lechatnoir/E+ via Getty Images

Advertising network WPP plc (NYSE:WPP) is due to announce its interim results on 5 August. I expect positive news after a strong first quarter. The shares have been falling back lately, but I think the industry giant is attractively priced and continue to attach a “buy” rating.

Business Continues to be Buoyant

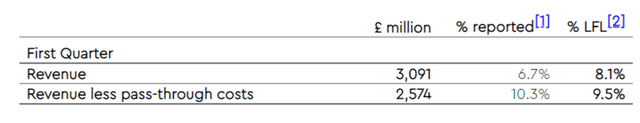

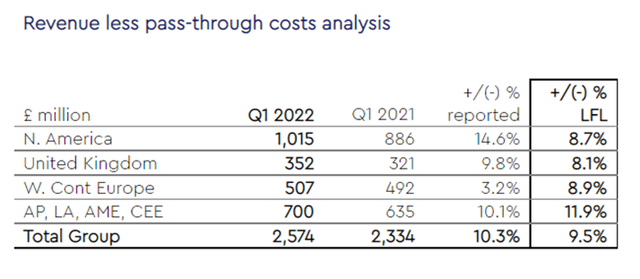

In its first quarter results released on 27 April 2022, the company reported like-for-like revenue growth of 8.1%.

This continues a return to form over the past couple of years. The business performed positively across all geographies and internal business sectors.

The WPP story is no longer as fresh or exciting as it once was, but I think it is easy to forget that when it works, it works very well. The company’s global reach and wide range of capabilities helps it win and keep very large client accounts. In the past couple of years, the company has continued to work to improve its digital proposition, for example recently launching a digital commerce managed service that will offer brands a fully outsourced direct-to-consumer ecommerce solution.

WPP’s move into more and more digital work keeps it relevant for an evolving advertising market, but at the same time its full range of traditional capabilities is what a lot of clients want, and I expect will continue to want. The first quarter saw WPP win $1.8 billion of net new business, including from Mars (where it became the global media partner), JDE Peet’s, and Sky. It has also announced several acquisitions in recent weeks.

Risks at WPP

One reason WPP shares have been falling lately is the expectation that an economic slowdown could lead to advertisers cutting budgets, hurting the group. I do see that as a risk. The company did not make much of it in its upbeat outlook contained in the earnings statement, other than to note, “Given the uncertain global environment, we remain ready to respond to any changes in the economy as the year progresses.” It noted that, after client demand was well ahead of expectations in the first quarter, it stayed strong going into the second quarter.

Net debt at the end of the first quarter also looked high to me, at £2.6 billion. The company said that was due to seasonal net working capital movements and share purchases, but if the share repurchase scheme substantially increases net debt then I see it as adding to the company’s balance sheet risks.

Valuation Looks Attractive

Since my March piece, WPP: Return To Growth And An Attractive Valuation, when I upgraded the stock to “buy”, its price has fallen 17%. Shares are down 28% since February.

WPP has now moved back to below where it was heading into the pandemic. But it is in far better shape now than it was then, in my opinion. It is leaner, no longer flailing following the exit of Sir Martin Sorrell as it was then and is reshaping itself to meet market needs better. While the dividend is only a little over half what it was in 2018, it is firmly in growth mode, with a 30% increase last year.

The shares now trade at a historical P/E ratio of 16. If earnings grow this year as I expect they will, the prospective P/E ratio is in the low to mid teens, which I regard as attractive for the company with its strong business model. As well as revenue growth, the company is targeting headline operating margin improvement of around 50 basis points. Taken together, those things should mean an improvement in earnings. On top of that, the company plans to undertake £800m of share buybacks this year, which given that its market cap is under £10bn will noticeably cut the share count and so boost EPS.

From a long-term buy and hold perspective, I continue to see value in the current WPP share price and accordingly rate the share as a “buy.”

Be the first to comment