Bet_Noire/iStock via Getty Images

Investment Thesis

The Consumer Staples Select Sector SPDR ETF (NYSEARCA:XLP) provides access to some of the world’s largest consumer staples companies. Over the last ten years, the ETF has underperformed relative to the broad market but has overperformed since the start of the current bear market. I believe that it is too late to invest now, even if it is only a short-term speculative investment, as the valuations of the top holdings are already too high and, in my view, we are close to a Fed tipping point, after which tech stocks are likely to outperform.

ETF Overview

The ETF has a low expense ratio of 0.11% and consists of only 35 holdings. The top ten stocks already make up 70% of the ETF, and the top four stocks 45%. Nevertheless, the ETF can be considered diversified, as the top stocks are very diversified regarding their geographic activity and product offering. Most of the companies are active worldwide and offer everything to satisfy people’s basic needs.

Valuation

Valuation is generally more difficult with an ETF and plays less of a role due to the broad diversification. However, if the top five stocks make up 50%, as is the case here, it is worthwhile to look at them. I think three key figures are sufficient for a rough overview: Forward P/E ratio, annual revenue growth over the last five years, and dividend yield.

| Forward P/E ratio | Revenue growth p.a. last five years | Dividend yield | |

| PG | 25 | 4% | 2.5% |

| PEP | 27 | 5.6% | 2.5% |

| KO | 25 | 2.6% | 2.8% |

| COST | 36 | 12% | 0.7% |

| WMT | 25 | 4% | 1.5% |

All stocks have high P/E ratios, little growth, and a medium-high dividend yield. Which stocks you should invest in as an investor also depends strongly on your own goals, what age you are and how much risk you are willing to take. For investors who already have a lot of capital and are especially concerned about protecting it, an investment in such companies or this ETF makes much more sense than for younger investors who are willing to take more risk.

Performance

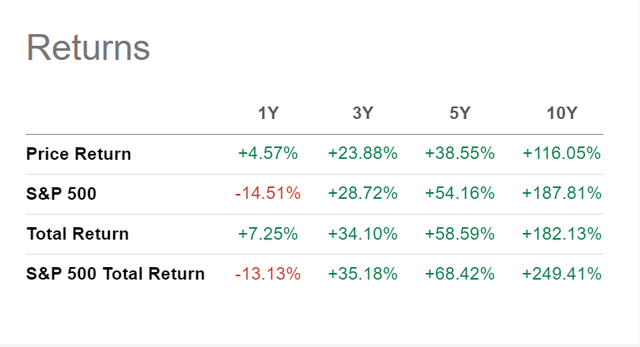

The historical performance and EPS growth is composed of not only on revenue growth but also buybacks. So we can see that the historical performance over ten years is worse than the S&P 500, but not much worse. Over the last three years, the performance has been the same, and for the previous year, there has been a significant outperformance. Tech has been sold off, and safe stocks have been more in demand.

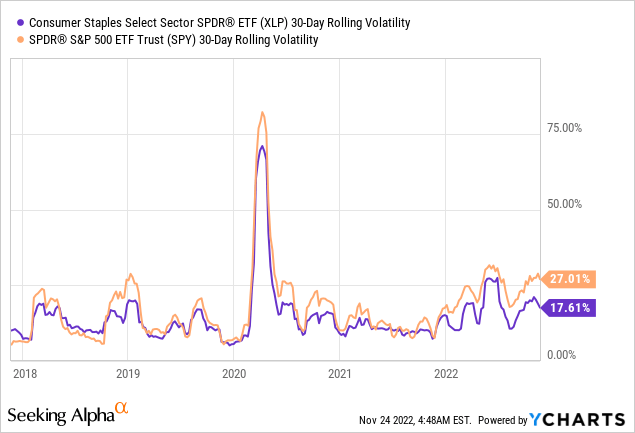

The current dividend yield is 2.4%, and the increase over the last five years is, on average, 4.5%. The average volatility is significantly lower. This is particularly evident in phases of generally high volatility, such as the 2020 crash and since the beginning of 2022.

A possible Fed tipping point

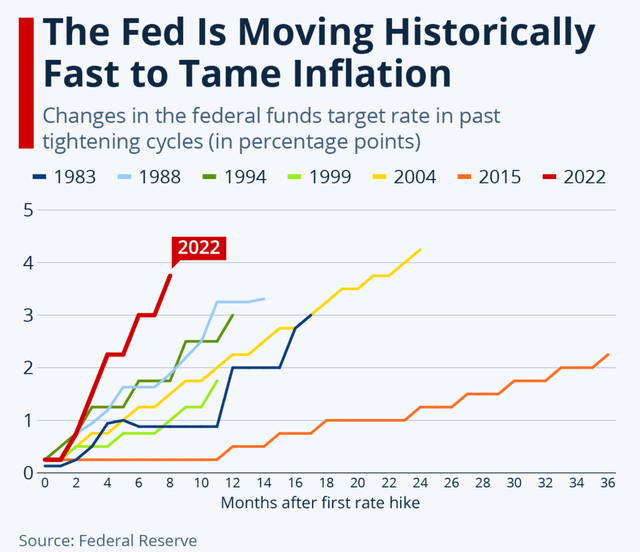

The interest rate hikes of the last few months were not the highest, but they were very fast in terms of speed. The voices in the market and the Fed are getting louder, warning that this speed should be slowed down significantly to wait and see the effects first and not burden the economy unnecessarily. In other words, the market and the economy need time to adjust to the new conditions.

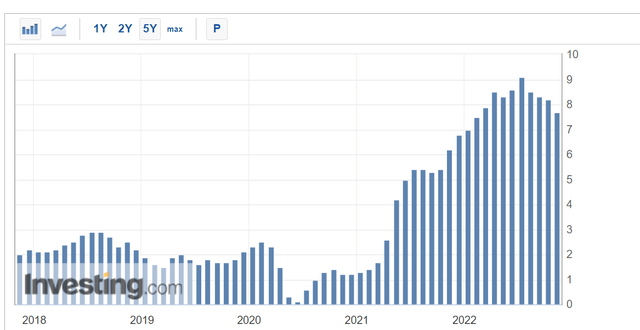

Further rapid interest rate hikes could cause unemployment to rise too sharply, as this is a lagging indicator. Recently, there have been more and more reports that companies are planning layoffs. Goldman Sachs also warns that inflation will fall significantly in 2023, which is very likely due to the base effect alone. The Consumer Price Index is still high but peaked in July and has been falling ever since.

All in all, there is a lot to suggest that we have already seen the peak of inflation and that next year the main topic will no longer be inflation but economic downturn instead. However, it is unclear whether this will result in constant or falling interest rates. But the time of sharply rising interest rates should at least be over very soon.

Conclusion

Perhaps the Fed will raise interest rates a few more times, but with the recession looming, the peak is likely to be reached relatively soon. As soon as that happens, the outperformance of consumer staples versus the broad market will most likely stop. Especially since the extremely high valuations of the vast majority of tech companies have now been reduced, they are now becoming more and more attractive to invest in. When money becomes cheaper, tech stocks will probably start to outperform again. Therefore, I believe that an investment in this ETF is too late by now. But if you want to park your money safely before the next bear market, you can keep this ETF in mind.

Be the first to comment