RGtimeline

The dip in the units of Energy Transfer (NYSE:ET) creates a new investment opportunity for dividend investors. Energy Transfer generates stable and predictable cash flows from its pipeline and storage assets and the midstream business solidly covers its distribution with cash flow. Additionally, Energy Transfer most recently raised its adjusted EBITDA guidance for FY 2022 again. With units now trading at a lower valuation, I believe Energy Transfer has a favorable risk profile as well as a very attractive distribution yield!

Enterprise Transfer and the value of stable and predictable cash flows

The number one reason why income investors would want to own midstream firms right now is because producers are currently confronted with a down-ward repricing of energy products. The price surge in petroleum and natural gas has led to record profits for producers this year – especially in Q2’22 and Q3’22 – but WTI prices are consolidating and have recently fallen to $71 a barrel, marking a draw-down of approximately 45% after topping out above $130 a barrel in March.

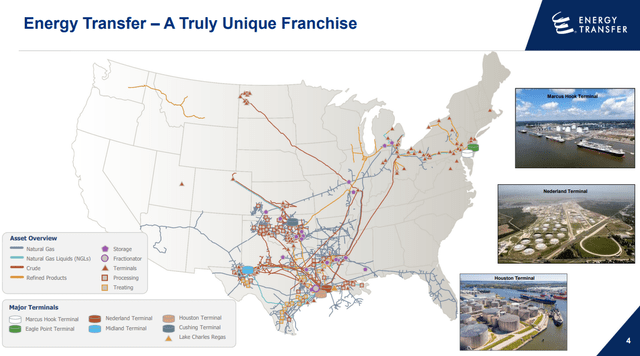

While producers are therefore facing lower revenue and cash flow prospects in the near and medium term, midstream firms like Energy Transfer don’t have this problem. Midstream companies own and operate large pipeline systems as well as storage facilities across the US to help producers get their product to market… and they charge them a fee for doing so. Energy Transfer is a diversified energy company with 120 thousand miles of pipelines (crude oil, natural gas, NGL and refined products) and storage infrastructure across the US.

Energy Transfer typically charges its customers transportation and storage fees for their energy products. Energy Transfer’s fee-based revenue streams are much more predictable and stable than the revenue streams of producers which, despite hedging, largely depend on the general direction of market prices.

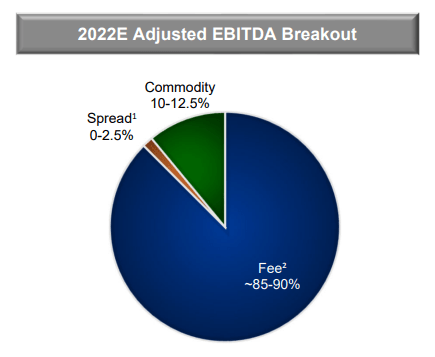

According to Energy Transfer’s projections for FY 2022, the midstream firm expects to generate 85-90% of its adjusted EBITDA from fees this year.

Source: Energy Transfer

The value of predictable cash flows and a high distribution coverage ratio are usually revealed during periods of heightened uncertainty, falling markets and declining energy prices.

Energy Transfer’s adjusted EBITDA and (adjusted) distributable cash flow increased about 20% in Q3’22 due to strong operational performance in the midstream segment where gathered volumes increased 47% year over year. Energy Transfer generated $1.58B in distributable cash flow in the third-quarter which translated to a distribution coverage ratio of 1.93 X. Energy Transfer’s distribution, I believe, should therefore be safe even if energy prices continue to drop into a prolonged, cyclical down-trend.

|

$millions |

Q3’21 |

Q4’21 |

Q1’22 |

Q2’22 |

Q3’22 |

Y/Y Growth |

|

Adjusted EBITDA |

$2,579 |

$2,811 |

$3,340 |

$3,228 |

$3,088 |

20% |

|

Distributable Cash Flow For ET Partners |

$1,306 |

$1,440 |

$2,066 |

$1,869 |

$1,576 |

21% |

|

Transaction Adjustments |

$6 |

$160 |

$12 |

$9 |

$5 |

-17% |

|

Adjusted Distributable Cash Flow |

$1,312 |

$1,600 |

$2,078 |

$1,878 |

$1,581 |

21% |

|

Distributions (Limited And General) |

$414 |

$541 |

$618 |

$710 |

$819 |

98% |

|

Distribution Coverage Ratio |

3.17 X |

2.96 X |

3.36 X |

2.65 X |

1.93 X |

– |

(Source: Author)

Raised EBITDA guidance and valuation

Due to resilient core operating performance in the third-quarter, especially in midstream, Energy Transfer raised its EBITDA outlook a third-time this year to a new range of $12.8-$13.0B, showing an increase of $200M at the both the bottom and the top end relative to the firm’s earlier guidance.

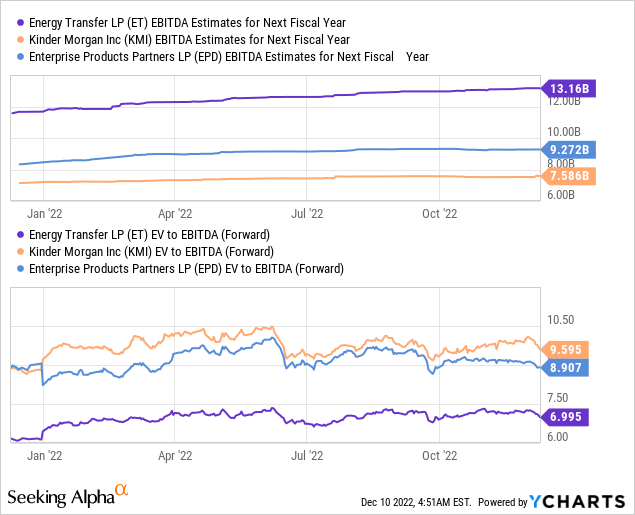

After the dip that has occurred in the market in December, Energy Transfer’s units are now valued at about 7.0 X forward EBITDA ($13.2B), which is an attractive multiplier factor to pay for a covered 9.3% distribution yield. The midstream also has a valuation advantage compared to Kinder Morgan (KMI) and Enterprise Products Partners (EPD), which have EV/EBITDA ratios of 9.6 X and 8.9 X.

Risks with Energy Transfer

Energy Transfer’s main commercial risks don’t relate, I believe, to a contraction in transportation volumes. The biggest risk, as I see it, relates to the regulatory environment which is currently not supportive of the energy industry as a whole. Regulatory restrictions could hamper the long-term growth opportunities of the midstream sector and therefore affect the degree to which Energy Transfer could grow its distributable cash flow and distribution.

Final thoughts

I can’t help but like the midstream sector now, chiefly because I believe producers are going to see dramatically lower revenues and free cash flows going forward. This is because energy prices rose steeply earlier in the year, but are now in a phase of consolidation. Midstream firms like Energy Transfer, however, typically enter into fee-based contracts which results in predictable cash flows and very limited market price risk. Considering Energy Transfer’s raised EBITDA guidance for FY 2022, strong distribution coverage of 1.93 X and a competitive valuation based on EBITDA, I believe Energy Transfer is in an attractive buy the dip situation!

Be the first to comment