timy1973/iStock via Getty Images

Intro

It will be interesting to see if shares of Xerox Holdings Corporation (NASDAQ:XRX) can make a comeback after the company announced a disappointing set of third quarter earnings numbers on the 25th of October. Xerox shares fell sharply in the wake of a non-GAAP EPS Q3 print of $0.19 and revenues of $1.75 billion. Both the top and bottom line reported numbers missed estimates with the company’s profitability or lack thereof being punished by investors at large. XRX shares ended up down 14%-plus for the day but the magnitude of the intra-day decline was much worse as shares fell below $12 a share immediately after the numbers were announced.

Our last commentary on Xerox actually pointed to this problem when we recommended that investors began to look beyond the attractive dividend yield on offer. The above recommendation is even more revealing now as, despite Xerox´s challenges with respect to its profitability, management has committed to the $1 per share dividend which means the prevailing dividend yield now surpasses 7%.

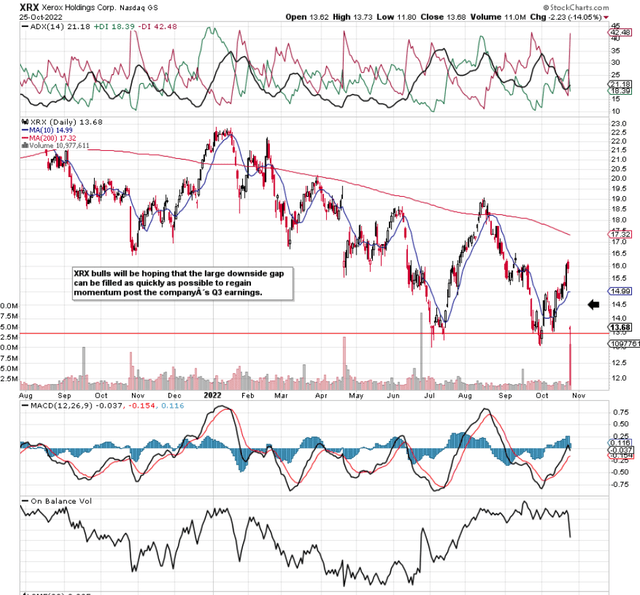

Now all eyes are on whether that downside gap can be filled in upcoming sessions and whether support can essentially be regained. If it can’t, and taking into account the heavy selling we witnessed yesterday, Xerox shares will most likely trend lower in the near term. Here are pointers (Worries regarding free cash flow and gross margin) as to why selling intensified in Xerox post the company´s Q3 earnings.

Xerox Technical Chart (Stockcharts.com)

Xerox’s Free Cash Flow

Free cash flow came in a negative ($-18 million) in the third quarter which was a substantial $99 million drop over the same period of 12 months prior. The annual FCF outlook as a result comes in at $125 million which again is a sizable drop from the previous $400 million estimate. Traditionally Xerox has been able to generate both sizable and consistent levels of free cash flow so this in one way is a change from the ordinary.

This drop obviously has ramifications for the dividend. With roughly 155 million shares outstanding, the annual estimate as we stand for the dividend payment is roughly $155 million. Obviously, this is not sustainable but management believes the extra cash being tied up in working capital as well as the commitment to the operating lease growth at FITTLE will ultimately bear fruit. This is why the fourth quarter number will be very interesting especially on the inventory side to see indeed if higher revenues can be realized.

Gross Margin

In a company like Xerox where both operating and gross margins trail the sector medians by some distance, preserving profitability is an absolute must. Unfortunately, Xerox’s gross margin dropped 60 basis points in Q3 due to an array of reasons. Poor availability of equipment and higher costs of goods sold were a double-whammy in the quarter. Furthermore, both the geographic mix as well as the product mix did not play in the company´s favor. On the geographic front, for example, sales can remain strong as you like but if the Euro and British Pound continues to weaken, then realized sales prices in these regions will be lower all things remaining equal.

Again, the bulls will be looking to the fourth quarter for much improved results with respect to gross margin. Management reiterated on the recent Q3 earnings call that supply chain headwinds are expected to continue to ease with geographic and product mix coming more into the company’s favor. The reason why gross margin is so important is that it’s very difficult to amend operating costs, taxes, and interest expenses in order to report sustained profits on the income statement. Although the lion’s share of the company’s debt is fixed, the company will have to refinance for cash flow purposes. On the costs side, Project Own has been a success with the savings it has produced but now this initiative is coming under pressure due to the above-mentioned operating costs increasing more than originally expected.

Conclusion

Suffice it to say, it’s certainly not a question of a “one-size-fits-all” solution for Xerox. To get the momentum back, we need to see some type of stability with respect to forward-looking sales. At present, the approximation is roughly $1.84 billion for Q4 in sales but this estimate has lost some ground over the past 30 days or so. Therefore, remaining bearish until we see a change in trend. We look forward to continued overage.

Be the first to comment