Suchat longthara

Buying into pricey companies is generally risky. This is especially true during turbulent times. When investor pessimism runs rampant, the downside for most firms of this nature can be significant. But even though a company’s stock might be expensive, there is no guarantee that shares will pull back like you think they might. A great example of this over the past several months can be seen by looking at Xylem (NYSE:XYL). As a global provider of water technology products, including water and wastewater pumps, filtration offerings, biological treatment equipment, and more, the counterargument would be that stability in the company’s area of operation would warrant share price stability. So far, this latter idea is what has prevailed. But even though the company is continuing to outperform the broader market, I do believe that shares should, moving forward, outperform the broader market until the stock either comes down or fundamentals improve. Because of this, I have decided to keep my ‘sell’ rating on the firm for now.

Unexpected stability

Back in early January of this year, I wrote a bearish article on Xylem. In that article, I talked about how the company’s historical performance had been generally impressive and I felt as though the long-term prospects for shareholders were encouraging. But at that moment, I could not get over how expensive shares were at that time, a feeling that led me to rate the business a ‘sell’ to reflect my view that shares should underperform the broader market for the foreseeable future. Since then, the company has defied my own expectations. While the S&P 500 is down by 16.9%, shares of Xylem have generated downside for investors of only 3.1%.

At first glance, you might think that this kind of return disparity would be warranted based on fundamental performance. But the picture has been surprisingly mixed. To see what I mean, we should dig into how the company has performed during the 2022 fiscal year so far. For the first three quarters of 2022, revenue for the company came in at $4.02 billion. That’s 3.7% higher than the $3.87 billion generated the same time last year. But there are multiple variables here that do need to be taken into consideration for instance, actual organic growth for the company came in at 8.4%, while divestitures impacted sales to the tune of 0.2%. The real pain for the company then came from foreign currency fluctuations, which ultimately hit the company by 4.5%. On the organic side, the greatest strength for the company came from its Applied Water segment. Organic growth here grew by 12.3%, thanks to strength and all three end markets that it operates in, with particularly strong performance across the industrial water applications market. Strong demand and higher prices combined to create this increase. Meanwhile, the Water Infrastructure segment also fared well, posting organic growth of 10.5%. According to management, this was driven by strength in both the utility and industrial end markets, with solid backlog and robust pricing helping out sales.

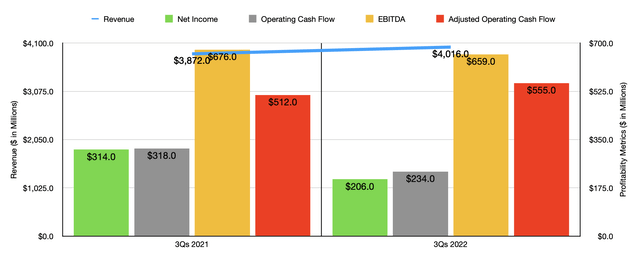

Although revenue increased nicely for the company, profitability struggled. Net income for the first nine months of 2022 came in at only $206 million. That’s down considerably from the $314 million reported one year earlier. Much of this pain came from a decrease in the company’s gross profit margin from 38.3% to 37.6%. Much of this change was as a result of cost inflation and increased spending on strategic investments. An unfavorable product mix also impacted margins to some degree. This came even as the company increased pricing in a manner that otherwise would have risen gross margin by 4.4% and in spite of a 2.3% improvement from productivity savings. Other profitability metrics largely followed suit. Operating cash flow fell from $318 million to $234 million. But if we adjust for changes in working capital, it would have increased modestly from $512 million to $555 million. And over that same window of time, we saw EBITDA worsen, falling from $676 million to $659 million.

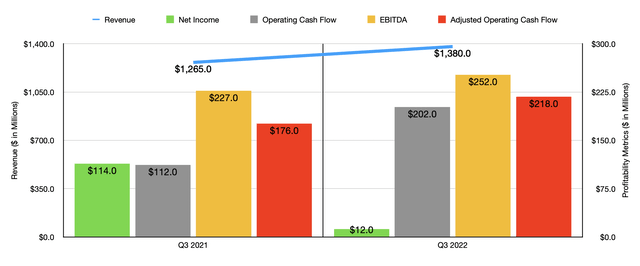

Considering how pricey shares of the company were, it might be a surprise to see this weakening in financial performance and yet not see a corresponding plunge in the company’s share price. However, the most recent data from the company has been encouraging. For starters, revenue in the third quarter alone came in at $1.38 billion. That’s 9.1% higher than the $1.27 billion generated the same time last year. A 15.7% surge in organic growth was somewhat offset by a 0.3% hit resulting from divestitures and a 6.3% impact resulting from foreign currency fluctuations. The strongest growth for the company during this latest quarter came from the Water Infrastructure segment, with organic growth of 19.8% driven by utility and industrial end market demand and pricing increases. And under the Applied Water segment, organic growth was 12.3%, with that increase coming largely from the industrial end market. Although financial data on the bottom line was mixed, it was mostly negative during this time. Yes, net income fell from $114 million in the third quarter of 2021 to only $12 million the same time this year. However, operating cash flow nearly doubled from $112 million to $202 million. On an adjusted basis, it increased from $176 million to $218 million. Meanwhile, EBITDA for the farm rose from $227 million to $252 million.

When it comes to the 2022 fiscal year in its entirety, management expects organic revenue growth of between 9% and 10%. However, actual reported revenue growth should be closer to 4% because of foreign currency fluctuations and divestiture activities. With the EBITDA margin for the company forecasted to be 17%, we should get EBITDA for the year of $918.5 million. Earnings per share, meanwhile, should be between $2.65 and $2.75. At the midpoint, that would translate to net profits of $488.4 million. No guidance was given when it came to operating cash flow. But if we assume that it would change, on an adjusted basis, at the same rate that EBITDA is expected to, we should get a reading of $635.7 million. Touching briefly again on revenue, it will be interesting to see what the future holds. While sales are certain to increase this year compared to last year, order data is coming in rather mixed. For the first three quarters of the year, orders totaled $4.82 billion. That’s up from the $4.72 billion reported the same time last year. But in the latest quarter alone, they came in lower year over year, dropping from $1.52 billion to $1.42 billion. This could be a leading indicator of some weakness ahead.

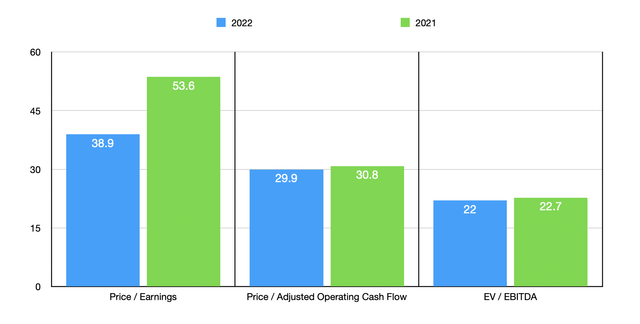

Taking the profitability estimates that we derived, I was able to calculate that the company is trading at a forward price-to-earnings multiple of 38.9. The forward price to adjusted operating cash flow multiple is 29.9, while the EV to EBITDA multiple should come in at 22. To put this in perspective, the results using the data from 2021 would be 53.6, 30.8, and 22.7, respectively. As part of my analysis, I also compared the company to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 5.7 to a high of 32.1. Using the price to operating cash flow approach, the range was from 5.7 to 20.3. And using the EV to EBITDA approach, the range was from 3.6 to 21.5. In all three cases, Xylem was the most expensive of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Xylem | 38.9 | 29.9 | 22.0 |

| Mueller Industries (MLI) | 5.7 | 5.7 | 3.6 |

| Parker-Hannifin (PH) | 32.1 | 16.3 | 21.5 |

| Crane Holdings Co (CR) | 16.0 | 15.0 | 9.9 |

| EnPro Industries (NPO) | 14.3 | 15.5 | 9.0 |

| Standex International (SXI) | 19.6 | 20.3 | 11.3 |

Takeaway

Truth be told, I find myself surprised by the recent share price performance achieved by Xylem. Although results definitely improved in the latest quarter, results for the year as a whole look mixed and order data for the latest quarter was rather disappointing. Shares are definitely cheaper than if the company were to match the same kind of financial performance achieved in 2021. But even factoring in recent estimates, the stock looks rather pricey to me. Due to these factors, I still feel as though a soft ‘sell’ rating is appropriate at this time.

Be the first to comment