on reducing average rent is felt. That’s a financial benefit I failed to mention in my first report: saving money on rent for smaller stores is just one benefit of YUMC’s strategy of rationalizing store sizes; the company also enjoys lower costs as it expands into lower-tier cities.

Some margin benefits, however, are expected to be short-lived, according to management. These include:

- $30 million rent reduction that is unlikely to be repeated in 4Q

- Wage inflation slowed, increasing by only 2% in the third quarter but expected to pick up in the fourth quarter

- Marketing expenses which will inevitably need to be ramped up.

Growth outlook

Third-quarter store growth and exceptional margins didn’t deter YUMC from maintaining its full-year goal of 1,000 to 1,200 net store openings. In light of the current COVID crisis in China, I cannot overstate how unbelievable this is. Management is optimistic about continued strong store expansion despite the uncertain external environment. Also, because there are a thousand KFC restaurants but zero Pizza Huts, management believes there is room for growth in secondary markets where smaller outlets have proven successful.

Cost inflation

Despite some costs being delayed due to the 1-2 quarter lockup period, the company has kept cost inflation in the low single digits as market commodity prices have risen by the mid to high single digits. Management anticipates that additional cost pressures will emerge in the upcoming quarters, and they plan to innovate cheaper products and, if possible, sign longer procurement contracts in order to lessen the impact.

I’ve already mentioned this potential downside, and to be fair, it’s not something over which YUMC has any say. Having the effect reduced to the low single digits is a remarkable feat, and one that management should be proud of. Whatever the case, I would advise to continue monitoring the situation, in case things run out of hand.

Coffee business update

I have not touched on this part of YUMC’s in my report as I thought it has minimal impact to overall value. Moving forward, I would give periodic update whenever there is something worth highlighting. Over the past quarter, after seeing greater potential in K-Coffee and Lavazza, YUMC is winding down COFFii & Joy in favor of those two brands for its coffee business in the current quarter. Currently, Lavazza has 78 locations and is working to expand its brand, menu, digital presence, delivery options, and physical retail footprint.

Model update

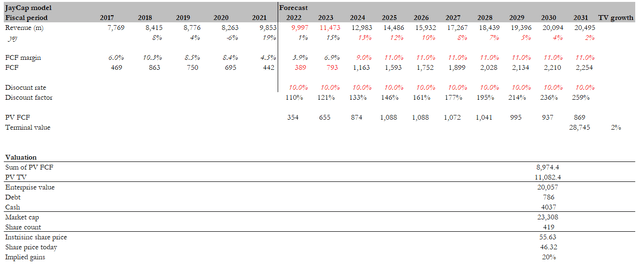

My investment thesis stays intact, I expect YUMC to continue growing by capitalizing on multiple tailwinds and successfully executing its growth strategies. Below are some updates to my discounted cash flow (“DCF”) model:

- Revenue and free cash flow (“FCF”) to follow consensus estimate in FY22 and FY23.

- Mature FCF margin to increase to 11% in FY25 (previous model was 10%). This is to reflect the lower rental cost as YUMC venture to lower-tier cities.

Assuming the aforementioned assumptions and a 2% terminal growth rate, I calculated an intrinsic value of $55, or a ~20% upside over the current Yum China Holdings share price ($46.32).

Red flags

Short-term pressure from raw material cost and wage inflation

As mentioned above, these two are the potential catalyst in the short-term that could hurt the stock. Investors will not like it when YUMC reports margin falling much more than expected.

Conclusion

By investing in YUMC, investors gain exposure to the rapidly growing China quick service restaurant market, which is being driven by consumers’ increasing demand for fast food and Western cuisine. The company is led by competent executives who have previously expanded the chain’s retail footprint and introduced novel uses for locally sourced goods. Growth and expansion, in my opinion, are within Yum China Holdings’ reach, and will serve to fortify the company’s competitive edge and kick-start a self-sustaining “fly-wheel” effect that will propel the company forward at an accelerated rate.

Be the first to comment