David Ramos/Getty Images News

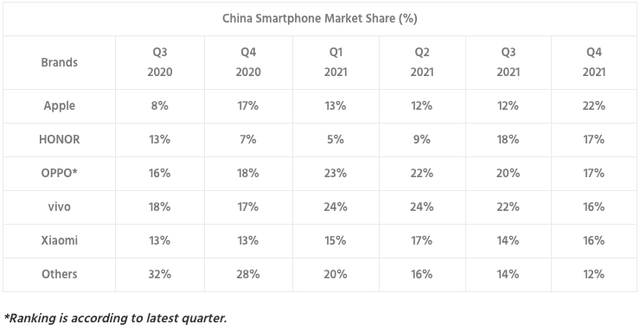

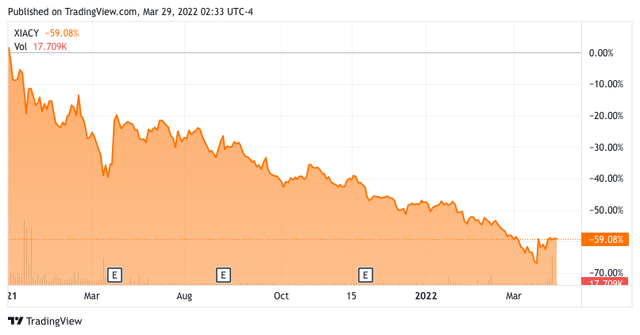

A series of headwinds have forced Xiaomi Corporation’s (OTCPK:XIACY) (OTCPK:XIACF) stock to decline steadily over the past year or so. As of this writing, Xiaomi is trading at a near-60% discount to the all-time high set in January 2021. Among the major headwinds were the U.S. ban, which was subsequently lifted, the global chip shortage, which Xiaomi expects will ease up and possibly “even revert in the second half of 2022,” and a slowly declining China market share that also appears to be exhibiting a reversal – or, at the very least, an upswing – based on the latest quarter.

Now that the majority of headwinds have either let up or are on the verge of doing so, the current price looks quite attractive. That said, what are the underlying numbers that justify a bullish long-term outlook for the stock?

There are several key points that highlight the strength of the company’s performance and business model as well as the abating headwinds, the combination of which should positively impact stock price over the long haul.

Thesis

The strongest indicators of any company’s future prospects, in my opinion, come from the core data around revenue trends. At the risk of sounding simplistic, as long as the sales graph keeps pointing upward, nearly any other hurdle can be overcome with the right mix of pricing power, margin management, astute cash management, prudent capital allocation, a focus on investor returns, and expanding and extending the growth runway for the company’s products and services. Xiaomi seems to check many of those boxes, and their combined effect on the stock will be amplified or leveraged by strong revenue growth.

However, the stock’s movement over the past year or more has been in a direction that’s contrary to what such logic might dictate. Understandably, the headwinds mentioned earlier were responsible for this steady decline, but that has now bloated and solidified into overcautiousness on the part of the market; more important to the thesis of this article, however, it has opened up a potentially lucrative window of opportunity for long-term investors looking to cash in on China’s dominance over the global smartphone market, Xiaomi’s strong position therein, and other factors that will support ongoing growth.

Long-term and Recent Revenue Growth Trends

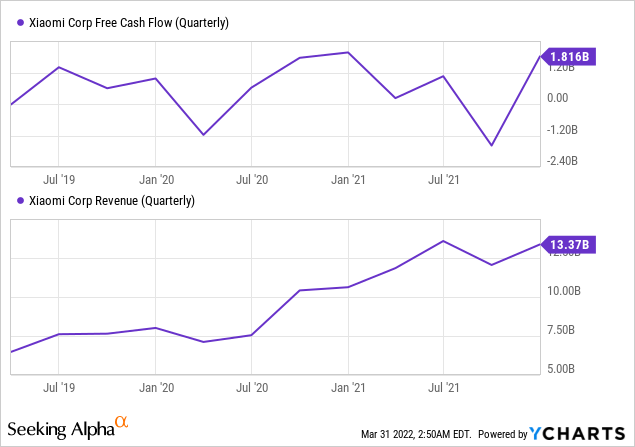

Let’s take a look at how revenue trends have shaped up over time, beginning with historical revenue growth and ending at the latest reported quarter, or Q4-21.

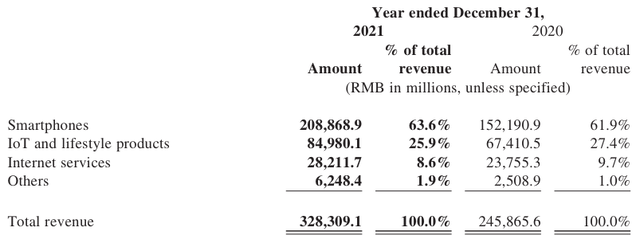

Despite Trump-era headwinds that saw Xiaomi’s revenue growth slow down from 68% in FY-17 over FY-16 down to 18%-19% in FY-19/FY-20, Xiaomi kept growing its sales in double-digit percentages. Revenues grew from RMB67 billion in FY-15 to RMB328 billion in FY-21, representing an impressive CAGR of +30% over that period.

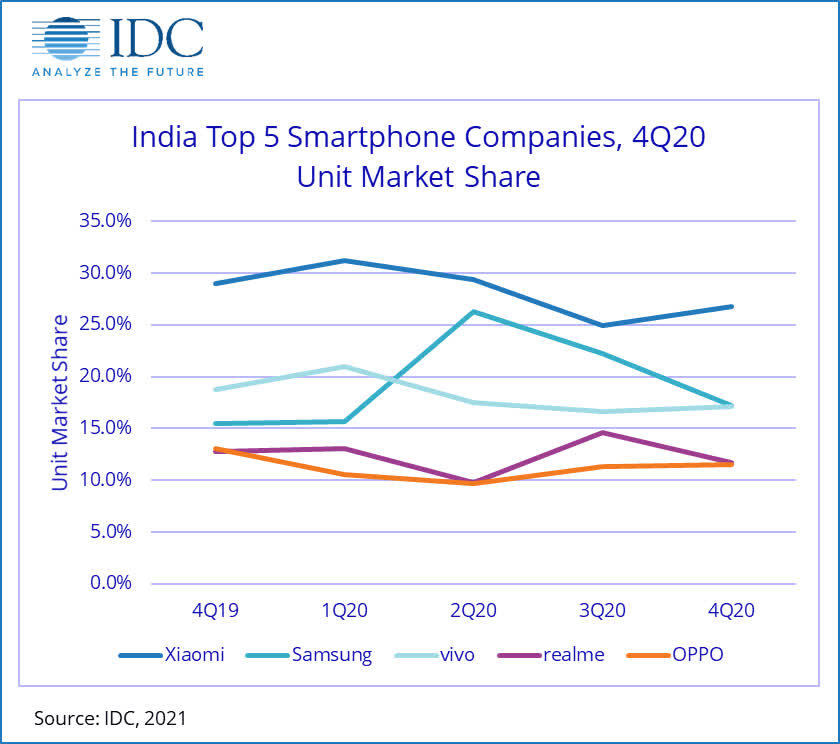

A lot of support for this growth came from non-US markets, particularly China and India, where Xiaomi smartphones (the largest revenue segment contributing +60% to overall revenues) now either hold a leading position or are among the leaders by market share.

IDC

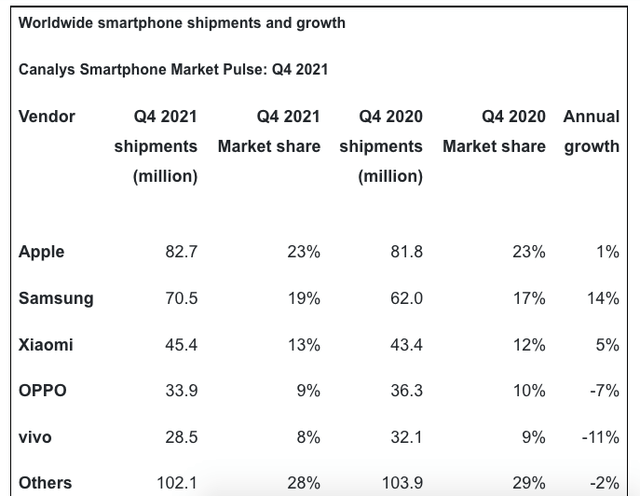

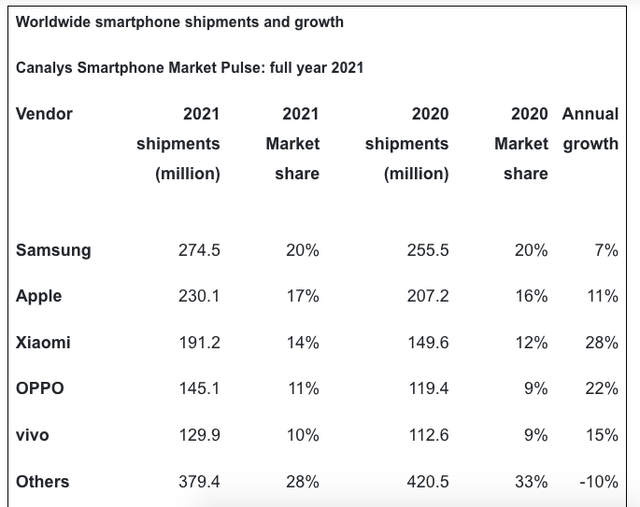

Data from Canalys shows Xiaomi as the #3 smartphone vendor by shipments both globally as well as in China as at the end of Q4-21 and FY-21, its position relatively unchanged from the prior periods and showing stronger growth than the majority of smartphone brands.

Per Xiaomi’s President and Partner Wang Xiang at the Q4-21 earnings call last week:

As we continue to expand globally, we ranked number one in 14 markets and Top 5 in 62 markets in the year. In particular, we ranked number two in Europe with a market share of 23% and retained our number one position in Spain for two consecutive years and the number one position in India for 17 consecutive quarters.

Going back to our revenue growth story, the smartphone segment wasn’t the only one pulling its own weight. Emerging as able support pillars are the IoT and lifestyle products segment comprising smart TVs, tablets, and laptops, which now contributes a quarter of overall revenues, and the high-margin (Gross profit margin of 74.1% in FY-21) Internet services segment comprising advertising and Internet services revenues.

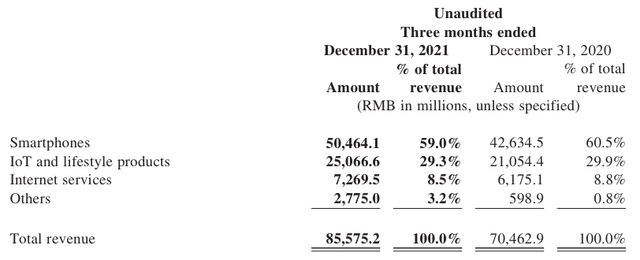

Overall, historical growth has been very strong, with the latest quarter validating this. In Q4-21, revenues grew by 21.4% overall compared to the prior period, while annual revenues grew by 34% on a similar basis.

As I mentioned earlier, strong revenue growth can be complemented by several other factors to help a stock gain upward momentum. That hasn’t happened yet in the case of Xiaomi Corp., but the supporting pillars are very much present, as outlined below.

Pricing Power and Product Mix

In addition to higher sales volumes across Xiaomi’s reportable segments, the company also reported ASP (Average Selling Price) increases for smartphones and smart TVs. The smartphone segment typically sees aggressive pricing practices, so Xiaomi’s ASP increases primarily come from a product mix shift toward premium smartphones. Nevertheless, the higher demand for premium products over mid-range and budget models clearly favors Xiaomi’s growth trajectory. Smart TV ASP increases have also contributed to this, albeit in smaller measure. This translates to ongoing pricing power as these trends continue.

Margin Management

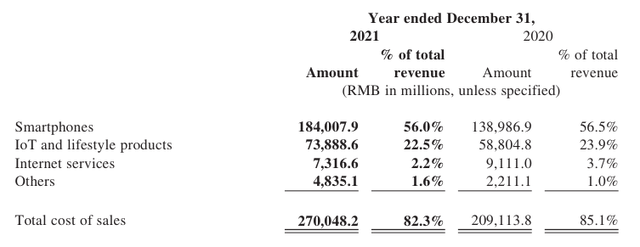

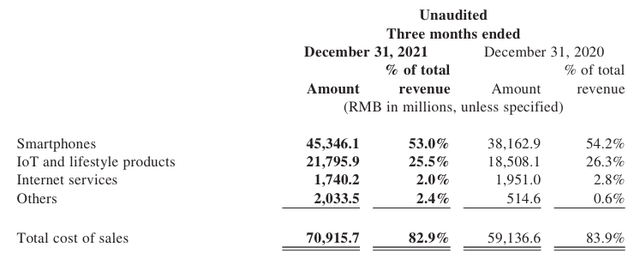

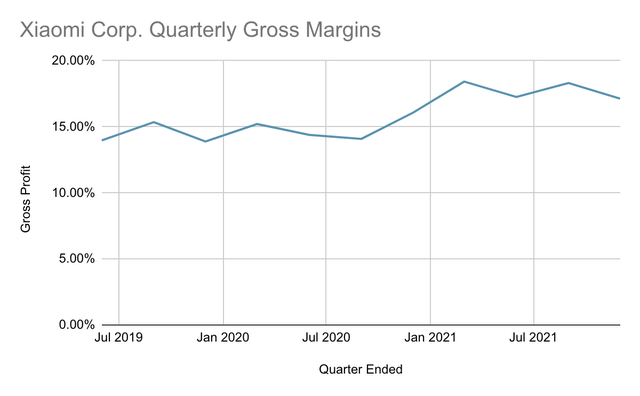

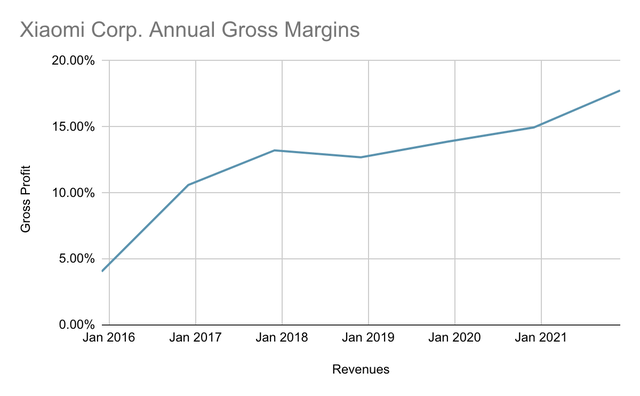

Xiaomi follows a strategy that ably supports the growth of its largest segment. The company’s aggressive pricing of its core products – smartphones – is offset by higher margins in other growing parts of the business, such as IoT and lifestyle products, and Internet services, as seen in the comparative data for FY-21 and Q4-21 below. This is particularly true of the Internet services segment but also applies to the IoT and lifestyle products segment.

FY-21

Xiaomi Corp FY-21 Annual Report Xiaomi Cost of Sales by Segment – FY-21

Q4-21

Xiaomi FY-21 Q4-21 Filing Xiaomi Corp FY-21 and Q4-21 Reports

This margin dynamic is further leveraged by the increase in total sales on the back of higher volumes and higher ASPs, with the result that Xiaomi has been able to expand its gross profit margins over time.

Furthermore, we see that this trend is even more pronounced when you look at a longer timeframe.

This increased leverage also allowed Xiaomi to spend more on R&D (up by 42.3%) and Selling and Marketing (up by 44.3%) without sacrificing bottom-line profitability (adjusted net profit up by 69.5%) for FY-21.

In other words, the proportionate increase in premium smartphone shipments compared to total smartphone shipments and the strong growth in higher-margin segments have joined forces to give the company increasingly higher operating leverage over time. This sets the cycle to repeat itself through the gains made from increased R&D and sales and marketing expenditure.

Capital Allocation and Returning to Investors

In FY-21, the company reported an R&D expenditure of RMB13.2 billion against RMB9.3 billion in the prior period. It also stepped up its sales and marketing expenditure from RMB14.5 billion in FY-20 to RMB21 billion in FY-21. As we saw, these line items have already been levered by topline growth with no material negative impact on bottom-line profitability, and continued strong revenue growth over subsequent quarters and years will ideally help the company bolster these metrics even further. Over the five-year period from FY-22 through FY-26, Xiaomi plans to spend over RMB100 billion in R&D toward fulfilling its ‘premiumization’ agenda for the smartphone segment.

Additionally, Xiaomi is actively engaged in acquiring synergistic and forward-looking businesses, which includes the step-up acquisition of Zimi, a smartphone accessories manufacturer, and the acquisition of Deepmotion, a self-driving car technology startup. While the Zimi move will help expand the smartphone ecosystem of accessories, the Deepmotion acquisition will further Xiaomi’s agenda to begin mass production of smart electric vehicles by the first half of 2024. The reported total consideration for these purchases was approximately RMB1.9 billion.

While Xiaomi does not pay a cash dividend, it does repurchase shares listed on The Hong Kong Stock Exchange Limited. Through FY-21, the company repurchased a total of approximately 358 million shares at an aggregate consideration of approximately HK$8.7 billion.

Investor’s Angle

From a financial standpoint, Xiaomi Corporation is on a reasonably sound footing. A quick look at the balance sheet as at December 31, 2021, shows adequate liquidity to pursue its capital allocation agenda, with current assets of RMB186 billion against current liabilities of RMB116 billion.

The long-term debt to equity ratio of around 15 indicates significant leverage but is ameliorated by increasing free cash flows and strong revenue growth over the past two to three years.

In terms of valuation, Xiaomi’s price to TTM GAAP earnings multiple indicates significant value here at the current figure of around 15 against the sector median of 29. That has largely been brought about by the loss of market cap over the past five quarters since the start of Q1-21 that we discussed earlier.

Moving forward, prudent cash management is the need of the hour because it will allow the company to keep investing in its current business while exploring synergies to support new initiatives such as self-driving car tech. Meanwhile, the gains from topline growth are being managed well to support the management’s capital allocation strategy in the short to medium term.

The risk of investing in Xiaomi stock primarily comes from the ongoing supply chain constraints and general political uncertainty. Nevertheless, if you can see past those macro headwinds, which have now subsided or are on the verge of doing so, the current price likely represents an excellent window of opportunity in the long run. Xiaomi is cementing its position as one of the dominant players in the global smartphone space, it is investing heavily in premiumization, and also exploring new product segments to support the long-term growth narrative.

The prolonged period of decline for the stock may not be over yet, and cautious investors may want to take a wait-and-see approach. However, going by the current performance and fundamentals, as well as the easing up of macro headwinds, it would appear that the bottom is near. That could well translate into a rapid price return on a solid stock that the market is overly cautious about.

Be the first to comment