Robert Way/iStock Editorial via Getty Images

XPeng (NYSE:XPEV) submitted a mixed earnings card for the third-quarter at the end of November that resulted in the EV start-up missing both on earnings and revenues. The delivery outlook for Q4’22 was a disappointment as well and I see growing headwinds for XPeng’s vehicle margins in a market that may have to deal with a slowdown in consumer demand. Although XPeng has a long term opportunity to grow its market share with an increasingly dense product line-up, my opinion on XPeng is more neutral now than it was earlier, largely because of slowing delivery growth and XPeng’s light delivery forecast for the fourth-quarter!

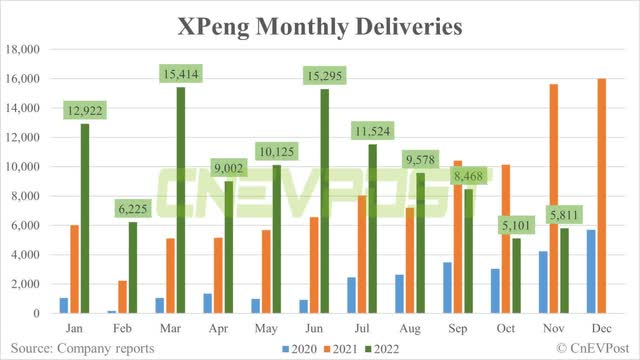

XPeng: Slowest growth in the industry group in November

XPeng delivered 5,811 Smart EVs in November, showing a 62.8% year over year decline in deliveries due to production challenges, weak supply chain links and COVID-19 limitations. In November, XPeng had the slowest month over month growth rate in its industry group — including NIO (NIO) and Li Auto (LI) — with 13.9%. November was also the third straight month in which the company has seen year over year declines in deliveries.

Both NIO and Li Auto delivered significantly more electric vehicles than XPeng in November. NIO delivered more than 14 thousand electric vehicles last month, with growth accelerating especially for NIO’s ET5 and ET7 sedan deliveries, while Li Auto delivered more than 15 thousand EVs to customers.

|

Deliveries |

September |

Sep Y/Y Growth |

October |

October Y/Y Growth |

November |

Nov Y/Y Growth |

MoM |

|

XPEV |

8,468 |

-18.7% |

5,101 |

-49.7% |

5,811 |

-62.8% |

13.9% |

|

NIO |

10,878 |

2.4% |

10,059 |

174.3% |

14,178 |

30.3% |

40.9% |

|

LI |

11,531 |

62.5% |

10,052 |

31.4% |

15,034 |

11.5% |

46.6% |

(Source: Author)

XPeng’s vehicle margins are at risk

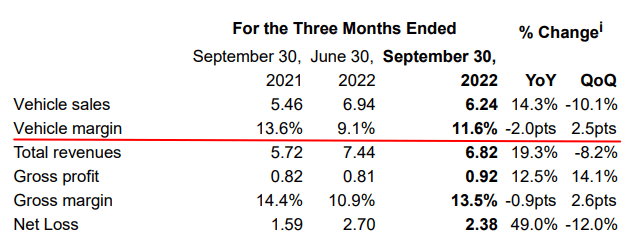

A major issue I see with Chinese EV makers in general relates to vehicle and profit margins. If the former declines, so will the latter and XPeng is already seeing a contraction in vehicle margins due to growing cost pressure from higher raw material prices as well as demand weakness. Slowing demand is potentially a big issue for EV manufacturers because it limits their ability to raise prices and protect vehicle/profit margins.

XPeng’s vehicle margins were 11.6% in Q3’22 and showed a decline of 2 PP year over year. Although there was a 2.5 PP quarter over quarter uptick in margins, it remains to be seen how sustainable the rebound in margins really is. With growth slowing down in China, I worry about potential demand weakness and deteriorating pricing power for EV manufacturers going forward… both of which indicate continual pressure on XPeng’s vehicle (and profit) margins.

Source: XPeng

Light outlook for Q4’22 deliveries

XPeng has guided for deliveries of just 20-21 thousand electric vehicles in the fourth-quarter, implying a 50-52% decline year over year due to continual supply chain problems as well as the production ramp of the company’s all-electric G9 sport utility vehicle.

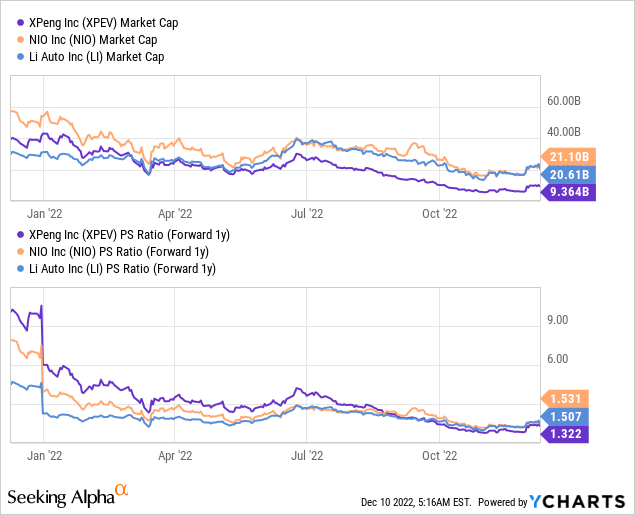

Valuation vs. rivals

All three Chinese EV start-ups I am covering here — XPeng, NIO and Li Auto — have seen much higher sales-based valuation factors at the beginning of the year than they are today. As a slowdown in production growth materialized throughout the second- and third-quarter, however, the market started to reprice the prospects of electric vehicle start-ups. XPeng is now expected to break-even in its operations in FY 2025, meaning investors still have to wait at least 3 years for profits to show up on the firm’s profit and loss statement.

XPeng currently trades at a P/S ratio of 1.3 X and the company is expected to see a big jump in revenues in FY 2023. The average prediction — based off Seeking Alpha-provided estimates — calls for revenues of $7.1B next year, which implies a top line growth rate of 82%.

Other risks with XPeng

There are many risks for XPeng and other EV manufacturers and they include the supply chain, higher raw material costs, contracting vehicle margins, slowing consumer demand for EVs and production challenges, especially regarding the G9 SUV which is the latest EV product that is ramping up for XPeng. Additionally, investors are no longer excited about EV companies which could, at least in the short term, limit the sector’s valuation potential. What may also continue to weigh on the sector is that most EV companies have significant factory output and delivery volumes, but most companies, including XPeng, are not profitable yet.

Final thoughts

I like XPeng and the company’s electric vehicle products. The product lineup is getting more dense and XPeng has a strong opportunity to participate in the growth of the EV sector in China long term. However, I believe that the firm is set to grow much more slowly in the future than it did during the pandemic. With inflation and costs remaining a top issue for EV companies, I expect pressure to build on XPeng’s (and the sector’s) vehicle margins. Considering that XPeng also issued a very light outlook regarding deliveries in the fourth-quarter, I see XPeng as a long-term hold!

Be the first to comment