curraheeshutter

High insider ownership is generally considered a positive for shareholders, as it aligns their interests with managements’. However, sometimes shareholders are seeking regular return of capital to them, while management is focusing on the long-term stability of the company and its expansion. Such situations are often leading to great companies being underappreciated and outright rejected, due to the lack of dividends and/or share buybacks, regardless of the long-term prospects. I believe this is the case with W&T Offshore (NYSE:WTI). Insider ownership in the company is amongst the highest in the energy sector, yet the there is no capital return to shareholders as of now. Instead, management has been deleveraging and focusing on expansion opportunities. Despite the great 2022, short interest has been climbing, while the estimated NPV of only the proven reserves indicates 84% upside to the current share price. Overall, while the company doesn’t seem a good fit for income oriented investors, I believe that long-term shareholders could be rewarded nicely from potential significant share price appreciation.

Company overview

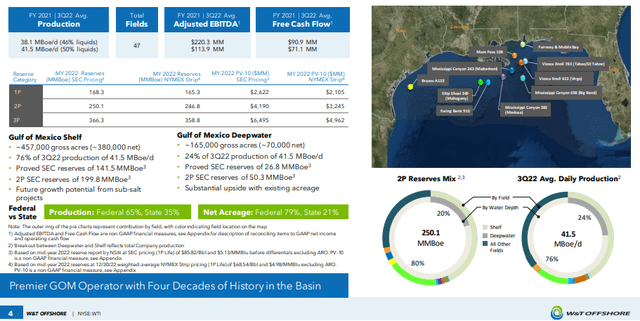

W&T Offshore is a US oil and gas company with interests in 47 fields covering 669k acres in the Gulf of Mexico. The company has been operating in the area for nearly 40 years, making it an industry veteran. While currently production is pretty much evenly split, in terms of 2P reserves Natural has accounts for 58.1%, while liquids fill the remaining 41.9%.

Long-term focus

One of the characteristics that make WTI unique is the high insider ownership of 34% as the CEO Tracy Krohn owns more than 1/3 of the 143.2M shares outstanding. Presumably, this should align his interest with that of shareholders.

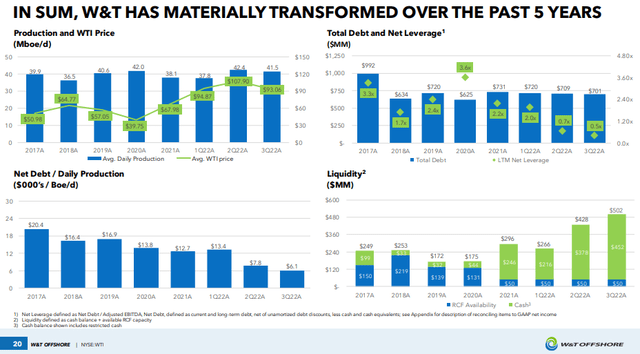

WTI’s 5 year highlights (‘WTI’)

However, the high insider ownership doesn’t automatically transfer into substantial dividends as in fact the last distribution to shareholders was made in 2014. Instead, management has been utilizing capital with a long-term view focus. While in the past 5 years, production has been fluctuating around 40kboe/day, the financial condition of the company has greatly improved going from net debt of almost US$900M to US$254.3M in Q3’22.

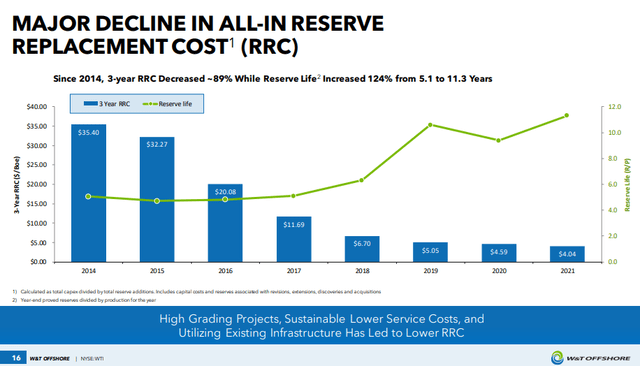

Reserve life and replacement costs (‘WTI’)

Also, since 2014, the reserve life has doubled, going from around 6 years to 12 with significant reduction of reserve replacement costs in the meantime.

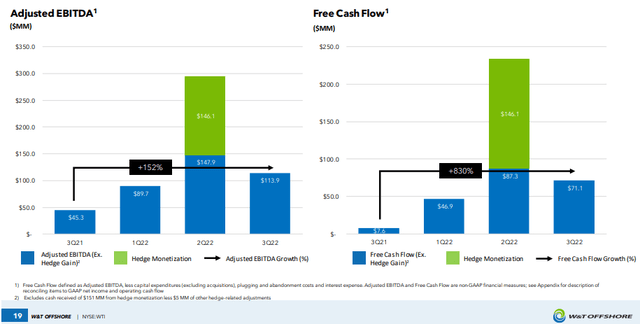

Strong cash flow generation and deleveraging

2022 has been a truly remarkable year for WTI as it generated FCF of over US$350M in the first nine months alone. It has to be noted that this figure includes a US$146.1M from hedge monetization as management opportunistically took advantage of the natural gas prices spike in Q2’22 and readjusted the weighted average price of its call options on the commodity from US$3.78/Mmbtu to US$7.48/Mmbtu.

In the beginning of 2023, management took the decision to redeem its 9.75% Notes due in November 2023, which had principal of US$552.5M, with a mixture of cash and new debt. The latter is due in 2026, has a principal of US$275M and is priced at 11.75%. While nominally the rate on the new debt is higher, it has to be noted that the all this is happening in a rapidly raising interest rates environment. Still, the move is a net positive for WTI as I estimate the annualized cost savings of the deleveraging to over US$17M, which will be eventually added to the bottom line.

| Principal (US$M) | Rate | Interest expense (US$M) | |

| 2023 Notes | 552.5 | 9.75% | 53.9 |

| 2026 Notes | 275 | 11.75% | 32.3 |

| Savings | 21.6 | ||

| Marginal tax rate | 21% | 4.5 | |

| After tax savings | 17.0 |

In light of its improving financial position, WTI had its rating upgraded by Moody’s to B3 from Caa1 with a stable outlook.

Expansion opportunities

In the Q3’22 earnings call, there was no mention of initiating a shareholder return program like many other oil and gas companies did. Instead, management will continue to focus on deleveraging and expansion, as indicated by the CEO:

I think it’s been a very good quarter for us. I’m looking forward to the rest of the year and the years after that. I like the way the company looks right now with our balance sheet and it feels good to be in a position where you can pay off all the debt as well or carry it further into the future with a modest amount of debt and leverage by making accretive acquisitions.

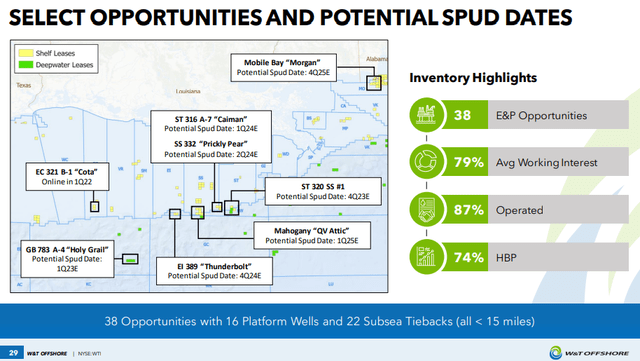

Organic growth opportunities (‘WTI’)

However, WTI seems to have considerable organic growth opportunities as well. One of the most exciting is the so-called Holy Grail well in the Magnolia field. It’s expected to be spudded in Q1’23 and the company has been accumulating long-lead items for the project with total CAPEX expected to come at US$80M. According to the CEO, the successful execution of this project could lead to “very large” production increase in H2’22.

Valuation

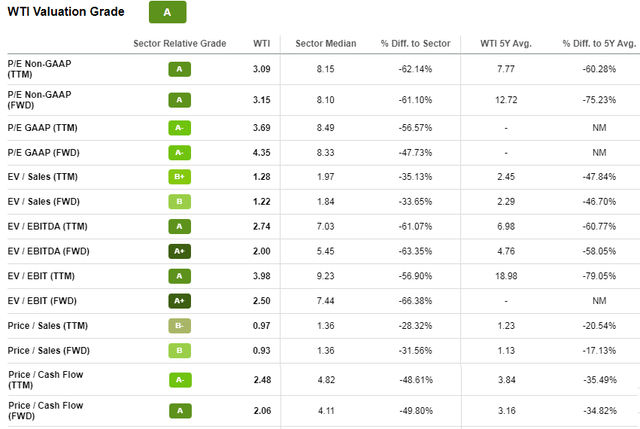

WTI vs the sector (Seeking Alpha)

Looking at the Valuation screener of Seeking Alpha, WTI has an A grade, with multiples significantly below both the sector median and its own 5-year average values. I think that the lack of shareholder return could be one of the main reasons for the stock being underappreciated, as most energy stocks distributed some of their cash flows back to investors. Another reason could be the debt profile of WTI. After all, it had US$552.5M maturing in 2023 in a rapidly raising interest rates environment. However, this concern was dealt with and management plans to keep deleveraging.

In order to obtain a conservative sense of the fundamental value of WTI I used the estimated NPV of just the proven reserves, discounted at 10%. It assumes oil price of US$68.54/barrel and natural gas price of US$4.98/Mmbtu.

| Unit | ||

| Total PV-10, less PV-10 of ARO ($MM) | US$M | 1 848.6 |

| Net debt | US$M | 254.3 |

| Implied equity value | US$M | 1 594.3 |

| Shares outstanding | M | 143.2 |

| Fair value/share | US$ | 11.13 |

| Current share price | US$ | 6.05 |

| Upside | 84.0% |

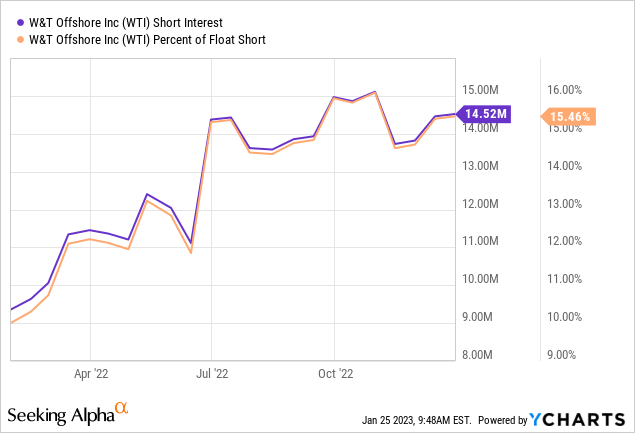

High short interest

Despite what appears to be a substantial discount of the current price to the fair value, short interest in the company is high and had been climbing for most of 2022. While I can’t find any obvious reasons except the maturing debt in 2023, which has been dealt with recently. So I’m more than welcome to hear any possible explanations.

However, if oil prices stay elevated, which I find likely and WTI keeps delivering, shorts may find themselves getting squeezed. A potential catalyst for this could be positive developments regarding the Holy Grail well spudding. I think that initiating a shareholder return program will be a very powerful catalyst for this stock as well, but the prospects for this are not high for the foreseeable future as management intends to focus on growth.

Risks

The improving financial position of WTI with meaningful decrease in debt and lengthening of the maturity profile, the company is on solid footing. Still, there are some risks. I identified the following:

Exploration risk

As WTI is focusing entirely on growth, exploration risk is naturally higher than in a company that returns some value to its shareholders. Still, the track record of WTI’s management has been solid so far, with a substantial increase in life of reserves.

Operational risk

The nature of the Gulf of Mexico exposes the companies to the mercy of the weather. It’s not uncommon for production to be disrupted in some parts of the Gulf of Mexico, as it happened recently as a result of the Hurricane Ian.

Oil and gas prices risk

This is an obvious risk for oil and gas companies. WTI enters 2023 with oil production completely unhedged. However, natural gas production is partially hedged with swaps and puts for the next following years. Generally I expect elevated oil prices to persist for the foreseeable future as the emerging economies are increasing demand, while developing countries, especially the EU are trying to prevent exploration in pursuit of their green agenda.

Conclusion

W&T Offshore seems misunderstood by investors. Despite the very high insider ownership and the substantial cash flow generation in the last year, no capital was returned to shareholders. Instead, management is pursuing a deleveraging and growth strategy, which could end up being a long-term benefit. The current share price offers 84% upside to the estimated NPV of just the proven reserves, without taking into account any possible reserves. In that regard, while WTI may be a good option overall, income oriented investors should look elsewhere.

Be the first to comment