bjdlzx

There has been some concern about oil and gas prices given the current situation of trying to cool down an overheated economy. Those concerns are likely to continue for some time. But a company like Yangarra Resources (OTCPK:YGRAF) that managed to post a profit during a challenging year like fiscal year 2020, will sail through a recession.

Fiscal year 2020 was such a challenge for much of the industry that even a lot of integrated companies lost money. One sign of low costs or above average margins is the ability to profit when the industry as a whole clearly does not. That also meant this company avoided the usual impairment charges because profits indicate that costs are what they should be (or lower) no matter whether you are using the United States GAAP or the Canadian (in this case) test for asset values.

Latest Quarter

Yangarra managed to post yet another quarter where the profit margin was “giant”. That is still another sign of unusual profitability.

(Note: Canadian Dollars Unless Otherwise States)

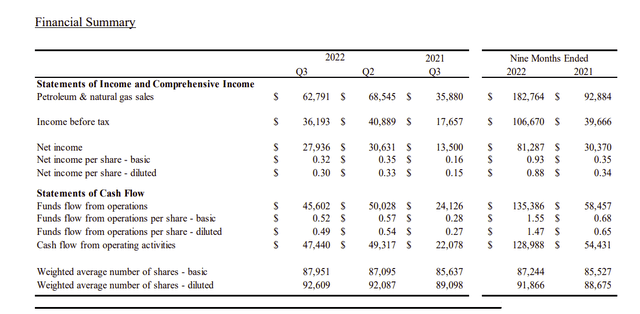

Yangarra Summary of Third Quarter 2022 Results (Yangarra Resources Third Quarter 2022, Earnings Press Release)

Management is clearly sticking with the plan of repaying debt while managing to grow the company. Investors can expect relatively fast growth from this company that will also work to decrease the debt ratio as effectively as repaying debt.

This company produces a fair amount of natural gas in addition to oil and gas production. So, there is incentive for management to begin well production during the heating season when natural gas prices are strong.

In the meantime, management will have repaid about one-third of debt by the end of the fiscal year, as long as the latest management guidance holds. This is one of very few companies that I follow that is digging its way out of the “debt strangulation” caused by the fiscal year 2020 pandemic challenges. The market has not yet rewarded the progress. But that will likely change as the ratios continue to improve.

Why Growth Is A Priority

A company like Yangarra Resources probably needs to grow production to attract the institutional attention that helps the stock price valuation of larger companies. But management is growing production while reducing debt. In fact, in the second quarter, management announced that it has a goal to cut the debt balance nearly in half from the previous levels.

Management kind of backed off from that forecast in the latest quarter. But only because it will not happen this fiscal year. Next fiscal year, management intends to “keep going” to get that debt down to acceptable levels as dictated by the stock market.

Even with the latest commodity price volatility, the current environment has offered (and continues to offer) companies a “once-in-a-lifetime” opportunity to materially improve balance sheets and corresponding debt ratios. Most companies have a priority to do just that, including this one.

Management Experience

A review of the board and management experience indicates that this management (and board) has built and sold companies before. Therefore, production growth will likely overshadow market requirements for shareholder returns in the form of dividends. That strategy is likely to payoff far better.

As more than one CEO put it, if you get your capital back, then you have to reinvest it. But current commodity price levels indicate a satisfactory return on capital far in excess of opportunities elsewhere. This management has the percentage of stock to withstand some market demands that may not be best for the company long-term. That is very good news for shareholders.

There were market fears created from the experience of the period of 2015-2020. A lot of speculative money came into the market (both as debt and capital money) at the market top to “make a killing”. Instead, big losses happen. So now there is a demand for an adequate return, when the problem was investors offering money for deals that should have never been done.

But as usual, “closing the barn door after the horse left” is not a real good strategy. This recovery looks like a typical recovery so far that will last like typical recoveries. Therefore, the current market fears appear to be unwarranted. That may change, of course, but the market often sees ghosts of the past long after the reasons for those ghosts are gone.

Well Profitability

This company has long produced a fair amount of natural gas and liquids in addition to oil. In fact, the percentage of oil produced by a well drops as the well ages. Fortunately, these wells pay back very fast. Therefore, whatever gets produced after the payback is just extra cash flow because this company can often drill a second well with the same capital in the same fiscal year.

(Note: Canadian Dollars Unless Otherwise Stated)

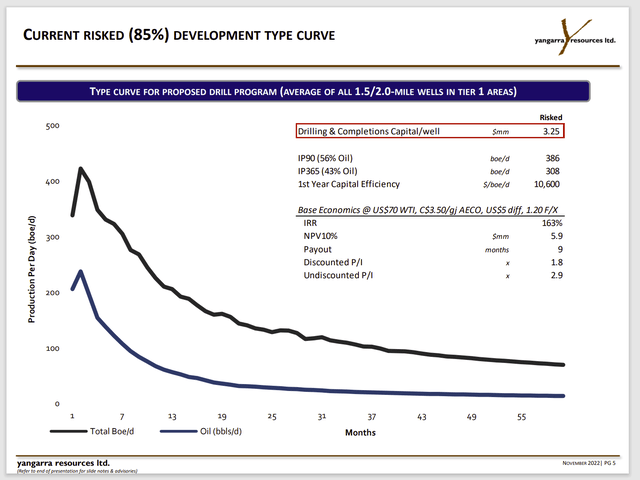

Yangarra Resources Well Performance And Profitability Summary (Yangarra Resources November 2022, Corporate Presentation)

Oil and natural gas prices are currently higher than the conservative assumptions used above. Furthermore, the company often accelerates first quarter development into the fourth quarter to take advantage of strong natural gas prices during the heating season. That acceleration effectively raises the return on those accelerated wells a percentage or two over the life of the well.

Canadian producers often have to stop (or lower) drilling activity during Spring Breakup in the second quarter. That activity restarts when things dry out in the third quarter. That means well drilling and completion activity is normally focused on the fourth and first quarters in Canada. This aides the considerable percentage of natural gas production with an emphasis on using the initial high production of a well during the strong winter pricing.

It should be noted that this company is pioneering the development of a relatively new interval. Therefore, the profitability numbers have changed (mostly downward) as the company gains more information about the interval. But those lower numbers are still comfortably profitable, and the payback is still extremely good. In fact, the payback number is probably extremely important, as that is when the company gets its money back in acceptable fashion. Anytime the payback is less than two years, then generally the well to be drilled is an acceptable risk. In this case, the payback is far less than two years. Therefore, the risk is low and the chance for above average profits remains excellent under a wide variety of potential commodity prices.

Profits

The result of the management strategy and the interval they are exploring is an unusual level of profitability.

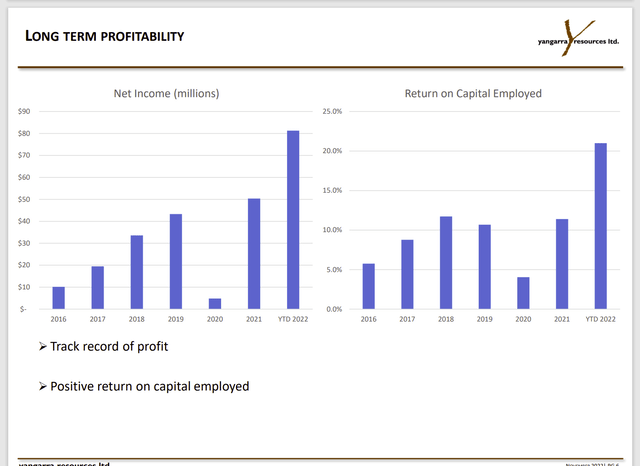

Yangarra Resources ROC and Profitability History (Yangarra November 2022, Corporate Presentation)

The result of the well profitability is a corporate profitability record that is seldom matched. Typically, this type of acreage is not preferred to acreage with a higher percentage of oil production. But the combination of well cost and production characteristics have clearly led to an unexpected level of profitability for this mixture.

That was the case before natural gas prices reached the current levels. Even if oil prices were to decline further, the production costs are very close to dry gas levels. That makes a well that produces significant amounts of oil and natural gas very profitable. The superior profitability is likely to remain a permanent advantage as long as management keeps up with technology advances.

The Future

Management reported more earnings in the first half of the fiscal year than for all of the previous fiscal year. Management is also growing production at a rate seldom seen in this industry. When combined with the debt repayments, this stock offers downside protection that is not common in the industry.

The current price-earnings ratio if the first six months are annualized is less than two in the current environment. A low price-earnings ratio strategy has long paid out superior results to investors, especially when the company is as financially healthy as this one is.

Generally, with cyclical companies, investors can expect the stock price to surpass the previous cyclical peak of $5 plus an amount of inflation as a base case. This management intends to grow production at an average rate of the teens to twenty percent. That is likely to eventually lead to a far higher stock price once the market realizes the superior profitability of this company.

That could take the market some time because acreage that produces natural gas and liquids in the current quantity if often not considered prime (or Tier 1) acreage. The contrarian opportunity is that this acreage has turned out to be far more profitable than is typical. In fact, this acreage if more profitable than many Tier 1 plays I follow. There is every possibility that profitability will continue far into the future. Therefore, I think this stock is likely to lead to unexpectedly large capital gains.

Be the first to comment